The US dollar is ripping towards twenty-year highs with nothing to stop it as EUR is flushed away by its grand Russian failure:

Australian dollar always tracks EUR:

Oil rallied on new Putin gas threats but that chart is terrifying. When/if we break $98 it is going to collapse:

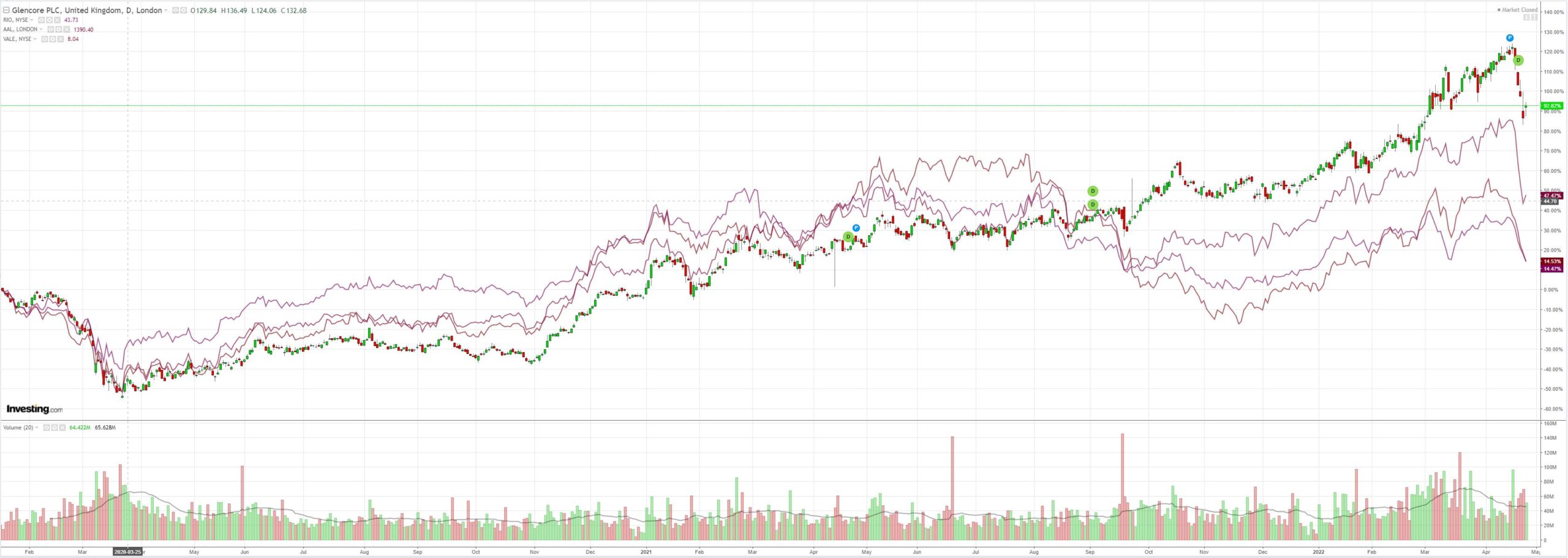

Metals are getting the sniff but this has only just started:

Big miners (LON:GLEN) without coal were puked again, and this after China pledged more building:

EM stocks (NYSE:EEM) tanked. I can’t believe Wall St sold this trade for the past year:

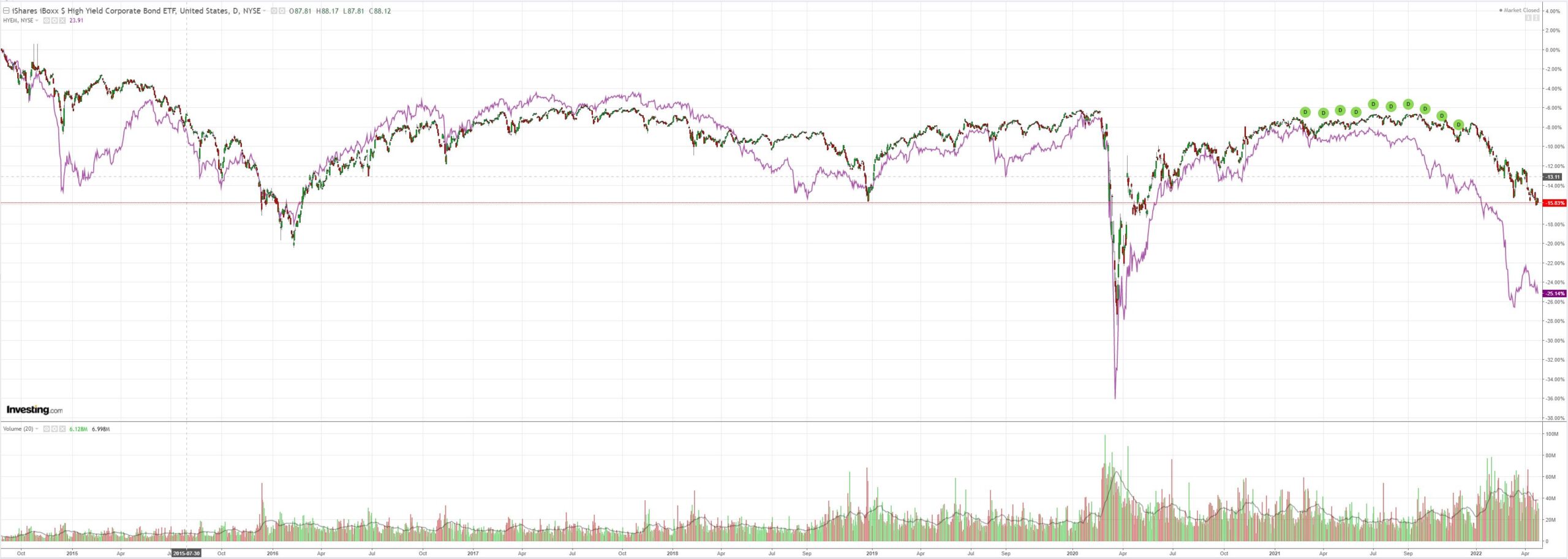

Junk (NYSE:HYG) looks ready to vomit lower:

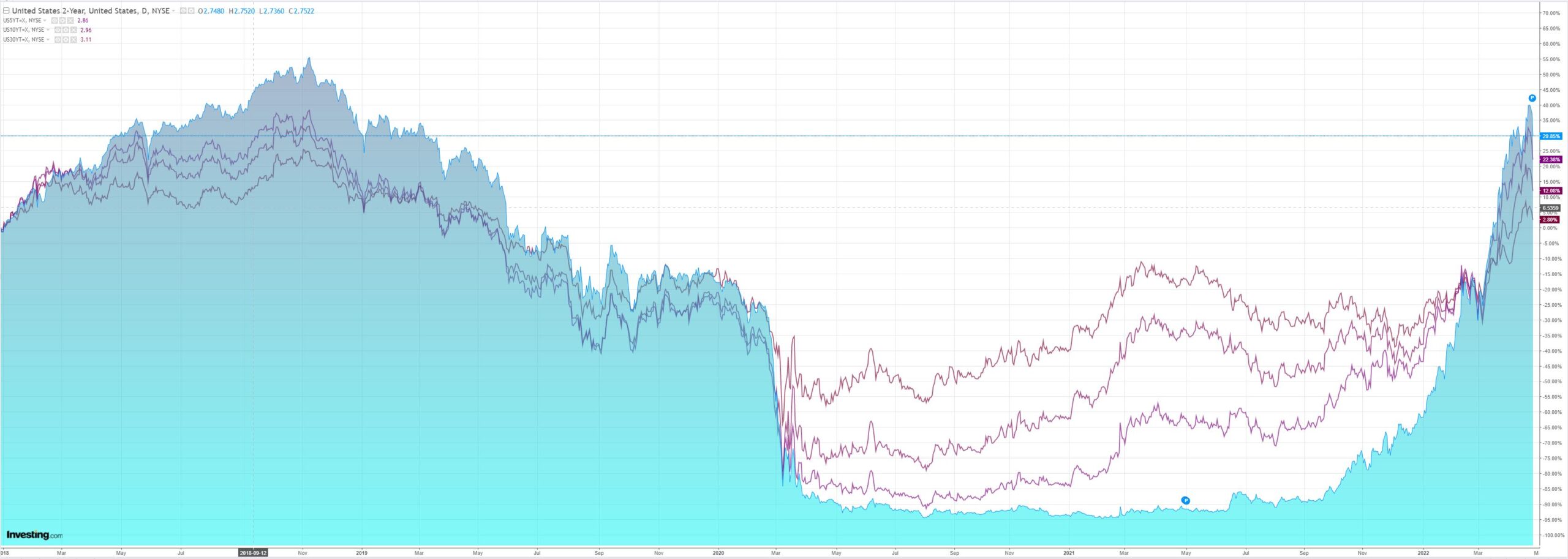

Yields tanked:

As stocks crashed. Those support levels going to hold? Pfft…

Westpac has the wrap:

Event Wrap

US durable goods orders in March were solid, the headline measure slightly below estimates at +0.8%m/m (est. +1.0%m/m) but the ex-transport measure at +1.1%m/m (est. +0.6%m/m). New home sales remained high at an annualised 763k (est. 768k) from a revised 835k (initially 772k). The report cited a combination of delayed construction/backlogs as well as higher mortgage rates. FHFA and CoreLogic house price surveys for Feb. were higher than their 1.5%m/m estimates, at 2.1%m/m and 2.39% respectively. Richmond Fed manufacturing survey surprised with a gain to 14 (from 13, est. 9), but the report cited increased pessimism over the next six months. Conference Board consumer confidence fell slightly to 107.3 (est. 108.2, from a revised 107.6 (initially 107.2)). Expectations rose to 77.2 from 76.7, and the present situation fell to 152.6 from 153.8.

Russia will cut off gas supplies to Poland and Bulgaria this week, in a major escalation in the standoff between Moscow and Europe over energy supplies and the war in Ukraine. Russia had threatened to halt gas supplies to countries that refuse pay for the product in Russian roubles.

Event Outlook

Aust: The Q1 CPI will be published. The surge in dwelling purchase prices is expected to play an important role given the conclusion of grants. Auto fuel and food prices will also likely to make a strong contribution. Westpac forecasts a 2.0%qtr and 4.9%yr lift for the headline CPI (market median 1.7% and 4.6%). The ongoing disruptions to supply lines and the robust strength of domestic demand reflects more broad-spread inflationary pressures, thereby supporting a 1.2%qtr (3.4%yr) gain in the trimmed mean measure.

China: Industrial profits will face headwinds associated with COVID-19 lockdowns in March but profit growth should improve as these disruptions fade.

US: Wholesale inventories should continue to build at a robust pace in March (market f/c: 1.5%). Meanwhile, pending home sales activity is expected to remain weak in March as the onset of higher mortgage rates begin to cool housing demand (market f/c: -1.0%).

We are headed for a global recession. Europe is being rocked by a war and energy shock with no end in sight. China is being rocked by a property and COVID shock with no end in sight. The US is being rocked by an inflation and rates shock with no end in sight.

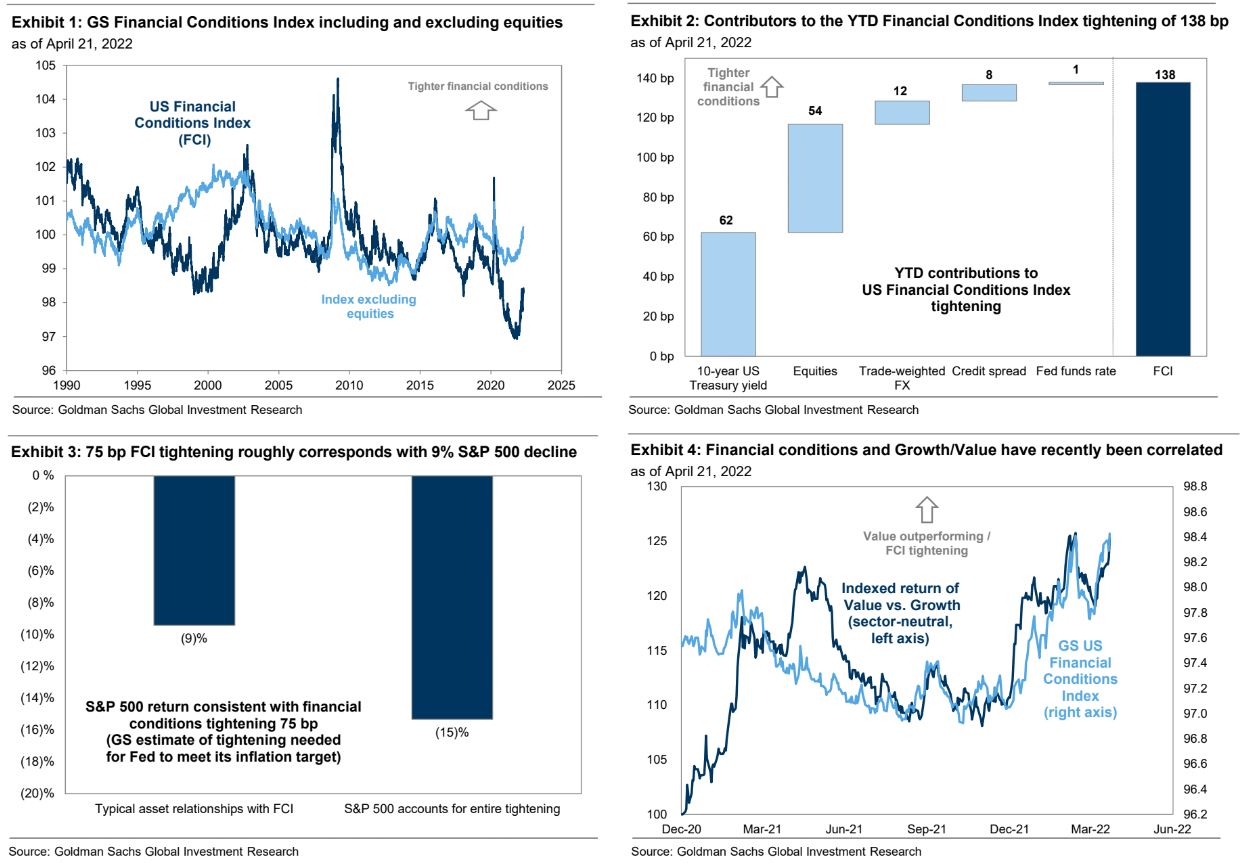

We are already seeing global and US goods demand normalise as services rise post-COVID. As stocks tank, the wealth shock will deliver a demand hiccup as well. Equities comprise a huge component of financial conditions:

This demand weakness will flow straight back up the global supply chain to China and Europe, both of which already have weak and dying domestic demand. Global supply chains will slump into excess capacity.

EMs are roadkill in this scenario as capital flows out to the US, China lifts competitiveness with a falling CNY and commodities crash both owing to plunging demand and the collapse in inflation that unwinds the market mania.

All of this before we even get to some credit event.

We are at the verge of a major global deflationary bust much like the post-Spanish Flu 1920/21 depression and de-globalization event.

Needless to say, AUD will not do well in this environment.