DXY was flat last night:

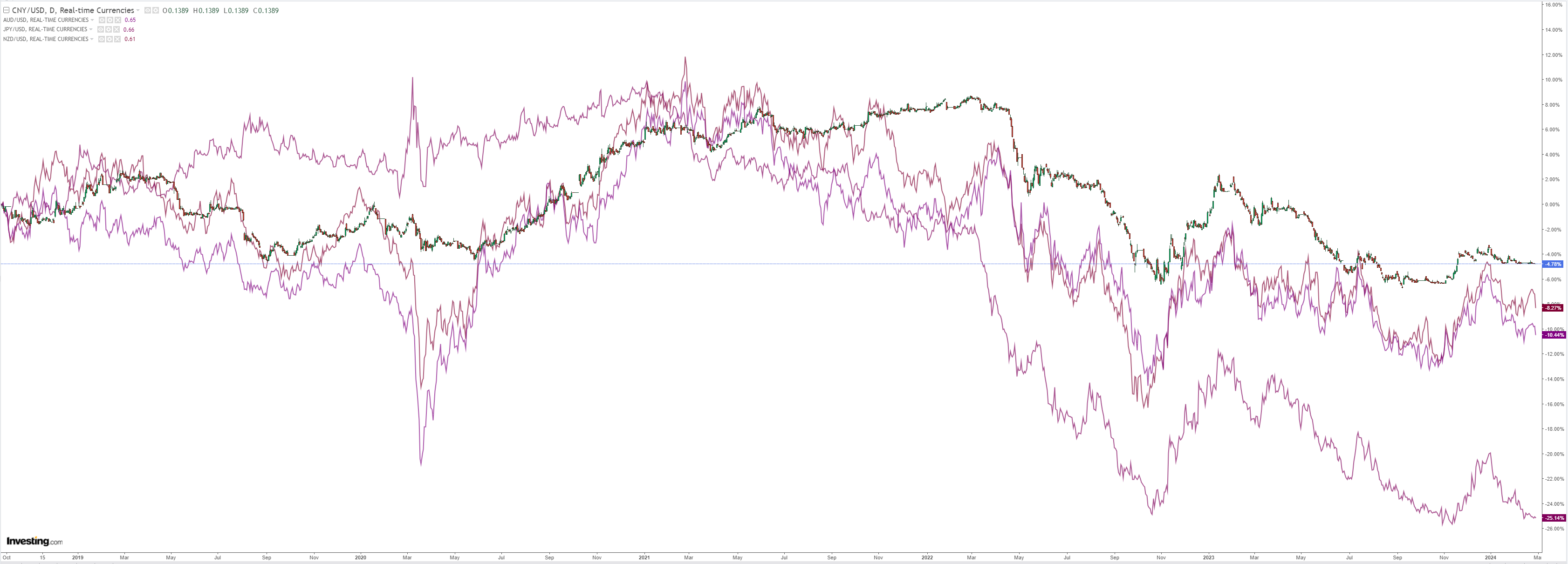

The bottom fell out of AUD anyway:

NZD helped it lower after the RBNZ acknowledged the crushed economy:

Oil is plodding along:

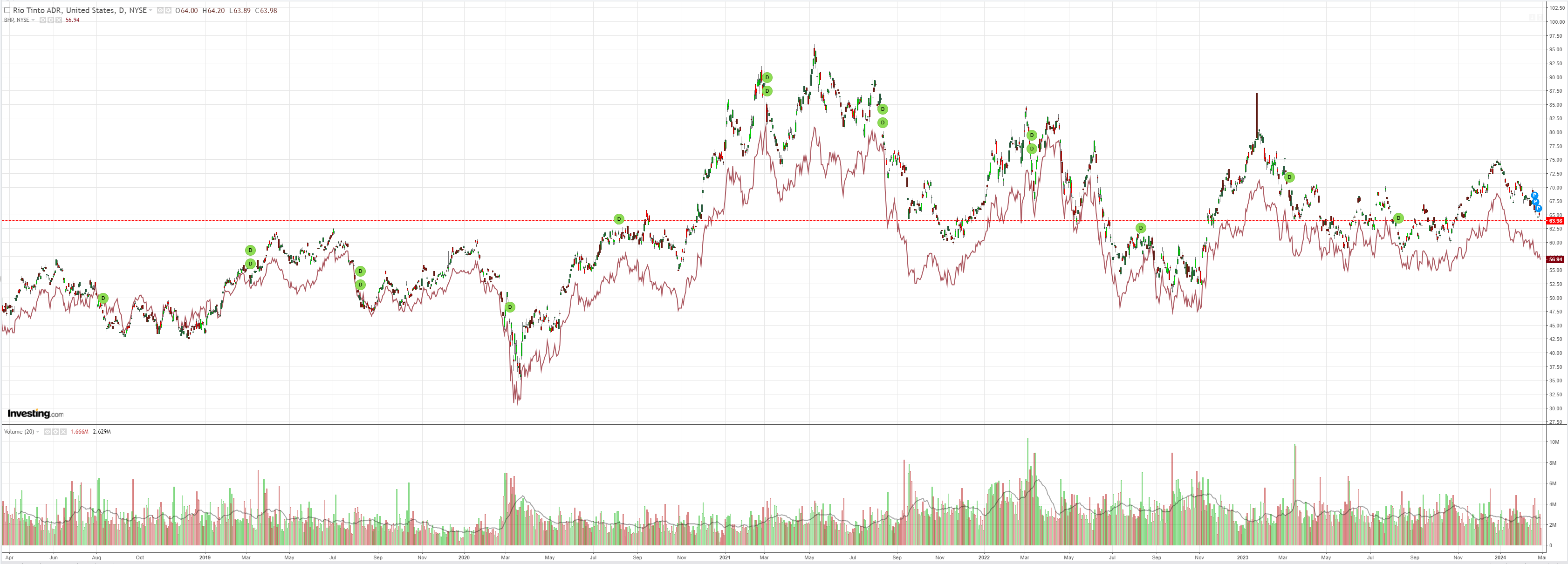

Dirt yawn:

The miners are going to retest the lows:

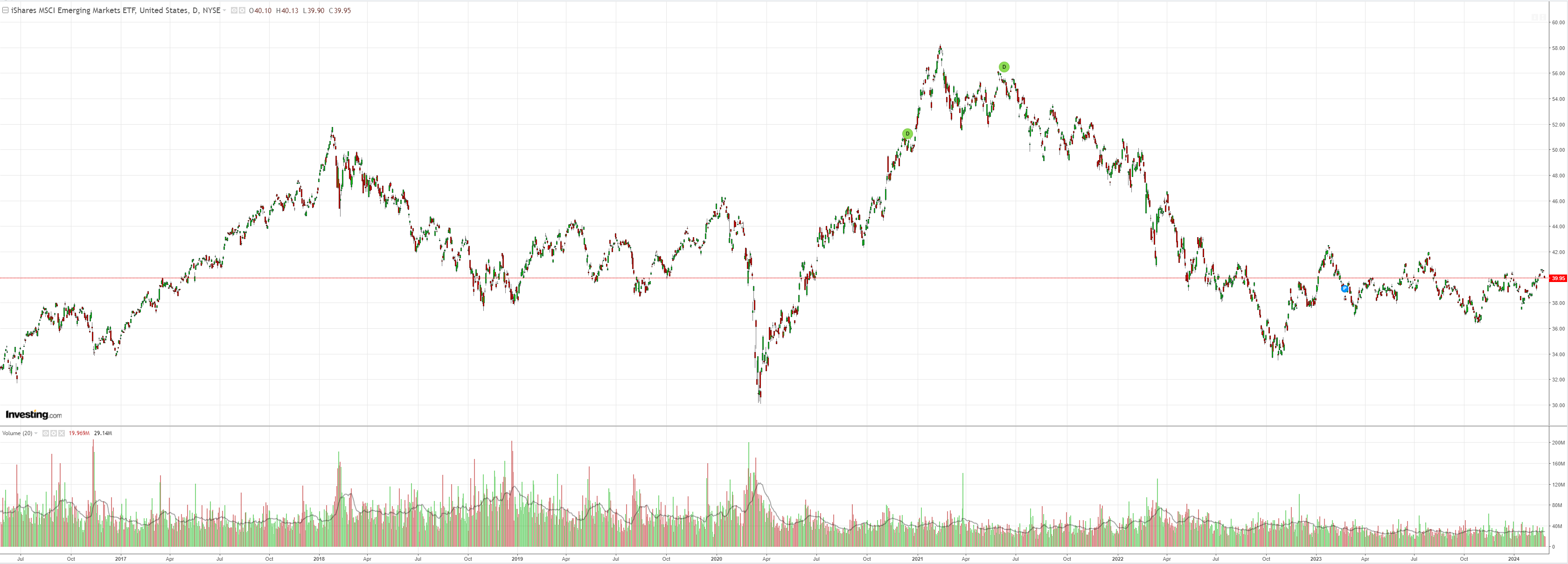

EM yawn:

Junk still hoping:

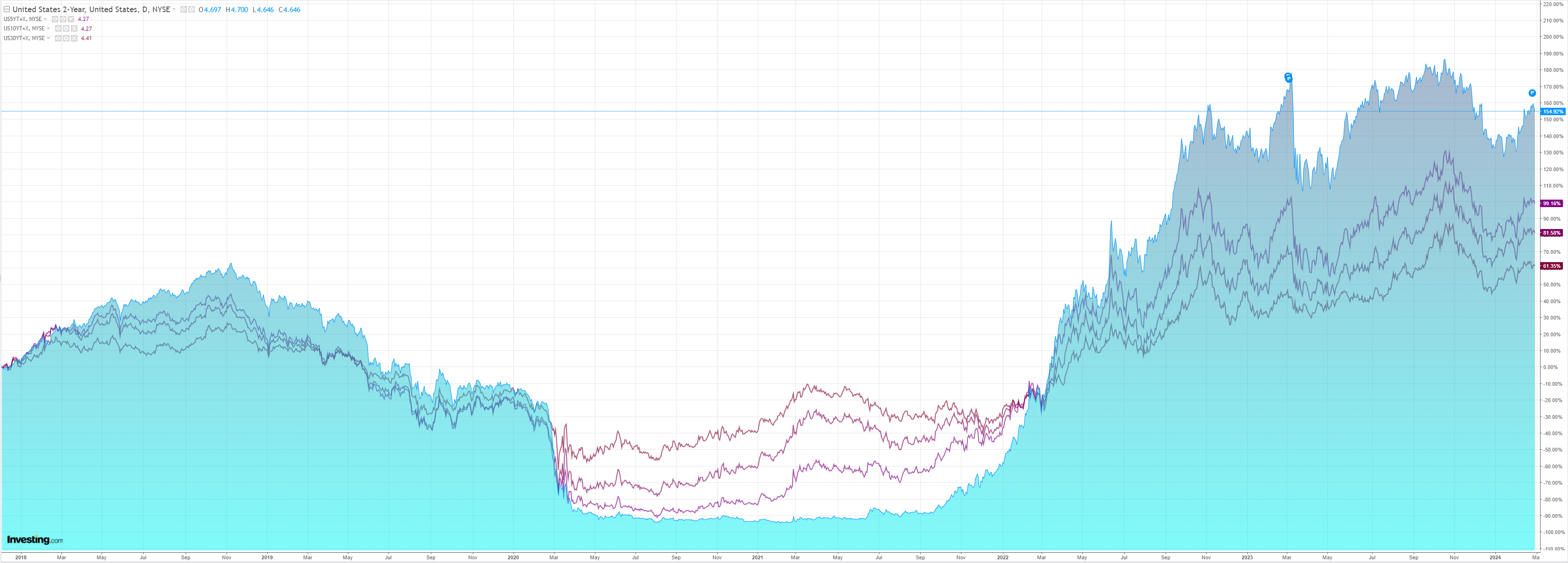

As yields roll:

Stocks softened:

US data was good with solid GDP revisions, but last night’s forex action was all about the local data.

The RBNZ is done and dusted as expected. Why anybody thought anything else is beyond me. NZ is in a deep recession, and inflation is crashing.

Likewise, in Australia, though, the recession here is per capita as Mad Albo stuffs the joint with migrants to prevent wearing the opprobrium of a negative headline number.

Yesterday’s -0.33% monthly inflation print was a beauty, and there’s more to come, so the bullhawks are fleeing as the RBA warms up the shears.

I can’t see AUD falling entirely off the chair with positioning so bearish already, but yesterday knocked the yield spread leg off the stool.

With the US thumping along, China so terrible, and iron ore very shaky, the AUD bull case ain’t looking good.