DXY is at new closing lows:

CNY is still falling at speed:

AUD was flogged again despite risk rising a little:

Oil was bashed:

Metals too:

Miners (LON:GLEN) eked out a gain:

And EM stocks (NYSE:EEM):

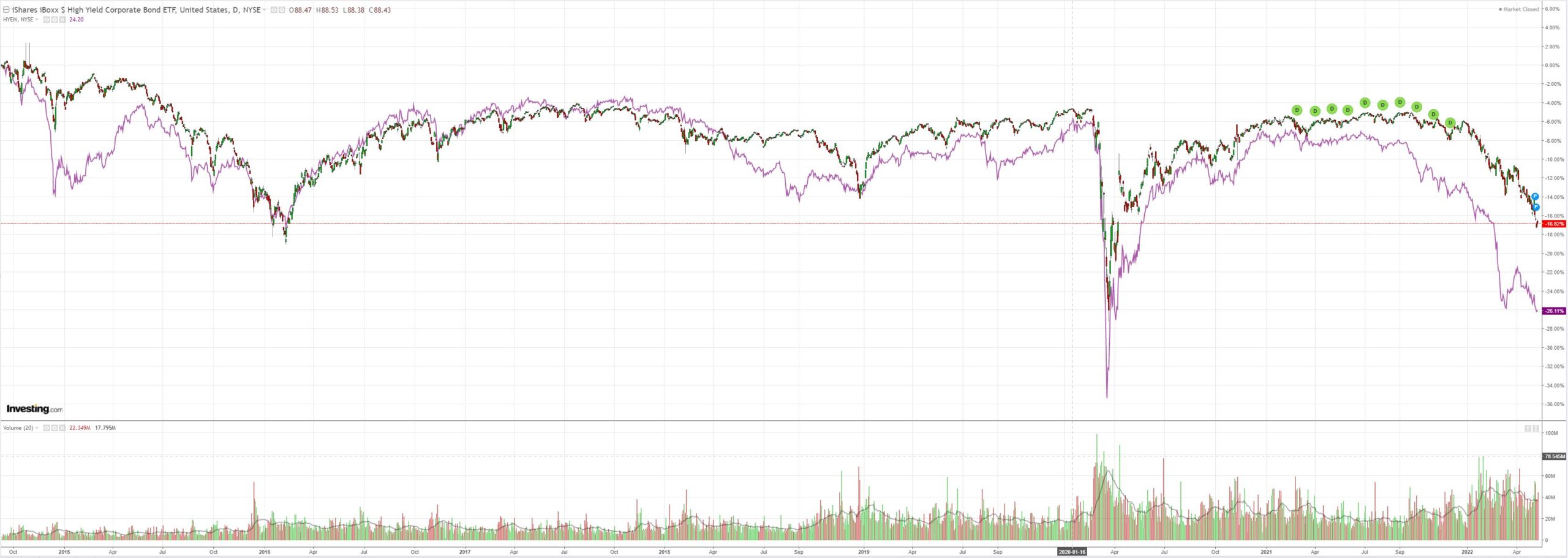

Plus junk (NYSE:HYG):

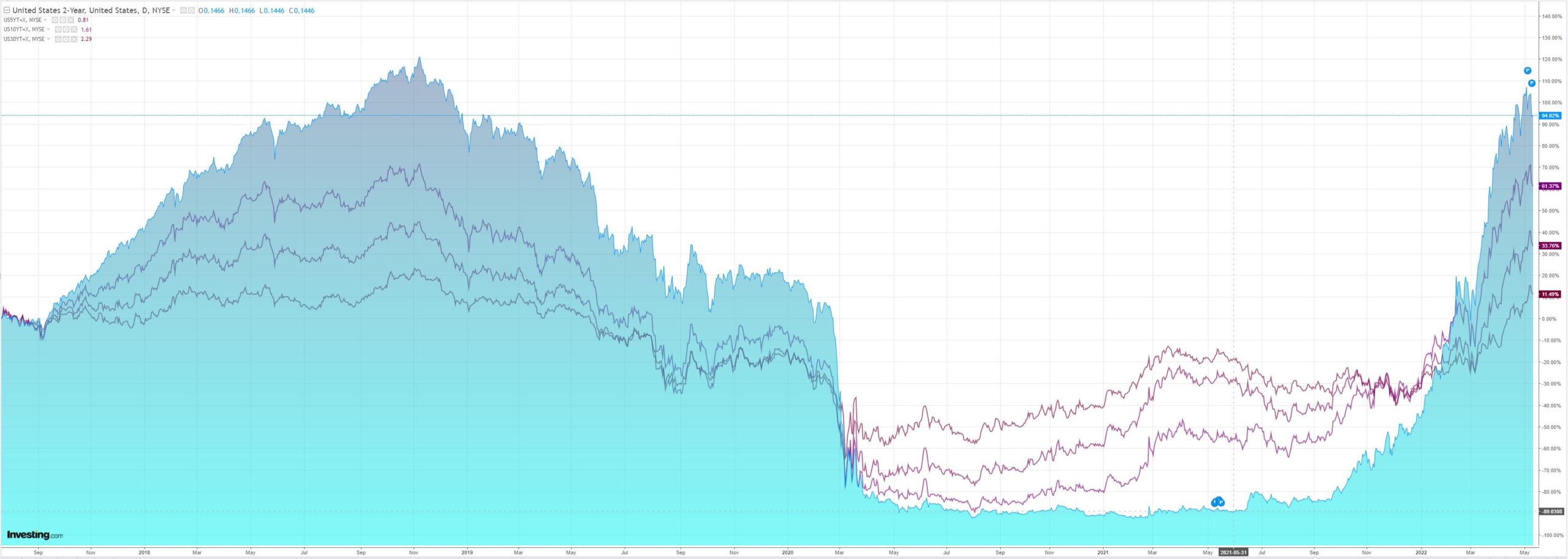

Yields fell and the curve flattened:

Stocks lifted a bit:

Westpac has the wrap:

Overnight Market Wrap

Global market sentiment: US equity market sentiment stabilised, the S&P500 off a 12-month low and up 0.3% on the day. Bond yields fell further, and the US dollar rose.

Currencies: The US dollar index is up 0.2% on the day. EUR fell from 1.0580 to 1.0526. USD/JPY ranged between 129.87 and 130.55. AUD ranged between 0.6914 and 0.6986. NZD fell from 0.6350 to 0.6276 – a two-year low. AUD/NZD rose from 1.1000 to 1.1040.

Interest rates: US 2yr treasury yields roundtripped from 2.63% to 2.55% and back, while the 10yr yield fell from 3.06% to 2.94%. Markets currently price the Fed funds rate to be 53bp higher at the next meeting in June, and 200bp higher by year end.

Australian 3yr government bond yields (futures) fell from 3.15% to 3.06%, while the 10yr yield fell from 3.62% to 3.48%. Markets currently price the cash rate to be 36bp higher by the June meeting.

Commodities: Brent crude oil futures fell 3.2% to $103, copper fell 0.5%, gold fell 0.7%, and iron ore fell 2.3% to $128.

Event Wrap

US NFIB April small business survey was unchanged at the low since April 2020 at 93.2 (est. 92.9). Inflation, labour constraints and growth concerns remained high.

FOMC member Williams said it is hard to estimate where neutral is, but echoed Chair Powell’s comments about moving “expeditiously” to a more neutral rate level. He also sees the economy remaining strong, with growth average about 2% this year, and core inflation ebbing to about 4% in 2022 and 2.5% in 2023. Mester also echoed Powell’s message that 50bp increases are on the table in June and July, but added that a larger move of 75bp could be warranted later in the year: “We don’t rule out 75 forever…When we get to that point in the second half of the year, if we don’t have inflation moving down we may have to speed up.”

ZEW surveys for Germany and Eurozone remained in negative territory. German expectations rose to -34.3 from -41.0 (est. -43.5), Eurozone to -20.5 from -43.0. German current conditions at -36.5 (prior -35.0) were below the estimate of -35.0. Eurozone current conditions fell to -35.0 from prior -28.5. The report cited continued concerns over recession risks should Russian gas supplies be blocked, but described the outlook as a “slightly less pessimistic” profile of deterioration at “a lower pace”.

ECB’s Nagel repeated concerns that avoiding entrenched inflation expectations is important, and that necessary adjustments to policy must be gradual and data dependent. She also supported asset purchasing ending in June and rate hikes starting in July.

Event Outlook

Aust: Westpac-MI Consumer Sentiment is set to see a bigger shock in May with the earlier and more aggressive than anticipated start to the RBA’s tightening cycle.

China: Elevated commodity prices continue to buoy producer inflation (market f/c: 7.8%yr) with limited pass through to consumer prices (market f/c: 1.8%yr)

US: Energy prices are set to be a negative for April’s CPI result (Westpac f/c: 0.3%; market f/c: 0.2%). The FOMC’s Bostic will discuss monetary policy and the economy at two separate events.

Not much to add today. AUD has more downside so long as the Fed continues to hike aggressively and CNY falls.