DXY is on the verge of breaking even higher as EUR pukes lower. Parity ahead for these two:

AUD tumbled to new lows though recovered some:

Oil still looks bearish. Gold is sinking on rising real yields:

Commodities are no longer enjoying the DXY:

Miners Glencore PLC (LON:GLEN) were split:

EM stocks (NYSE:EEM) are at the cliff:

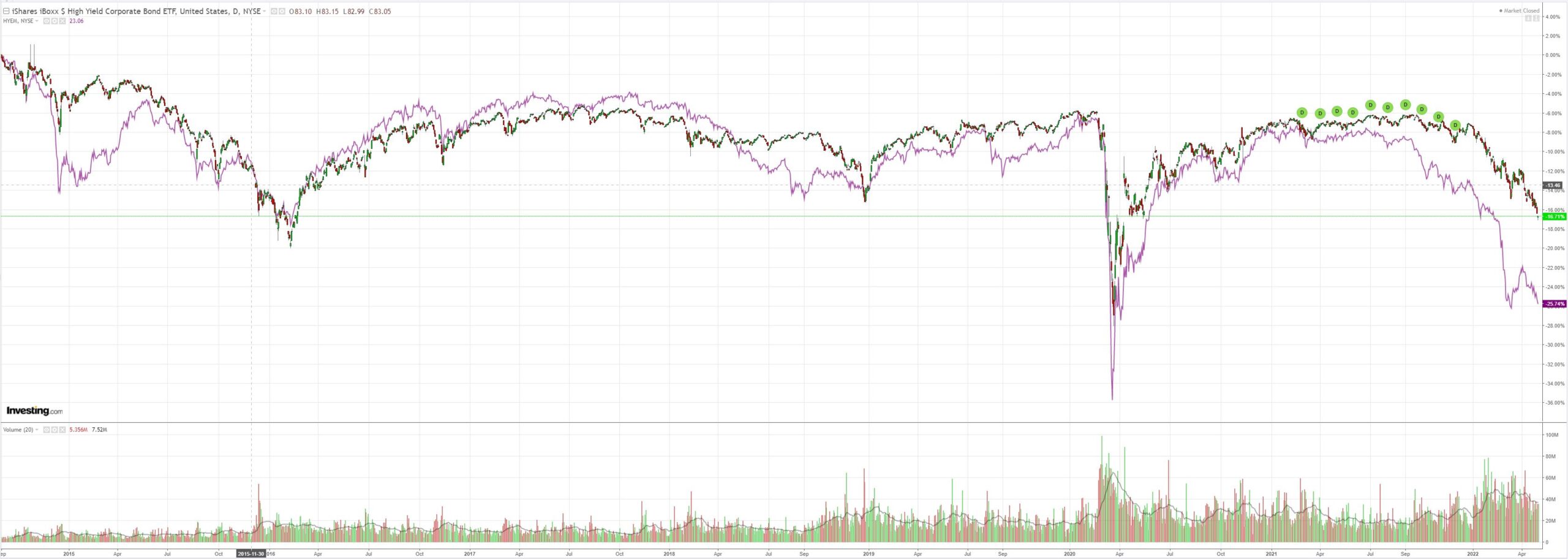

So is EM junk (NYSE:HYG):

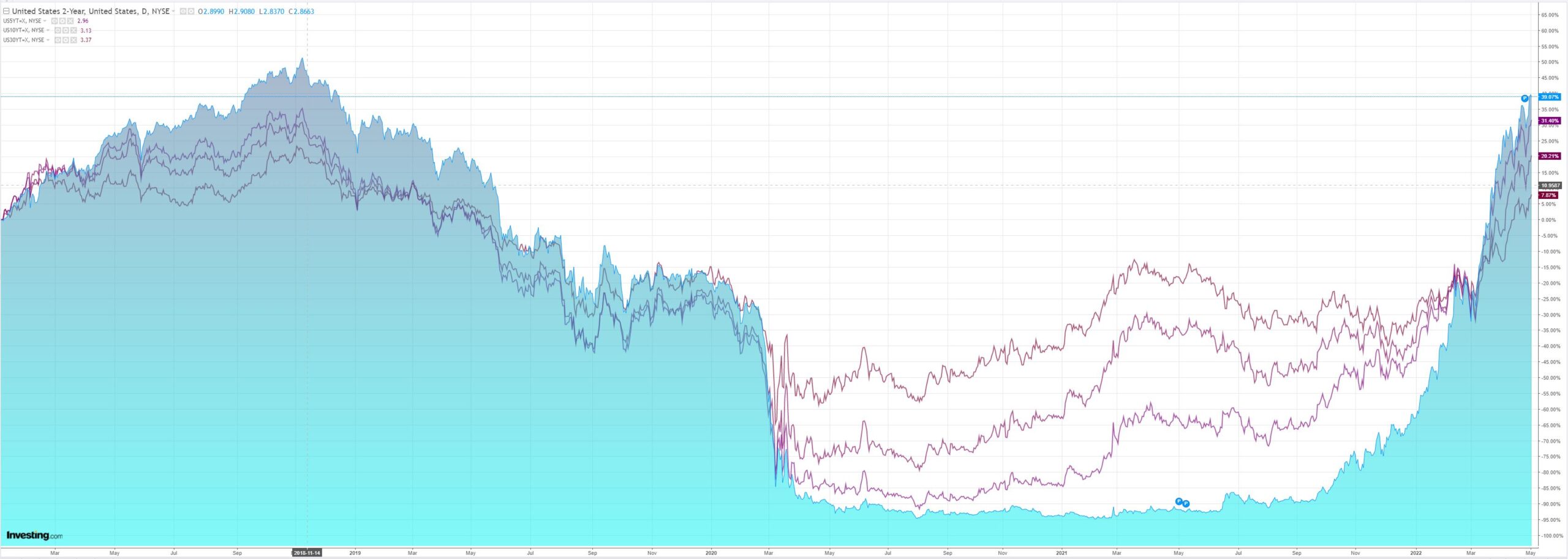

As Treasury yields rose again. Second derivative gains are slowing:

Stocks dumped and pumped just because:

Westpac has the wrap:

Event Wrap

US ISM manufacturing activity disappointed at 55.4 (est. 57.6, prior 57.1). That said, the April reading remains elevated despite the pullback. Producers have benefited from higher prices, despite rising input costs, and the need to rebuild inventories into 2022 after stimulus-induced 2021 sales surge. Construction spending in March also disappointed, rising 0.1% (est. +0.8%).

Event Outlook

Aust: Given the strength of the labour market and inflation, the RBA is expected to announce the start of the tightening cycle at the May meeting. Westpac anticipates an increase of 15bps to 0.25%.

NZ: A decline in building consents issuance is anticipated for March as some of February’s sharp rise in multi-unit consents are reversed (Westpac f/c: -5.0%).

Eur/UK: The European unemployment rate is expected to hold at 6.8% March, laying the foundation for robust wages growth. The final release of April’s S&P Global (NYSE:SPGI) manufacturing PMI is due for the UK (market f/c: 55.3).

US: Factory and durable goods orders should continue to build over 2022 as businesses bring inventories back towards pre-pandemic level (market f/c: 1.2% and 0.8% respectively). March’s JOLTS job openings are expected to point towards robust demand for workers (market f/c: 11200k).

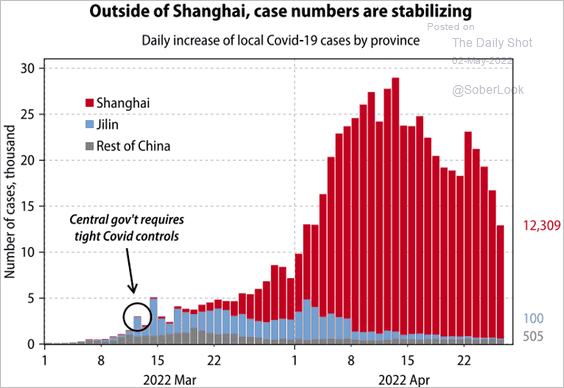

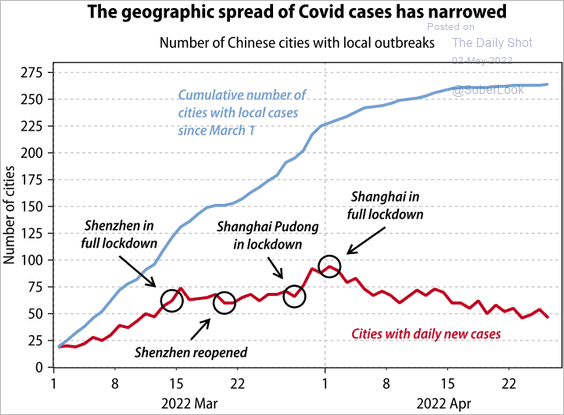

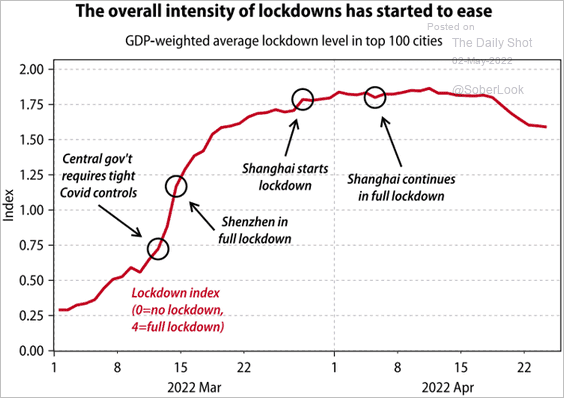

We are massively oversold so can expect these crazed intraday reversals to continue. I am also now wondering if some Chinese reopening and a Russian peace are not too far away. The former is making some progress with OMICRON:

And Russia can’t keep fighting the entire western military-industrial complex. Its withdrawal to the Donbass to declare victory and start building lots of walls is not far away.

These could present tactical reversals for the AUD, and risk assets, though the Fed remains the main game and until it relents AUD is still going lower on a trend basis.