DXY eased:

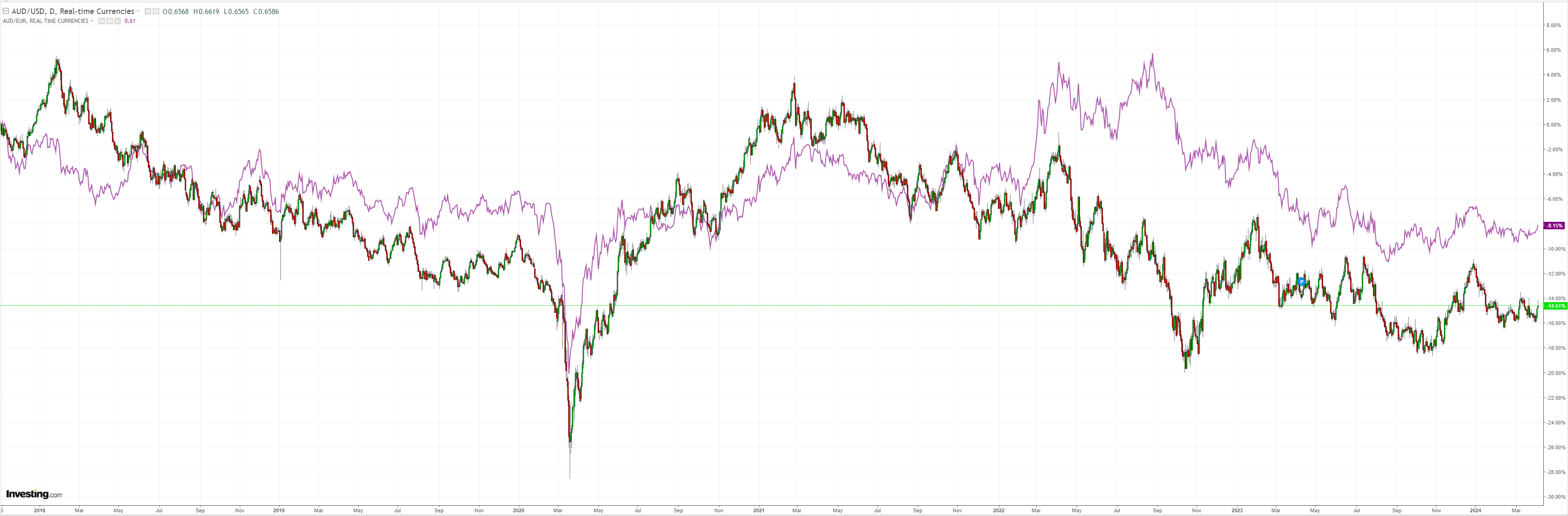

AUD popped:

No help from North Asia:

Oil bull:

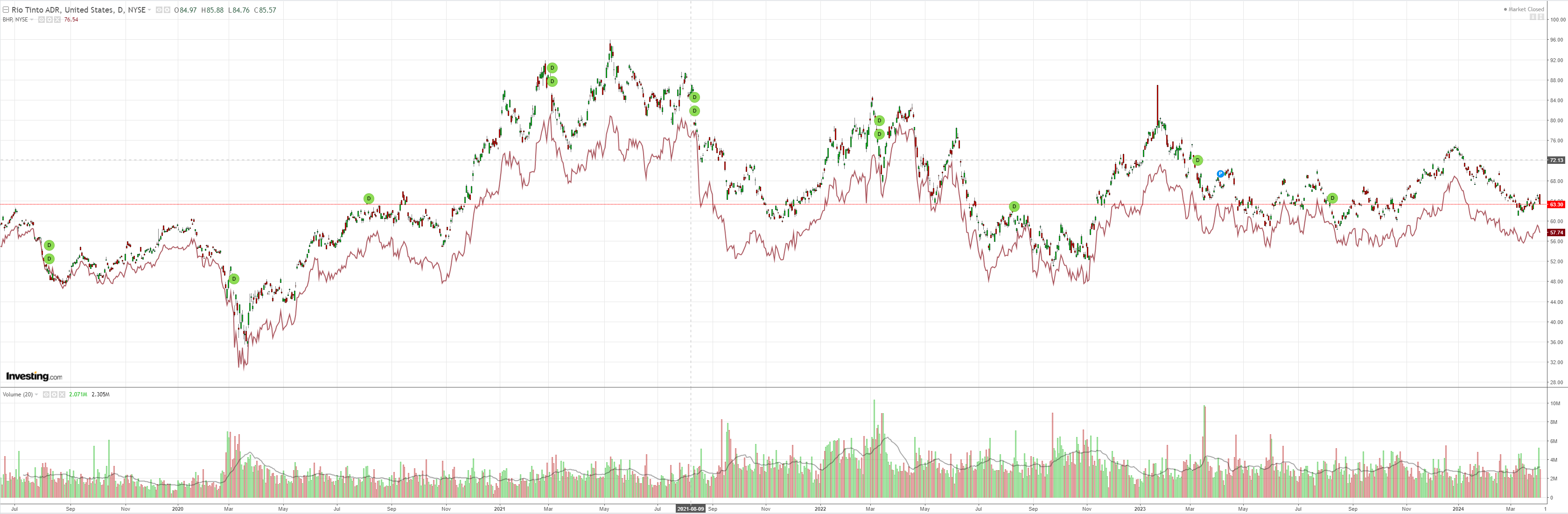

Dirt bull:

Mining bust:

EM false break out:

Junk is warning:

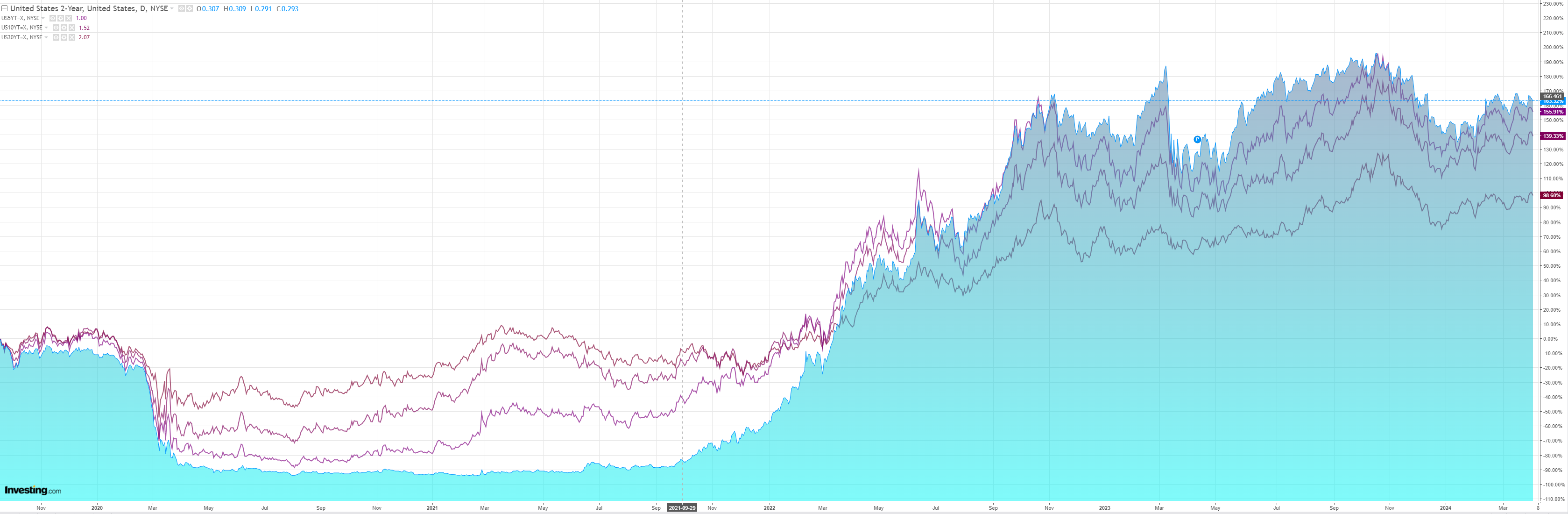

Yields eased:

Stocks puked:

Weirdly, it is a battle between dovish Fed speakers pushing down DXY and an oil bull run that has mounting geopolitical tailwinds, and dovish Fed speakers behind it. UBS has more:

- Rally / buying right into the 14:30 New York energy close – suggests heavy index fund prepositioning ahead of GSCI roll onset tomorrow where energy will be upweighted in the index

- Geopolitics – reports of potential attacks within Iran and also potential retaliation toward Israel following Monday’s airstrikes.

- Bullish consensus and flow – a number of Street strategists have been out today talking about upside risk toward the $95-100 range in crude. Meanwhile, flows here have skewed toward upside buying in the options space

- Technicals – Front-month WTI crude oil just completed a ‘golden cross’ technical formation with the 50- and 200-day moving average crossover. The front month is aimed at $88.58 above; $91.08 is key as the 76.4% Fibonacci retracement level in Brent… which is precisely where Brent is trading at this moment.

The more dovish the Fed gets, the more hawkish oil becomes.

I can’t see AUD getting very far in this environment.