DXY is the world’s whipping boy now:

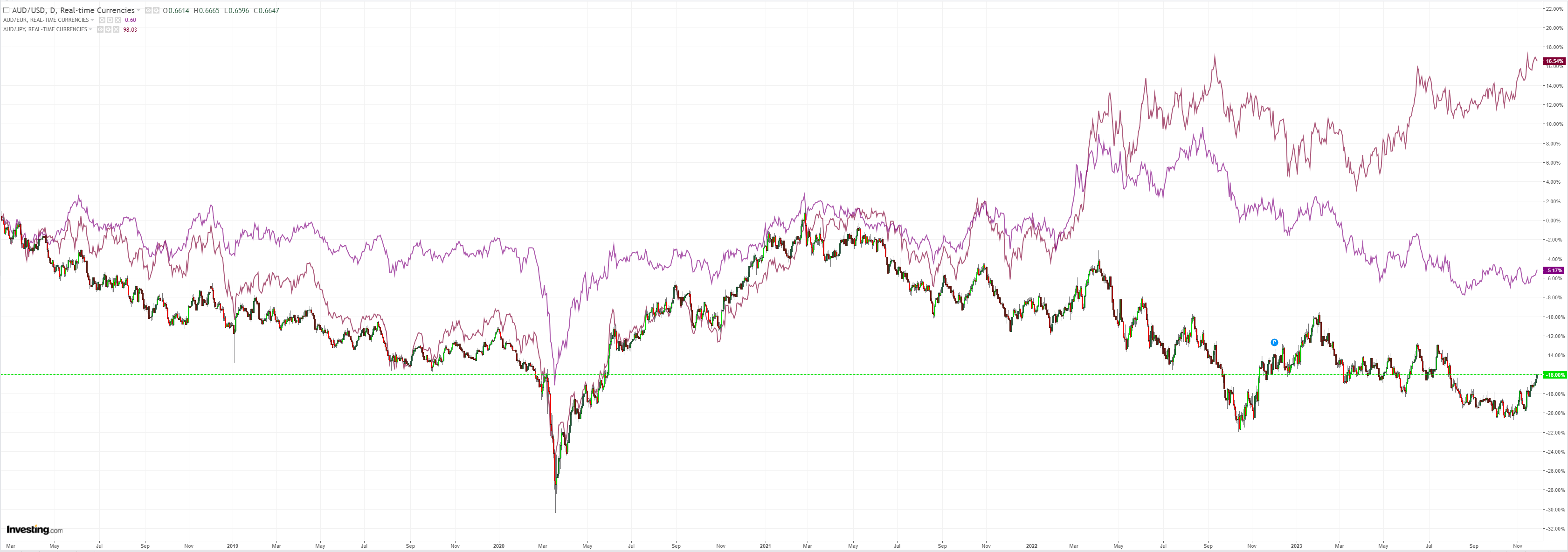

AUD flies:

CNY is stalled which will weigh on AUD if it continues:

Brent is being helpful. Gold is off and running:

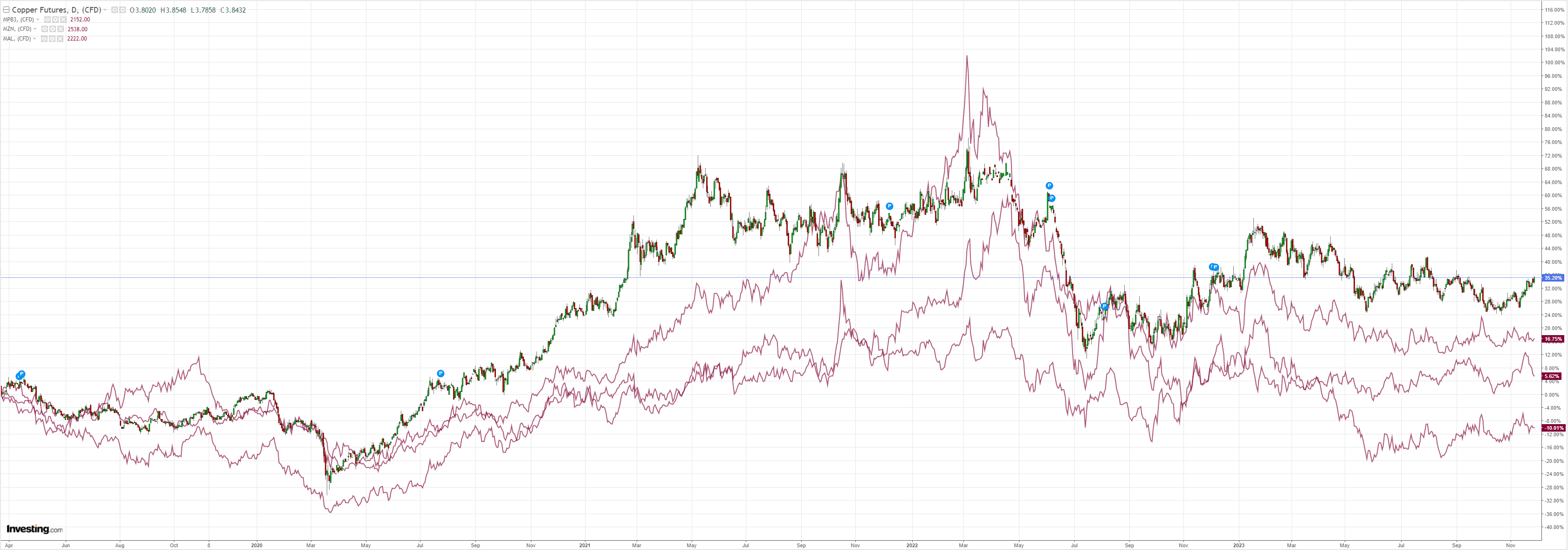

Copper too but broader dirt nope:

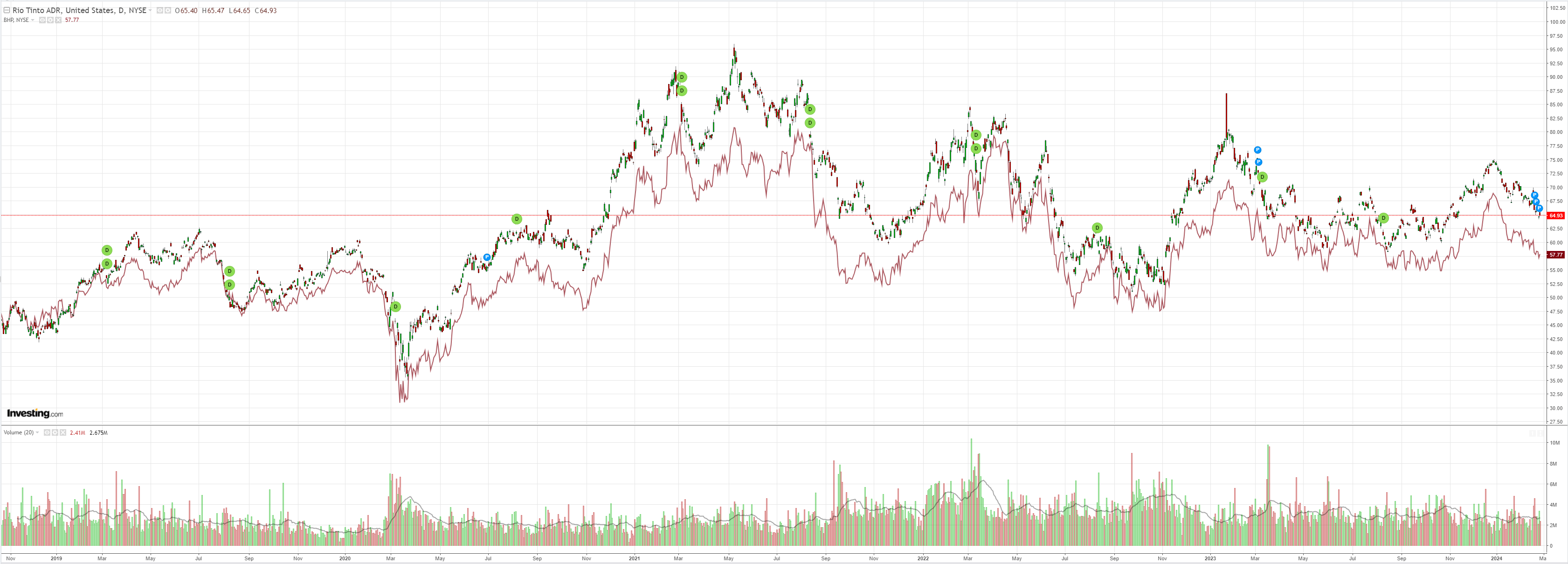

Miners are underperforming:

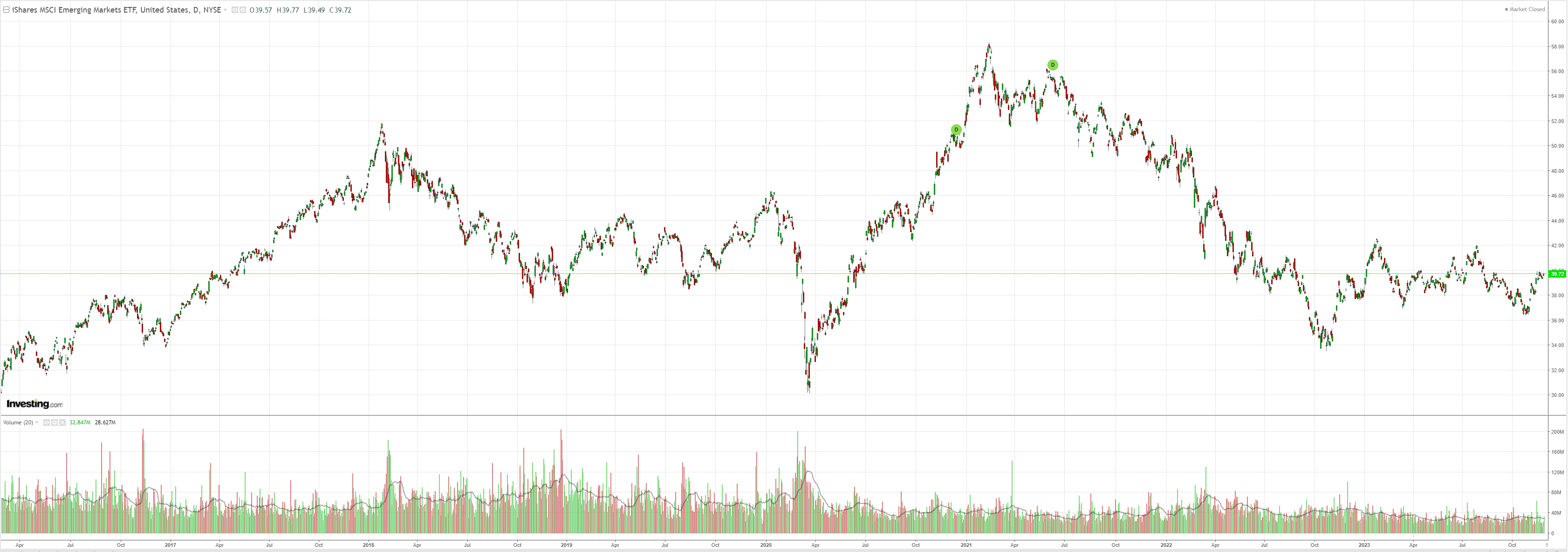

As is EM on China woes:

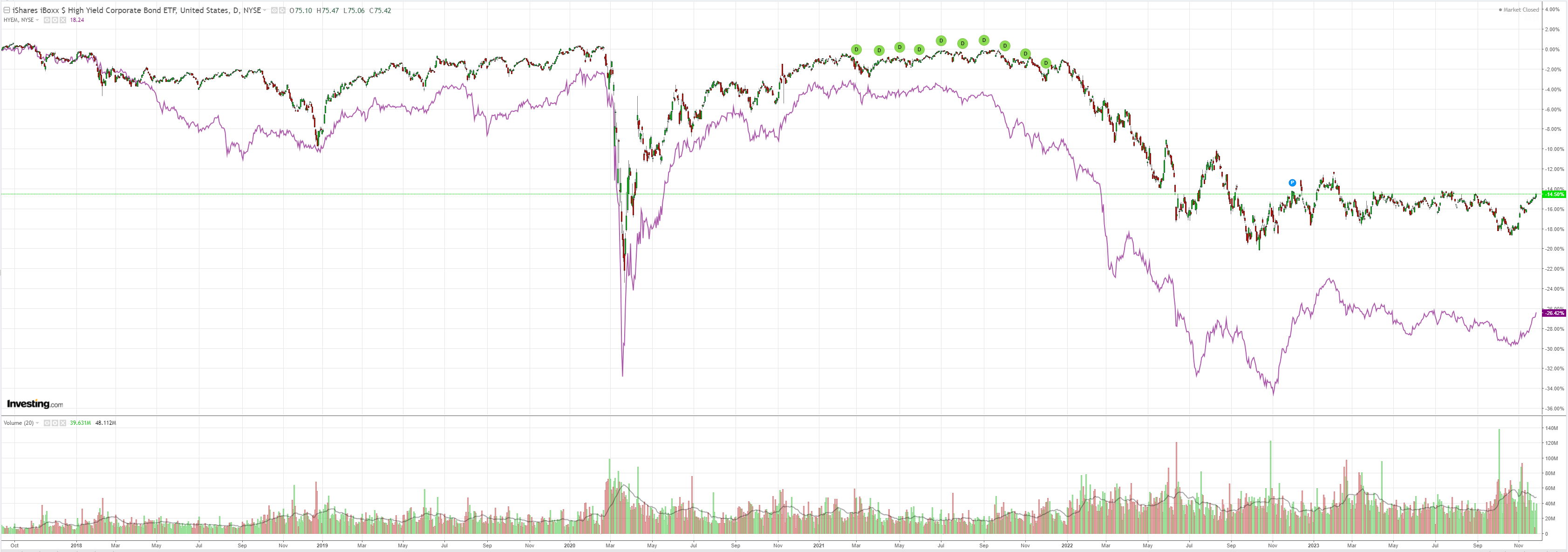

But junk is bullish for risk:

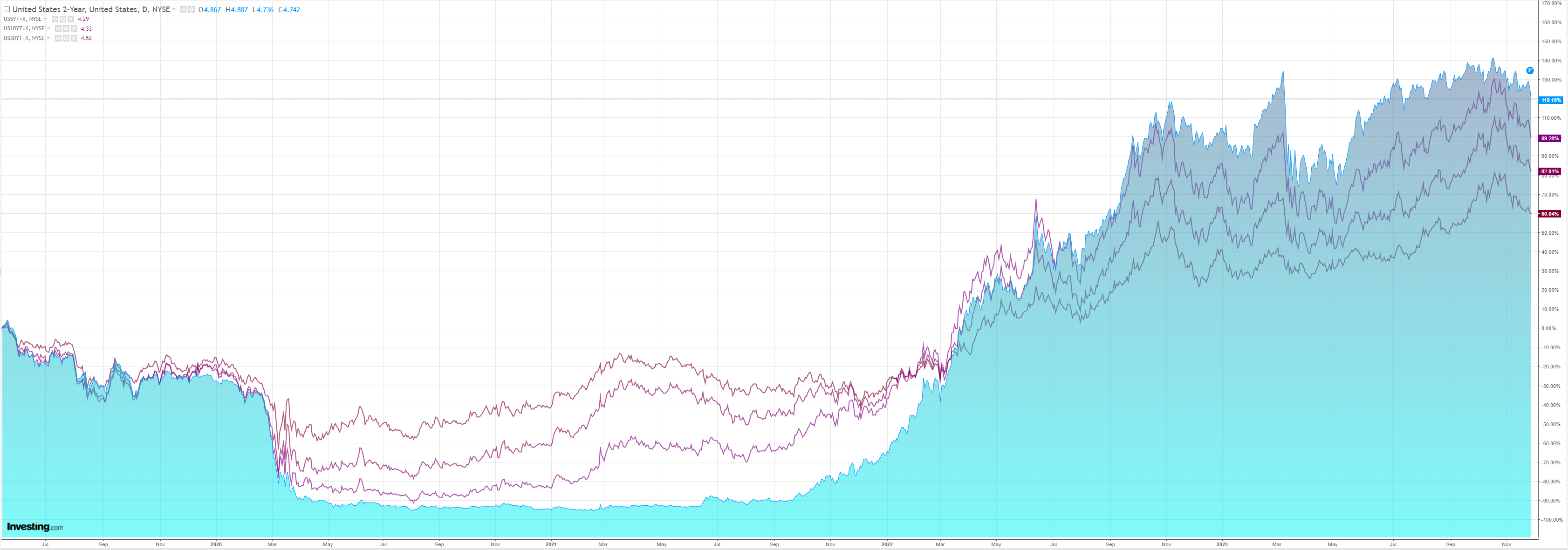

As yields take a beating:

Stocks are struggling to to keep pace:

The Fed is feeding reflation bets:

Fed swaps are now anticipating over 100 basis points of rate cuts by the end of 2024. In a speech entitled “Something Appears to Be Giving,” Governor Christopher Waller — one of the most-hawkish officials — said he’s “increasingly confident that policy is currently well positioned to slow the economy and get inflation back to 2%.” While acknowledging the many uncertainties, his colleague Michelle Bowman refrained from telegraphing an imminent hike.

And the ECB is looking at crashing inflation:

In October, Eurozone headline inflation slowed once again significantly from 4.3% to 2.9% while core inflation declined more marginally from 4.5% to 4.2%. Large negative base effects for energy were the main driver, also helped by lower pump prices, increasing the spread between headline and core inflation.

It’s going to rain rate cuts in Europe and the US in 2024 while Australia is beset by fantastically inept Albofltion which will delay or prevent monetary easing.

Ideal conditions for the AUD rally to continue.