DXY was down and EUR up overnight:

To infinity and beyond!

Everything anti-DXY up:

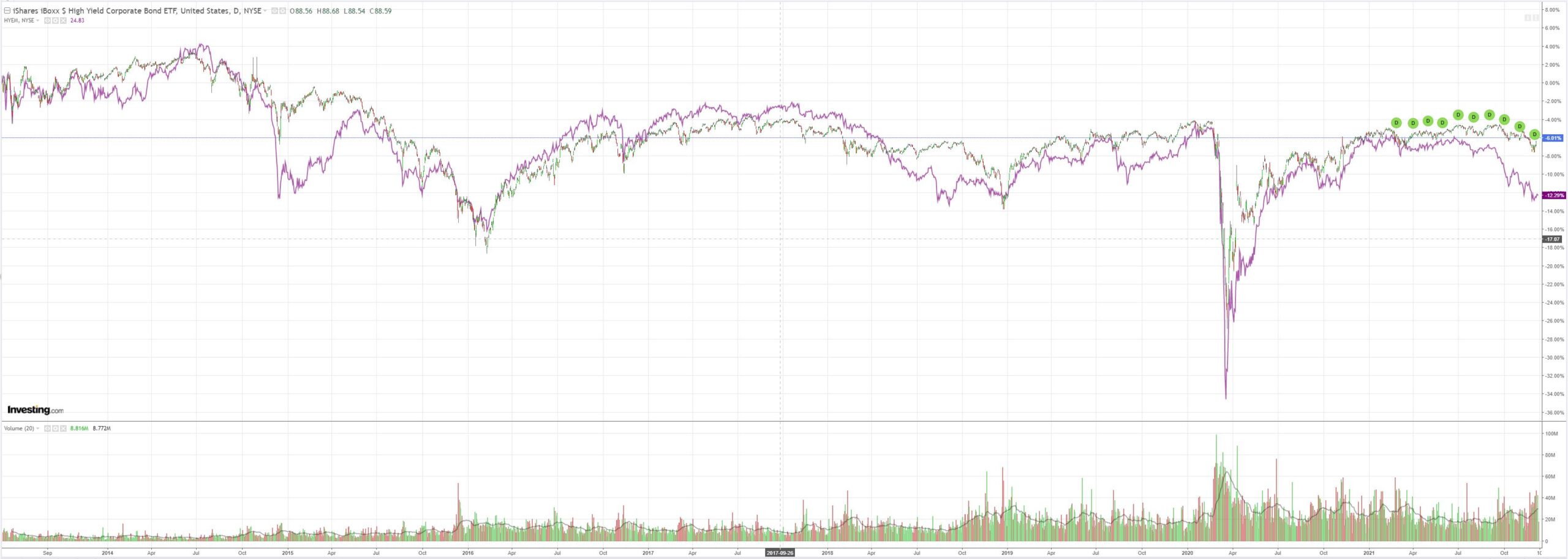

Except EM junk:

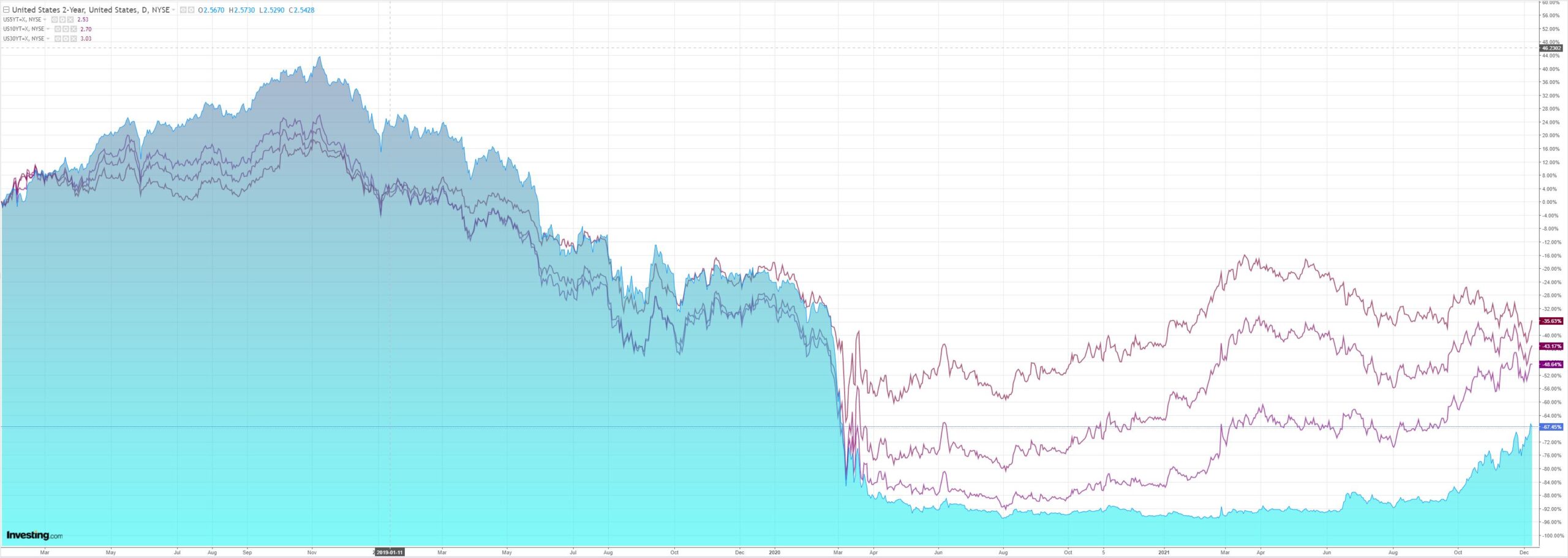

Treasury curve steepened:

Stocks led by GAMMA:

Westpac:

Event Wrap

Bank of Canada kept its policy rate at 0.25%, matching widespread expectations. Officials reiterated that the “economy continues to require considerable monetary policy support.” As such, they remain committed to keeping the policy setting steady until “economic slack is absorbed so that the 2 percent inflation target is sustainably achieved…this happens in the middle quarters of 2022.” The current spike in inflation is viewed as temporary, although it is “closely watching inflation expectations and labour costs to ensure that the forces pushing up prices do not become embedded in ongoing inflation.”

US JOLTS job openings in October of 11.033m beat consensus of 10.469m, with September revised to 10.602m from prior 10.438m.

Event Outlook

Aust: RBA Governor Lowe will speak at the Payments Summit 2021, 9am, online.

NZ: Manufacturing activity in Q3 is expected to have fallen by 4.2% q/q due to the lockdowns.

China: Consumer inflation is expected to remain modest in November (market f/c: 2.5%yr) despite intense supply-side pressures as evinced by producer prices (market f/c: 12.1%yr). M2 money supply growth should remain steady in November and is ample for robust activity growth (market f/c: 8.7%). Meanwhile, new loans for November should point towards healthy growth in credit into year end, setting the scene for an acceleration in investment in 2022 (market f/c: CNY1572.5bn). Note, the M2 and loan data is due 9-15 December.

Ger: Germany’s trade surplus is expected to moderate slightly in October, but should remain wide in 2022 as exports benefit from the global recovery (market f/c: €14.3bn).

US: Initial jobless claims are expected to stabilise near historic lows (market f/c: 220k). The final release for October’s record high wholesale inventories will confirm businesses’ desire to rebuild stock as supply chain constraints are worked through (market f/c: 2.2%).

An evening of classic reflation dynamics which makes absolutely no sense as OMICRON deteriorates except if you extrapolate it to the US where vaccine rates are low and falling and the market is now sniffing out delayed Fed tightening.

This is the definition of febrile. If OMI is manageable it will reverse in short order. If not, it will keep going.

Not much else that I can add.

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.