DXY was up and away as the latest CPI approaches:

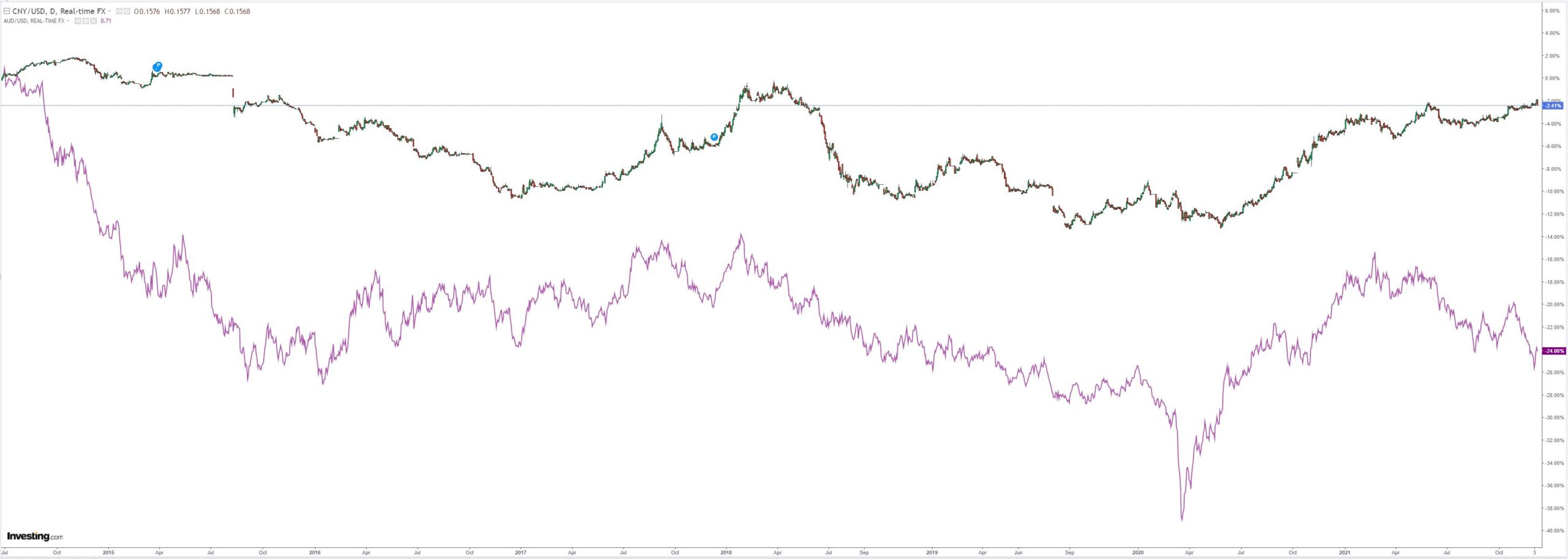

The Australian dollar flamed out:

All of the usual anti-DXY moves followed. Commodities, EMs and miners down:

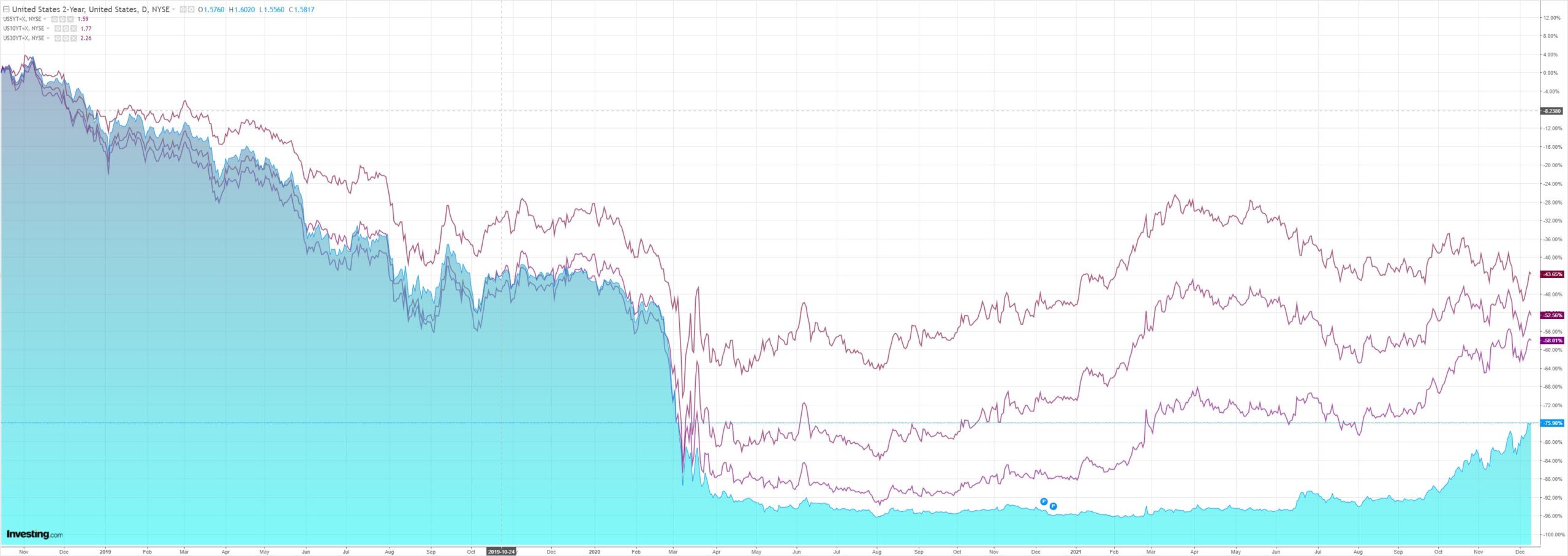

The Treasury curve flattened again:

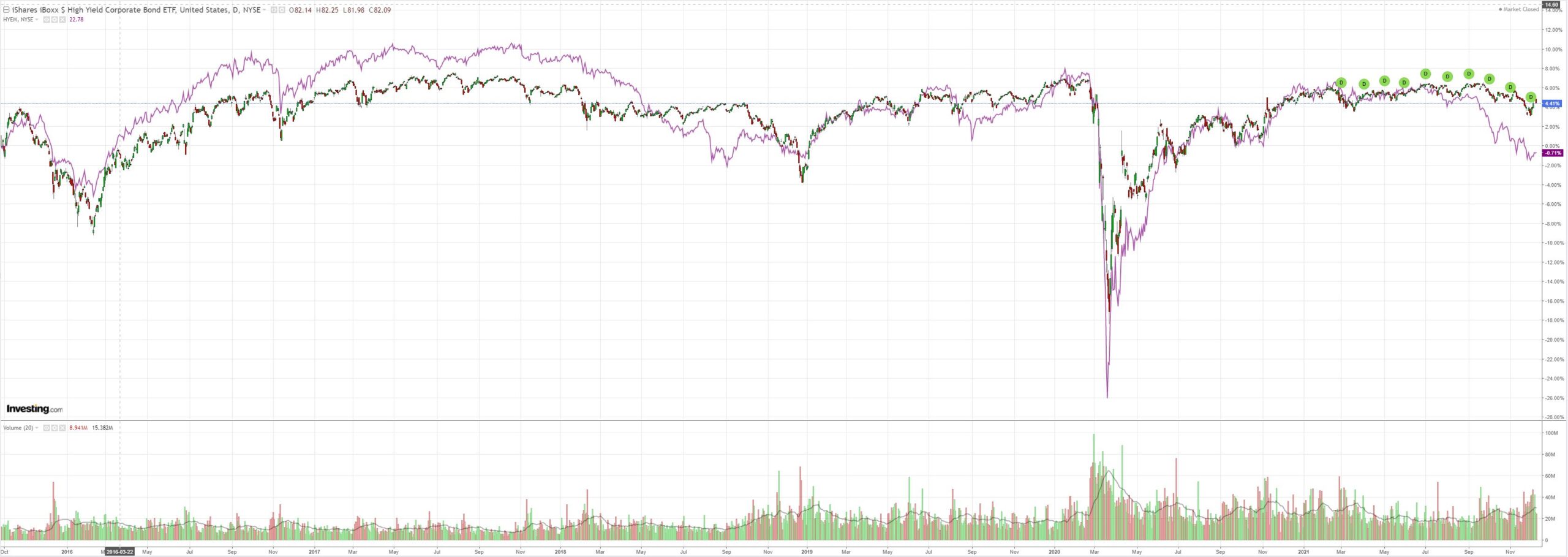

And stonks went backwards:

Westpac has the wrap:

Event Wrap

US weekly initial jobless claims fell to 184k (est. 220k, prior 227k) – the lowest since 1969. Continuing claims rose to 1.99m (est. 1.91m, prior 1.95m). Final Oct. wholesale inventories were revised from +2.2%m/m to +2.3%m/m – a record high, with rising prices a major factor.

Germany’s Oct. trade surplus narrowed to EUR12.8bn (est. EUR14.3bn, prior EUR16.0bn). However, the rise in both exports (+4.1%m/m, est. +0.8%m/m) and imports (+5.0%m/m, est. +0.4%m/m) suggests that activity was higher than had been intimated in production data.

Event Outlook

NZ: The November manufacturing PMI should report a lift due to the easing of restrictions and related demand boost. November Electronic Card Retail Sales is also expected to post substantial gains on reopening and Black Friday sales, albeit partly offset by Auckland’s restrictions (Westpac f/c: 5.0%).

Germany: The final release of November’s CPI will confirm energy’s significant contribution.

UK: The trade deficit is expected to narrow slightly in November, but significant uncertainty remains given Brexit and COVID-19 (market f/c: -£2424mn).

US: Another substantial lift in consumer prices is anticipated in November as robust demand broadens the scope of inflation beyond the categories first associated with reopening (market f/c: 0.7%m/m, 6.8%y/y). The December University of Michigan sentiment survey should continue to signal weak confidence as high inflation reduces purchasing power (market f/c: 68.0).

Perhaps the most significant event of the night was the PBoC hosing off capital flows with a hike to its reserve ratio for forex funds. This immediately thumped what has been a tearaway CNY:

Goldman muses on why CNY has been rising despite a slowing economy and monetary easing:

…while investors were worried about potential outflows and depreciation pressures of the currency in light of expected China policy easing andUS policy tightening, we think CNY would remain strong and continue to appreciate due to 1) elevated goods trade surplus; 2) continued inflows to the bond market from index inclusion and more reserve allocation; 3) the “unexplained USD holdings” by Chinese exporters and banks. Seasonality probably also contributed to the faster appreciation recently – corporate might have higher demand for CNY before year end and choose to convert some of their USD holdings back to CNY.

I have been wrong about this so far. But I still think that the PBoC will be forced to cut its prime lending rates before the property adjustment is stabilised and expect a falling CNY to follow.

That is the final piece in the 2015 analogy puzzle for a deflationary 2022. A falling CNY guts EMs and commodity markets as it adds trade balance pressure to markets already struggling with capital account pressures from US tightening.

CNY and AUD typically trend together. Though 2021 has so far been the exception, my view remains they will come back together via falling CNY in the year ahead.