DXY is breaking out as EUR breaks down:

AUD tried and failed to rally:

Driven by Chinese panic support of the CNY:

Commods are still relief rallying:

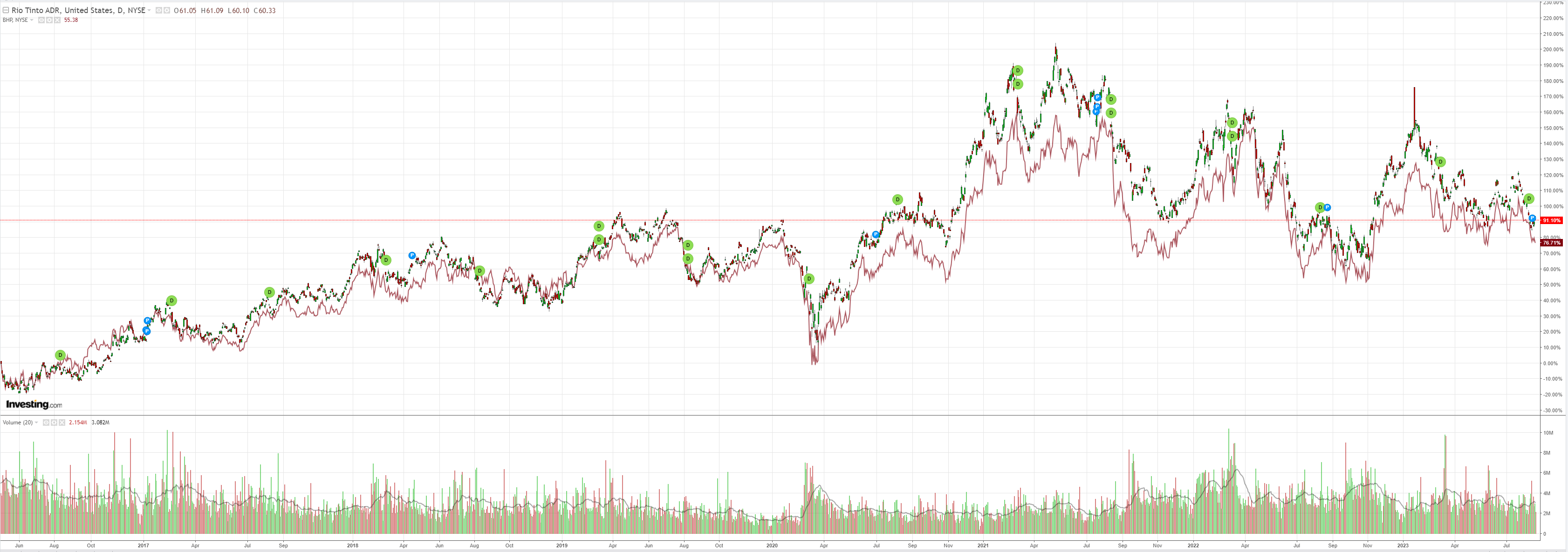

Not miners (NYSE:RIO):

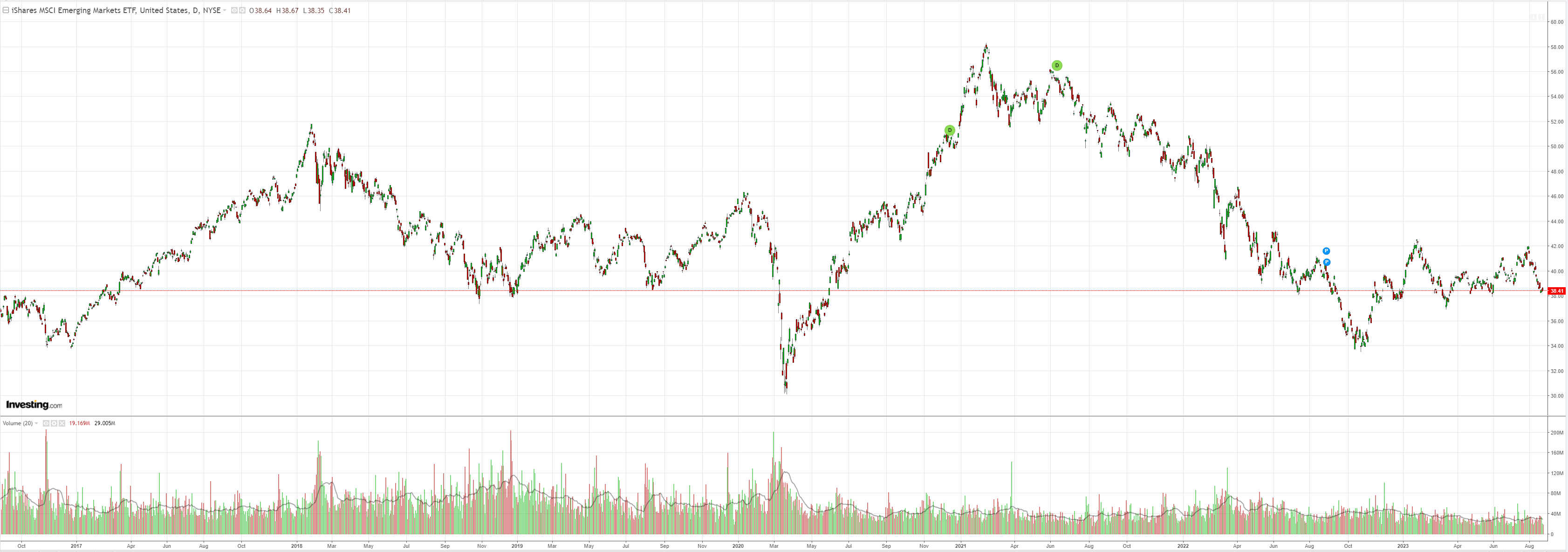

Nor EM stocks (NYSE:EEM):

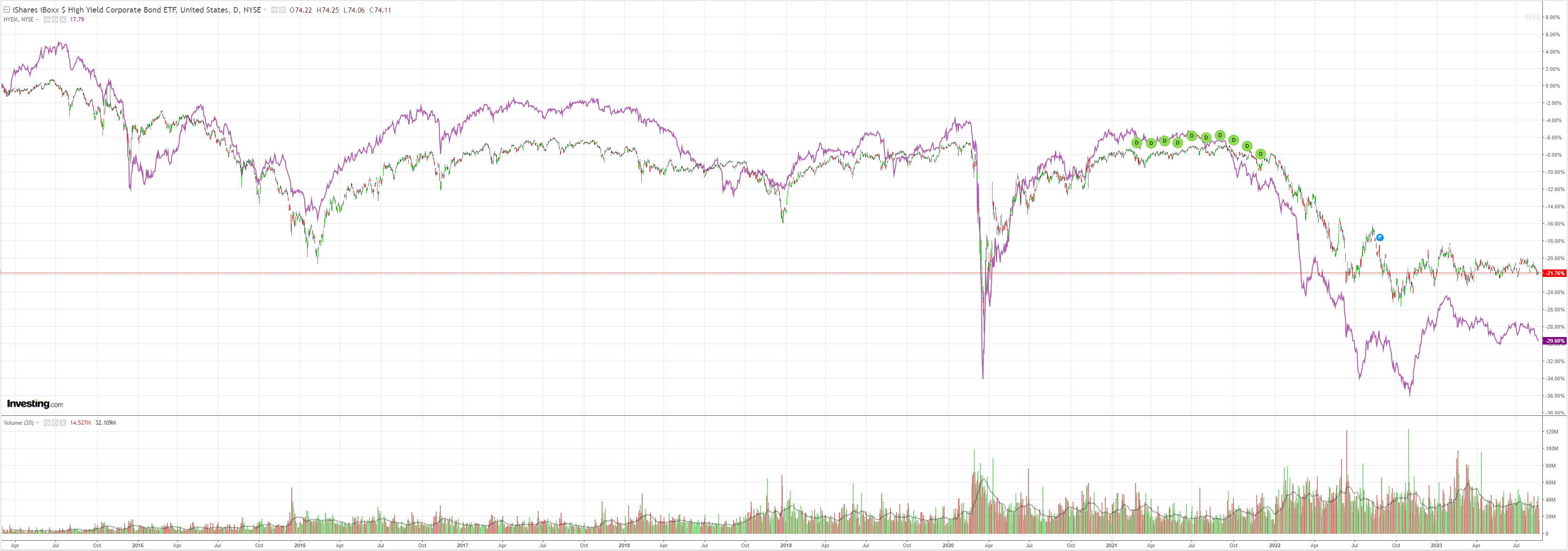

Junk (NYSE:HYG) is on the treadmill to hell:

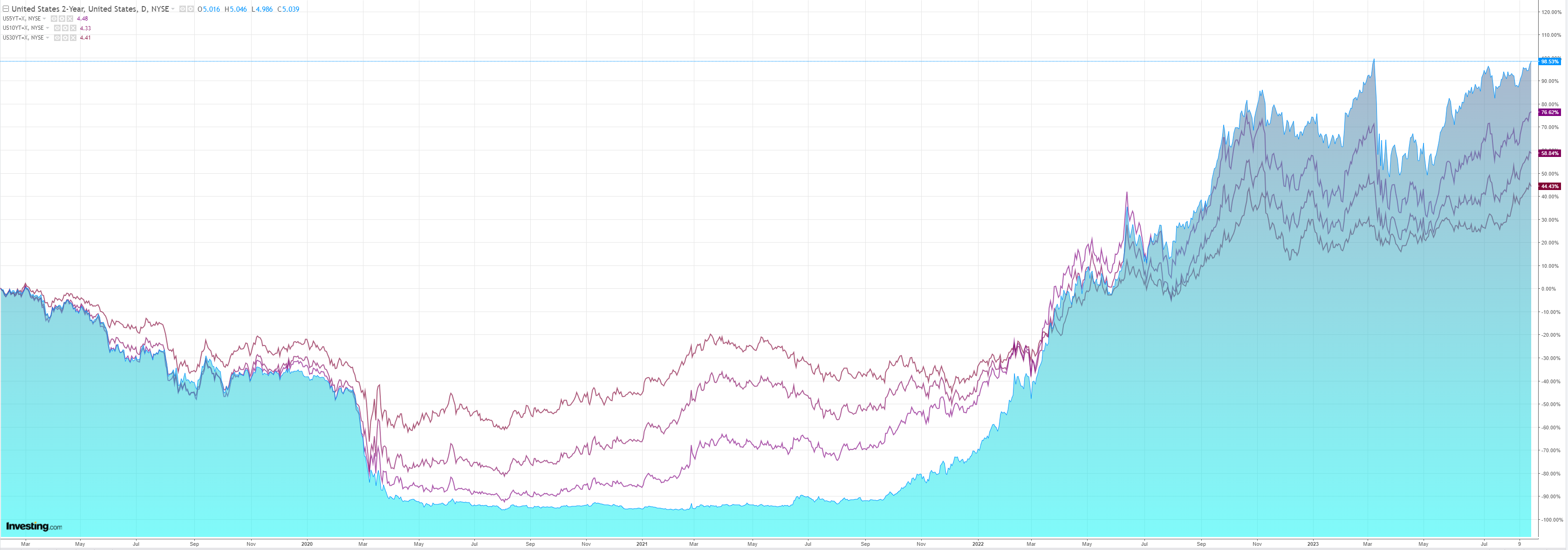

The Treasury curve flattened:

And stocks couldn’t follow through:

Societe Generale (EPA:SOGN) sums the attitude of markets.

AUD/USD at risk of further losses

China woes to hurt AUD further. Antipodean currencies are very exposed to China’seconomic problems. While the Australian dollar has already lost 7% since the double-top itf ormed in June and July at 0.69, further losses are possible.

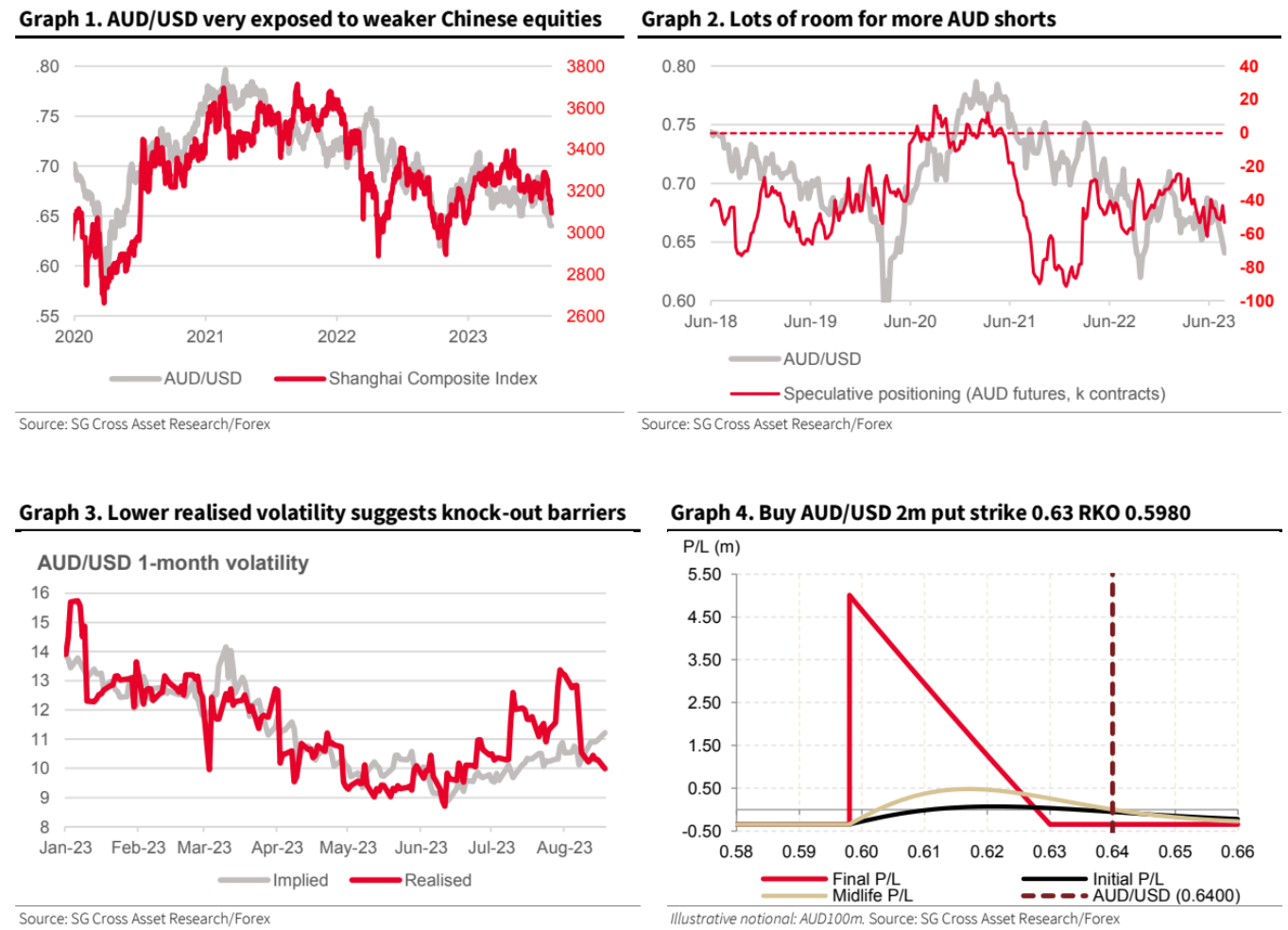

As our economists noted last week, almost all the July data missed market expectations by a wide margin. The message is loud and clear: China is experiencing all-out deflation. Contracting Chinese demand for Australian commodities (iron ore) and, more directly, softer Chinese stocks are putting AUD/USD more at risk(Graph 1).

Room for more AUD shorts. AUD/USD positioning has been structurally short for years. But the rapid fall in the currency over the past few weeks has not led to extreme positioning (Graph2). According to the CFTC, speculative shorts remain in the middle of their range, suggesting that the market is not crowded in any one direction, leaving room for more shorts.

RBA most likely done. The next RBA meeting on 5 September should confirm the market conviction that the central bank is finished hiking rates. The latest unemployment release was weaker and missed estimates, while the CPI has confirmed its downtrend, reaching 5.4% most recently. Thus, the case for higher rates is now very weak.

Expression Trading contained downside 0.62, a key support forAUD/USD, is now within reach. A deterioration in the market perception of China’s woes could however drive the pair into the 0.60-0.62 range, although a break below 0.60 is very unlikely, in our view. As realised vol is returning below the increasing implied vol(Graph 3), there is now value in aiming to capture a limited downside move.

Actually, I can see the Pacific peso swan diving into the 50s. Why not? China isn’t fixing anything, CNY has to fall much further, and it will drag down EUR.

DXY will benefit and our commodities are yet to even correct!