DXY was firm again last night as EUR fell:

The AUD had another strong night on today’s inflation print. A big yawn for me:

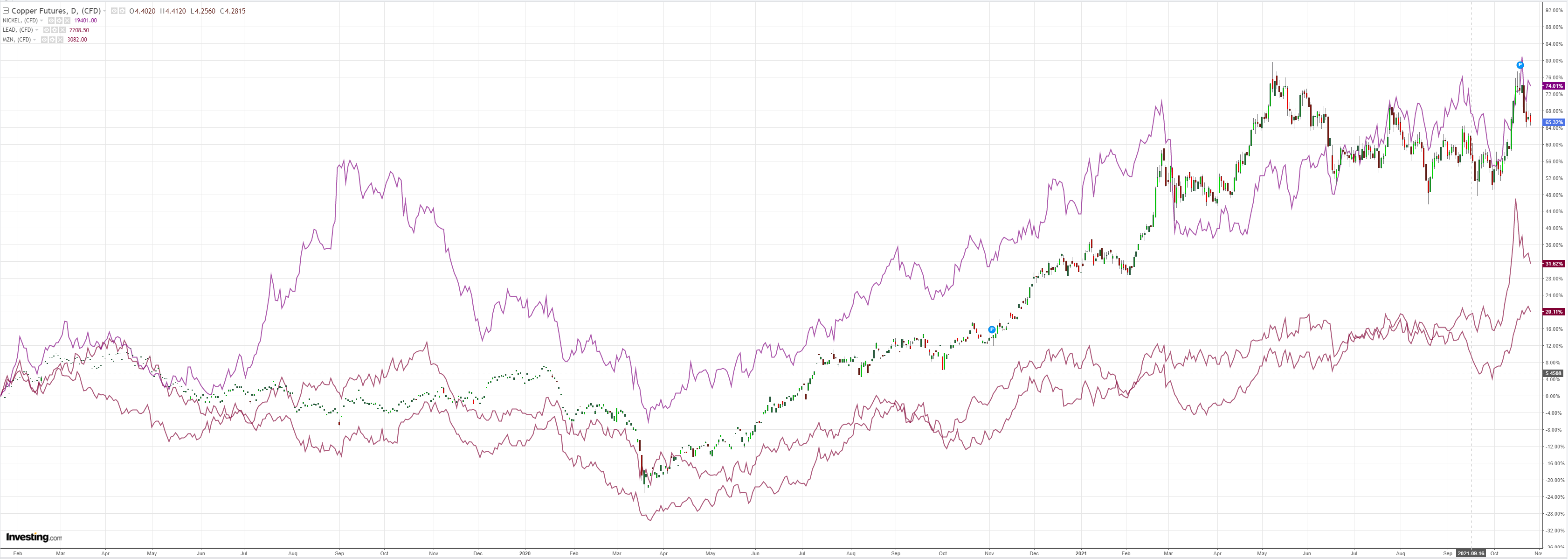

Base metals too on signs China is lifting metals processing output:

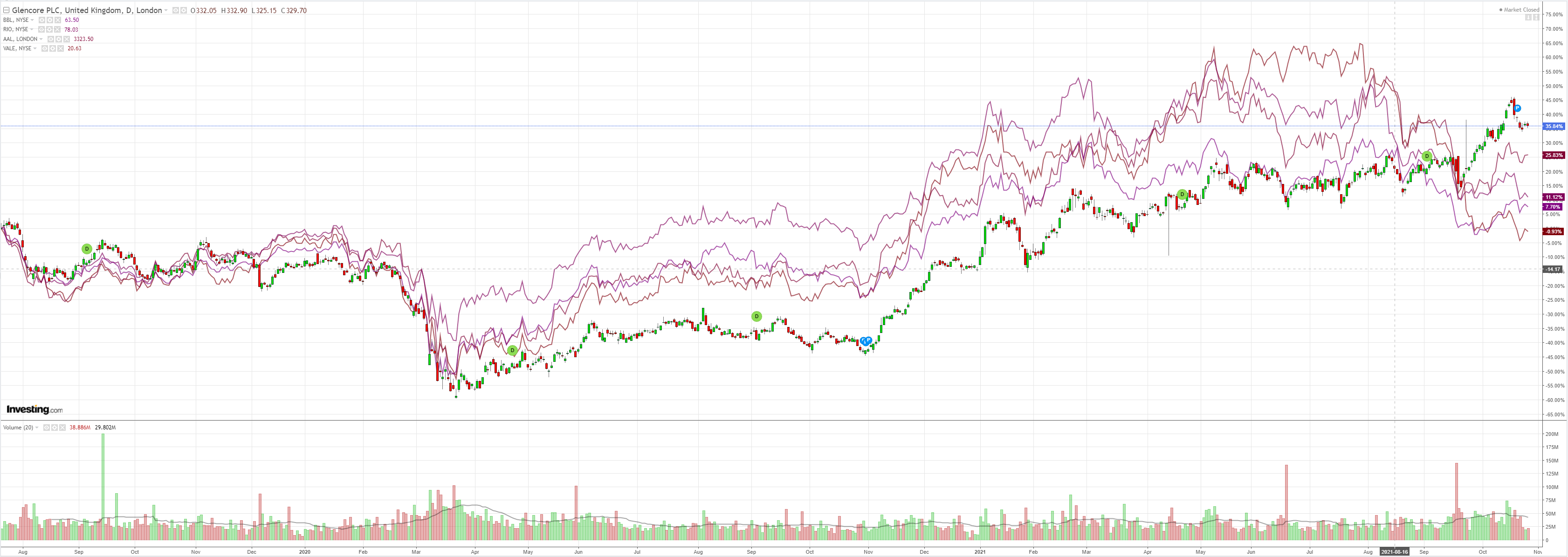

Big miners fell as well:

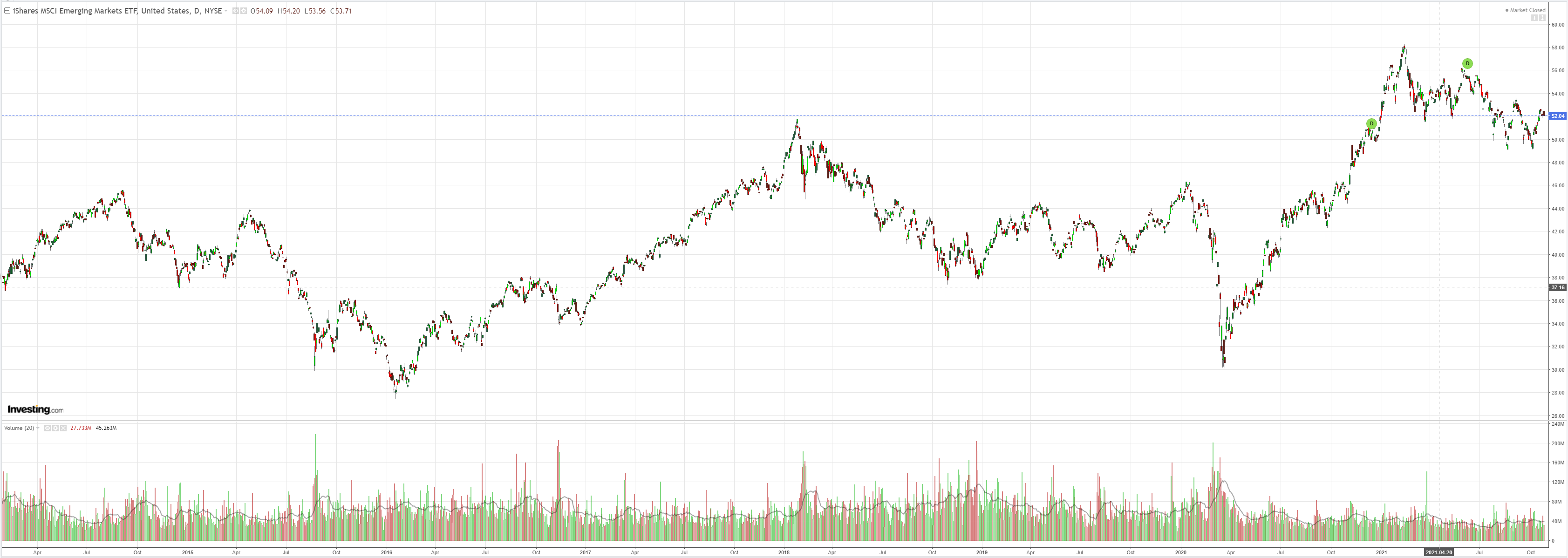

EM stocks have stalled:

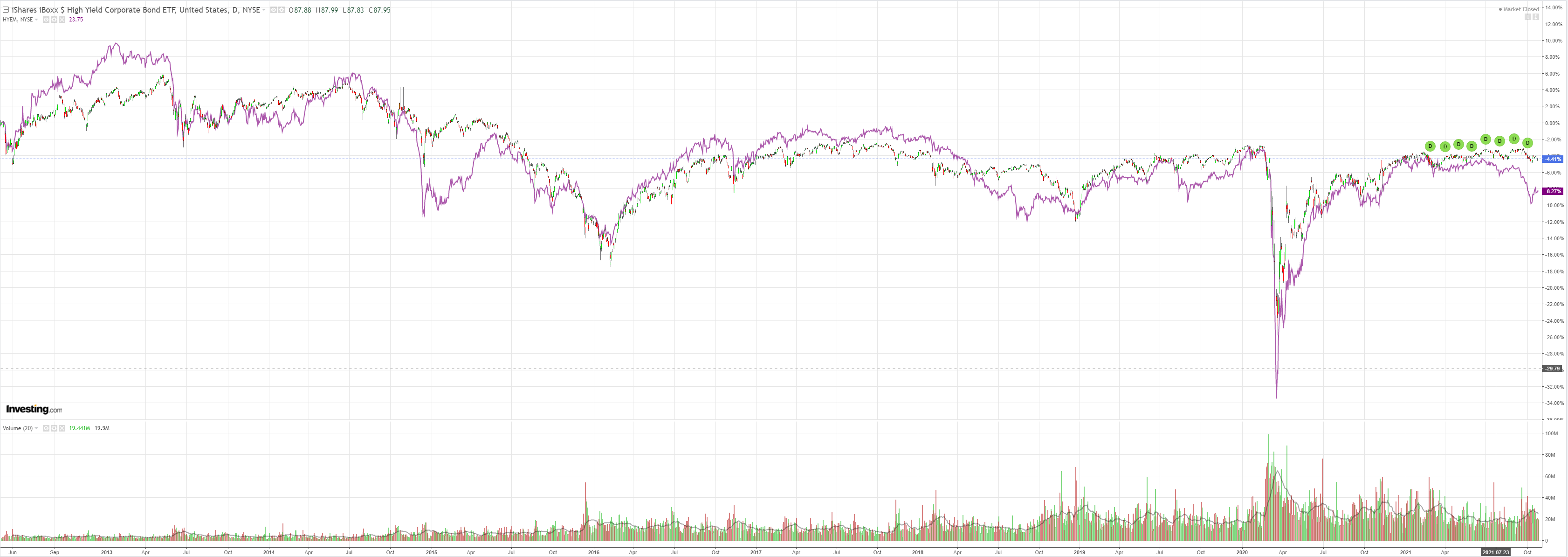

Junk bounced:

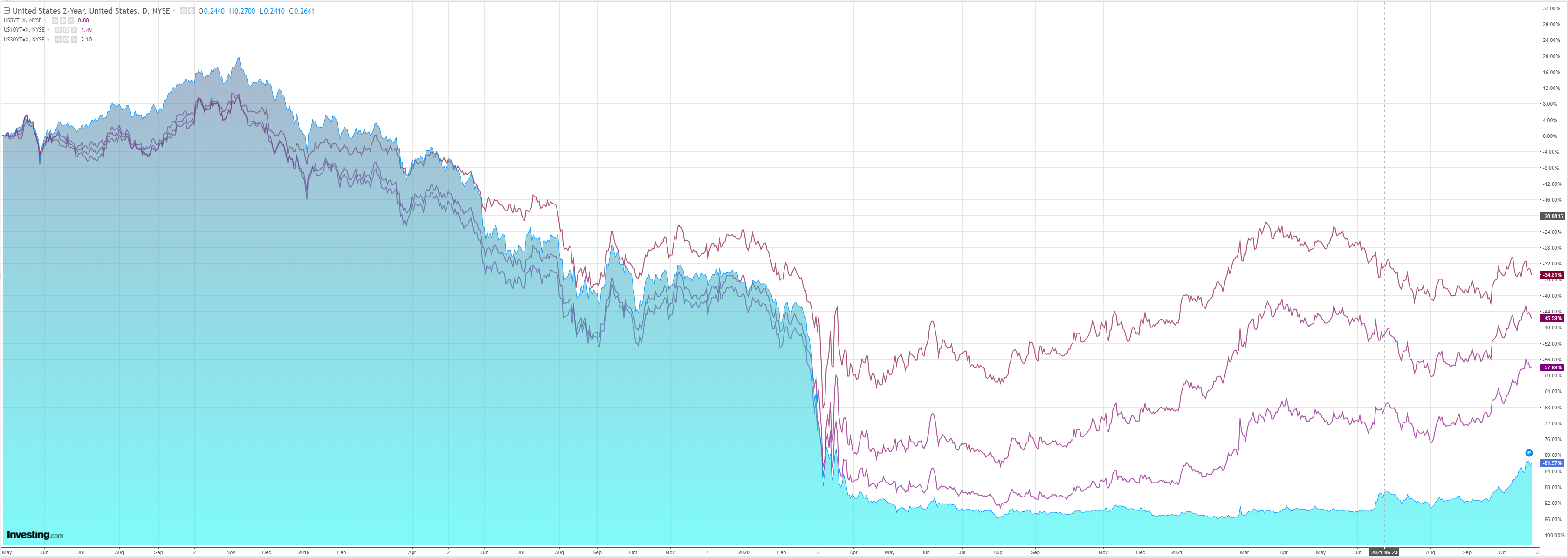

But the Treasury curve looks more and more like the curve flattening is here to stay:

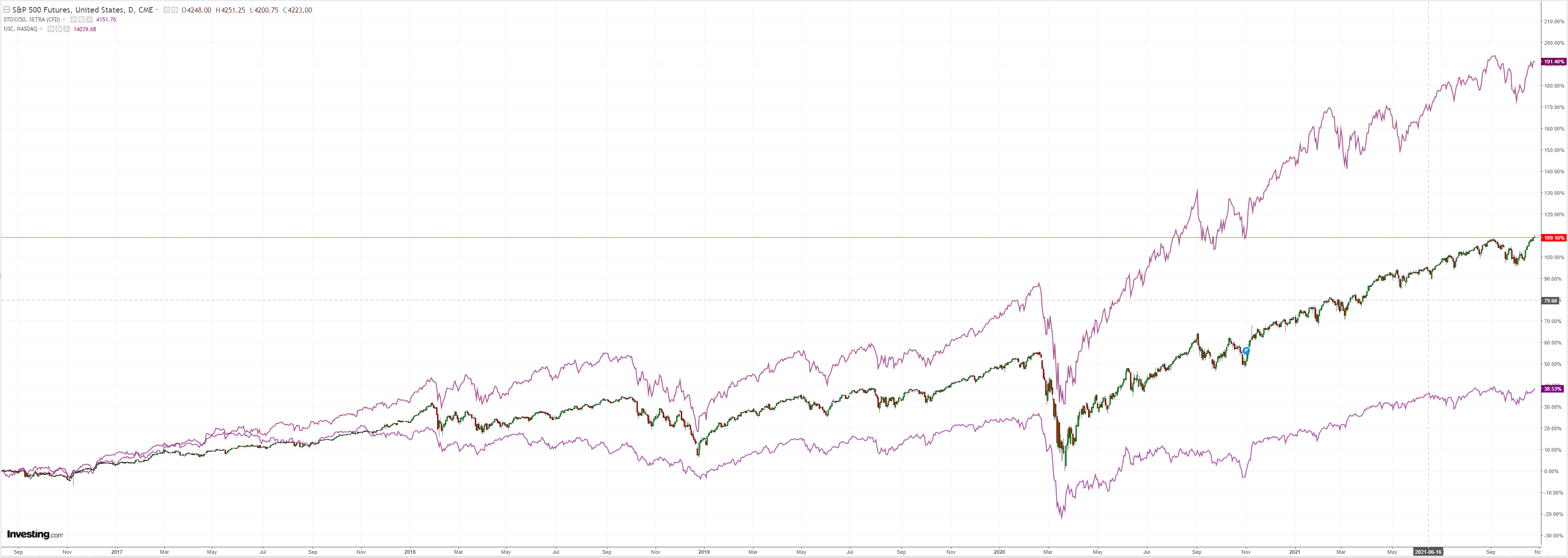

Stocks held at record highs:

Westpac has the wrap:

Event Wrap

US new home sales in September rose to an annual pace of 800k (est. 759k, prior revised to 704k from 740k), with a median price of USD408,800 (up from USD401,500). CoreLogic-CS house price index in August rose 1.17%m/m to 19.66%y/y (est. +1.5%m/m and 20.0%y/y).

Conference Board consumer confidence beat estimates with a rise to 113.8 (est. 108.3, prior 109.3), with current conditions at 147.4 (from 144.3) and expectations rising to 91.3 from 86.7 after a correction over the past 3 months. Inflation concerns remained at a 13-year high. Richmond Fed manufacturing survey rose to 12 from -3 against a median estimate of 5. New orders were particularly solid, rising to +10 from -19, and employment was firmer (27 from 20), although wages were little changed at 39 from 41.

UK CBI retail survey in October surprised with a large rise to 30 (est. 13, prior 11), in contrast to recent weak ONS data on retail sales. While volatile, sales have jumped recently as stock shortages continue to be a concern for the winter season.

Event Outlook

Australia: The Q3 CPI will be published. In terms of key drivers, fuel and motor vehicles will play an important role, while dwelling prices will also make a strong contribution. However, there is more uncertainty than usual due to the lingering effects from the now-expired HomeBuilder grants and the ABS imputing price changes for some services. The main offsets in Q3 are pharmaceuticals and communications. Westpac forecasts a 0.8% (3.1%yr) rise for the headline CPI, and a 0.5% (1.9%yr) gain for the trimmed mean measure.

NZ: Westpac is forecasting the trade deficit to widen slightly to $2170m in September after yet another bumper month for imports. The October ANZ business confidence release will subsequently provide a detailed sectoral breakdown of activity. Underlying inflation gauges will be worth watching as inflation expectations have surpassed the RBNZ’s inflation target band.

US: Wholesale inventories are set for a rebuild as supply restrictions abate. Durable goods orders for September are expected to fall 1.0% as the outlook for investment becomes more uncertain.

Canada: The Bank of Canada’s policy decision will see tapering near completion and the focus of post-meeting communications shift to the timing/conditions for rate hikes.

Credit Agricole (PA:CAGR) the analysis:

AUD: inflation, finally something for the RBA to worry about?

Australia’s underlying inflation, the average of the trimmed mean and weighted median inflation, has been below the RBA’s 2-3% inflation target for over five years. The Australian inflation number on Wednesday finally threatens to see underlying inflation breach the bottom of this target band. The market is bullish Australian inflation after NZ’s headline rate accelerated to the fastest pace since 1987, if a consumption tax increase is ignored. The 5Y rolling correlation between NZ and Australian headline inflation is currently running a bit below 60%. The correlation between Australian and NZ trimmed mean inflation (the main focus for the RBA) is also currently running at about 60% on a5Y rolling basis. But there are reasons to be cautious about expecting a surge in Australia’s inflation. While Australians and New Zealanders are both facing higher petrol pump prices, Australian electricity prices fell in Q3 on the back of lower coal and renewable energy prices. Unlike NZ, Australia’s wage inflation remains tame. And while Australia’s house prices have continued to surge—housing makes up the largest weight in the CPI at over 20%–it is the costs of buying newly-constructed homes by owner occupiers as well as rents, maintenance and utilities that are included in the CPI not the prices of existing houses or houses bought by investors. So, not all of the over 20% surge in house prices over the past year be captured by the CPI. So, there is a risk that inflation does not live up to the bullish expectations of the market and curb AUD upside against the NZD.

Meh. No wage inflation no RBA rate hikes. End of story.