DXY eased last night:

Which cut AUD some slack:

Oil flamed out. Gold sure ain’t worried about inflation:

Nickel is on a tear, other dirt was firm:

Big miners (LON:GLEN) to the moon:

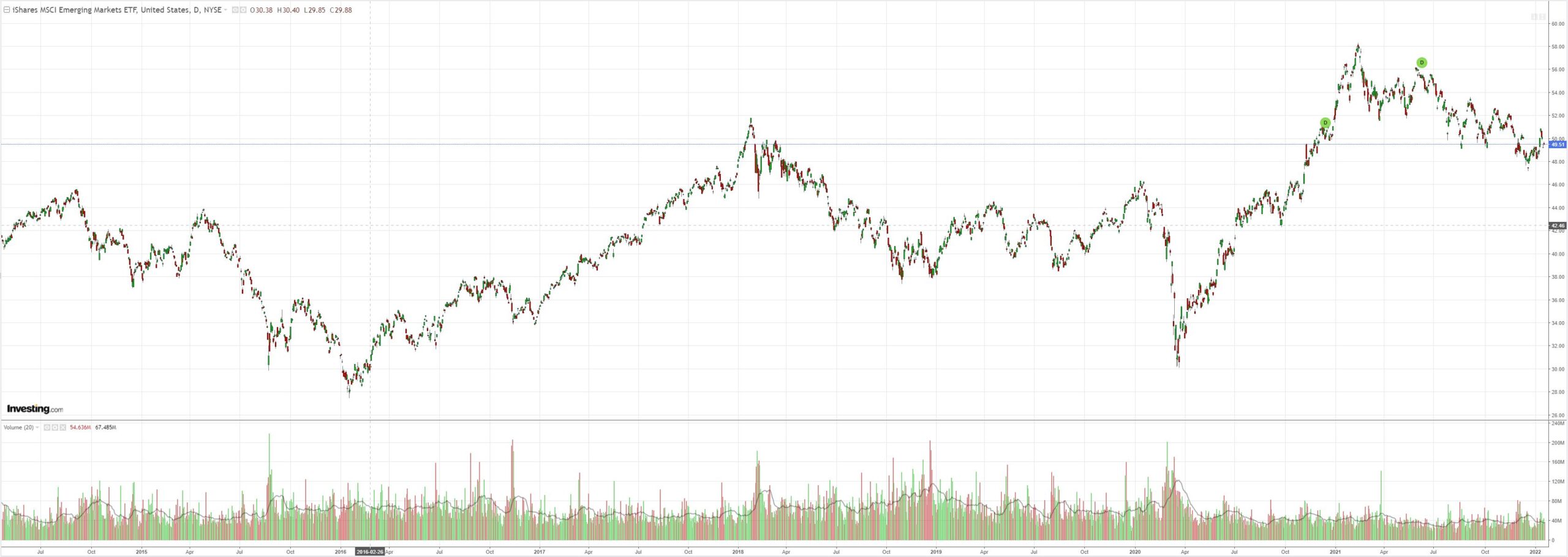

EM stock (NYSE:EEM) rout paused:

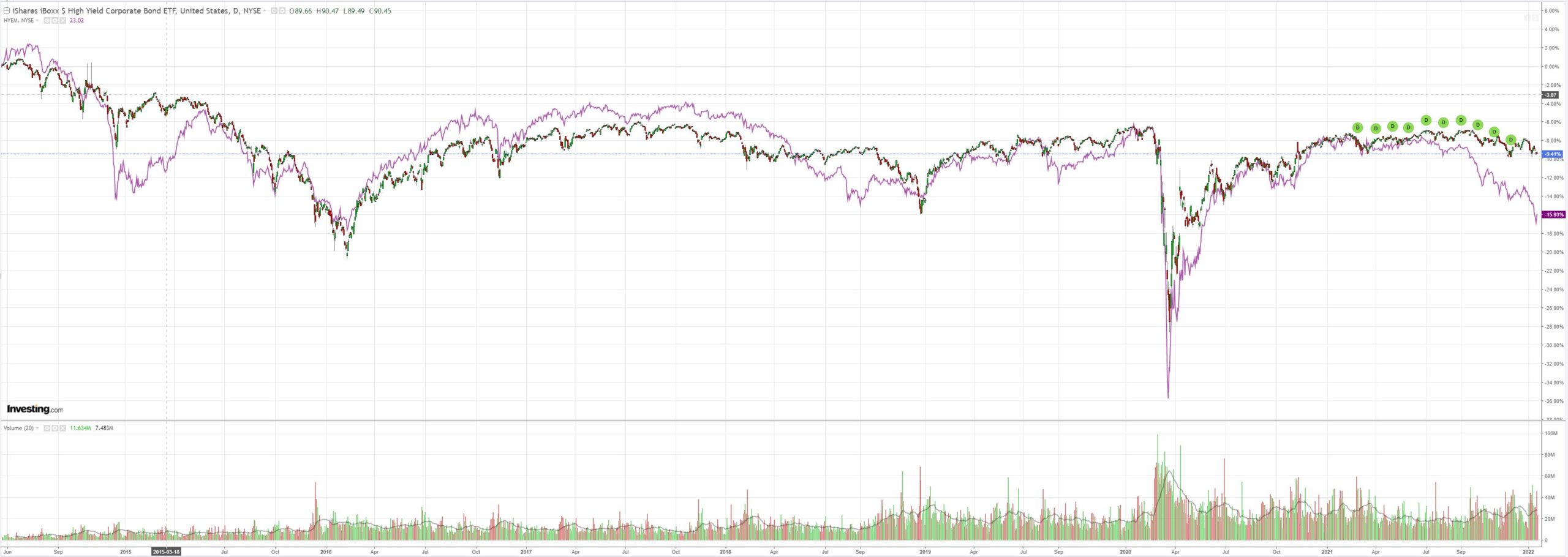

As EM junk (NYSE:HYG) finally lifted:

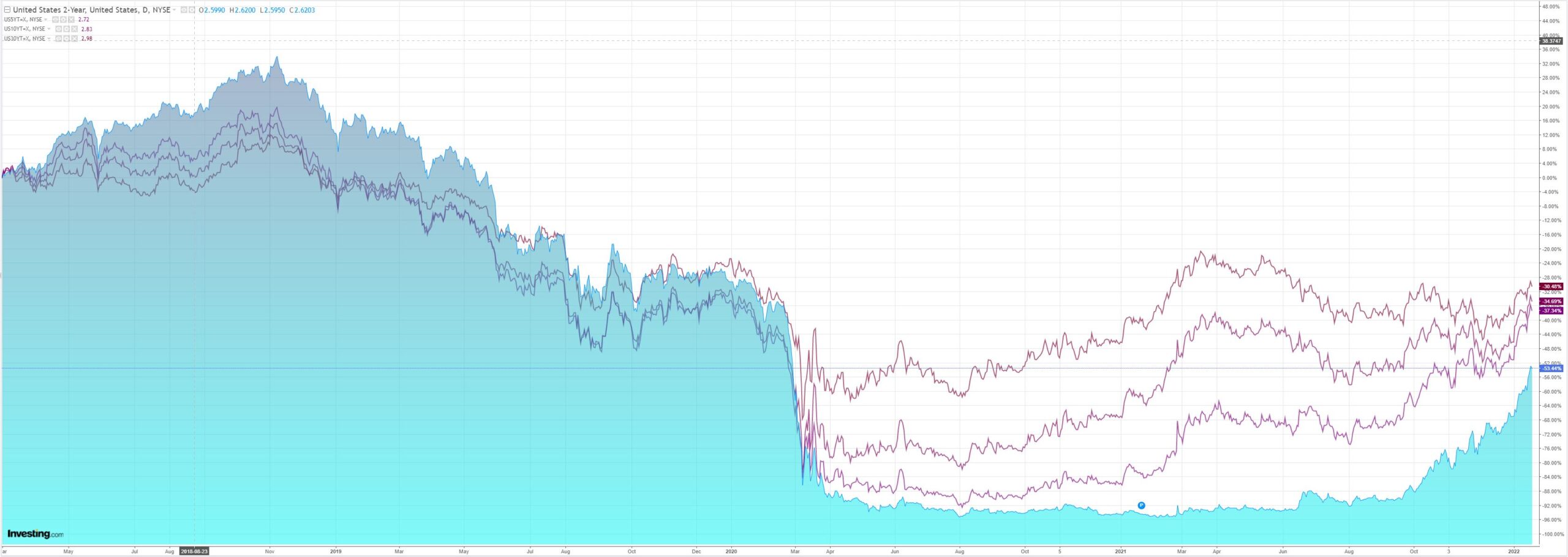

With Treasury yields easing:

Though stocks still struggled:

Westpac has the wrap:

Event Wrap

US housing starts and permits beat estimates. Starts rose 1.4% to a 9-month high of 1.702m (est. 1.679m). Building permits rose 9.1% to an 11-month high of 1.873m (est. 1.703m). Starts and permits continue to trend upward, with robust demand for both new and existing homes alongside soaring prices.

German HICP inflation was confirmed at 5.7% y/y in the final reading for December, unchanged from the preliminary release.

Event Outlook

Aust: December’s payrolls point towards solid gains in employment for the month (Westpac f/c 30k, market 60k), although the rising participation rate is expected to slow the fall in the unemployment rate (Westpac f/c 4.6%).

NZ: Fruit and vegetable prices should be a key driver in December’s food price index given the large declines seen recently in the category.

Eur: The final estimate of December’s CPI will continue to highlight the persistence of inflationary pressures (market f/c: 0.4%).

US: Initial jobless claims are expected to remain near historic lows (market f/c: 225k). The January Phily Fed index will offer a gauge of business activity in the region (market f/c: 19.0).Existing home sales are expected to remain solid in December given the strength of underlying demand (market f/c: -0.4%).

Not much changed. The Fed is still coming and commodities are still fighting it, ensuring that the Fed has to go even further.

Over the stretch, there’s only one winner there.

AUD is the bobbing cork amid these swells.