DXY was soft last night:

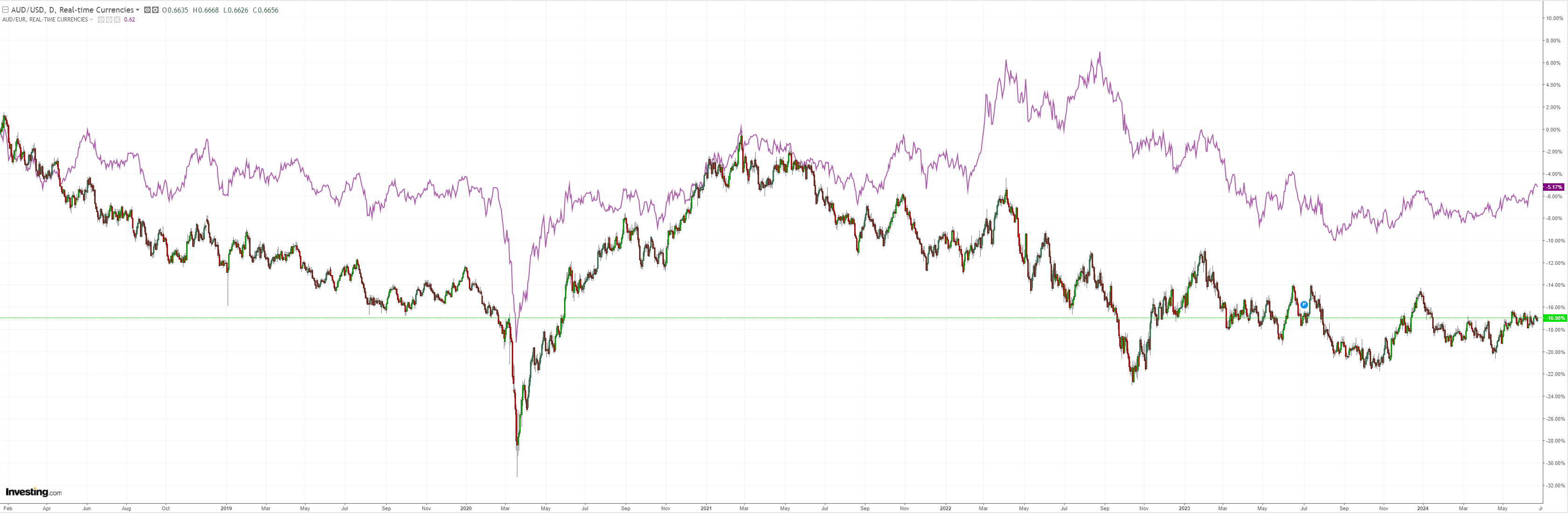

AUD firmed:

North Asia is going down:

Oil is being a CTA pest:

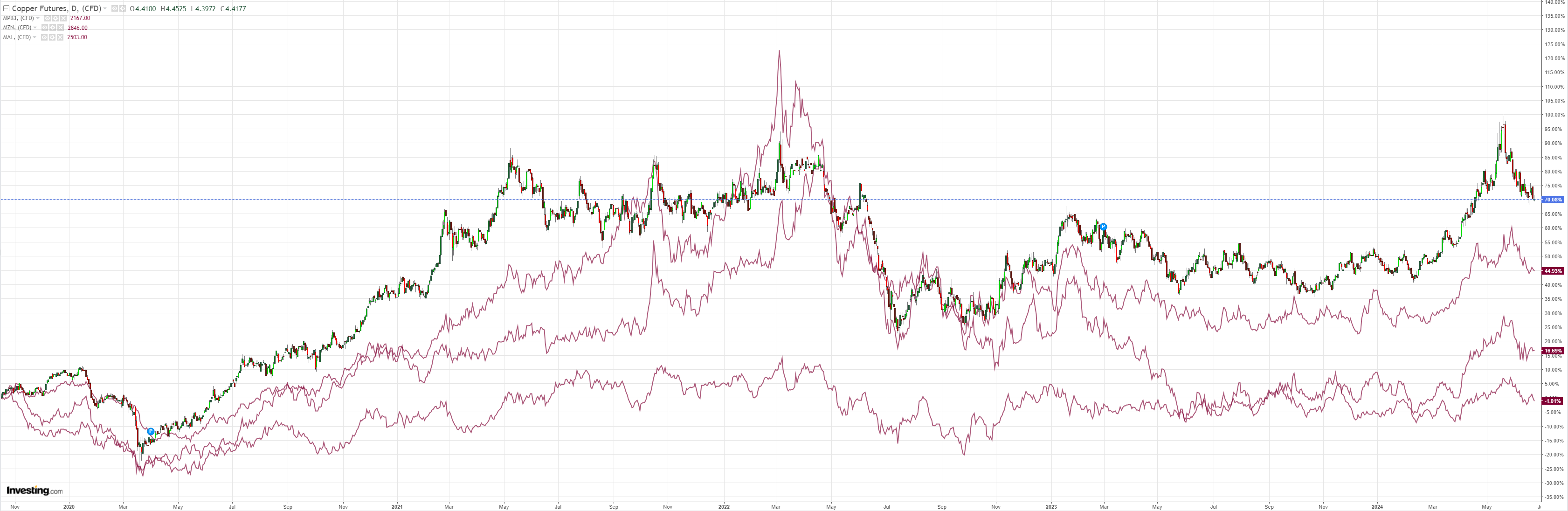

Copper and metals look ready to break down again:

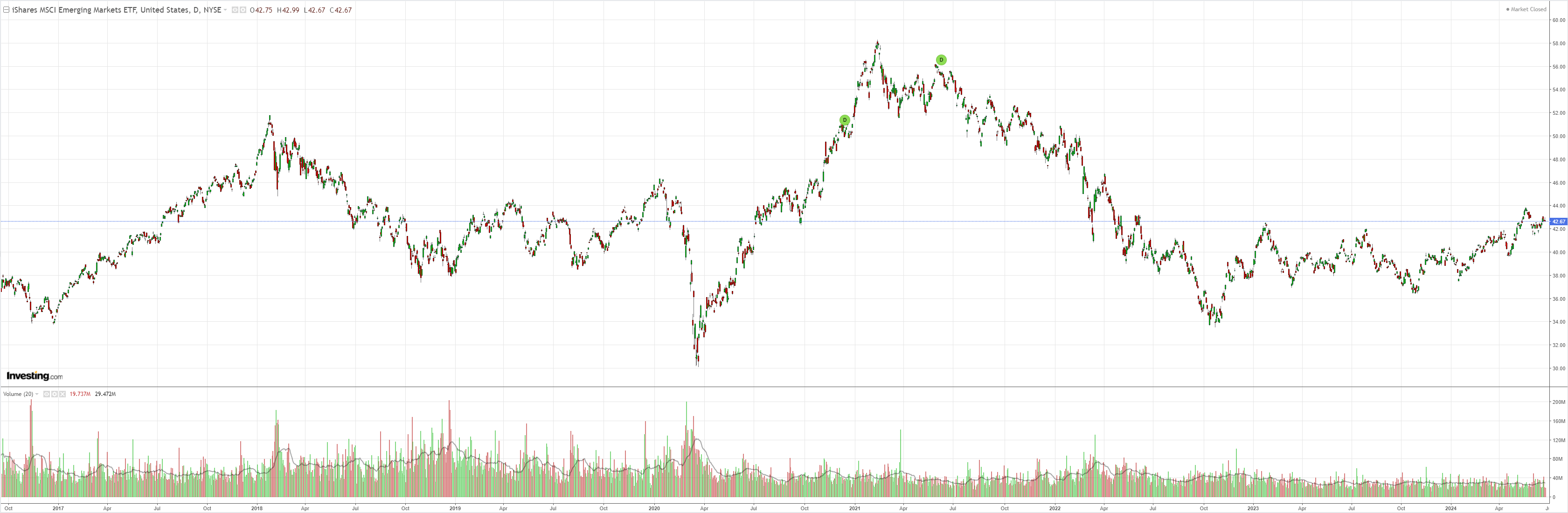

EM is holding:

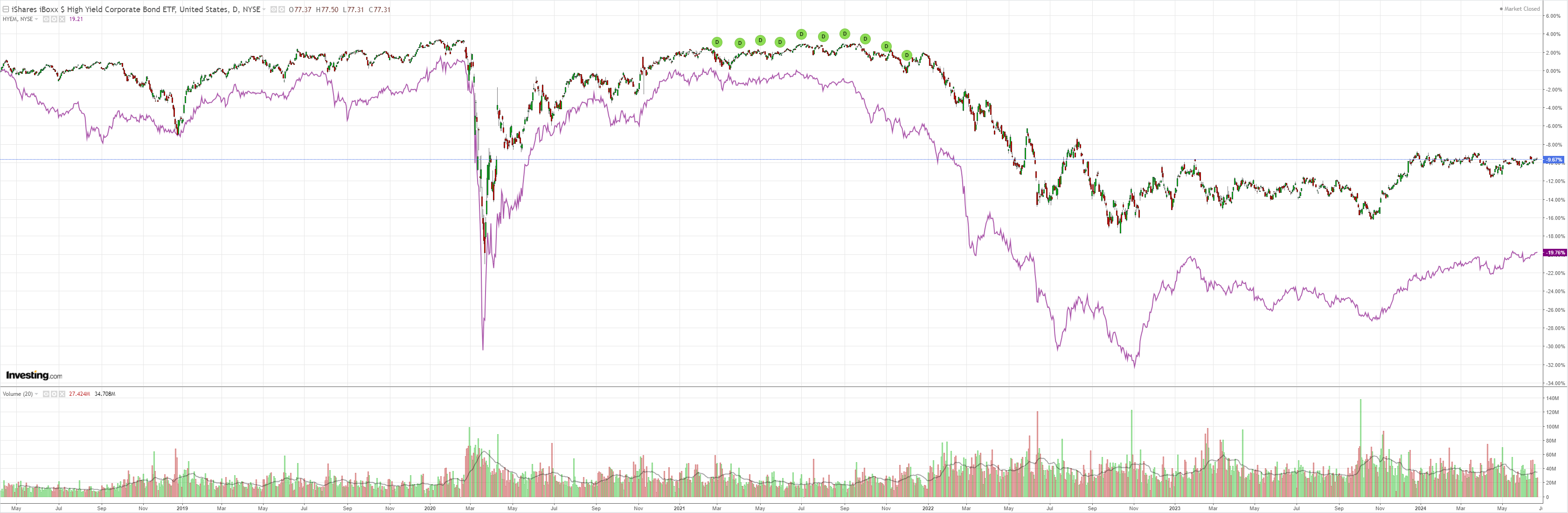

Junk is calm:

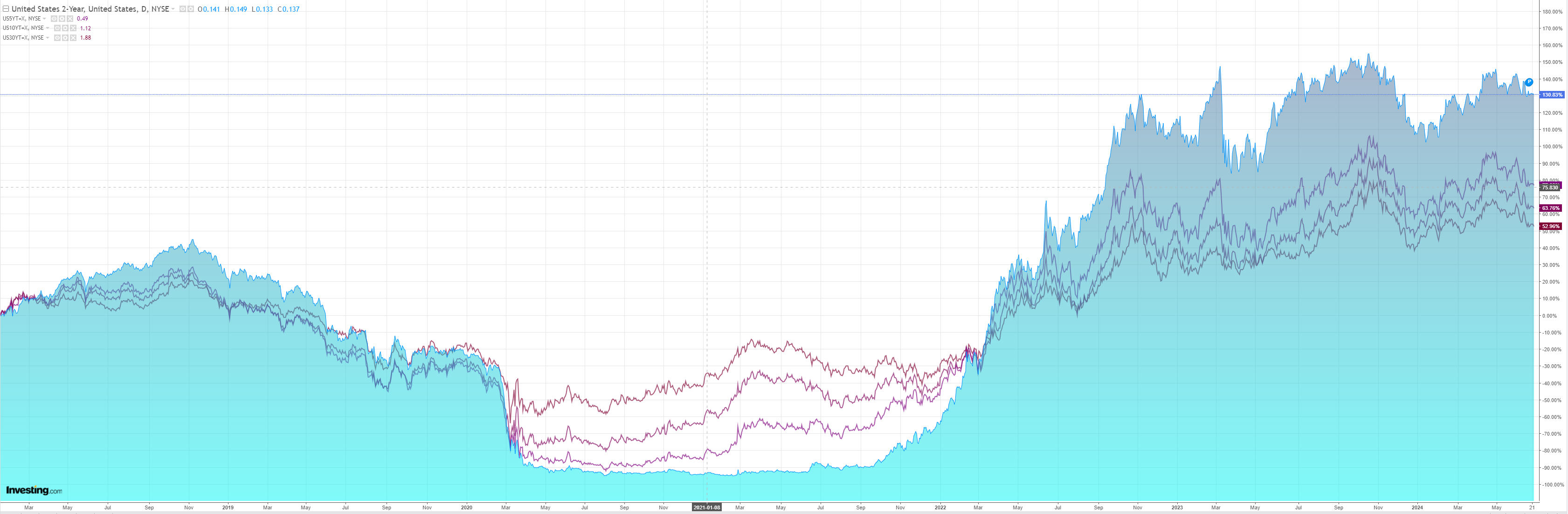

The US curve is flattening again as the economy slows:

High-flying tech has flamed out for now:

I would charactise today’s forex market as the US economy versus the US election.

The former is slowing at a good clip amid a drumbeat of job market skepticism:

On the other hand, the election is shaping as an inflationary beast, especially if Trump is elected and curbs immigration, delivers tax cuts, and hikes tariffs 100%.

Eric Peters, CIO of One River asset management gives us the good stuff:

“There are many ways to observe time,” said the Oracle (NYSE:ORCL), seated on a hot rock, serene. “Most of us think in terms of linear time, but it is just one way.”

I had traveled far to check in, sensing change on the horizon, but unsure as always. “There is also election-time,” said the Oracle, and seeing that I was unsure, he continued. “In your nation, November is the number 0 in election-time. October is -1, September is -2. December is +1, January +2. And so on, so forth.” I nodded, simple enough.

“The economy behaves in unique ways when viewed in this way.”

“Plug economic variables into election-time and you will find interesting patterns emerge,” said the Oracle, his gaze unfocused, taking in the infinite horizon.

“You often begin to see signs of behavioral changes in -4 and -3 when viewing election-time,” he said, referring to July and August heading into our Presidential election. “The more consequential the policy differences between candidates, and the tighter the race, the greater the impact.” I nodded. “Uncertainty in the outcome leads to delayed decision-making, reduced capital formation.”

I can’t see AUD going anywhere but down within the range while this kind of uncertainty rises.