DXY was soft again last night and EUR rallied:

The AUD is a roaring rocket

It looks rather like commodities. Oil:

And base metals, as the energy bubble cuts refining production in China:

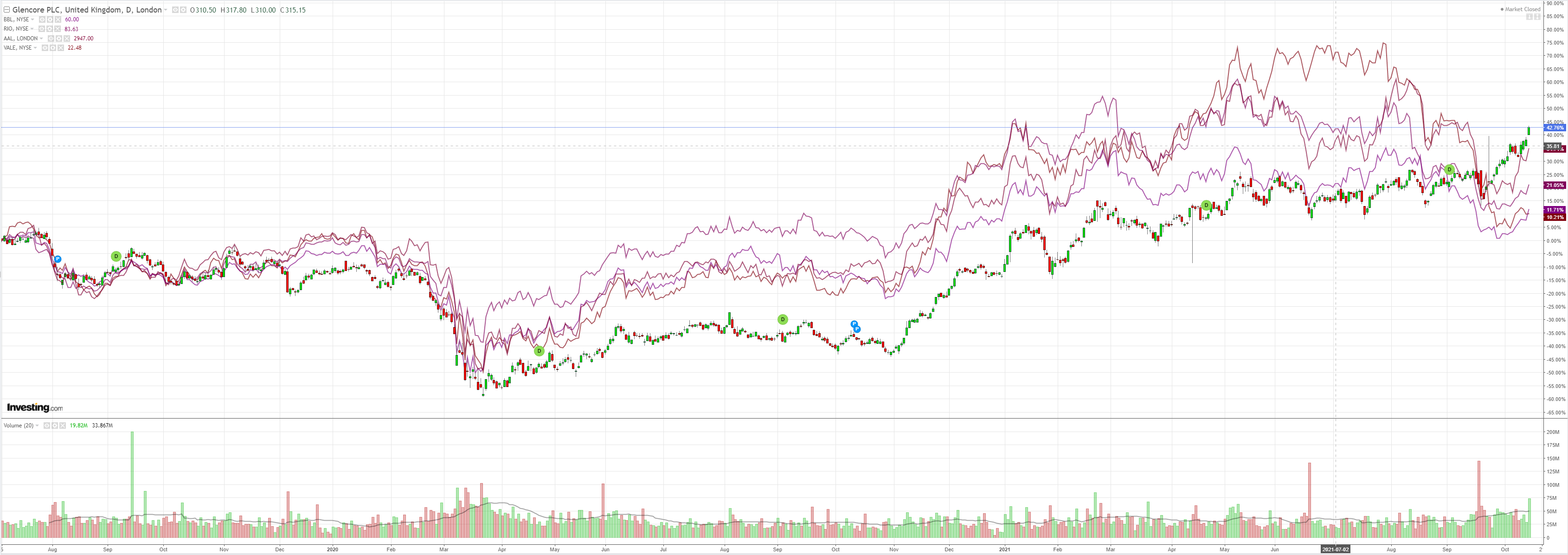

Big miners loved it:

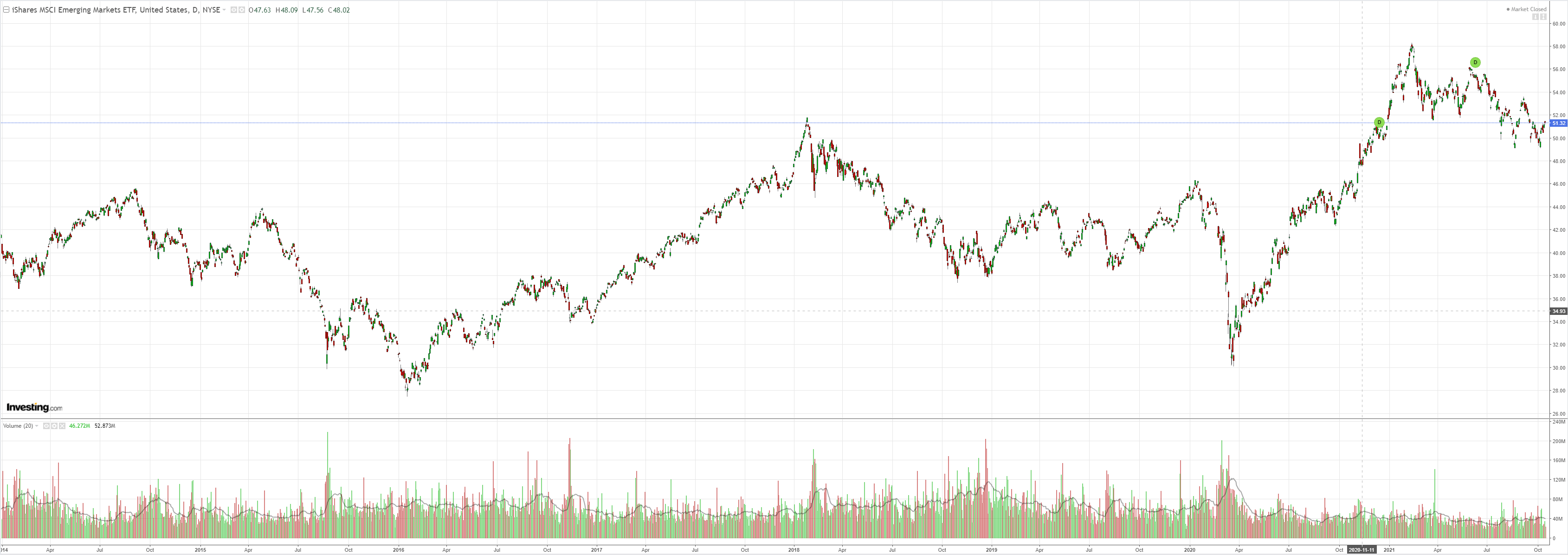

Even EM stocks lifted:

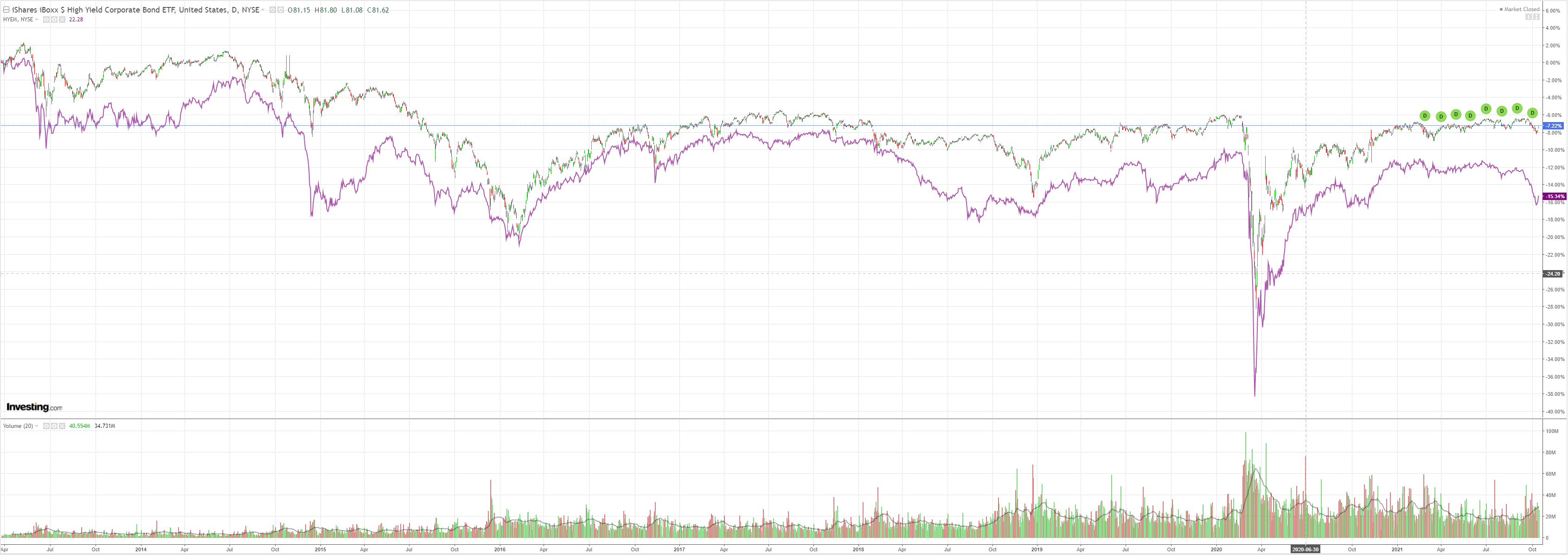

Junk is fixed!

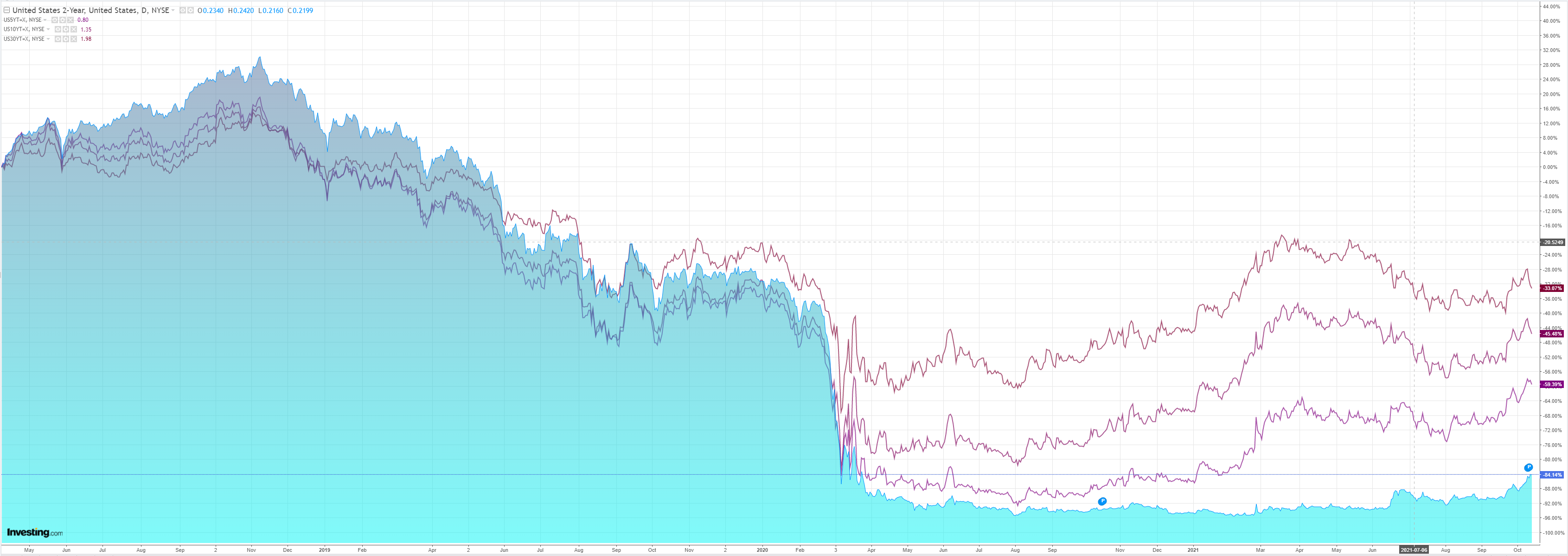

As the US curve was hammered. The bond market is beginning to price a short term boom and bust:

Stocks flew:

Westpac has the wrap:

Event Wrap

US weekly initial jobless claims were lower than anticipated, falling to 293k (est. 320k), and back at pre-pandemic levels. Although below estimates (2.670m), continuing claims of 2.593m remain well above pre-pandemic levels of around 1.700m. PPI inflation disappointed expectations, rising 0.5%m/m to 8.6%y/y (est. +0.6%m/m and 8.7%y/y, prior 8.3%y/y), ex-food and energy up 0.2%m/m to 6.8%y/y (est. +0.5%mm and +7.1%y/y, prior 6.7%y/y).

FOMC member Bullard thought QE tapering should begin in November. He believes activity dipped in Q3 but should rebound in Q4 and into 2022, and added that the labour market is tight with workers hard to find.

US earnings reports mostly beat estimates, with BofA, Citigroup (NYSE:C), Wells Fargo (NYSE:WFC) and Morgan Stanley (NYSE:MS) notable among financial institutions.

Event Outlook

New Zealand: September is expected to see a bounce in the manufacturing PMI as alert levels were eased in the month.

Europe: The trade surplus is expected to show further signs of stabilisation in August having narrowed through the first half.

United States: Today’s key US release will be September retail sales. The market is expecting the rotation to services and delta to weigh on activity in the month. October’s University of Michigan consumer sentiment release will also be in focus given recent weakness and lingering uncertainties over the outlook. The FOMC’s Harker and Williams are also due to speak.

We are now into an unhinged blowoff for commodities driven by the energy bubble. It is coal and LNG that matter, not oil, hence the outperforming AUD even against DXY. It is they that are killing Chinese electricity output and, in turn, swathes of global metals processing which is very energy-intensive.

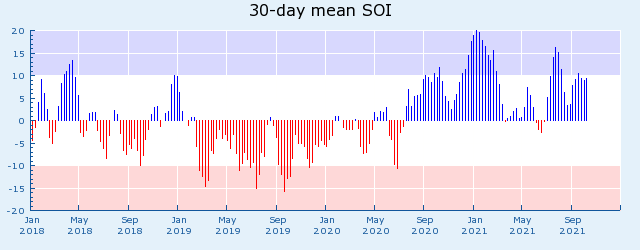

In this environment, it is pointless to offer rational explanations. A commodity mania has taken hold, even as the number one demand source for commodities – Chinese property – is crashing. This is an incredible boom and bust scenario that is literally as predictable as the weather, as we dance on the edge of a La Nina:

If it persists, it raises the risk of increased cyclone activity throughout the southern summer, putting at risk more coal and iron ore exports. Not to mention delivering havoc in global softs.

There is still nothing but a few short-term distortions to underpin the melt-up. But that doesn’t matter anymore. This thing is going to run until it doesn’t. Doing whatever harm it needs to kill itself whenever it is overhauled by increasing supply and collapsing Chinese demand.

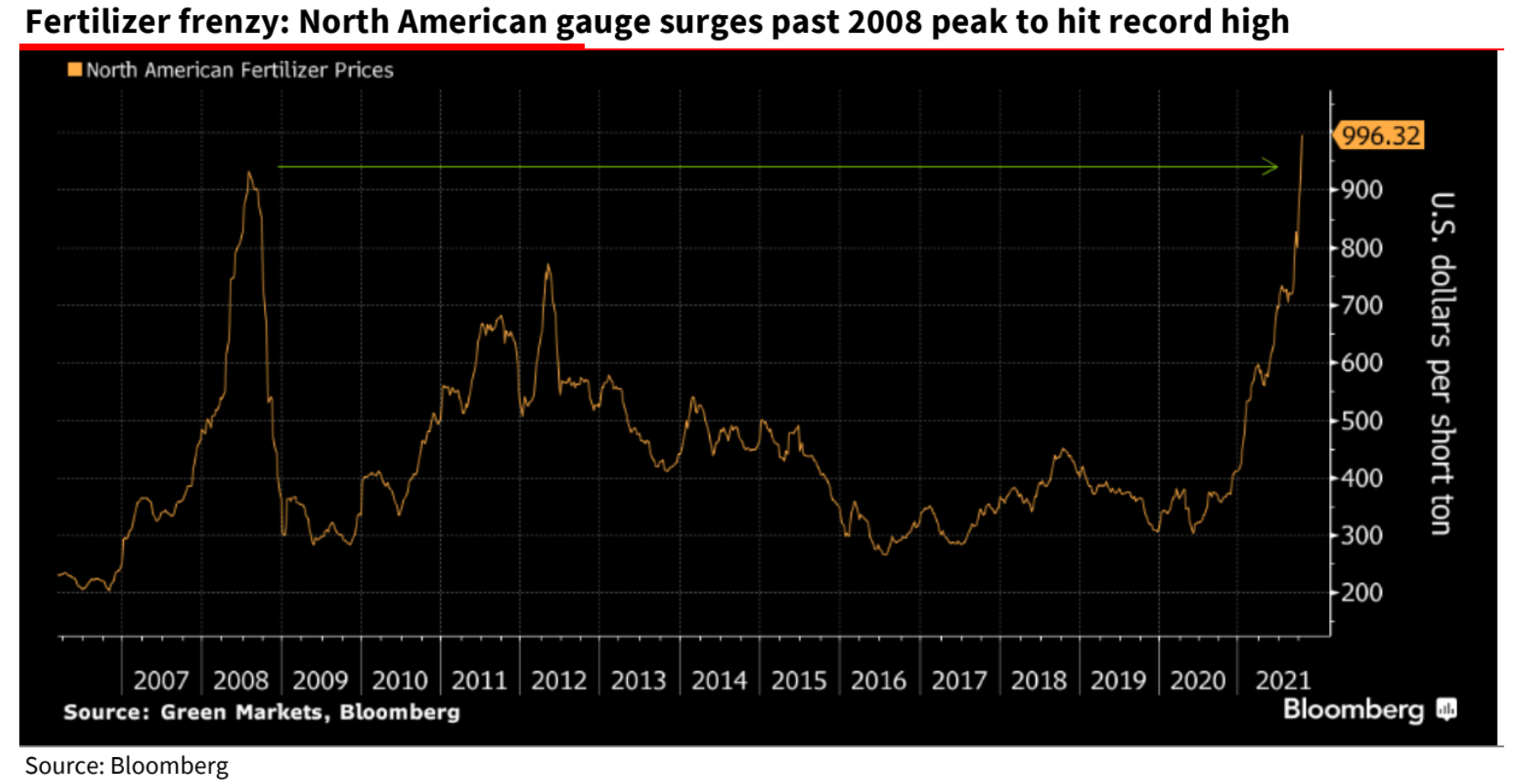

I have said repeatedly in this process that the notion of a new supercycle is manure. Well, guess what:

We are into a fully-fledged commodity bubble now. AUD will ride it higher and then crash with it.

Sit back, relax, and enjoy the show.