Street Calls of the Week

DXY reversed hard:

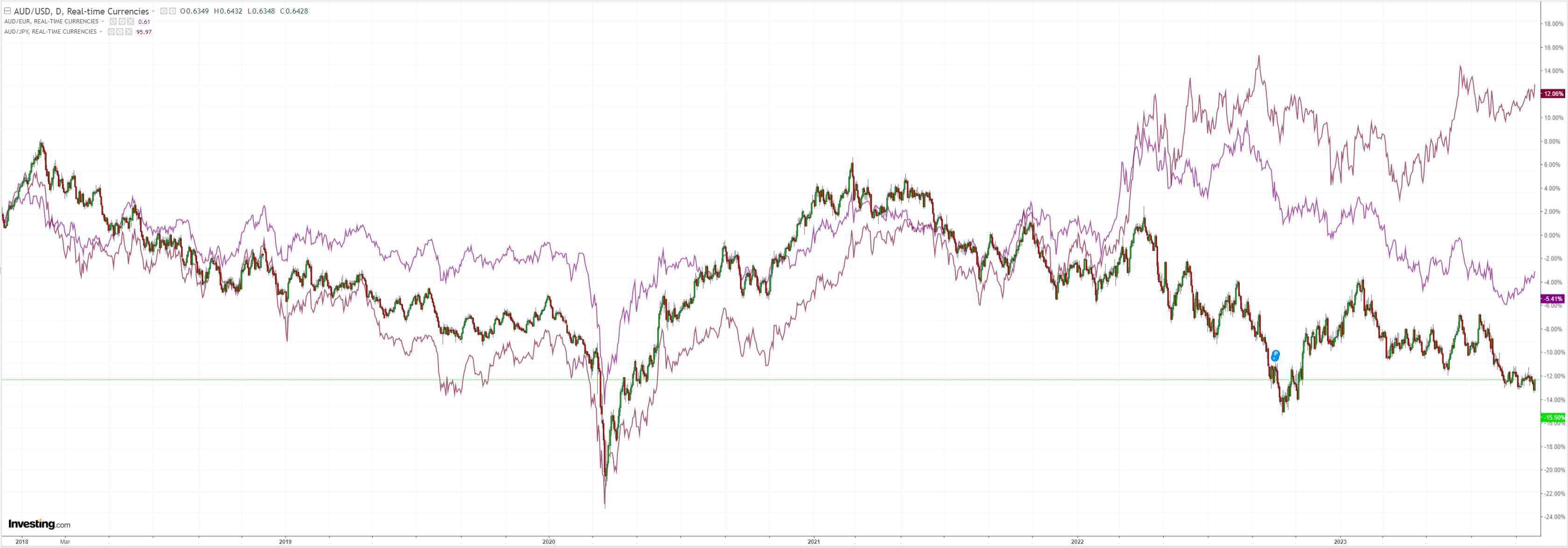

AUD too:

It isn;t obvious that CNY is a semi-floating currency:

Brent rolled:

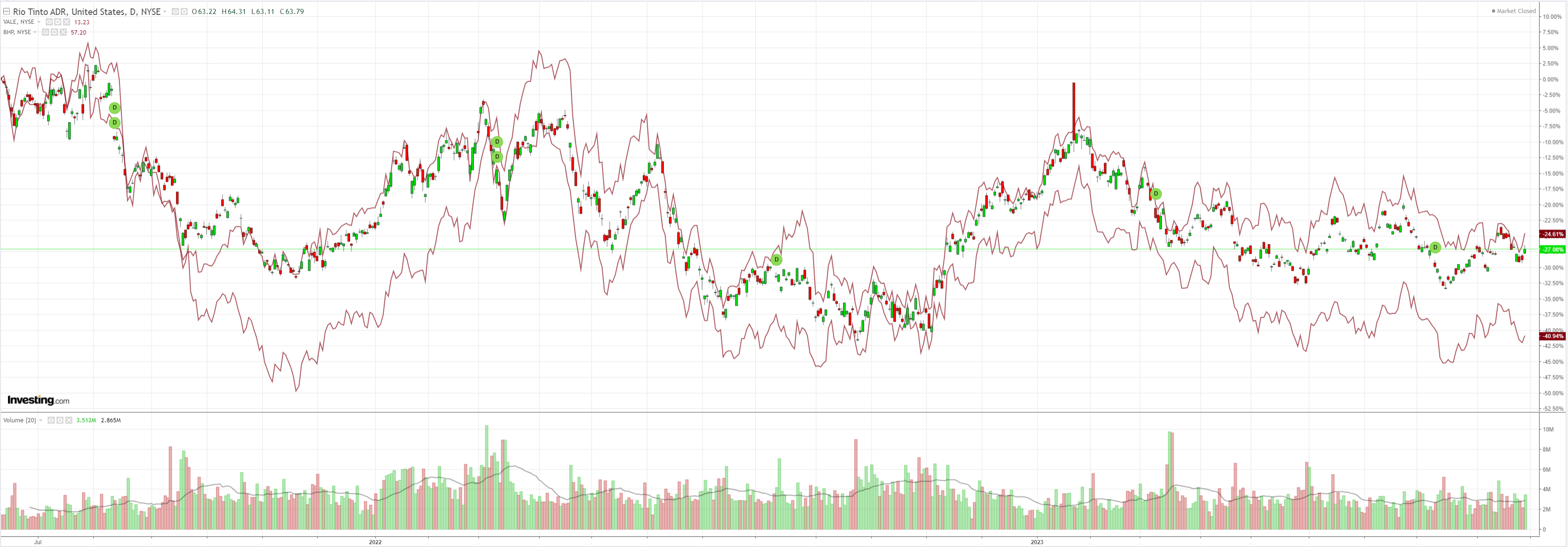

Dirt soared:

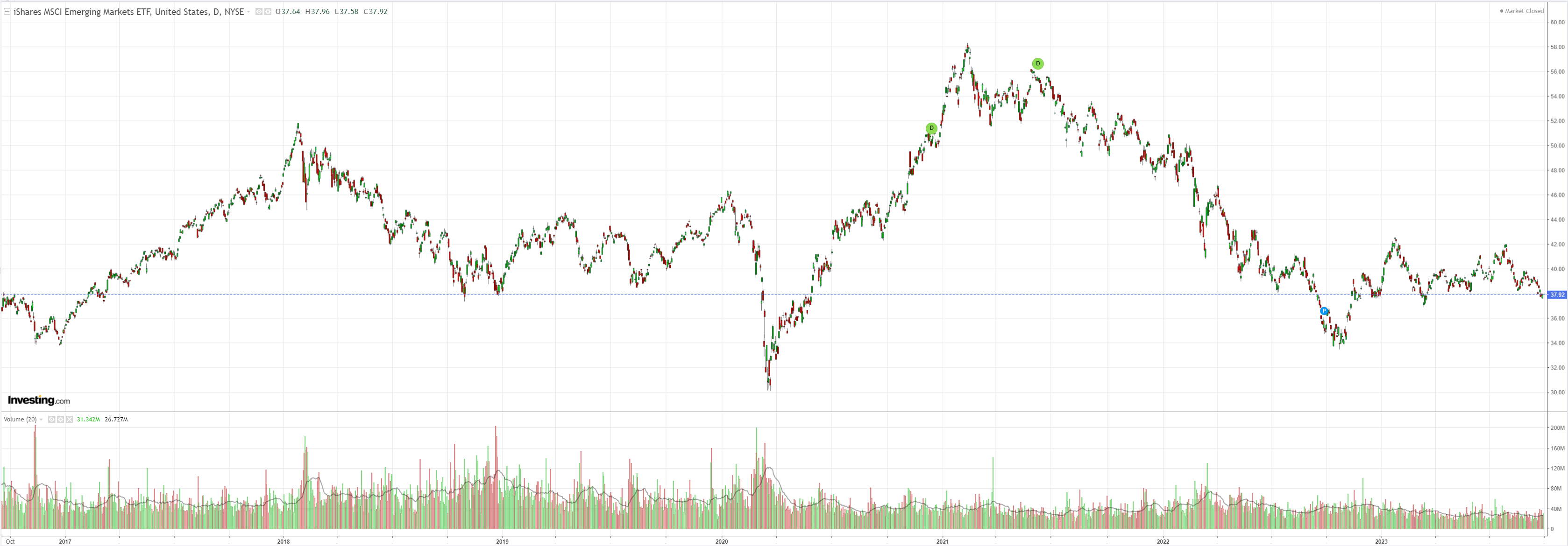

EM stock not so much:

But miners popped:

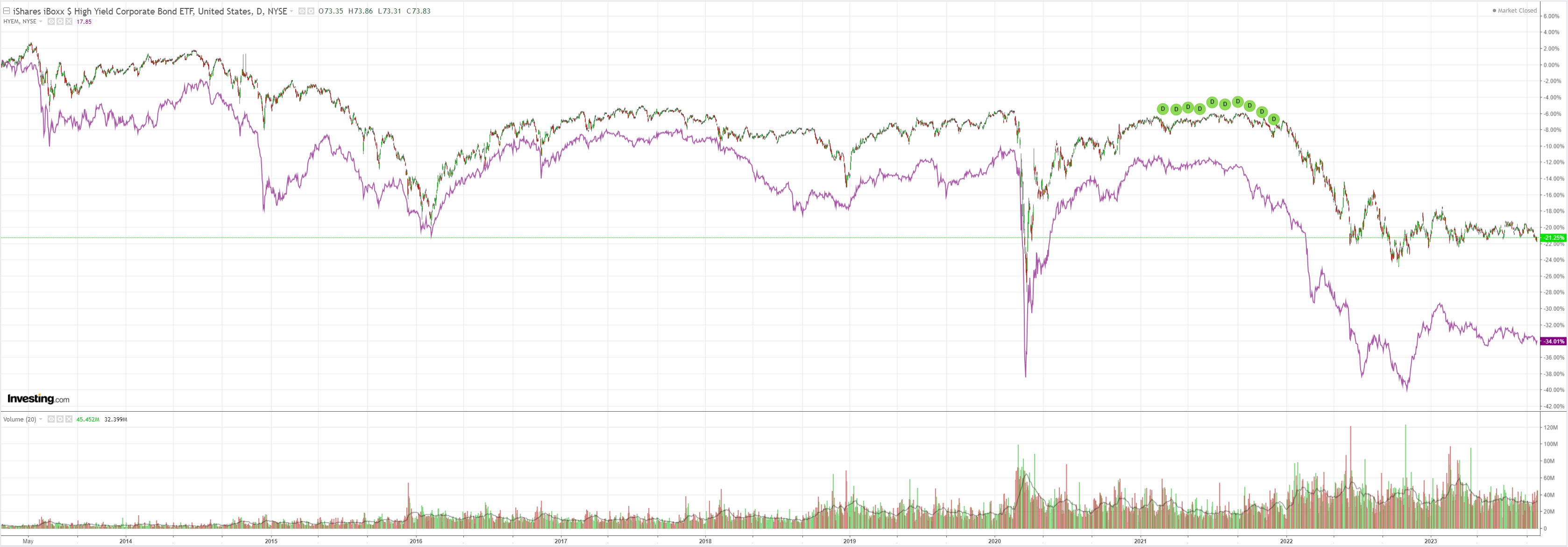

Junk firmed:

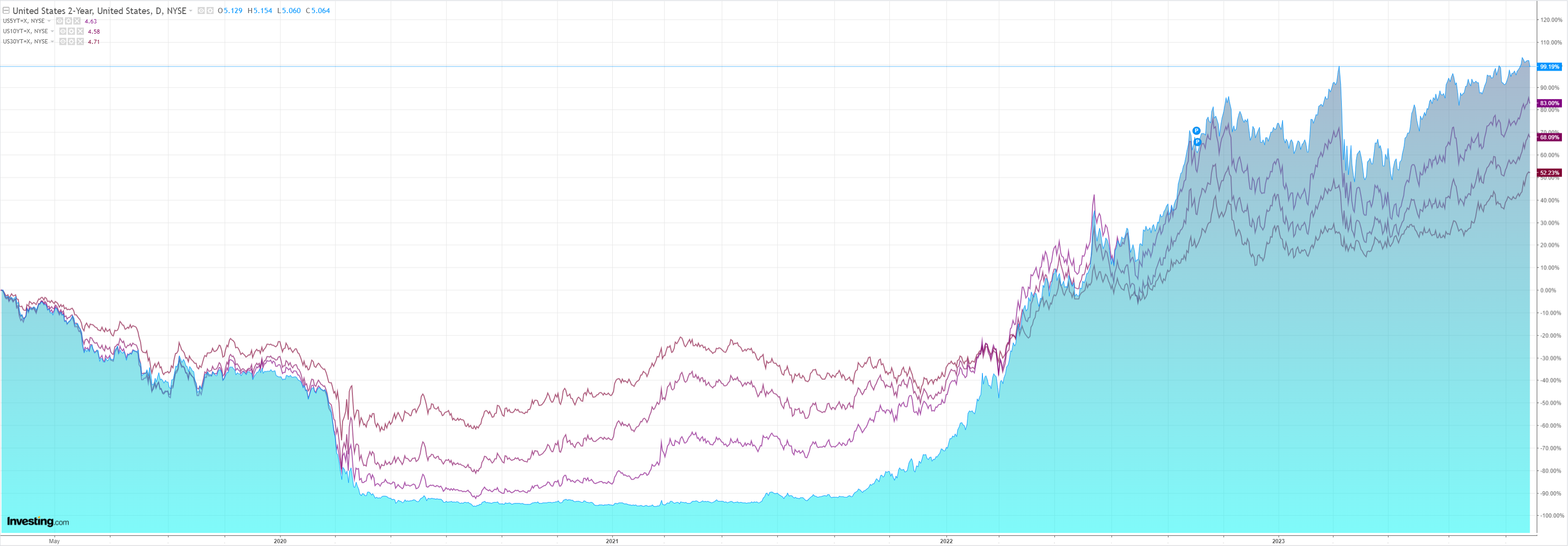

Yields eased slightly:

Stocks bounced but did not recapture support:

US GDP revisions offered the market reprieve as the consumer was marked down. Goldman has more.

Real GDP growth was unrevised at +2.1% annualized in the second quarter and consumption growth was revised down sharply to +0.8%—both below consensus expectations. However, the details of the report were strong on net, as the annual revisions resulted in a stronger multi-year trend in GDP and a stronger multi-year and recent trend in gross domestic income. The sequential pace of core inflation was revised higher in the second half of 2022. We left our month-over-month August core PCE inflation estimate unchanged at +0.12%, now corresponding to a year-over-year rate of +3.90% (vs. 3.79% previously). The personal saving rate was revised down over 2015-2019, reflecting downward revisions to proprietor and interest income; however, more recent revisions were positive, with the Q2 saving rate revised up 0.5pp to 5.2%. Pending home sales fell 7.1% month over month in August, below consensus expectations for a more modest decline. Initial jobless claims edged up by 2k to 204k, below consensus expectations for a larger rebound. We will update our Q3 GDP tracking estimates following tomorrow’s personal income and spending report.

Not exactly world-changing but enough to provide relief for severely overstretched markets with stocks and bonds severely oversold, oil severely overbought, and DXY plus pushed to extremes in opposite directions.

It might be time for positioning to take the front seat and work off these excesses for a while. AUD shorts are one of the most extreme.