Forex markets were the reverse of the night before with a firm US PPI enough to lift DXY with all of the usual consequences. EUR fell:

Australian dollar was universally puked:

Commodities, miners and EMs fell:

Yields edged higher:

Stocks were led by FAAMGs:

Westpac has the wrap:

Event Wrap

US weekly initial jobless claims fell from 387k to 375k, and continuing claims fell from 2980k to 2866k – slightly better than expected.

PPI inflation in July rose 1.0% (vs 0.6% expected). The ex-food and energy measure also rose 1.0%, for a 6.2% annual pace (prior 5.6%).

Event Outlook

New Zealand: Strong housing price growth will act as a tailwind in the July manufacturing PMI. Furthermore, June net migration figures are expected to remain subdued, despite the rise in arrivals from Australia before the travel bubble was suspended.

Euro Area: The market expects the June trade balance surplus to widen to EUR 10.8bn, but supply shortages may be crimping export growth.

US: The July import price index is expected to rise from higher energy prices, albeit at a slower pace than prior months (market f/c: 0.6%). The ongoing spread of the delta variant is likely to serve a damper for sentiment in the August University of Michigan sentiment index (market f/c: 81.2).

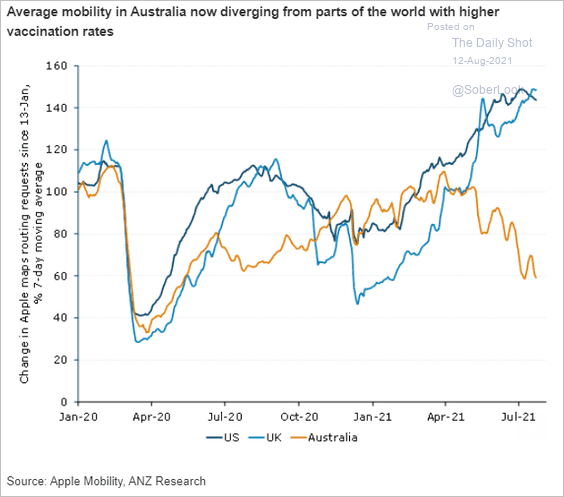

Not much to add today except this chart from ANZ:

I expect that divergence to get wider and remain in place much longer than does the RBA. Over time, it will come to reflect the same in yields and currencies.