DXY was down last night:

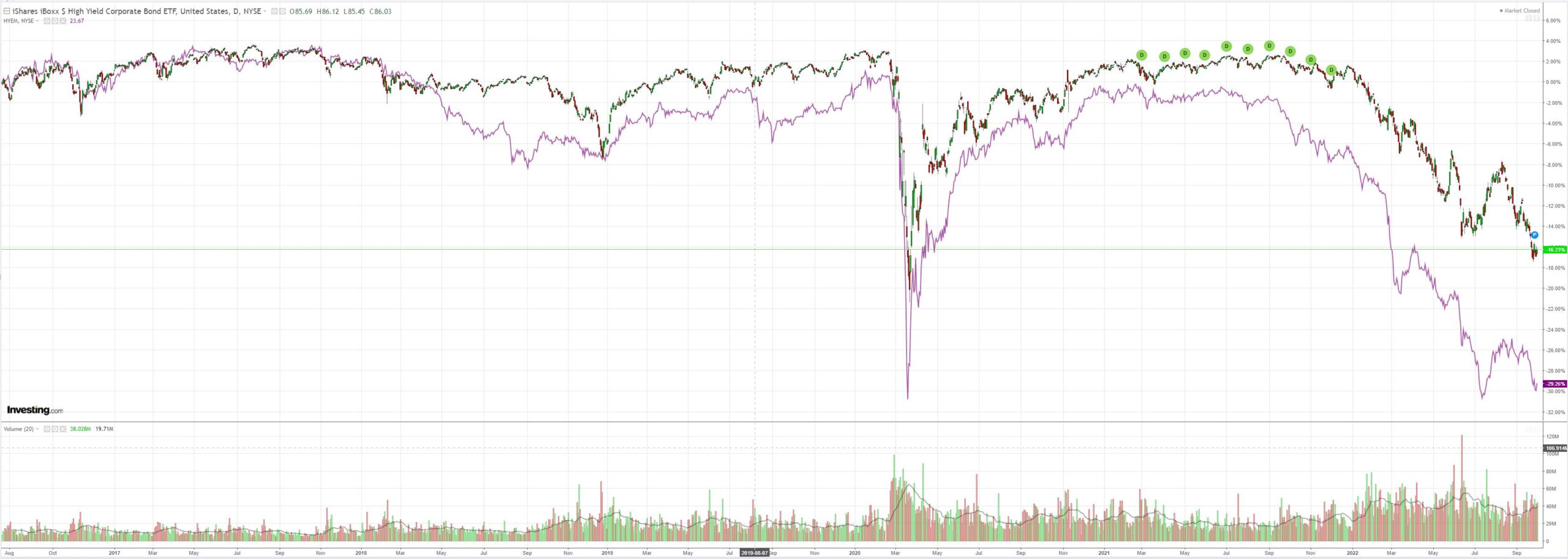

As usual, everything else was up. AUD, commods, EM (NYSE:EEM) and junk (NYSE:HYG):

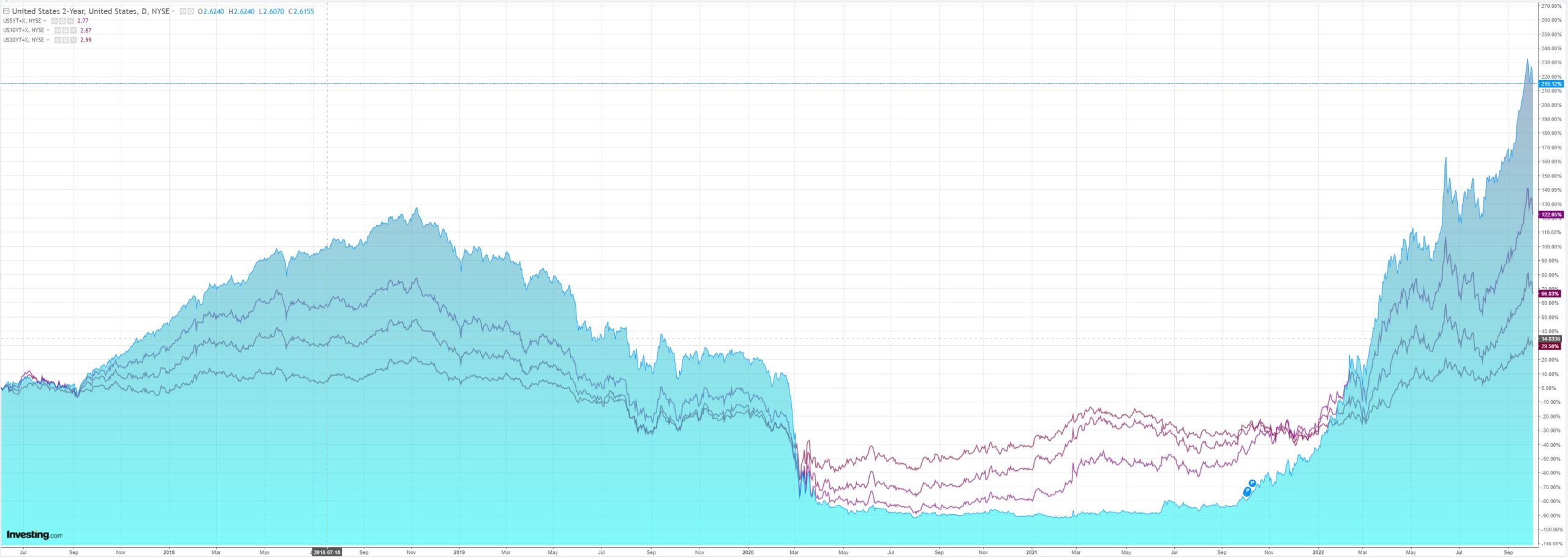

Treasuries were bid:

And stocks:

Is it possible these days to have a bid for bonds and not stocks? When we get there we’ll know we’re really approaching the end of this bear market.

The context for last night’s rally is positioning. Everything is oversold again. The trigger for the bid was a weak ISM:

“The September Manufacturing PMI® registered 50.9 percent, 1.9 percentage points lower than the 52.8 percent recorded in August. This figure indicates expansion in the overall economy for the 28th month in a row after contraction in April and May 2020. The Manufacturing PMI® figure is the lowest since May 2020, when it registered 43.5 percent. The New Orders Index returned to contraction territory at 47.1 percent, 4.2 percentage points lower than the 51.3 percent recorded in August. The Production Index reading of 50.6 percent is a 0.2-percentage point increase compared to August’s figure of 50.4 percent. The Prices Index registered 51.7 percent, down 0.8 percentage point compared to the August figure of 52.5 percent. This is the index’s lowest reading since June 2020 (51.3 percent). The Backlog of Orders Index registered 50.9 percent, 2.1 percentage points lower than the August reading of 53 percent. After a single month of expansion, the Employment Index contracted at 48.7 percent, 5.5 percentage points lower than the 54.2 percent recorded in August. The Supplier Deliveries Index reading of 52.4 percent is 2.7 percentage points lower than the August figure of 55.1 percent. This is the index’s lowest reading since before the coronavirus pandemic (52.2 percent in December 2019). The Inventories Index registered 55.5 percent, 2.4 percentage points higher than the August reading of 53.1 percent. The New Export Orders Index contracted at 47.8 percent, down 1.6 percentage points compared to August’s figure of 49.4 percent. This is the index’s lowest reading since June 2020, when it registered 47.6 percent. The Imports Index remained in expansion territory at 52.6 percent, 0.1 percentage point above the August reading of 52.5 percent.”

But, when you think about it for a moment longer than a nanosecond, falling new orders and rising inventories are good for inflation but really bad for profits.

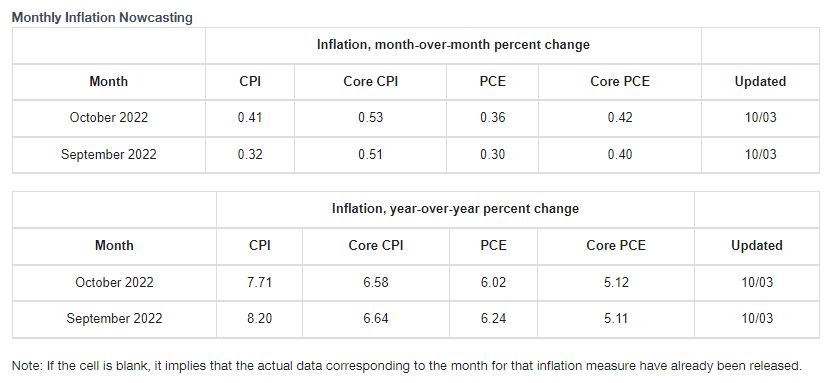

As well, the Fed sticky inflation problem is not getting better. Cleveland Fed CorePCE nowcasting is stuck at 0.4 per month:

The Fed needs to break wages and to do that it will need a goodly recession.

This is another bear market rally for AUD.