DXY got creamed:

AUD jumped:

North Asia helped:

Oil broke as OPEC bailed:

The metals falling knife was bid anyway:

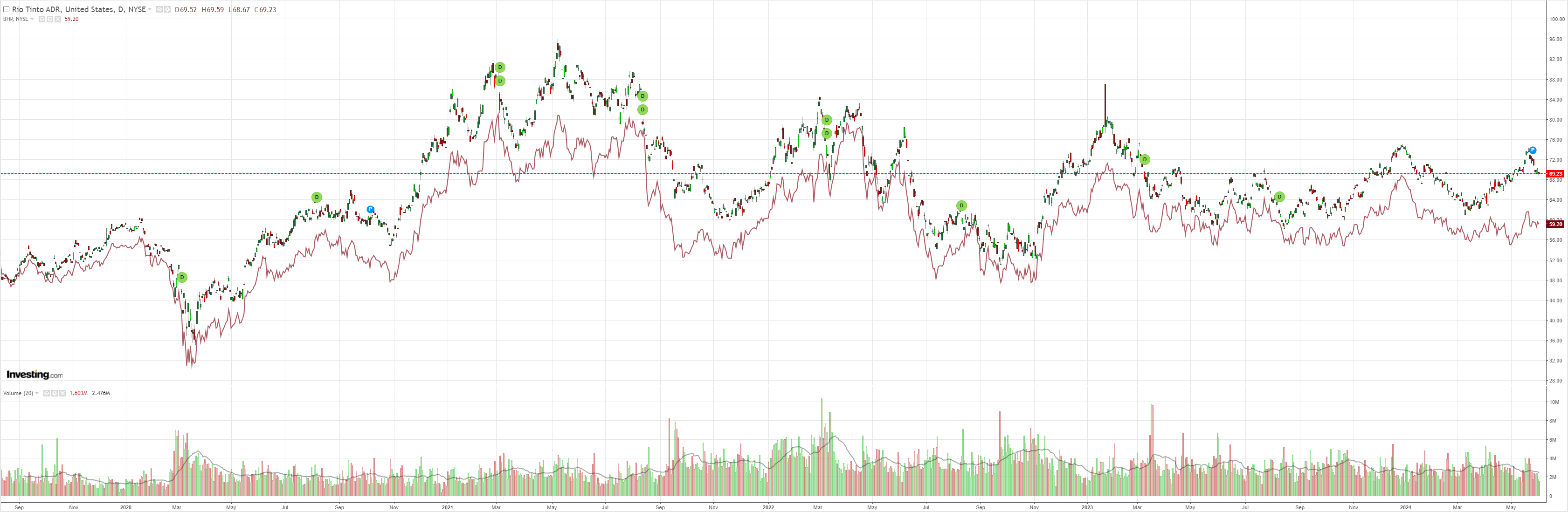

But not miners:

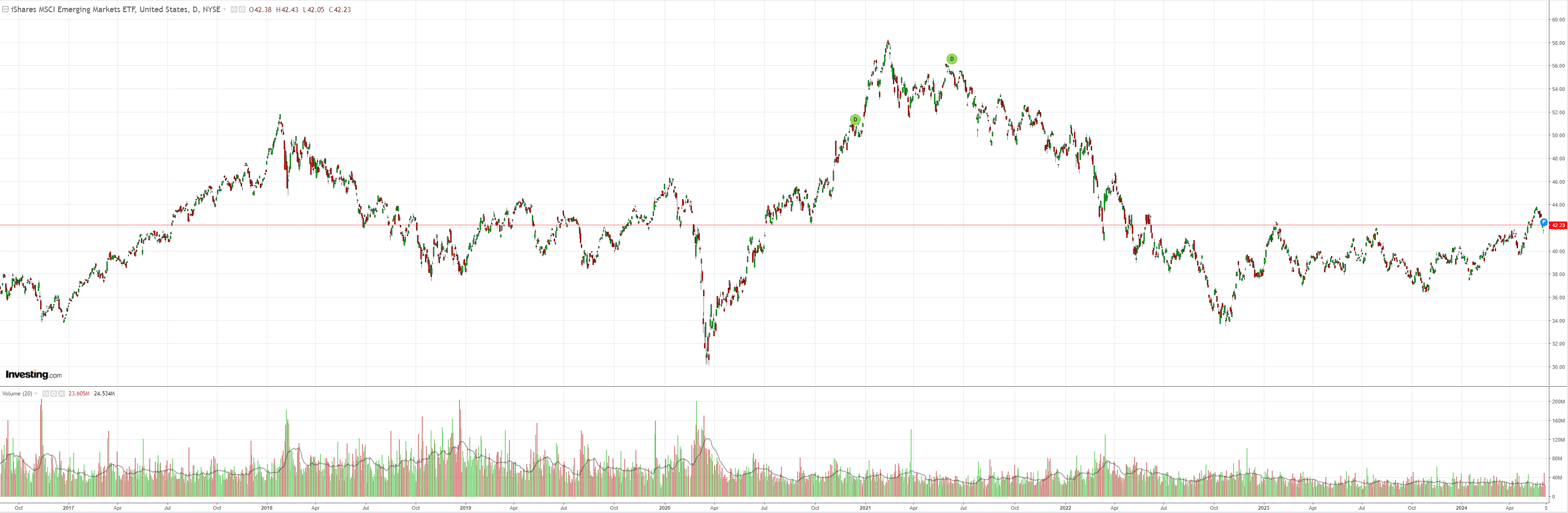

EM was:

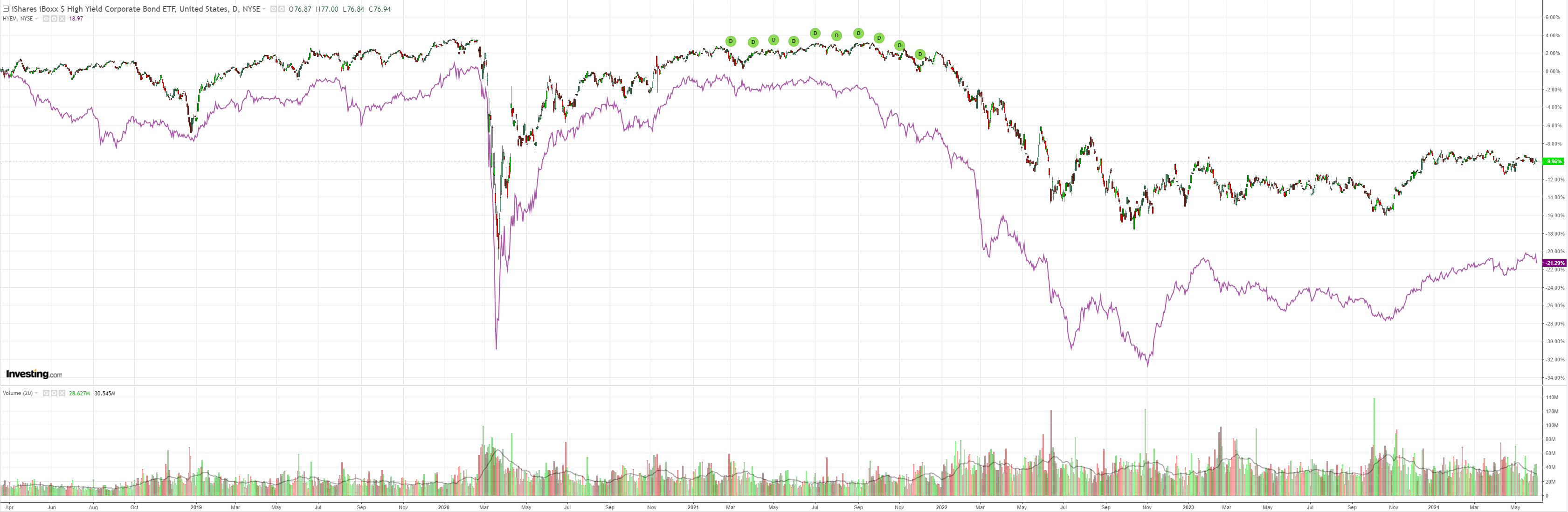

Junk puked:

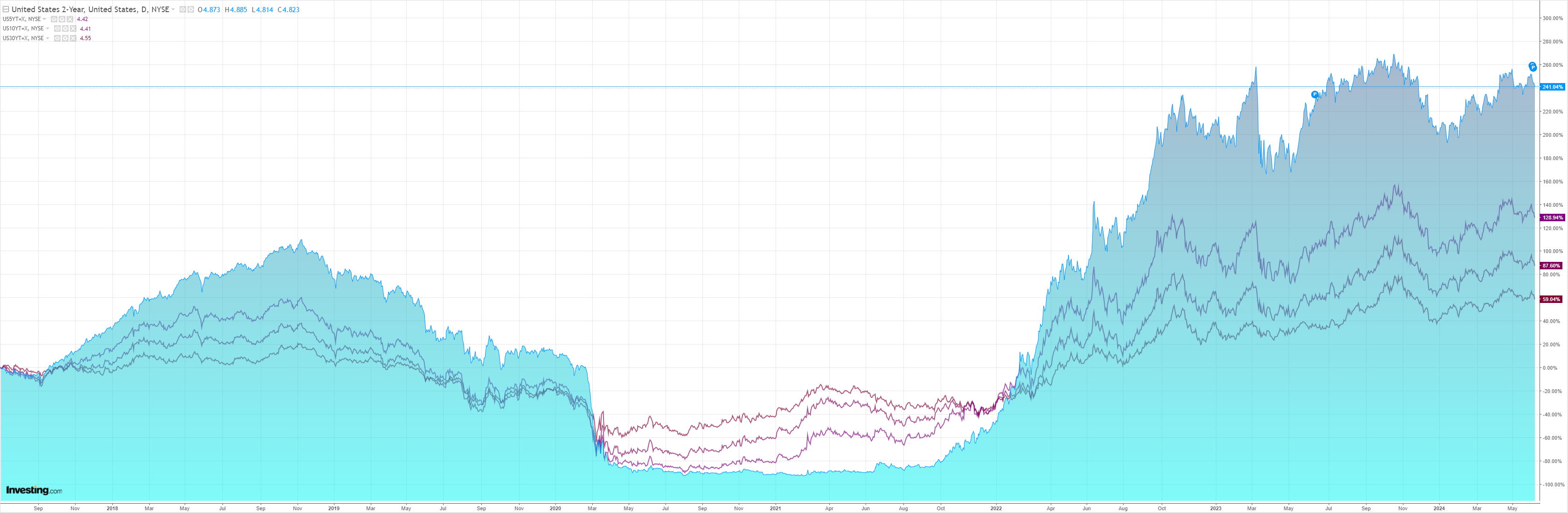

Yields too:

Which rescued stocks:

Due to the shale patch, DXY and oil have a pretty good correlation these days.

OPEC’s weekend capitulation to its own failing dynamics opens the way for marginal production price shakeout for US oil, which would require a price at least in the 60s and probably lower still.

I can’t say for sure that we’ll overshoot that far, but OPEC’s timetable of resumed production from cuts at minimum puts a lid on prices. RBC

The OPEC leadership went to great lengths to convey that this unwind from the group of 8 meeting in Riyadh can be paused or reversed depending on market conditions.

Hence, we do not see this as an abandonment of the active market management principle.

The August JMMC would seem to be a venue for a market gut check and an assessment of whether to proceed as planned with the unwind; though, we imagine the group will have further consultations in September.

We do not think they would go forward if market conditions deteriorated sharply from here given their stated emphasis on remaining “proactive, preemptive, and precautious.”

Hence, we see this as something of an aspirational taper schedule, not a binding course of action.

Some market participants may think that the horse has left the barn, with 8 producers now scheduled to increase production in 4Q’24.

Given that the bulk of the official increase is coming from Saudi Arabia, we think there remains something of a single decision maker dynamic when it comes to incremental barrels coming to the market.

That is all fair enough, but these markets are not in the mood for incrementalism. They are on or they are off.

If OPEC sits back for too long, a self-fulfilling sell-off can gather pace in DXY as Fed cuts jump back into the frame.

One might also ask if there isn’t a geopolitical play happening here as Saudi Arabia falls in behind the Biden administration.

Hang onto your hats. AUD may be about to blast off.