DXY is waiting for US inflation:

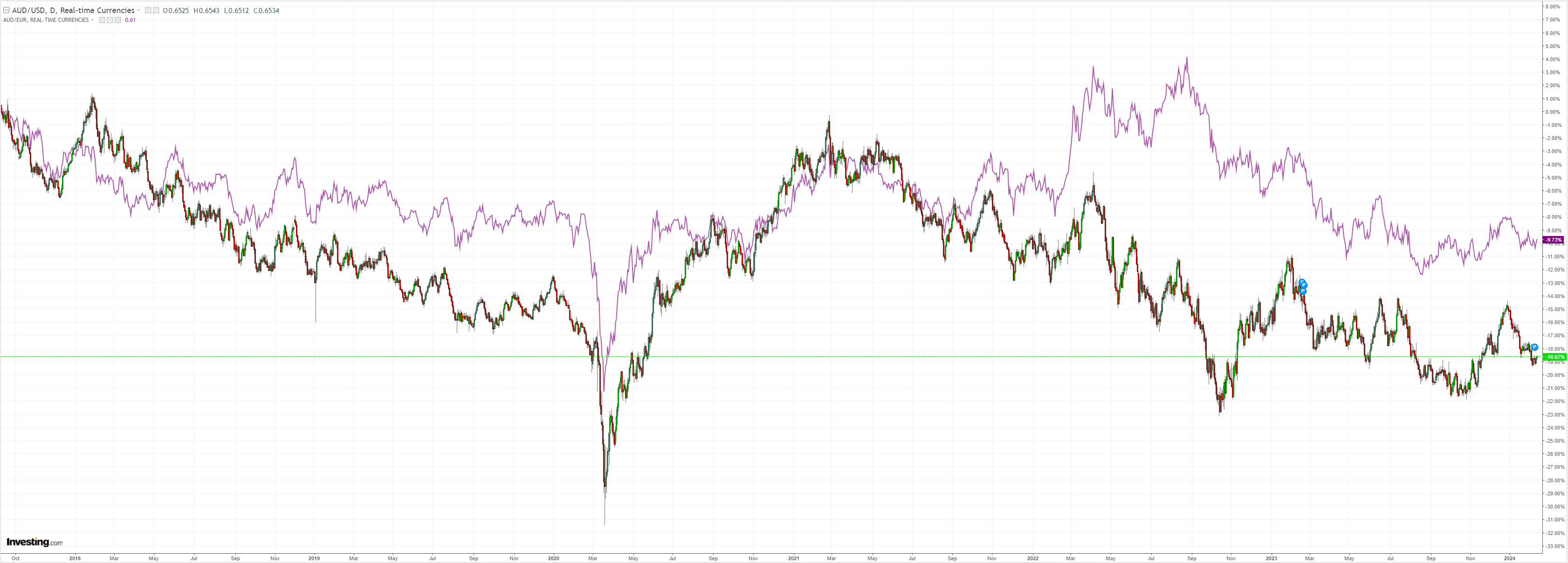

All other markets were so mixed that the market is confused about it. AUD sees a weak print:

North Asia sees nothing unexpected:

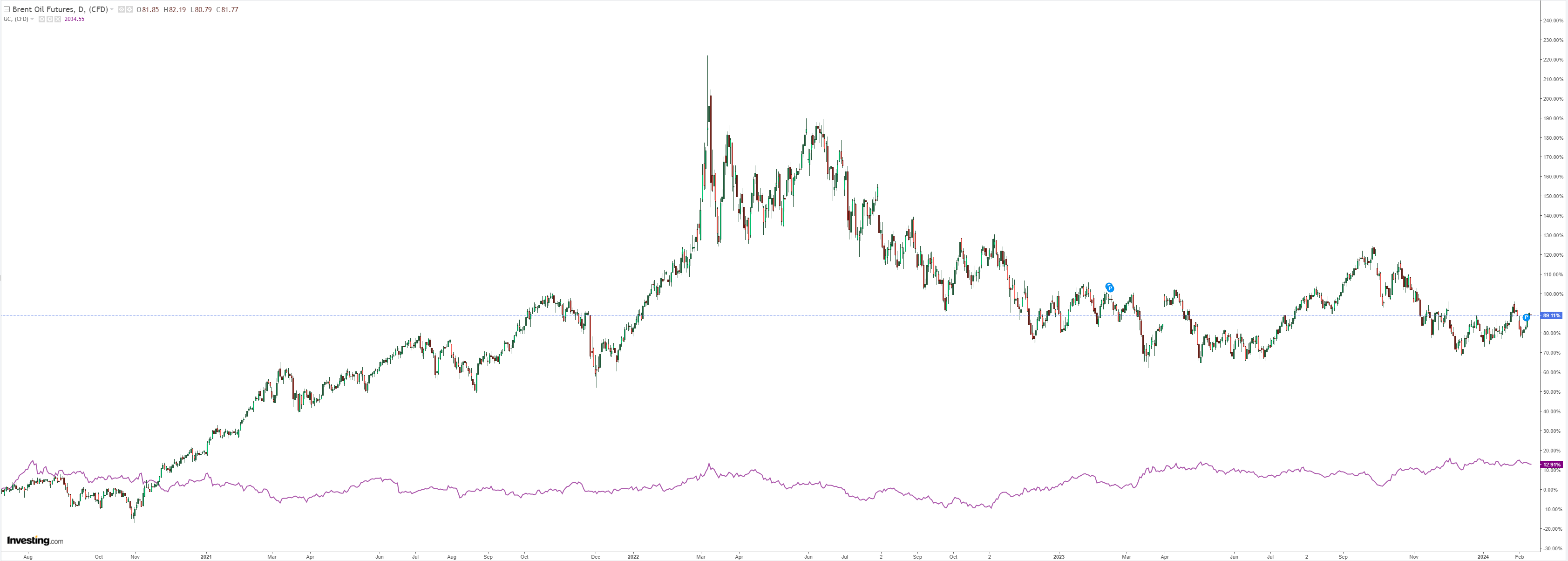

Oil and gold suggest a strong print:

Dirt can’t decide:

Miners see weak:

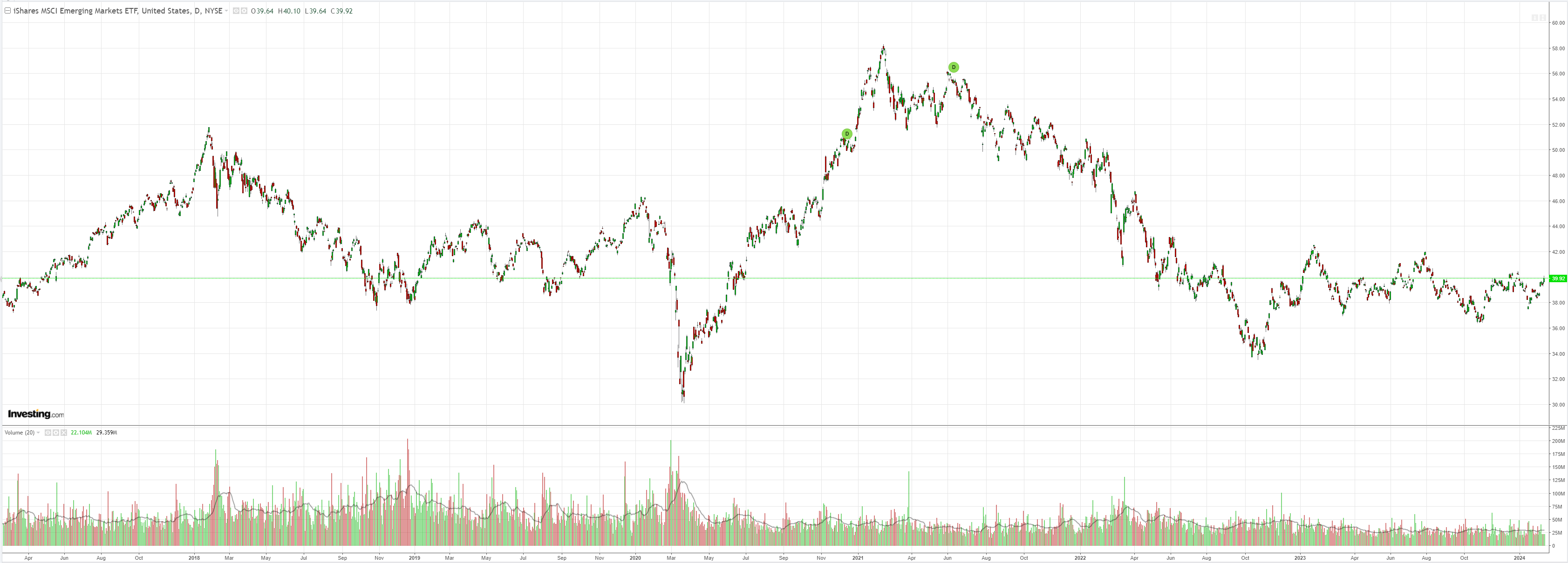

EM sees weak:

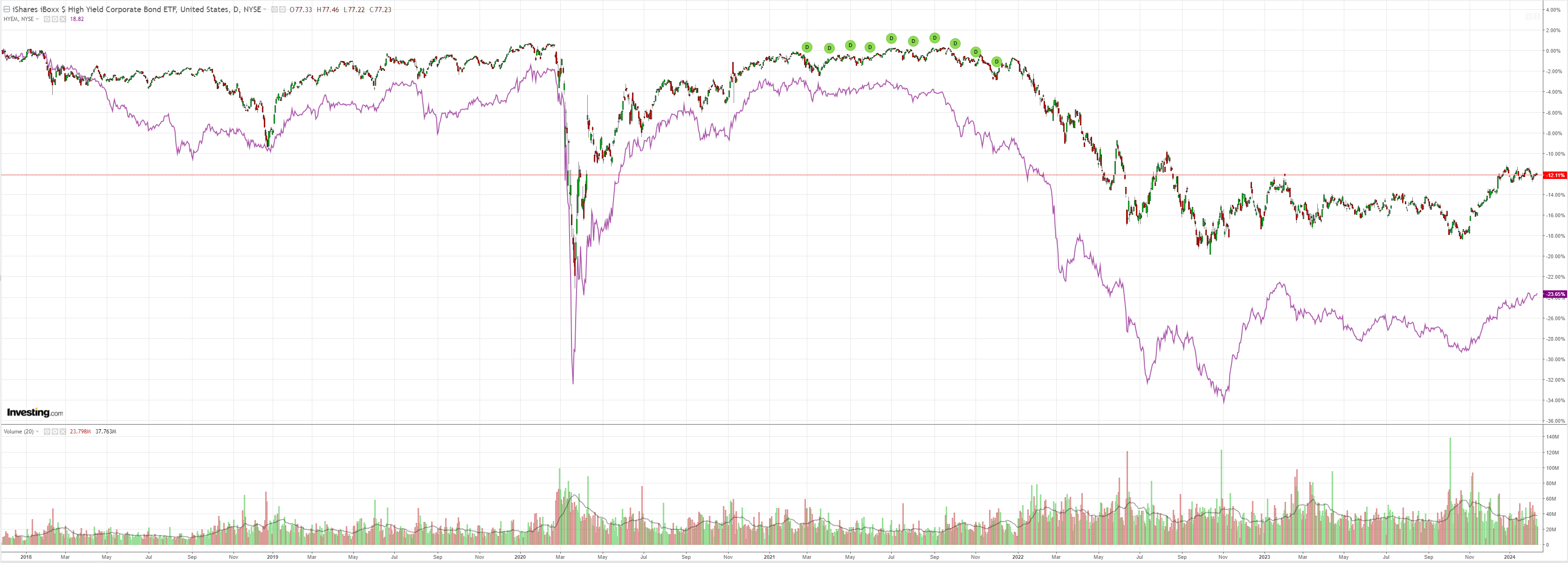

Junk sees weak:

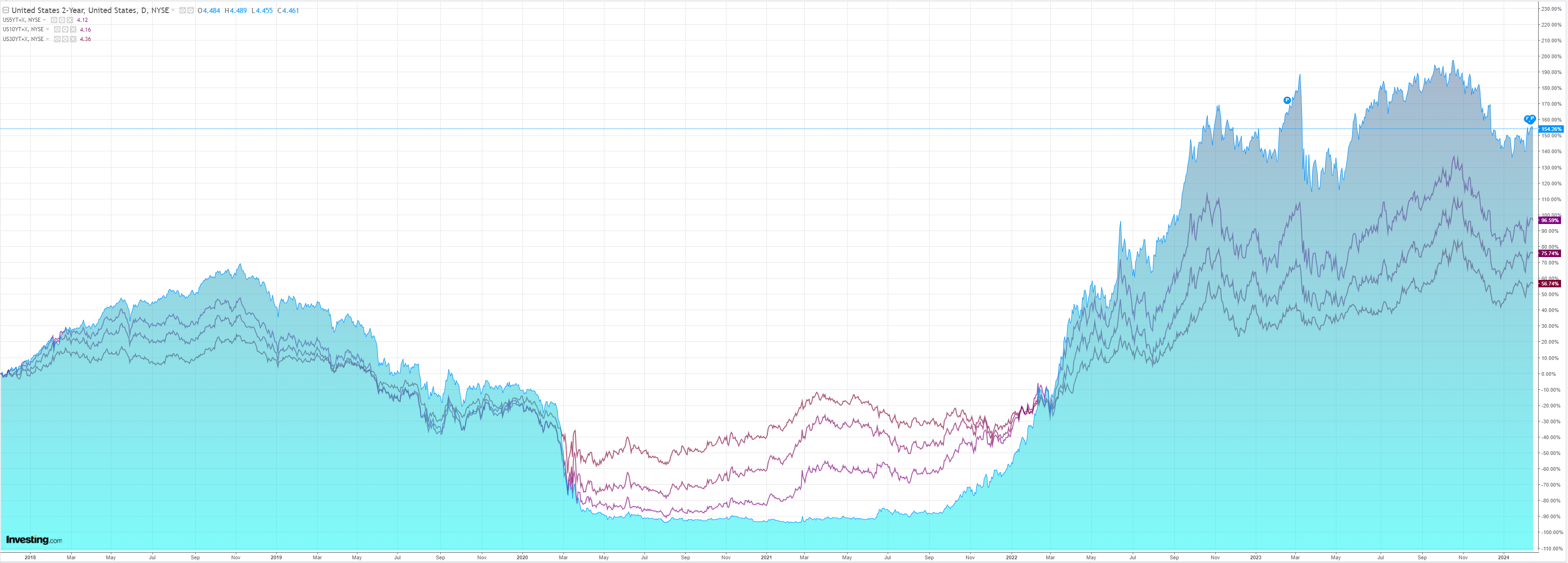

Treasuries see strong:

Stocks see weak:

Good luck making a head or tail of that. BofA sees a soft CPI:

The January Consumer Price Index (CPI) report should show ongoing progress oninflation. We forecast headline and core CPI rose by 0.2% m/m(0.16% unrounded) and0.3% (0.29% unrounded) respectively. As a result, y/y headline inflation should print five-tenths lower at 2.9%, and core should print one-tenth lower at 3.8%. Additionally, our forecast implies a headline NSA index of 307.961 compared to 306.746 in December.

But others are still upgrading the outlook. Sociate General for instance:

At the turn of the year, the US economy is showing more resilience. GDP growth in 4Q23 posted 3.3%,whilejob growth in January registered resurgent gains along with upward revisions for the end of 2023. We see mixed evidence looking ahead for the next two years but a balance that implies moderate growth ahead.

Importantly, inflation is slowing toward the Fed’s 2% goal, even as growth remains more resilient. The Fed can cut rates, but more slowly than we had anticipated.

At present, the FOMC’s dot-plot is looking reasonable. Fed participants too may need to revise up their growth outlook, but 75bp cut with ongoing cuts into 2025 is the most likely path.

In the end, it is still my view that the direction will matter more than the speed so any surprise CPI result is more a chance to adjust positions than it is to change them.

As for AUD this, I have no idea!