DXY broke lower last night and EUR broke higher

AUD catapulted higher:

Oil firmed:

Metals too:

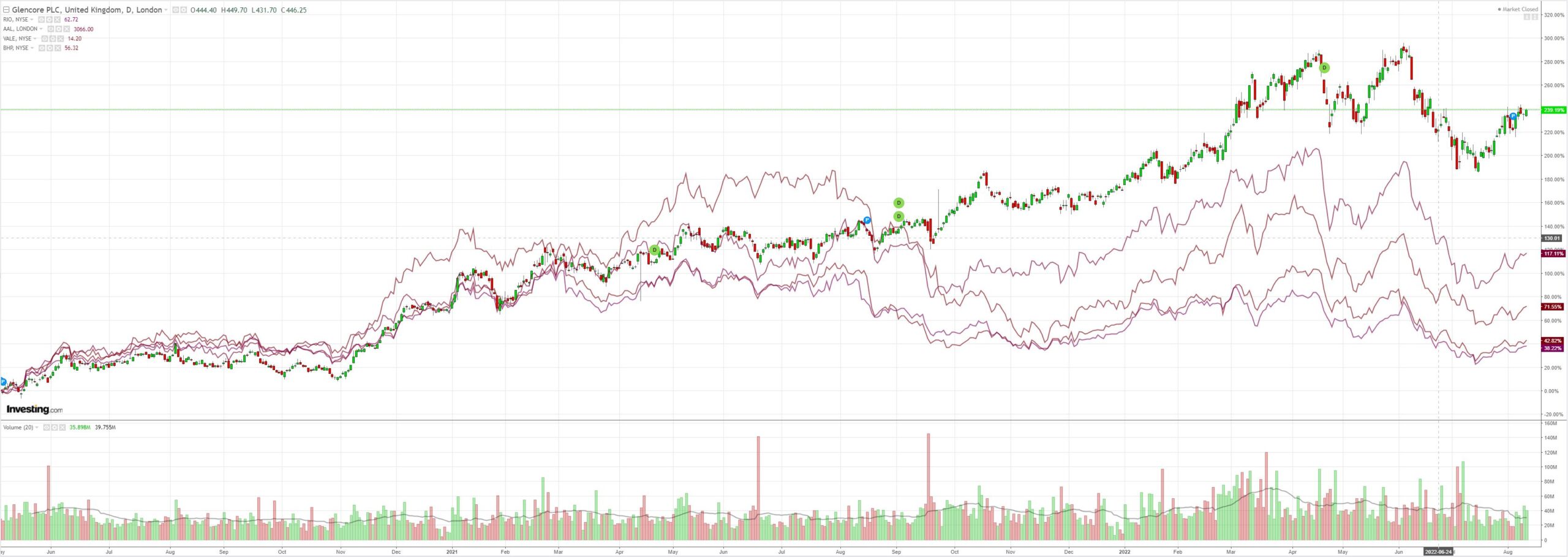

And miners (LON:GLEN):

Plus EM stocks (NYSE:EEM):

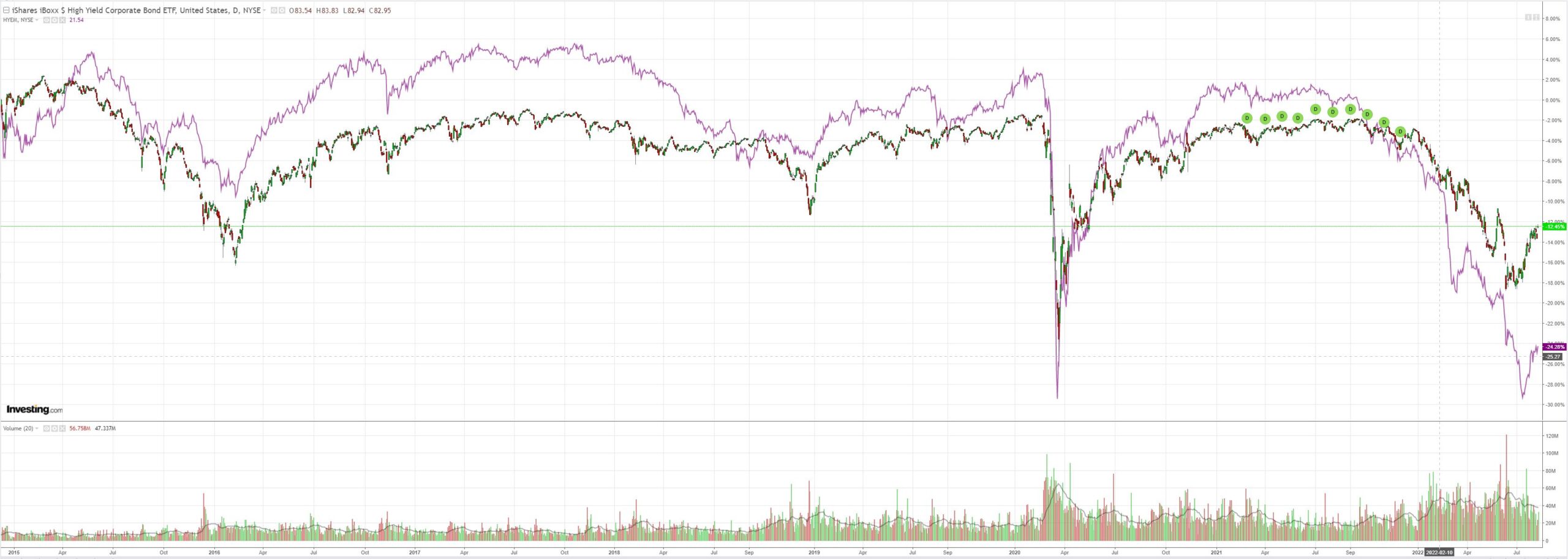

Junk (NYSE:HYG) was relatively subdued:

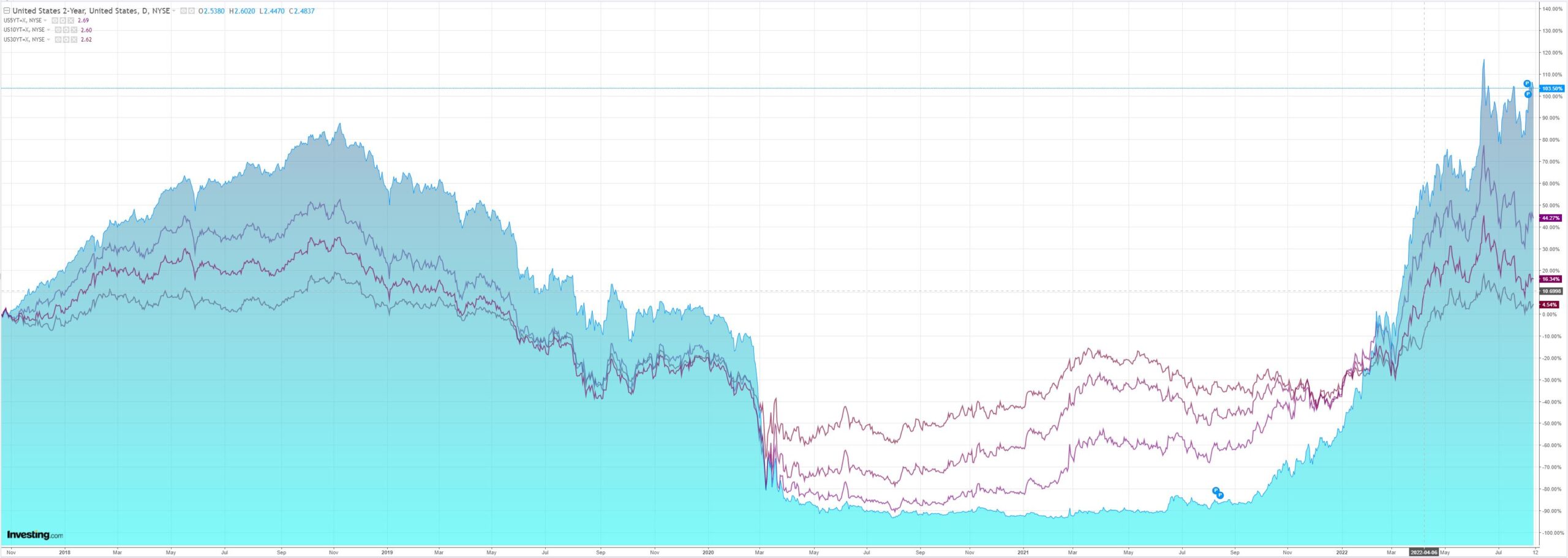

So were Treasuries but the curve steepened:

Stocks were in heaven:

BofA wraps the cause:

Headline CPI prices were flat (-0.02% unrounded) in July, compared to consensus expectations of a 0.2% increase. Energy prices fell by 4.6% mom because of the sharp drop in gasoline prices last month. Food prices increased 1.1%. Yoy headline CPI inflation dropped from 9.1% to 8.5%. While the non-core components came in a little stronger than we were expecting, the real surprise was the big drop in core inflation. The core CPI came in at 0.3% (0.31% unrounded) mom versus consensus at 0.5%. The yoy rate stayed flat at 5.9%. Core commodities cooled significantly to 0.2%:used car prices fell 0.4% but new car prices were up 0.6%. Apparel and education & communication commodities dropped by 0.1%and 0.8% respectively, while medical care and recreation commodities increased by 0.6% and 0.2% respectively. The slowdown in core goods prices is consistent with the drop in shipping prices and other signs of easing of supply chain pressures over the last few months. We should see further deceleration going forward, although auto prices could remain sticky high as semiconductor shortages are likely to continue through 2023. Meanwhile core services were up 0.4%. Medical care services rose 0.4%, while travel-related prices continued to drop: airfares and lodging were down 7.8% and 2.7%. The biggest concerns for the Fed is the continued strength in shelter inflation, which came in at 0.5%. OER and rentals were up 0.6% and 0.7%. Shelter is the most cyclical component of inflation and housing is the most important channel of monetary policy transmission. So the strength in shelter inflation suggests that demand is still holding up and the Fed still has more work to do. That said, housing has a smaller weight in PCE inflation–the Fed’s preferred metric–so the risk is that we get an even softer PCE report. In summary, the July CPI report is a welcome relief for the economy. Markets seem to agree, based on the initial positive response of risk assets to the report. The Fed’s forecast of a soft landing would be greatly improved if we see continued declines in core goods–particularly durables such as new and used cars and household furnishings–and a further slowdown in shelter inflation. We think this report is consistent with our forecast of a 50bp hike in September: as of this writing markets have cut September pricing by 8bp to 58bp.

In short, we are past peak inflation and peak Fed hawkishness. Needless to say, this is bearish for DXY, especially when the US has led the inflation surge so it will now lead it lower as well.

This is particularly the case for the AUD. Albo’s energy shock is feeding a whole new round of extreme inflation into the Australian economy over the next year that other currencies have already priced.

If Albo doesn’t break the energy cartel now then the AUD is going higher even as the economy stalls.