Street Calls of the Week

DXY is up and away:

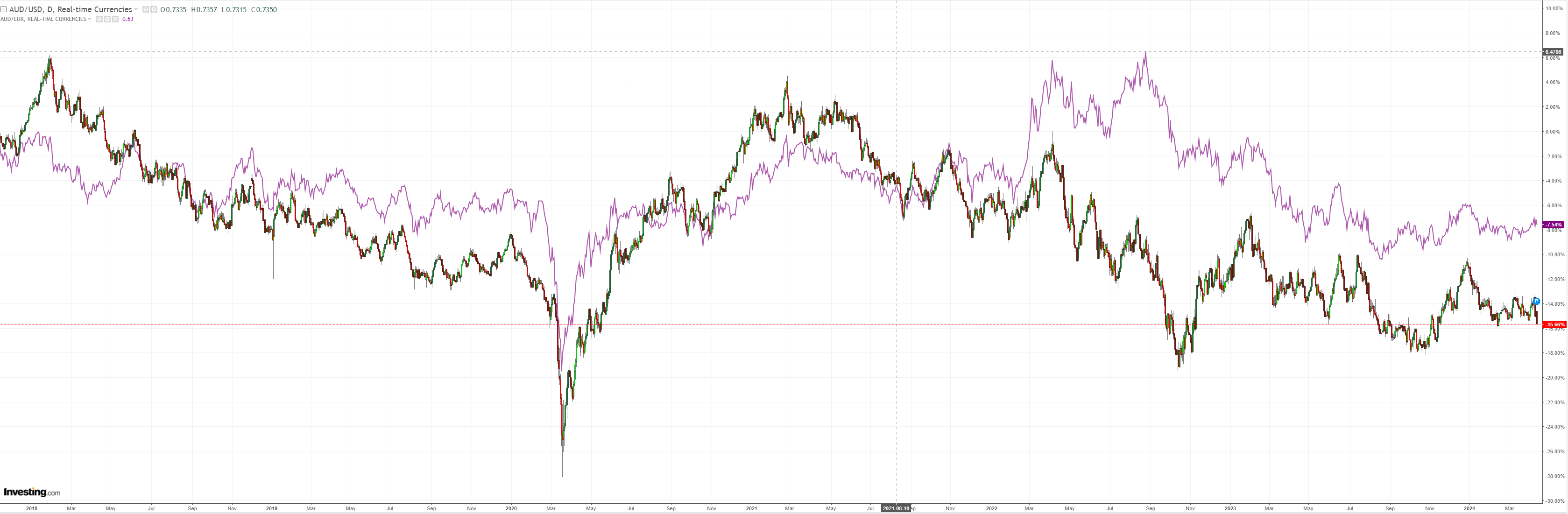

AUD is back at critical support:

North Asia is under intense pressure:

Oil and gold hanging in there:

Base metals still chasing no landing:

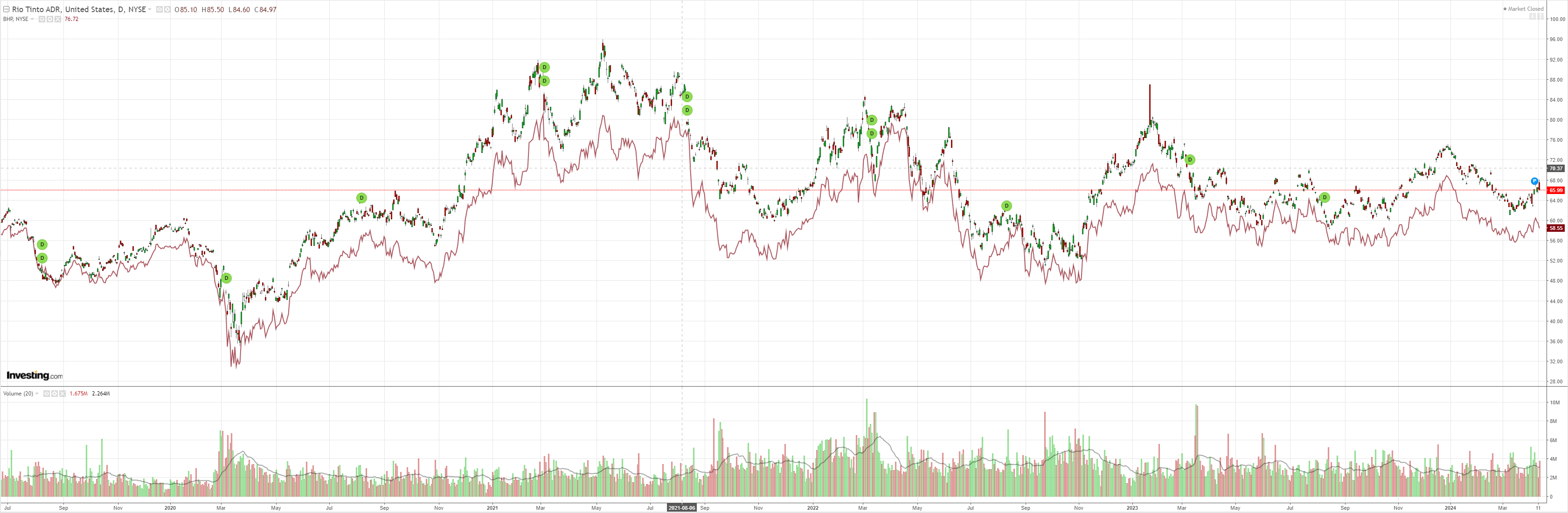

But not big miners:

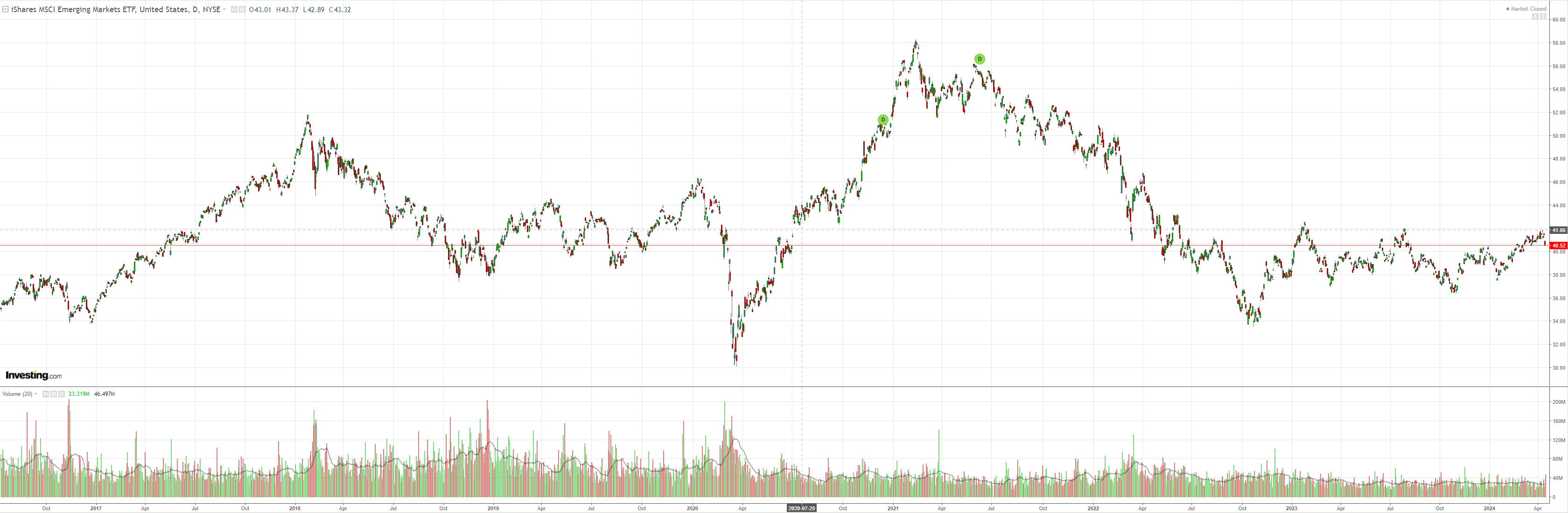

And EM hates no landing:

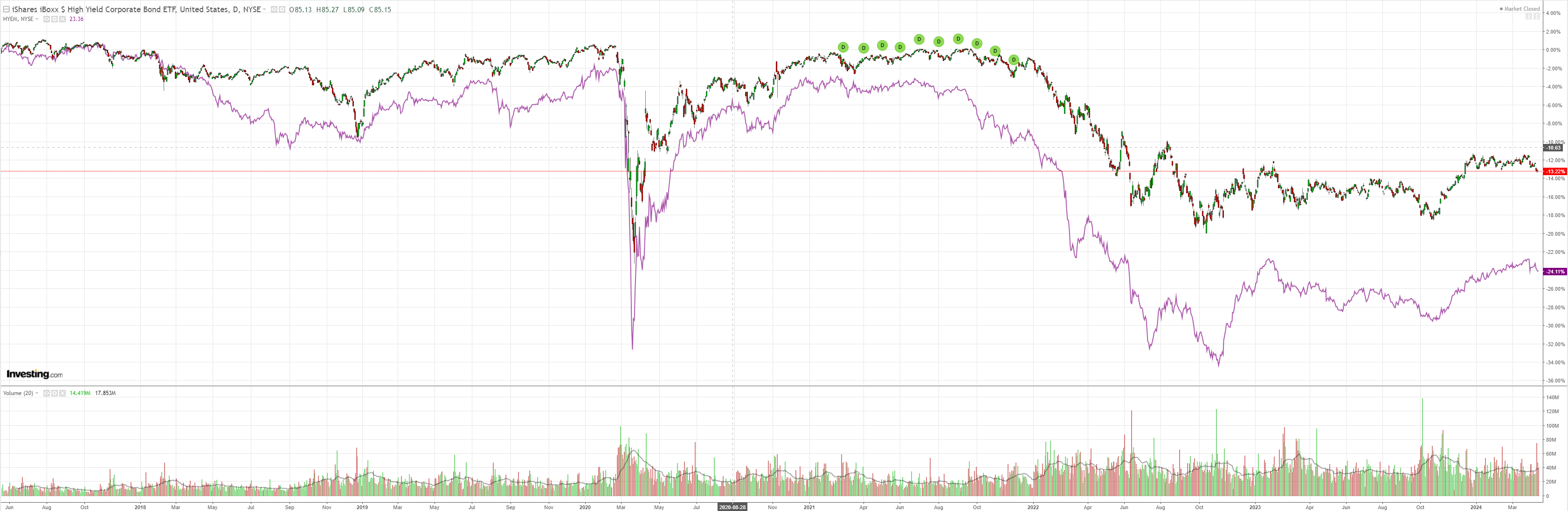

So does junk:

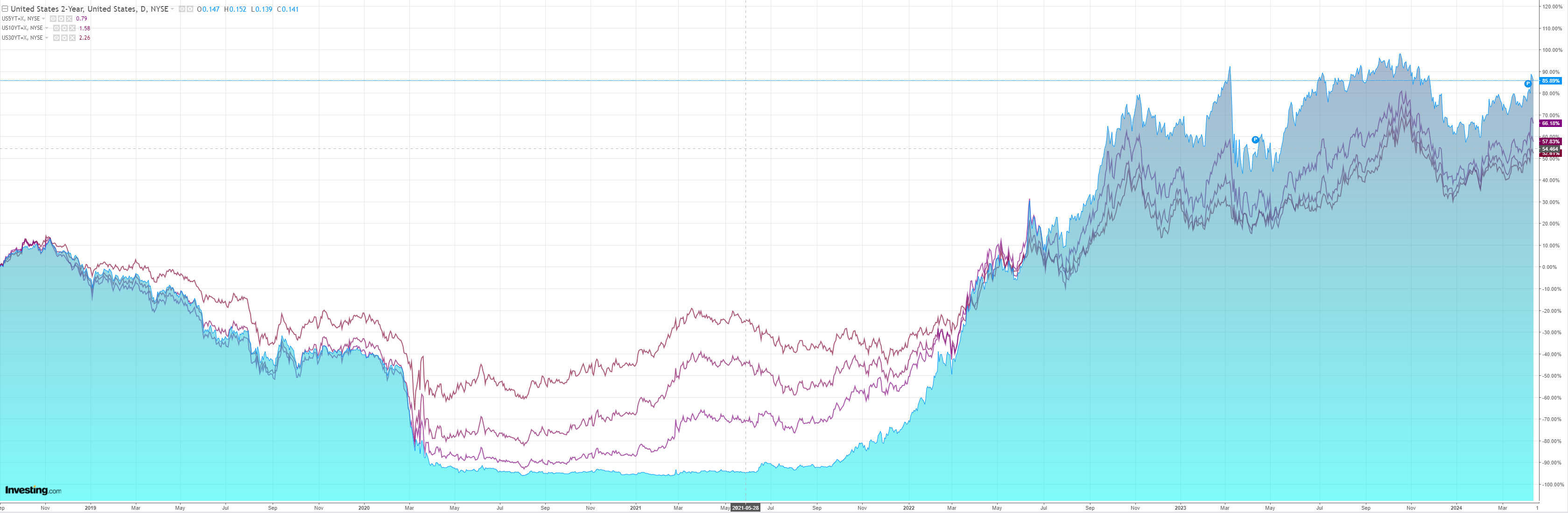

Yields fell but it was a steeper week for sure:

Stocks hate no landing:

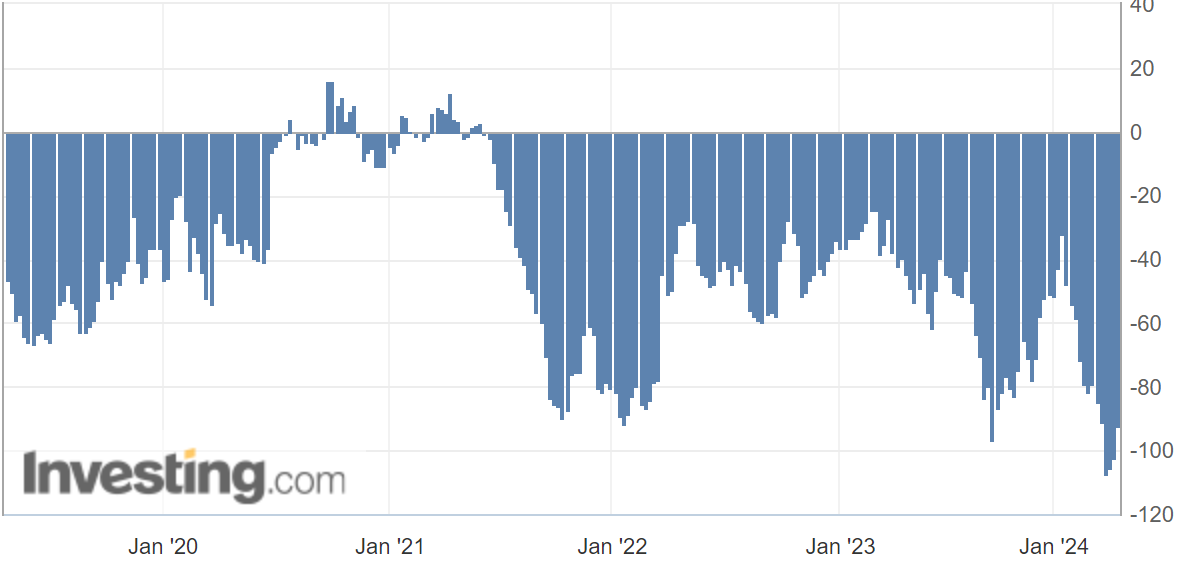

The AUD bear frenzy on CFTC eased slightly last week:

But it is still a massively short position that usually weighs against significant moves lower.

Yet, here we are, with the AUD falling on a range of indicators giving markets nightmares about a ‘no landing’ scenario in which inflation re-accelerates:

- global PMIs are lifting;

- Chinese activity Q1 is firm;

- US activity is strong, and inflation is firming;

- oil and commodities are rising to meet both.

However, equally, I can argue it is all a head-fake:

- the global PMIs recovery is narrow and very chip-related;

- Chinese activity is an inventory build and about to re-sag;

- a deleveraged US private sector has been taking its price signals from stocks, not yields, juicing wealth effects and AI exuberance, meaning a stock correction will snuff it out;

- oil is up on war risk in Ukraine and Israel, and other commods are sucked into its inflationary slipstream.

One is a ‘no landing’ scenario. The other is a ‘mungrel landing’ as various signals make a mess of everything.

If it is the former, then AUD is going to new lows as the Fed doesn’t cut or even hikes again.

If it is the latter, then AUD will oscillate in its mid-65 range.

I think the base case is still the second option.