DXY is firm:

AUD has landed on some thin ledge:

Oil up and away. It’s not a problem for inflation until 2024. Gold is getting hosed:

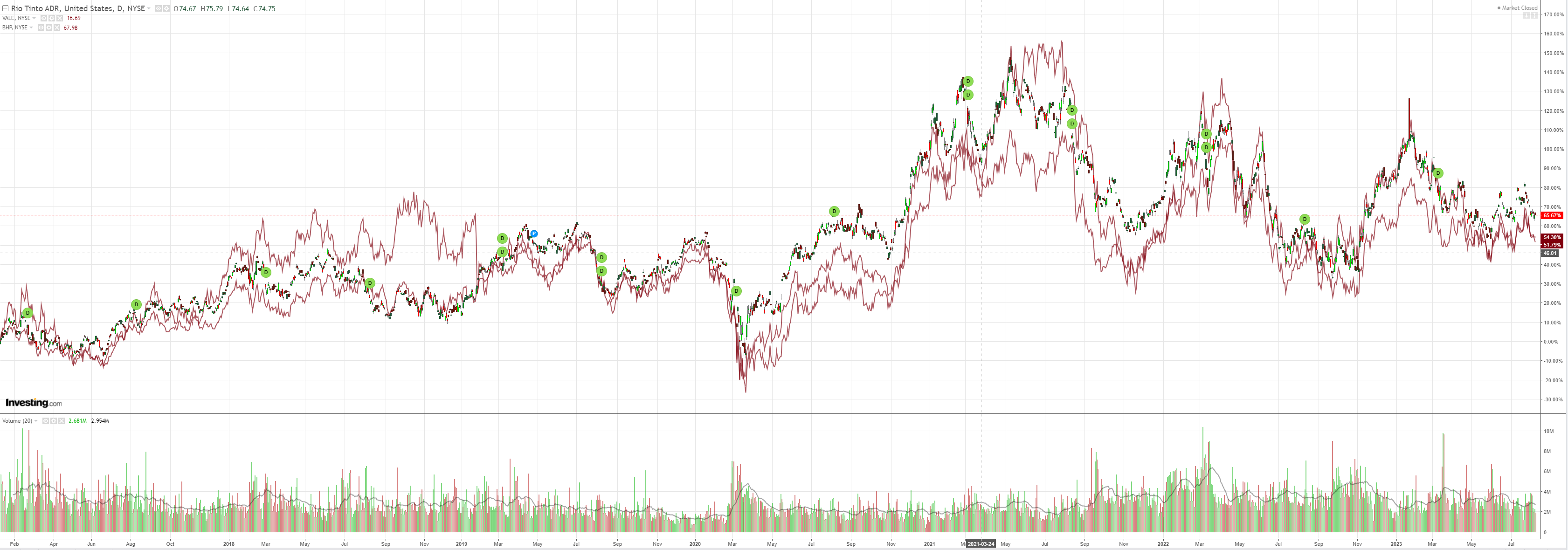

Dirt held on:

Big miners (NYSE:RIO) too:

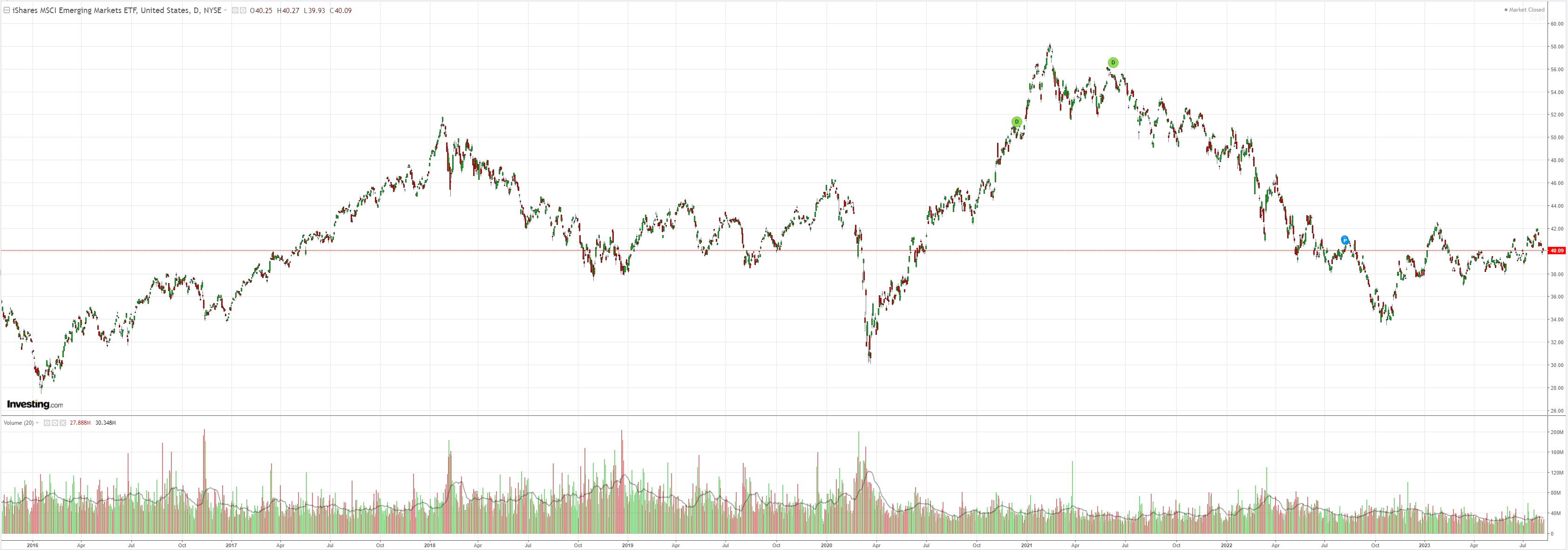

EM stocks (NYSE:EEM) might as well delist:

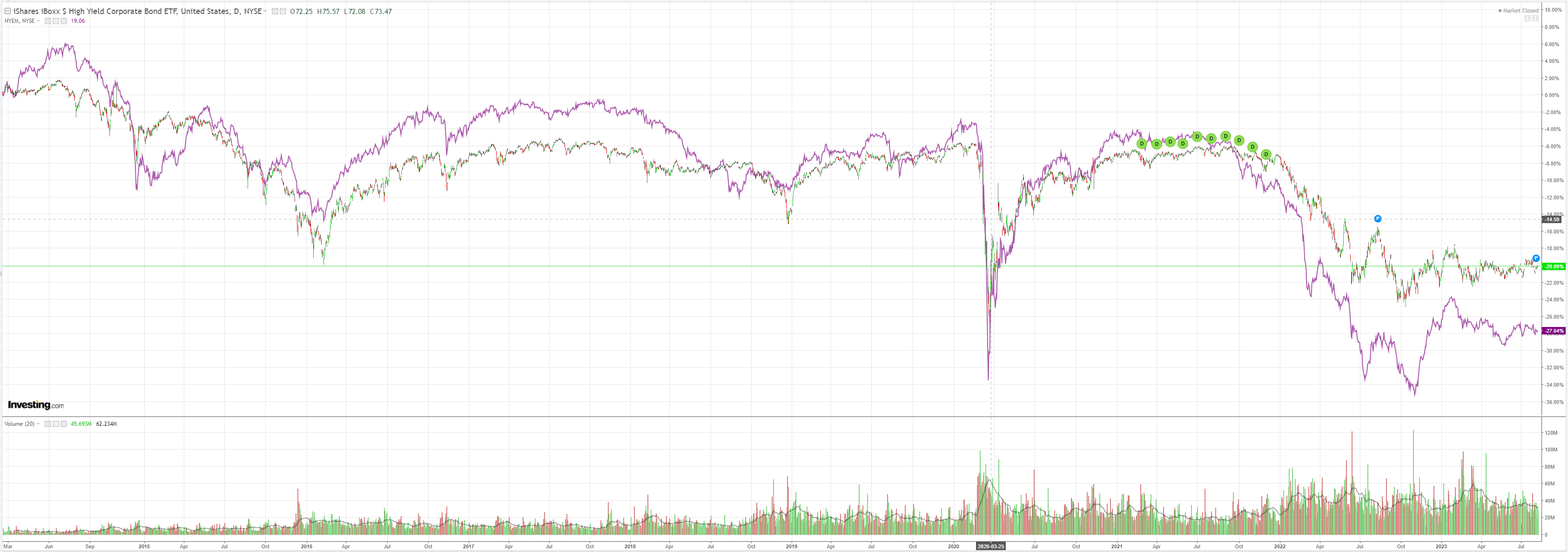

Junk (NYSE:HYG) was OK:

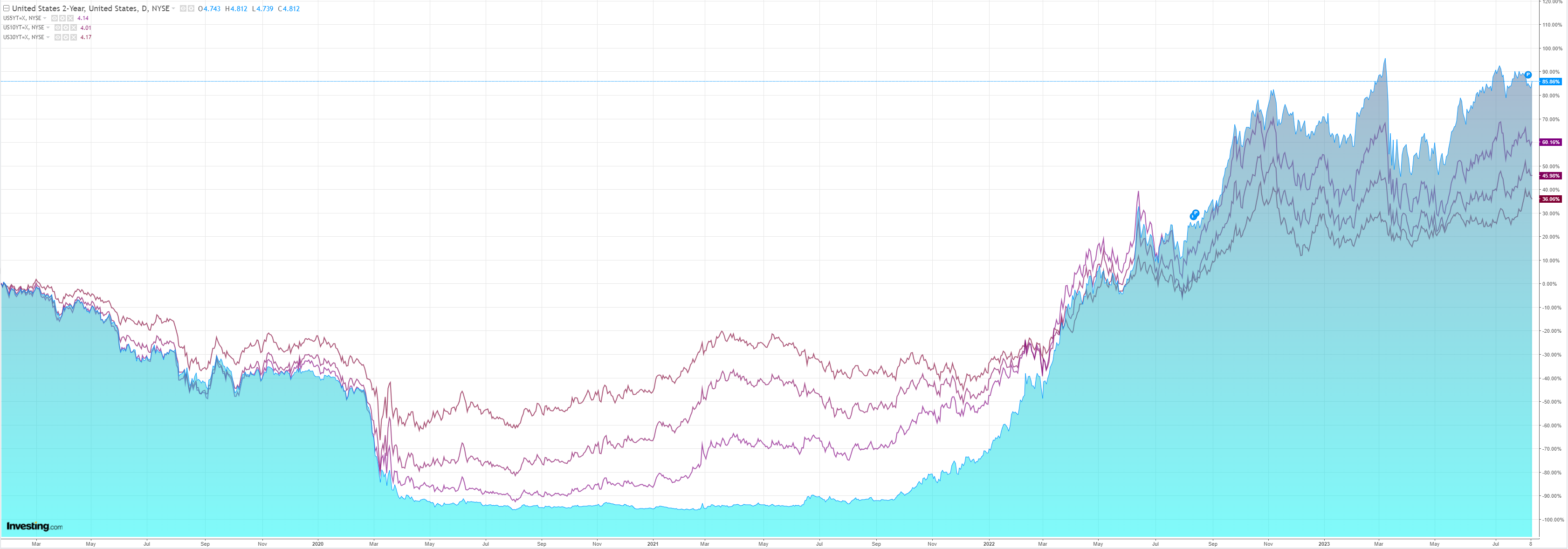

The curve flatenned:

The AI bubble may be bursting:

I’m expecting a weak US CPI tonight, so I would not be surprised to see DXY ease for a bit.

However, I do not see it getting far. Everything else is too weak, with China leading as it sinks into depression economics. Credit Suisse (SIX:CSGN):

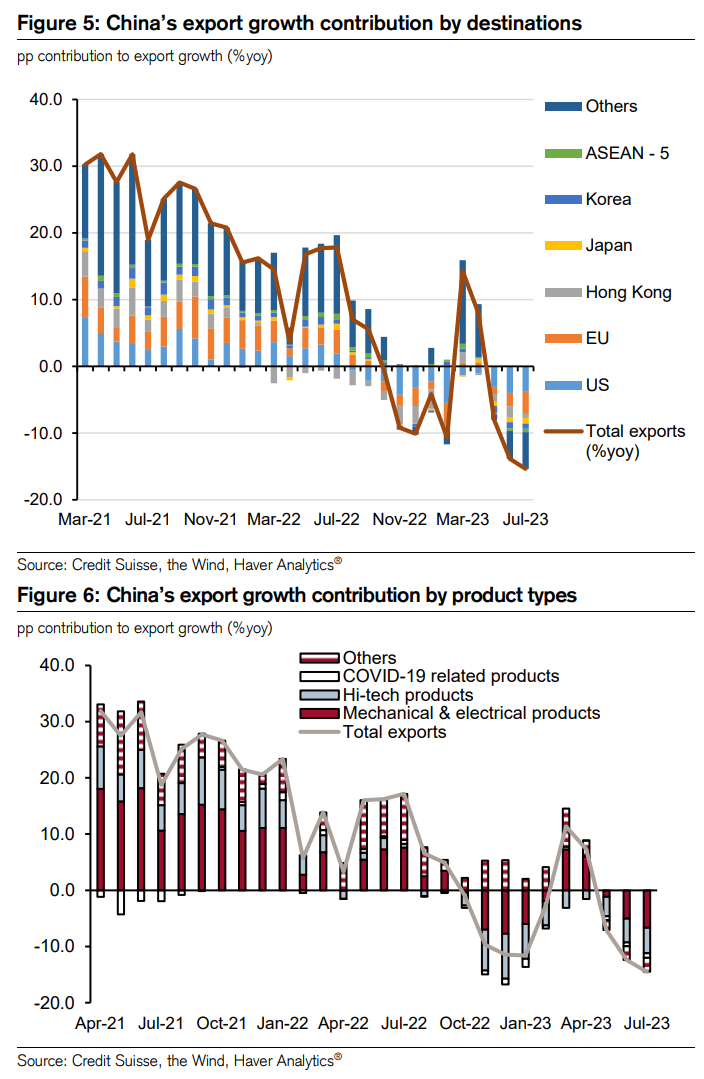

Two months ago, when May trade data reflected a deterioration to China’s external demand, we published our view that authorities would have greater tolerance for RMB depreciation (link). Since then, USDCNY has indeed increased from around 7.12 to around 7.21 today. Last month, when June trade data came out, we noted that “we expect ongoing softness in both external and internal demand going into 23H2. Considering this outlook, we reiterate our policy expectation that authorities will likely remain tolerant of a relatively weaker RMB against the USD and expect USDCNY to remain around 7.20-7.25 throughout 23Q3” (link). Today’s release of July trade numbers gives us no reason to change our narrative on this front. Upon seasonal adjustment, nominal and real exports in July were 4.1% and 3.9% lower than those of June, while nominal and real imports were 6.6% and 11.1% lower in the same period respectively. (See Figures 1, 2 and 3). Both exports and imports came in below consensus. The weakness in imports contributed to an increase in trade surplus from USD70.6bn in June to USD80.6bn in July. We see little policy catalyst that can effectively turn around China’s domestic demand in the near term. Looking ahead, we maintain our view that there will likely be additional depreciation of the RMB against the USD and reiterate that the bilateral exchange rate might reach 7.25 by the end of this year.

Total agreement from me. Weak CNY is weak AUD.