DXY sagged last night after its hot run:

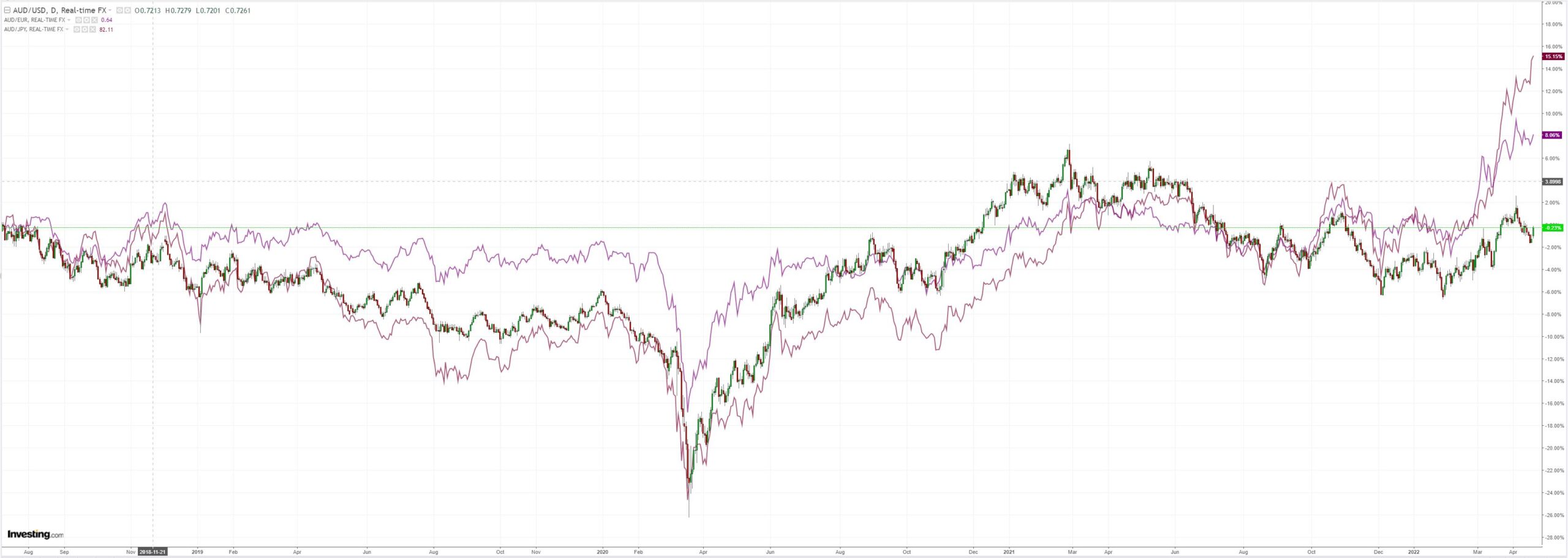

That brought relief to the AUD:

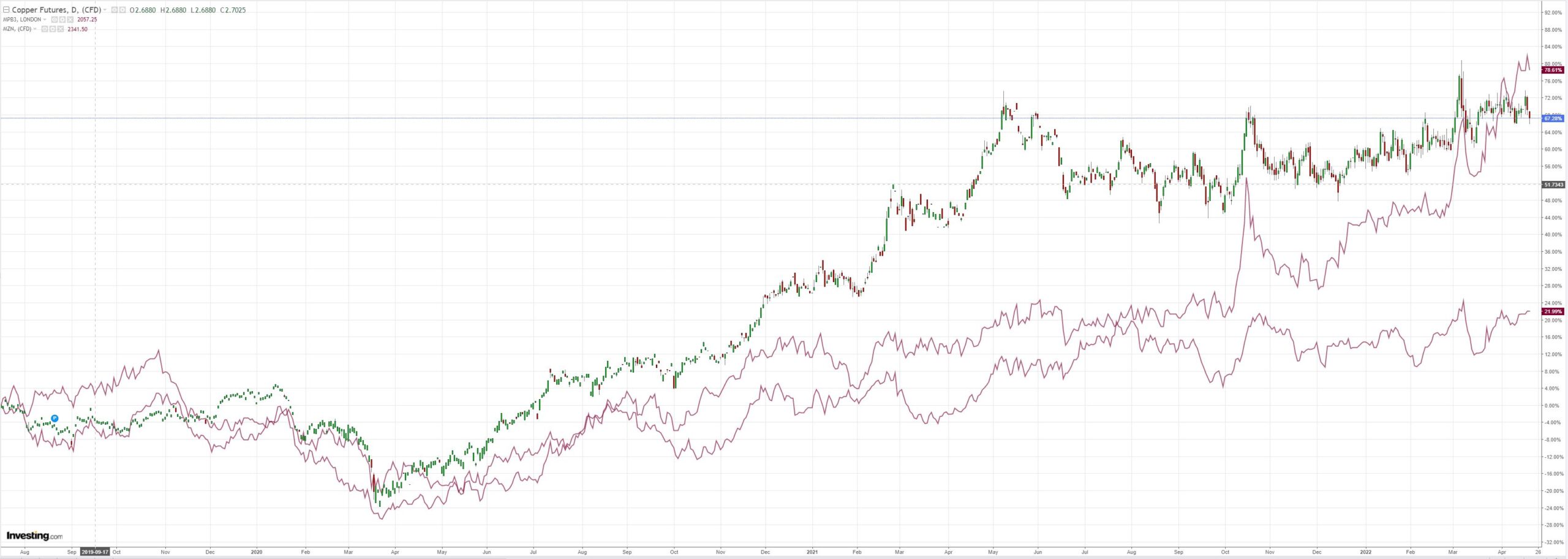

Even as commodities fell:

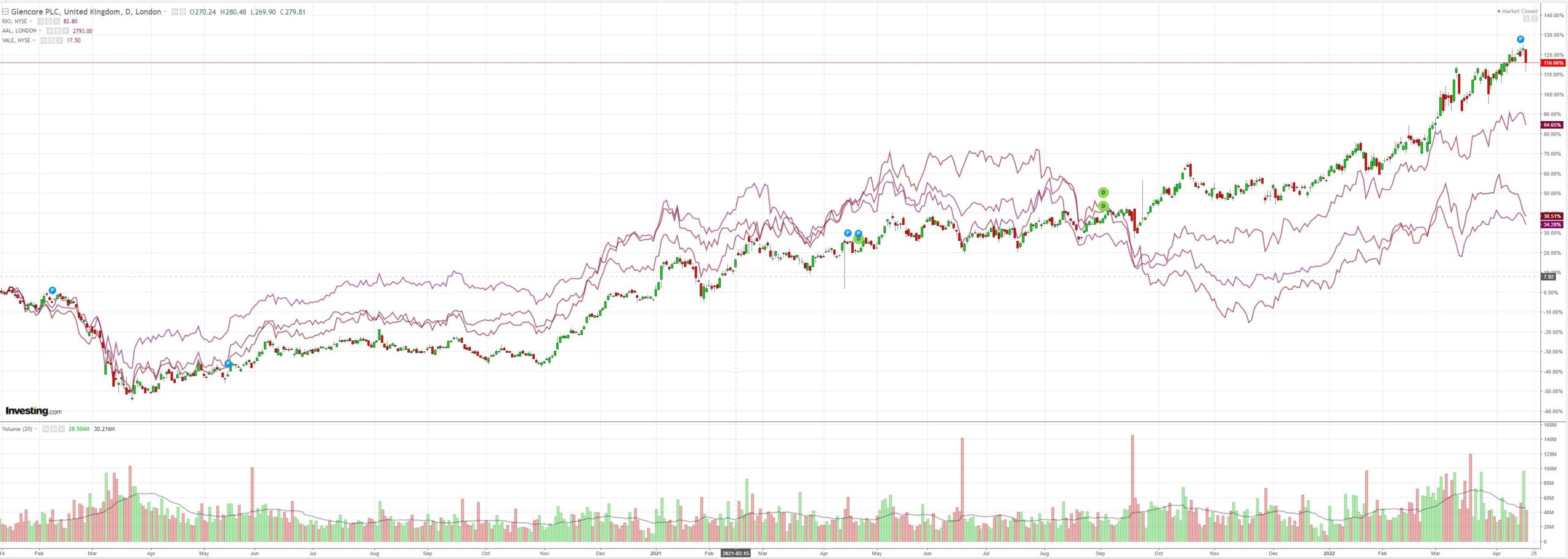

And EM stocks (NYSE:EEM):

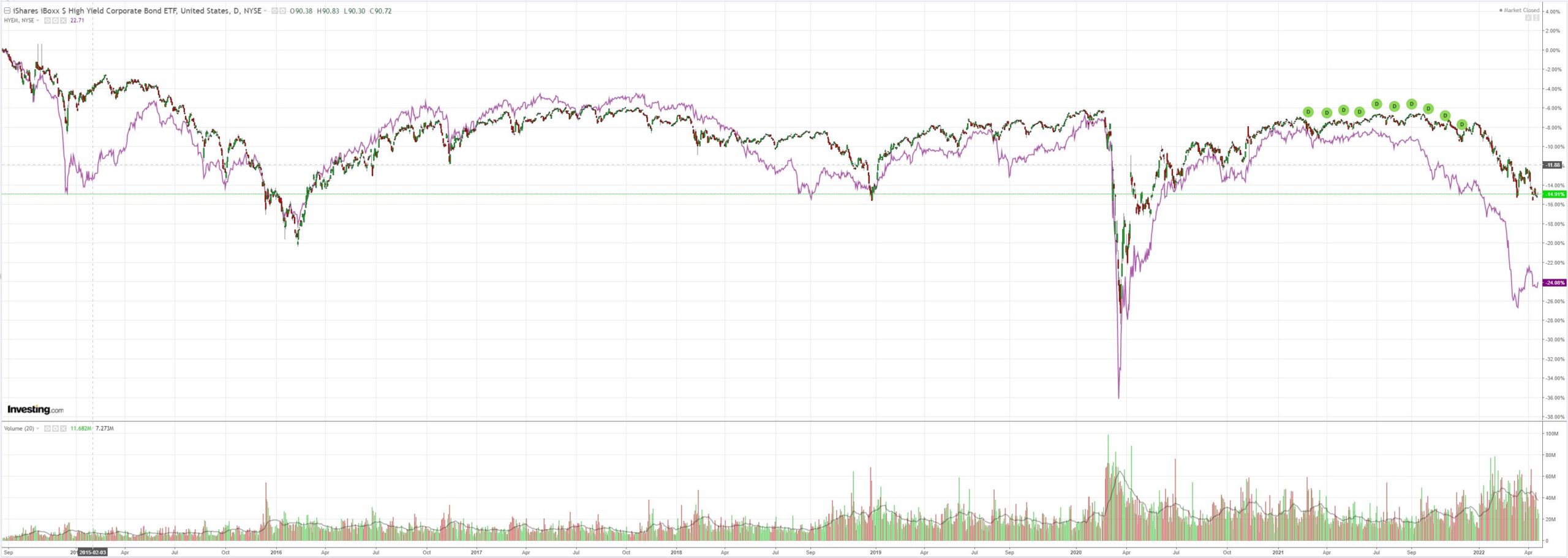

But junk (NYSE:HYG) did OK:

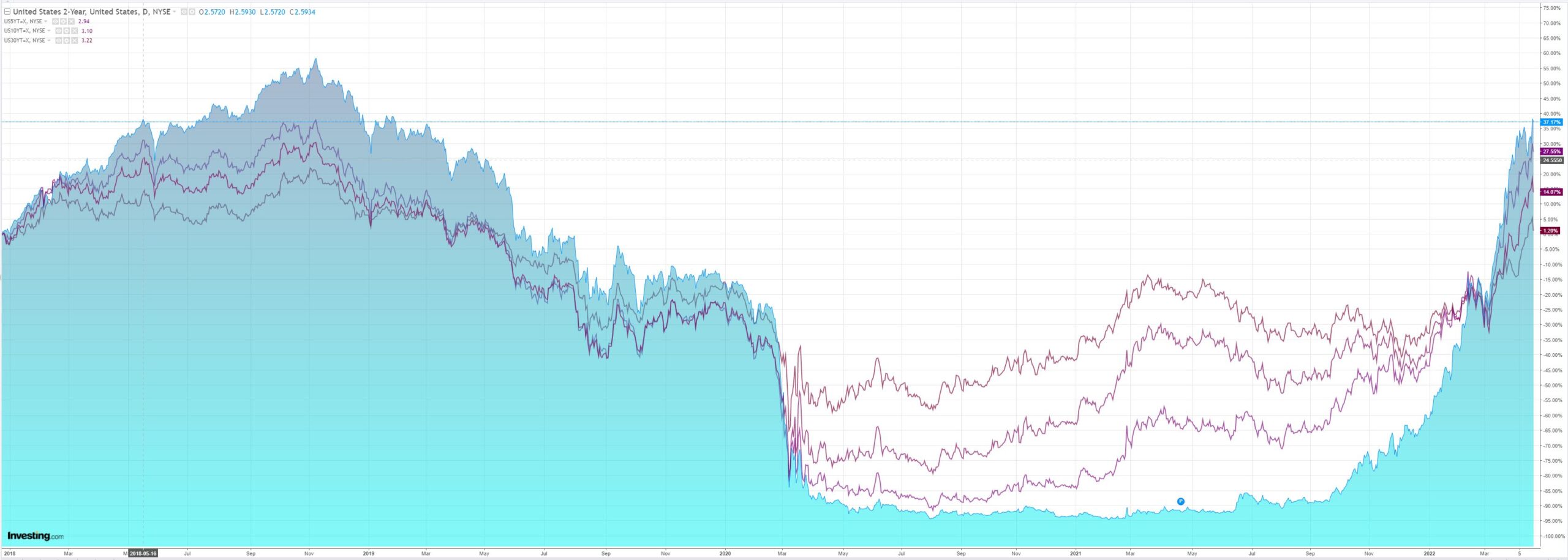

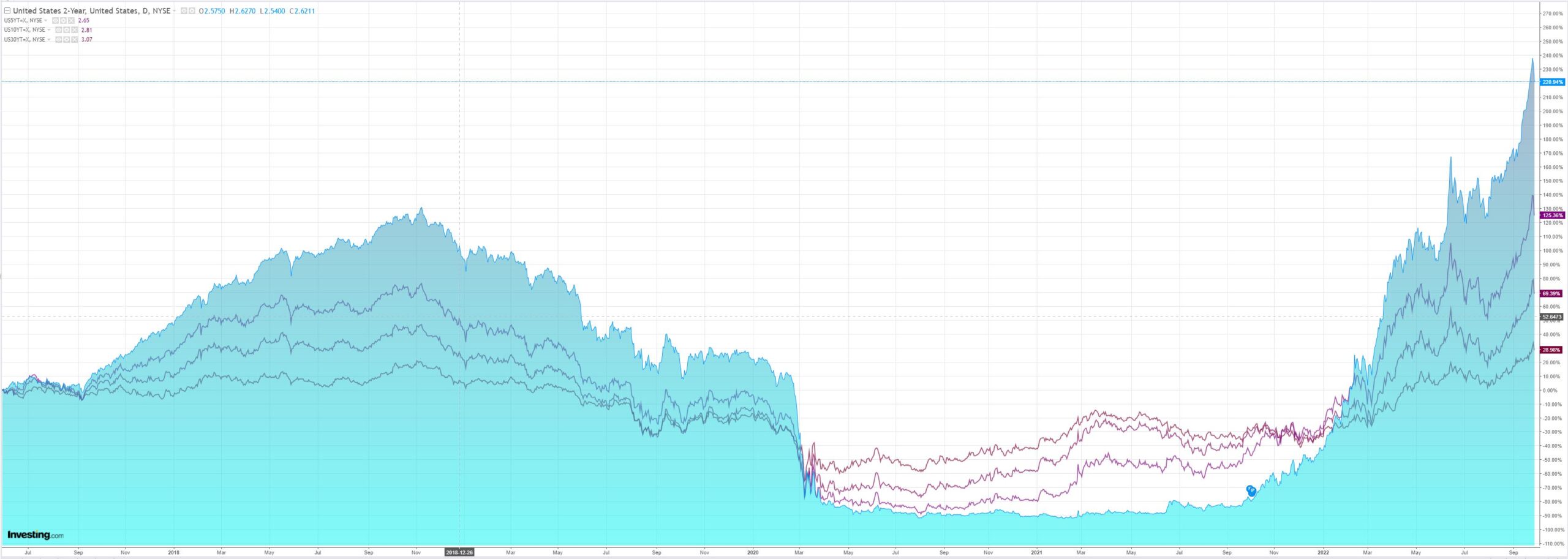

As the curve resumed flattening:

Stocks were weak:

The big news in forex yesterday is the breaking of CNY:

When CNY falls then all sorts of negative feedback loops intensify for global growth, especially when it is accompanied by Fed tightening:

- EMs are hammered on both their capital and trade accounts as capital retreats to the US and competitiveness to China.

- Commodities come under pressure as well because of weak Chinese growth, a rising USD and damaged EM consumption.

- A lower CNY is very deflationary for goods given China absorbs even more market share.’

Credit Agricole (EPA:CAGR) is onto it:

The CNY has weakened to its six-month low, and we expect larger CNY volatility and further depreciation ahead, in line with China’s growth and Covid worries, diverging monetary policy and unfavourable capital flows. This will likely weigh on other EM currencies, when the USD is also rallying. There could be more downside to EM Asia FX, as the correlation with the CNY is usually strong with the CNY as a regional anchor. We remain cautious on the KRW and TWD while we expect the SGD to outperform. There could be rising caution about Latam FX too, should the Chinese slowdown come along with less support for commodity prices. We remain defensive on Latam FX.

AUD also has a strong correlation with CNY, especially when it is weak:

The Fed tightening cycle ends most appreciably in an EM and China growth accident. CNY falls accordingly. AUD follows.