DXY was firm overnight with US market closed:

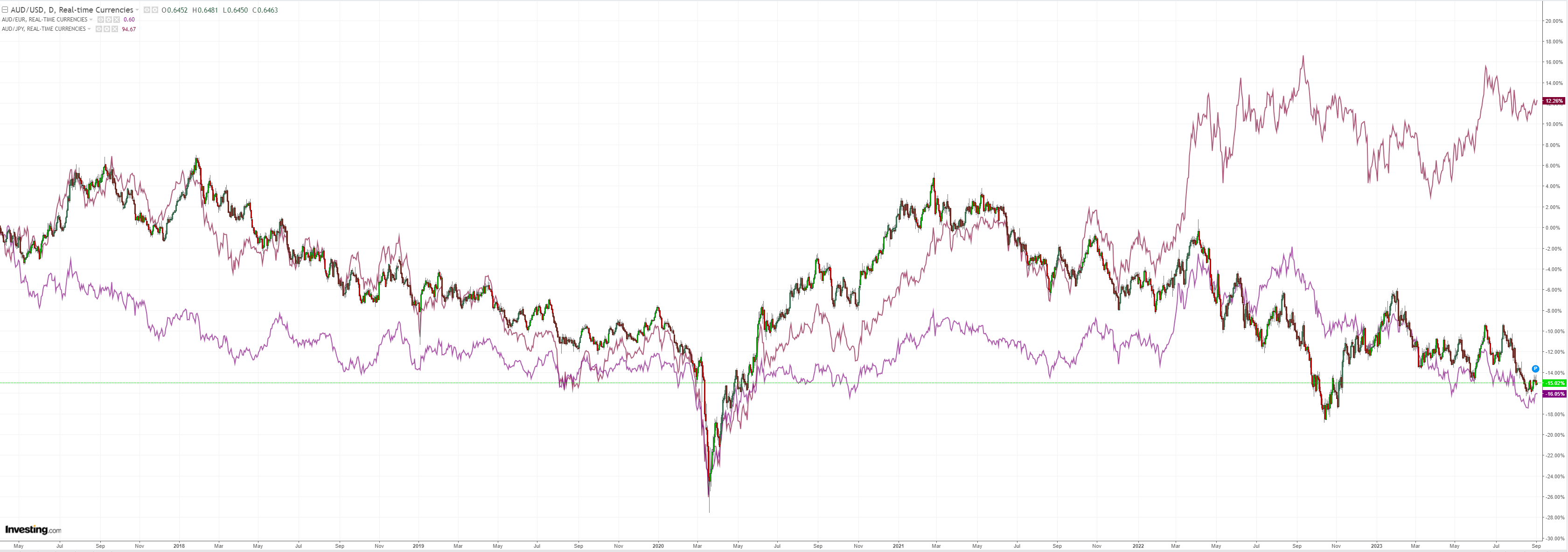

AUD fell:

Oil roared on:

Dirt reversed course:

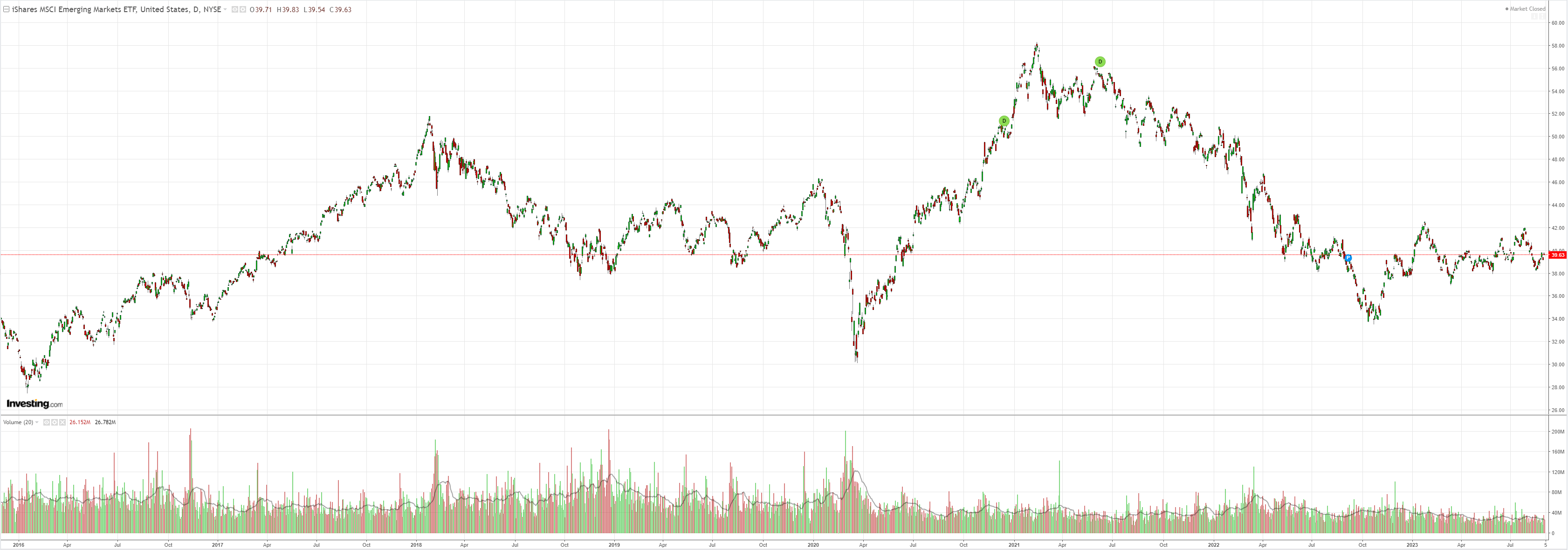

EM stocks are finished:

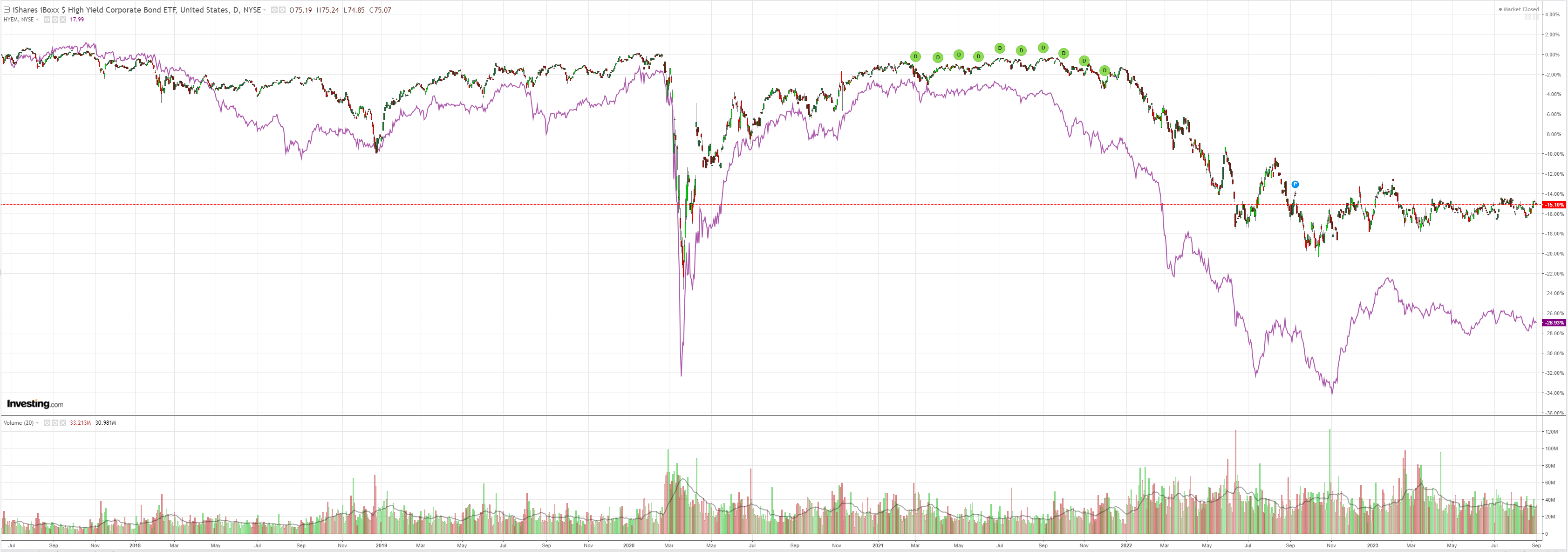

Junk fell:

Societe General has a good take on the AUD:

Economics

China’s debt problem is grave, but it need not lead to a fast-moving systemic financial crisis because the government has a tight grip on the financial system. However, China probably won’t be able to escape several years of depressed growth and inflation while it goes through a state-driven debt restructuring. That said, much of the adjustments to slow growth might have already materialised and this approach of slow deleveraging could contain devastating financial spillovers to other economies and global markets.

Equities

The short-lived reaction to the cut in stamp duty on 28 August is further evidence that the catalyst for a sustained upturn must come from a more forceful policy response to the housing crisis. Still, the banking sector is outperforming the broad market, which is not indicative of an imminent financial crisis. We expect the market to trade sideways. The channel of transmission to non-China equity markets in the region passes through a persistently weak credit impulse, a bearish point for cyclical industries.

Rates & FX

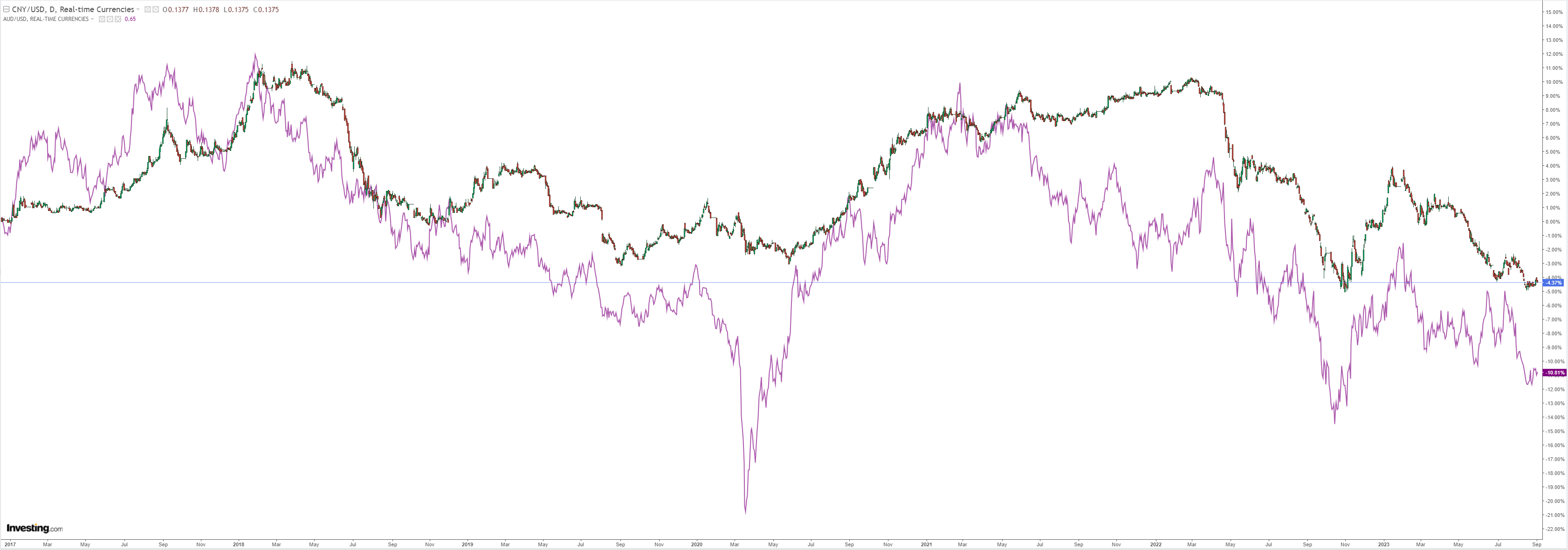

A scenario of a sustained low-growth era would imply lower yields in China and persistent depreciation pressure on the yuan. We have recently revised up our year-end USD/CNY forecast by 0.20 to 7.60. In terms of spillovers, we observe that higher economic exposure to China’s demand translates into higher correlation to the CNY, with North Asia FX and Thailand being the most correlated, followed by Southeast Asia FX, and the INR being the least correlated.

That’s a solid base case. FX is where the Chinese crash falls hardest. SG does not add Australia, the world’s only Devolving Market, to its analysis but we all know it is in the highly sensitive to China bucket and its correlation with CNY is extreme:

There is no bottom for AUD before CNY and the latter has many years of weakness ahead of it.