DXY is up and away with oil:

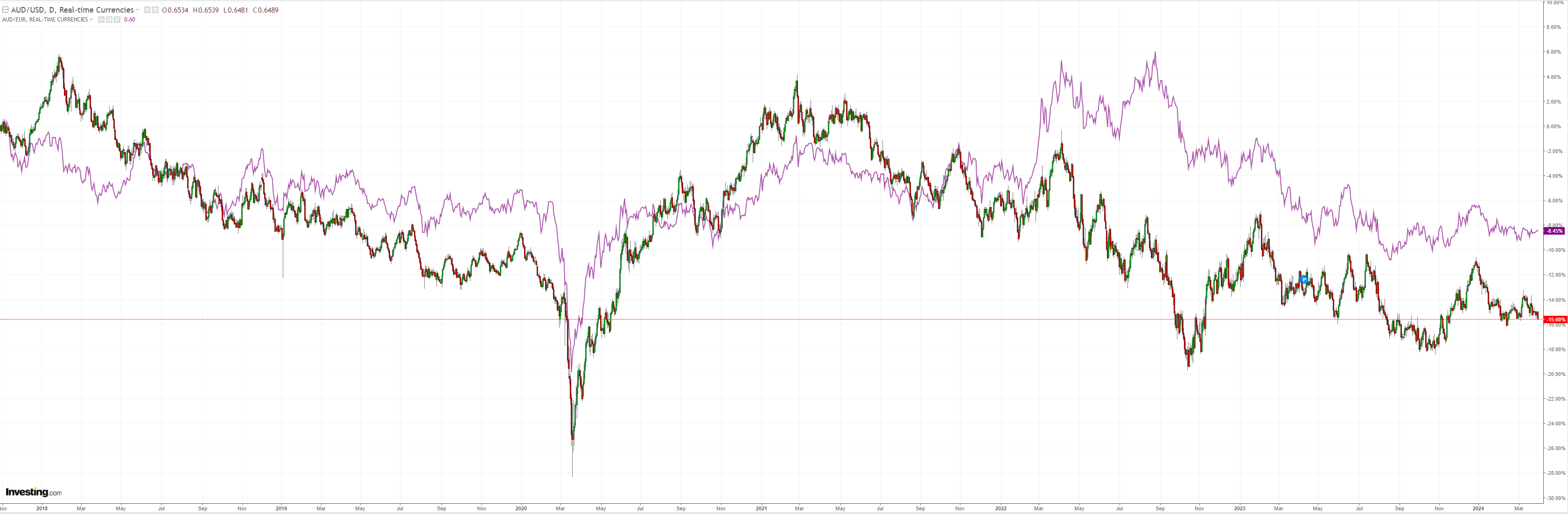

AUD is down, down:

Despite the bear’s party:

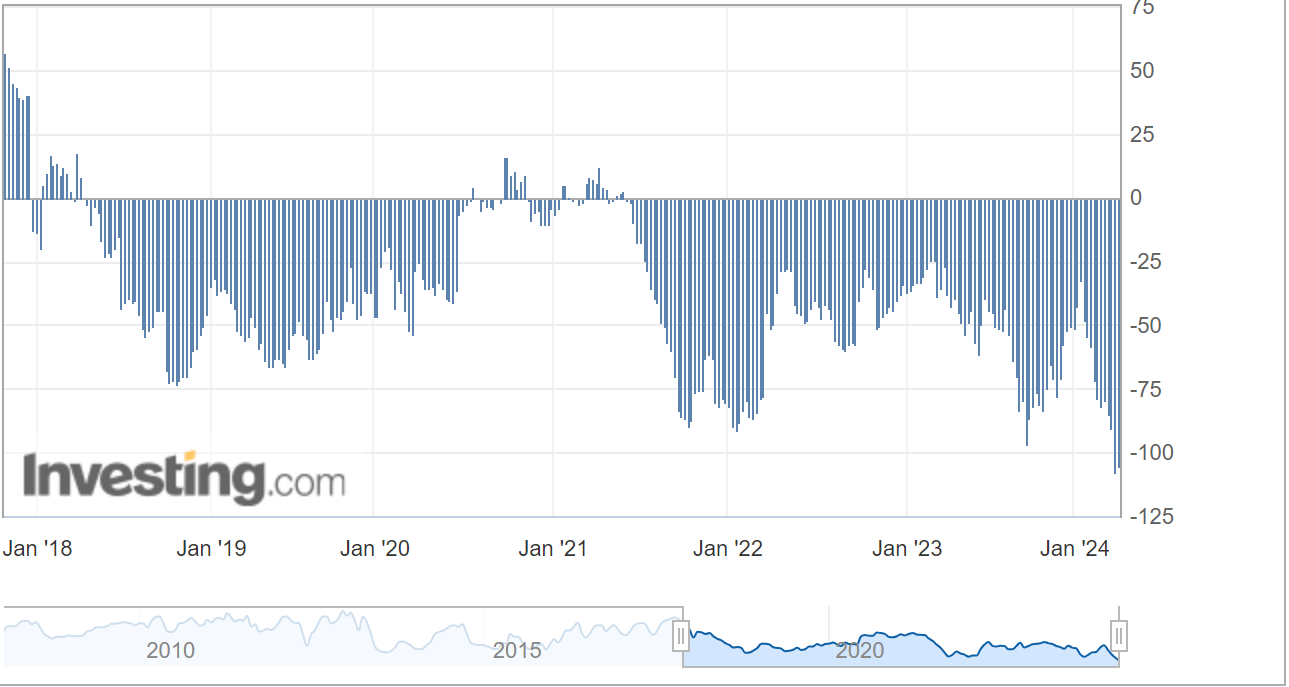

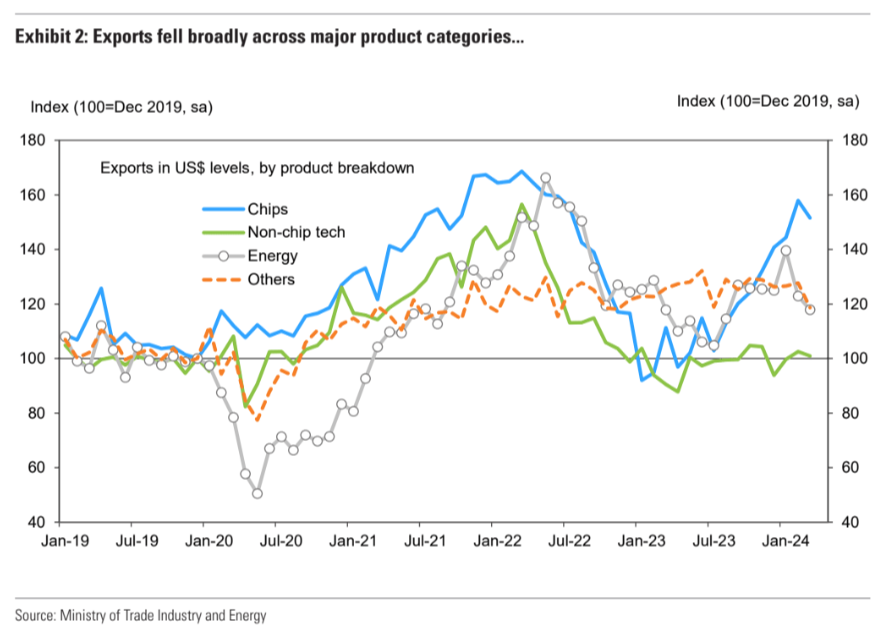

No help from North Asia:

Oil is threatening the entire rally. Gold is mad:

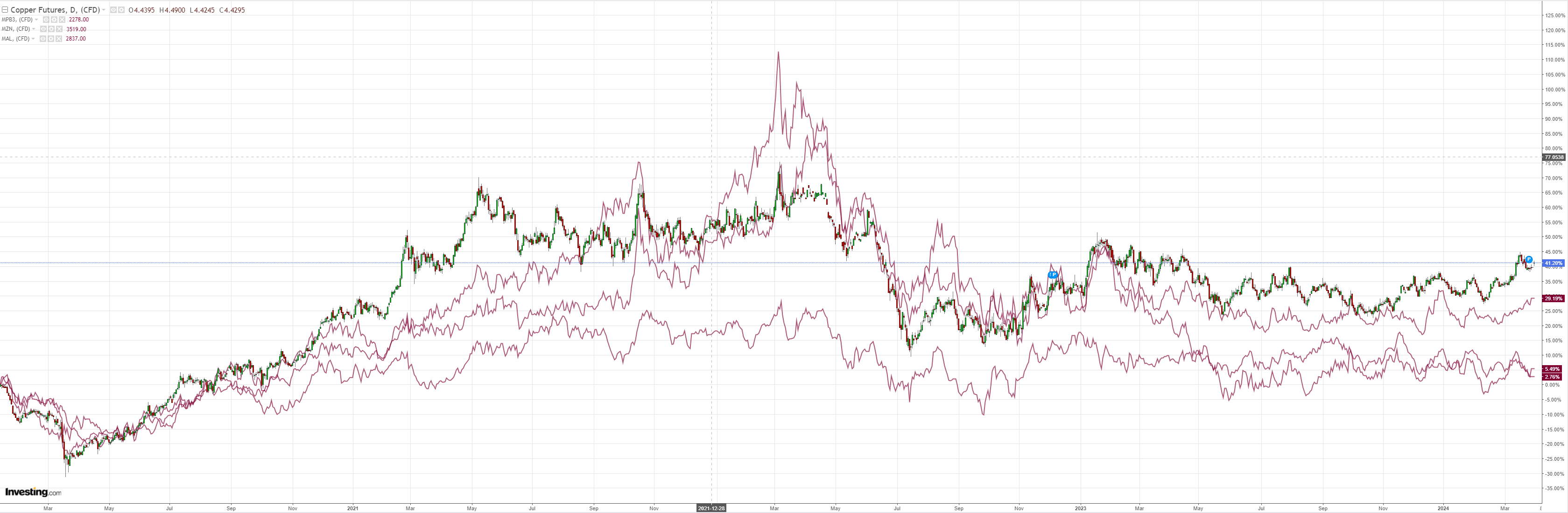

Metals meh:

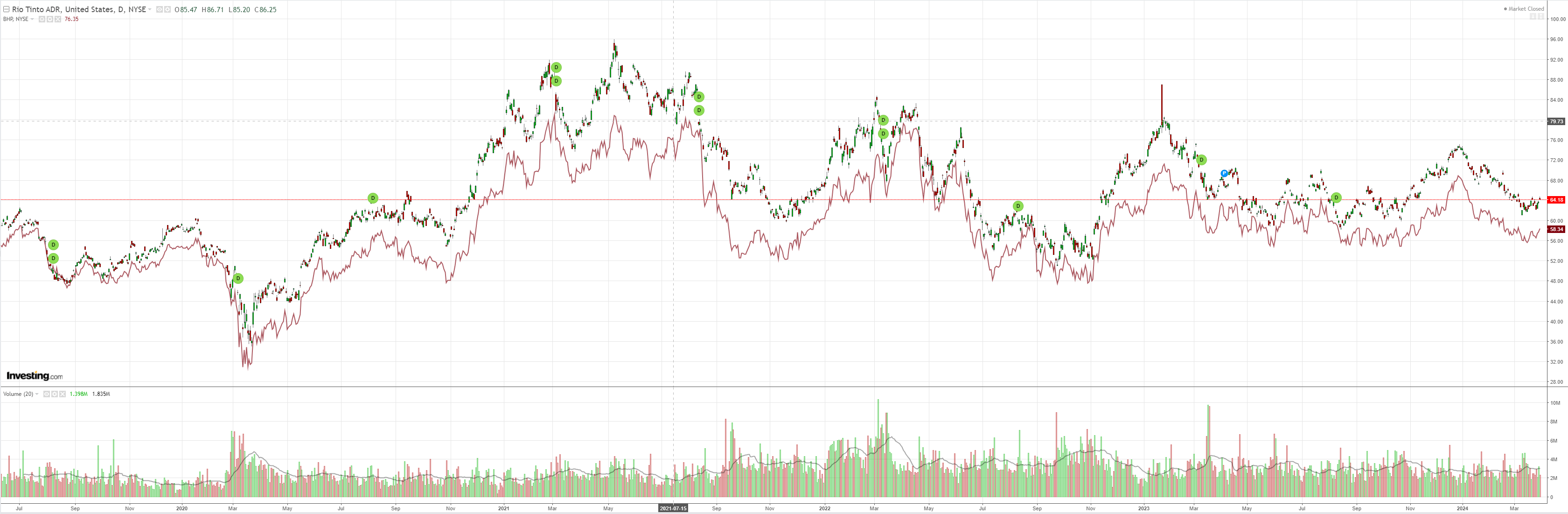

Miners dead cat bounced:

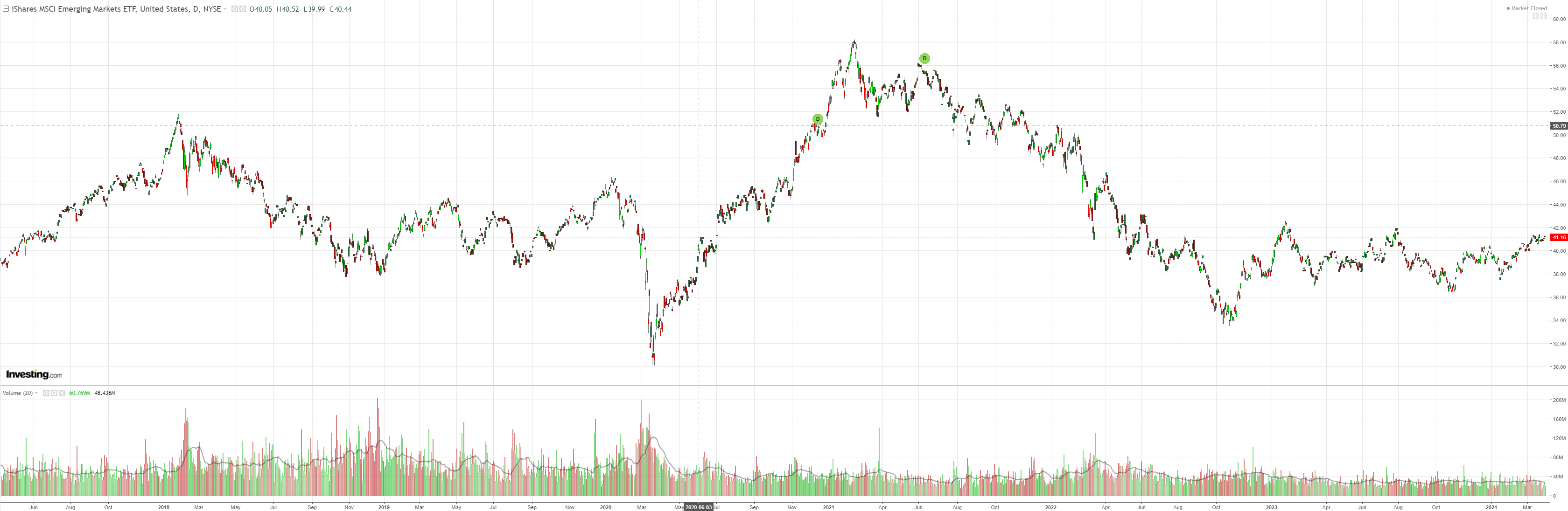

EM looks promising for no reason I can think of:

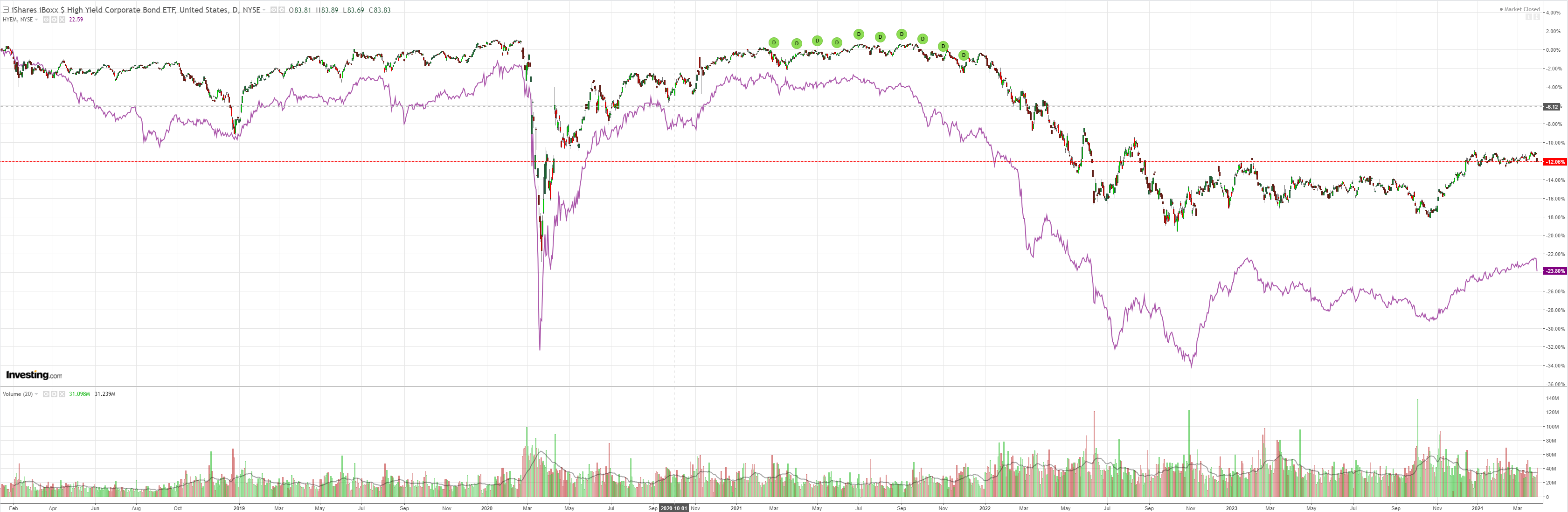

Not sure what happened to junk. Looks like a glitch:

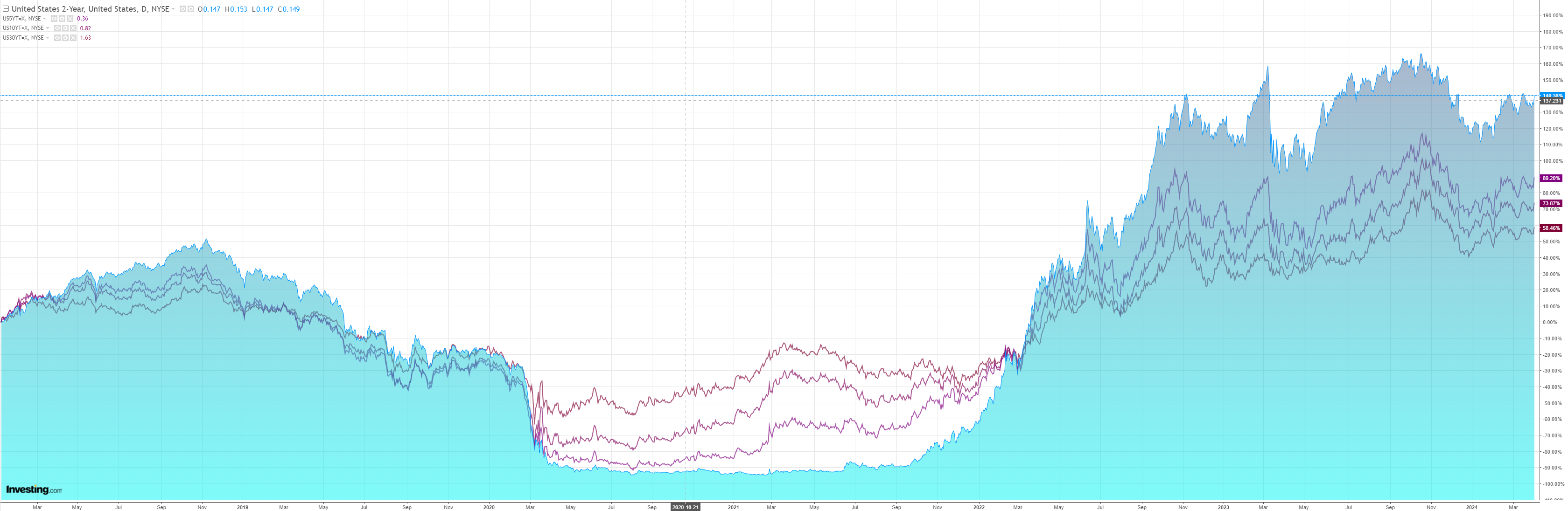

Yields up with oil:

Stock struggled:

The ISM is back:

“The Manufacturing PMI® registered 50.3 percent in March, up 2.5 percentage points from the 47.8 percent recorded in February. The overall economy continued in expansion for the 47th month after one month of contraction in April 2020. (A Manufacturing PMI® above 42.5 percent, over a period of time, generally indicates an expansion of the overall economy.) The New Orders Index moved back into expansion territory at 51.4 percent, 2.2 percentage points higher than the 49.2 percent recorded in February. The March reading of the Production Index (54.6 percent) is 6.2 percentage points higher than February’s figure of 48.4 percent. The Prices Index registered 55.8 percent, up 3.3 percentage points compared to the reading of 52.5 percent in February. The Backlog of Orders Index registered 46.3 percent, the same reading as in February. The Employment Index registered 47.4 percent, up 1.5 percentage points from February’s figure of 45.9 percent.

I put it to you that this is not as strong as it looks. It looks like AI spending distortions rather than a broad-based recovery. Check out the Korean export rebound:

It’s a big packet of chips and nothing else.

This helps explain why AUD is falling as the global industrial cycle lifts, which is the opposite of the usual.

AUD and AI do not mix.

Indeed, if AI plays out as expected, eliminating millions of entry-level jobs, Australia’s immigration-led labour expansion economic model is toast.