DXY is a one currency wrecking ball:

AUD is sitting right at the lows:

CNY took out 16-year lows:

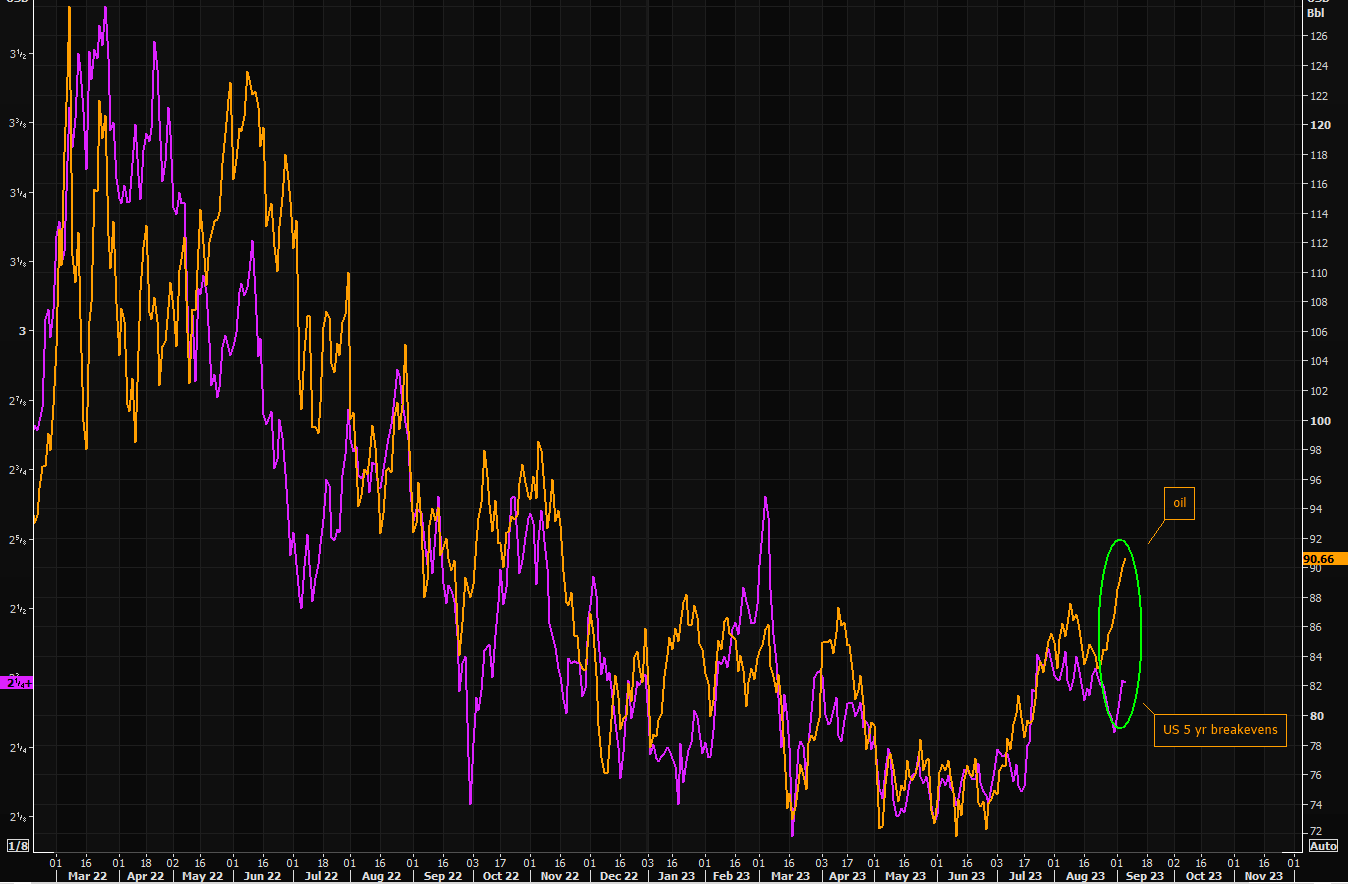

Oil is going to end the cycle:

As dirt decouples and confirms:

Miners rolled:

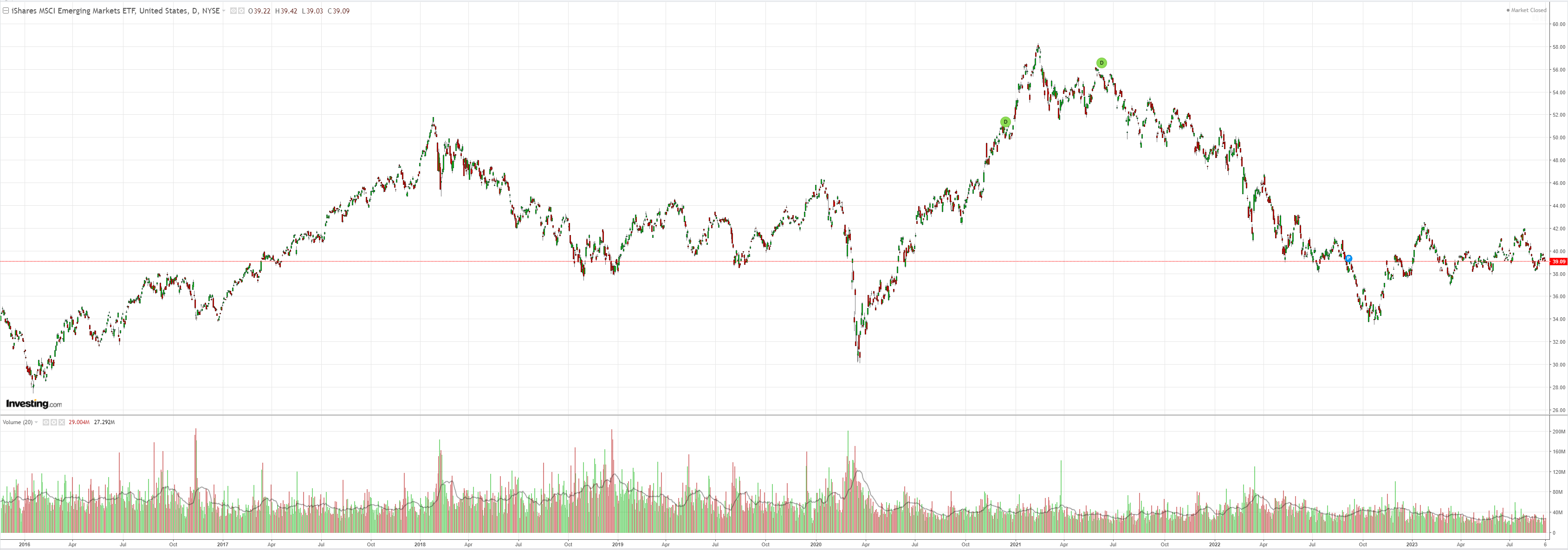

Abandon, ye, the Thrid World:

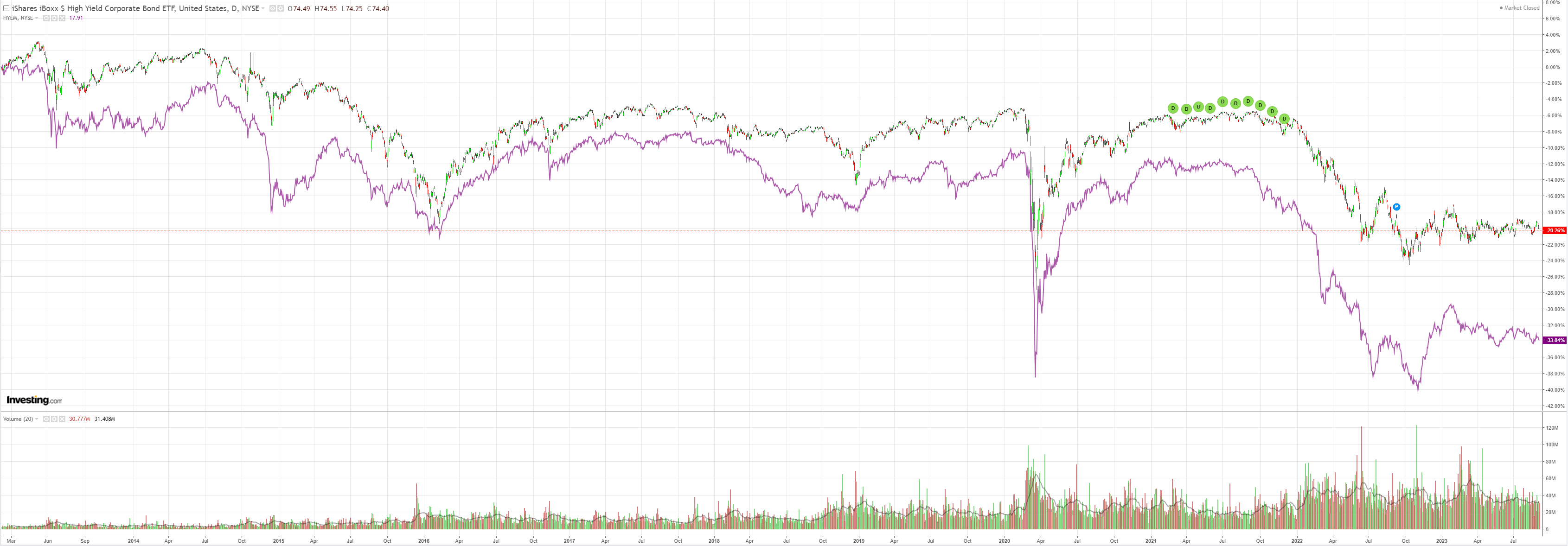

Junk funk:

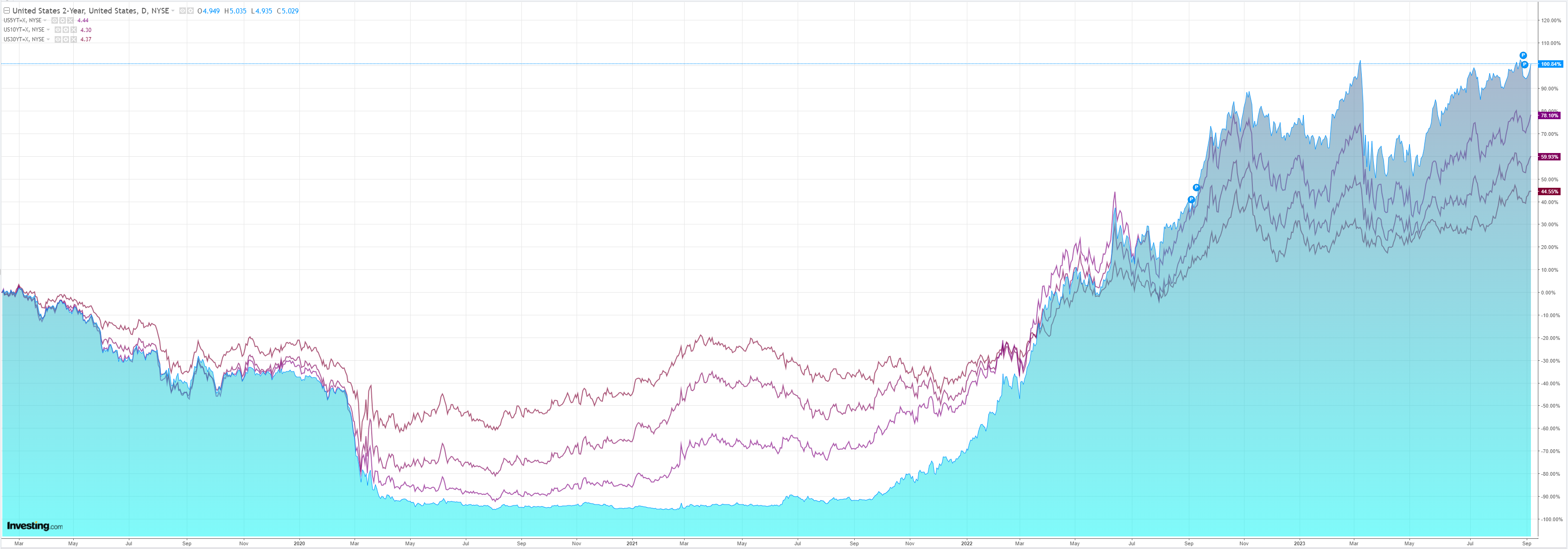

This time the bear steepener has oil to drive it:

In AI versus oil, there is only one winner:

German factory orders collapsed and the US services ISM took off. A nasty combination for ongoing DXY bullishness. Credit Agricole (EPA:CAGR) explains:

The USD-smile has firmly reassessed itself as the key template for FX markets in recent days. Among the key FX drivers of late has been the combination of better US data, growing energy costs and persistent concerns about the outlook in the Eurozone and China. These developments both boosted the rate appeal of the USD and weighed on risk sentiment, which fuelled demand for the high-yielding, safe-haven King USD. Focus today will be on the US services ISM for August as well as speeches by the Fed’s Susan Collins and Lorie Logan and the release of the latest Fed Beige Book. Ahead of the release, the market consensus is for the ISM services to hold up reasonably well in the face of the tightening. In addition, Fed officials could keep the door open for further tightening in part because of the resilience of the recent US data. Some positives are already in the price of the resurgent King USD and we think that it would take positive data surprises and/or hawkish surprises from the Fed speakers today to boost the currency’s relative rate appeal. That being said, we think that the USD should remain broadly supported especially if risk aversion spikes further in the very near term.

Oil is the key to the Fed now. If it keeps running it will have no choice but the hike again:

That will spike DXY and crash the stock market.

AUD is being shoved towards another cliff.