Street Calls of the Week

DXY is firm:

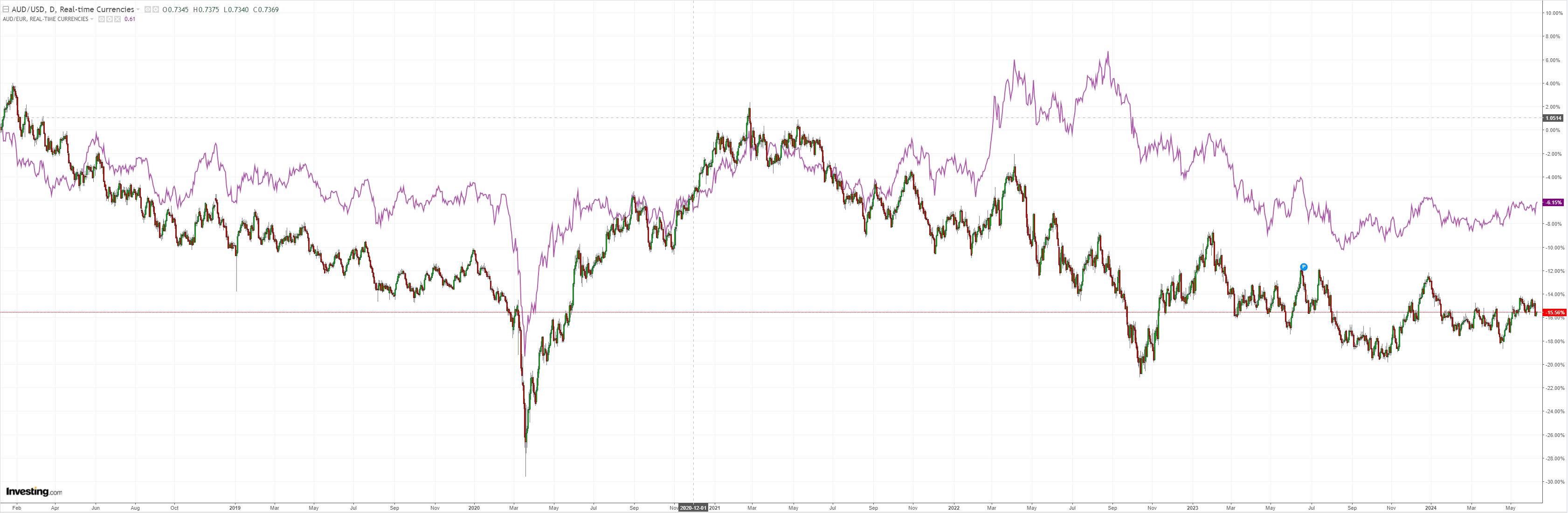

But so is AUD:

North Asia is no help:

Oil has recovered. Will it now fill the downside gap?

Metals mostly puked:

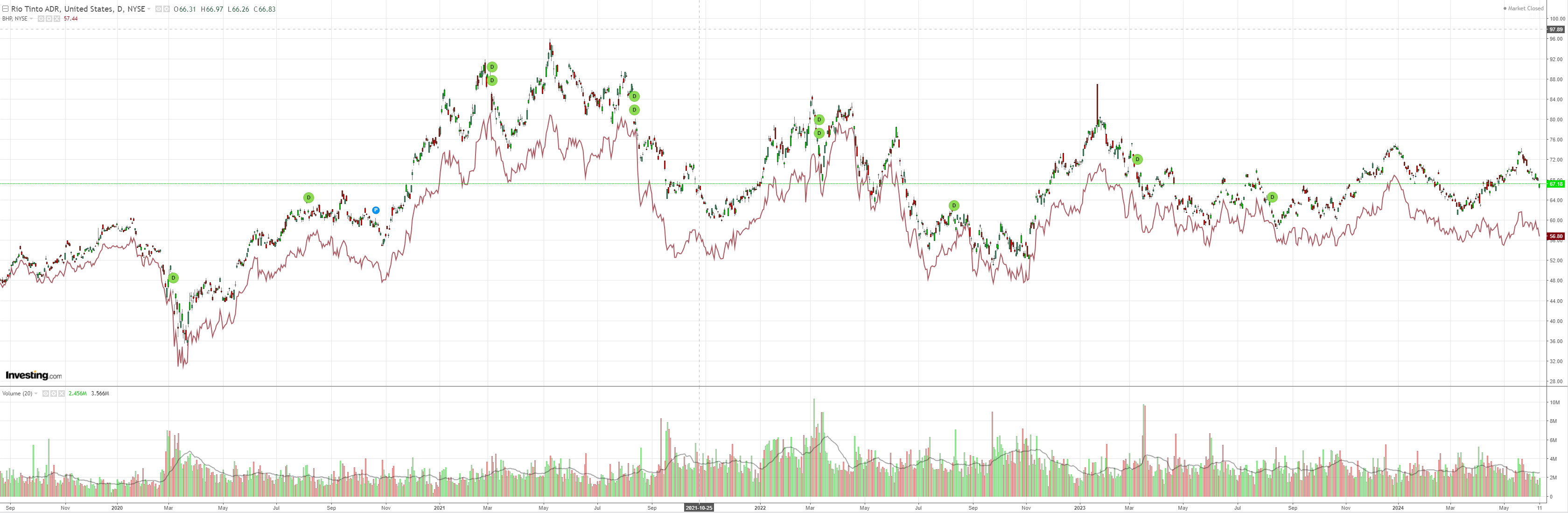

Miners too:

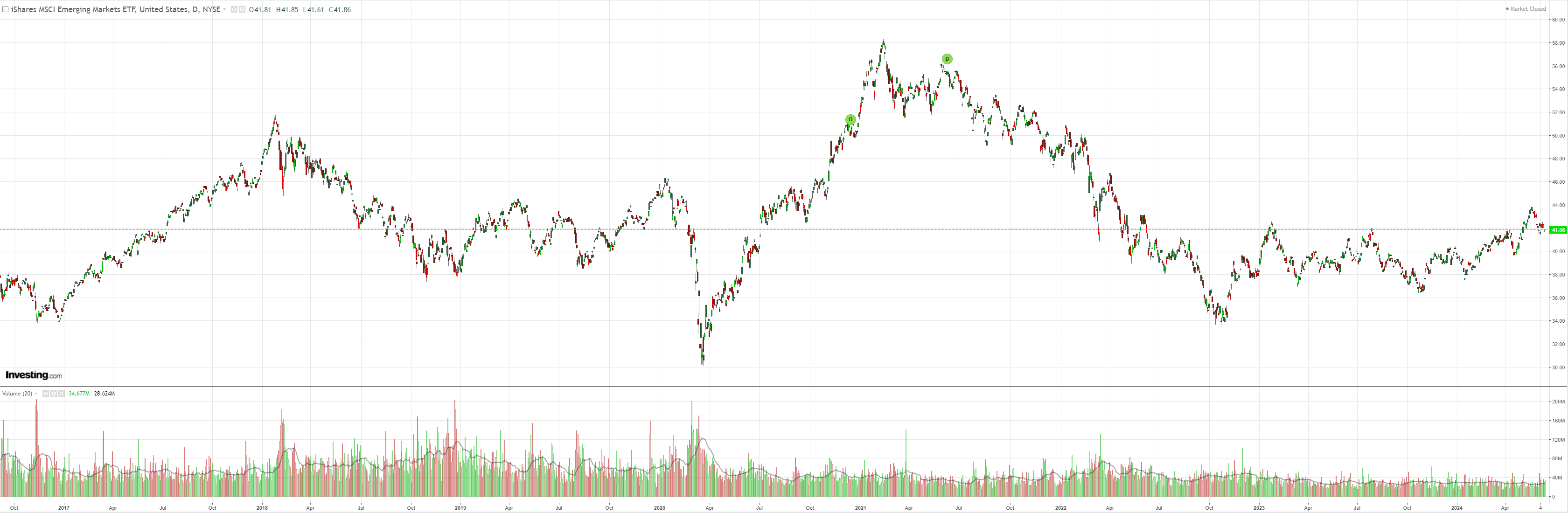

EM is holding support:

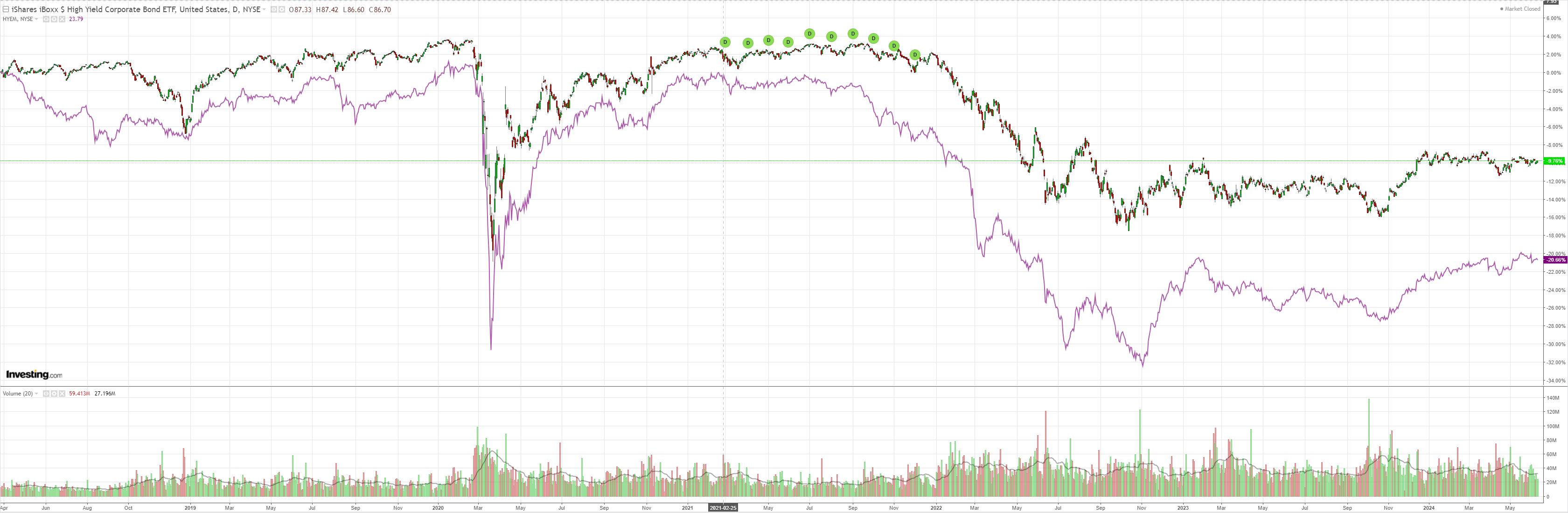

But junk is stalled:

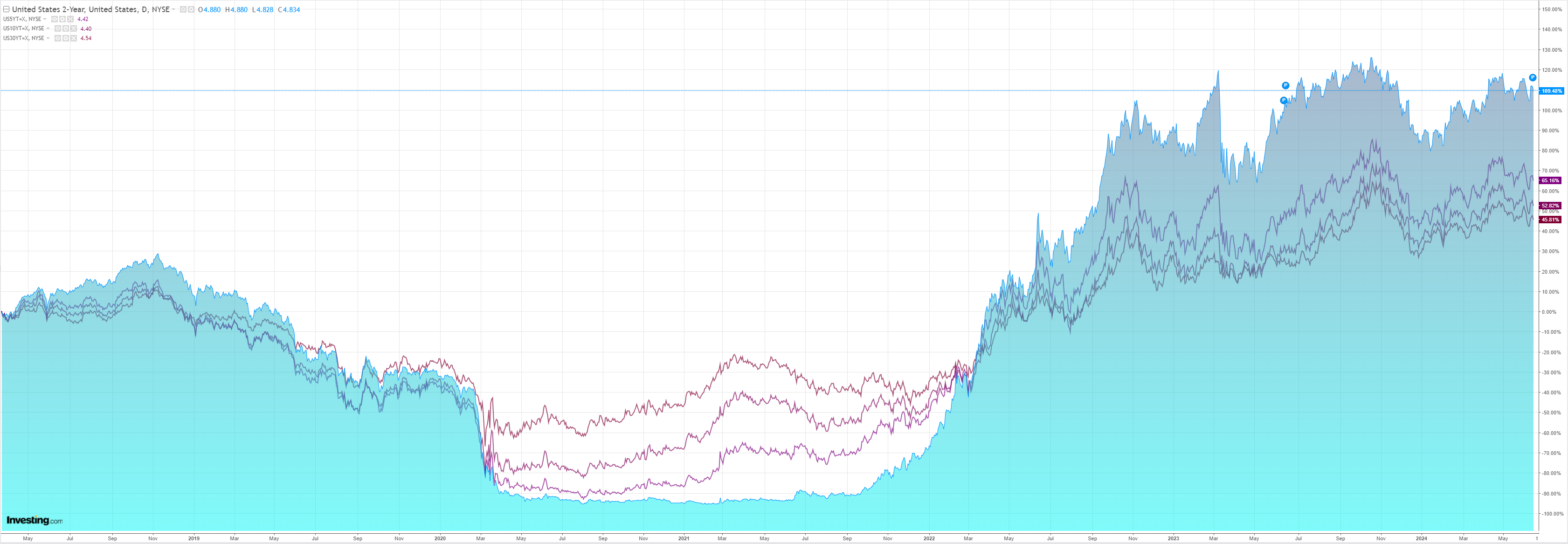

Bonds were bid:

As were stocks:

Tomorrow’s double whammy US inflation report and Fed meeting outcome are shaping as dovish today.

Most of the major Wall Street banks expect easing inflation. Citi is one:

Despite shifting our base case for the start of Fed rate cuts from July to September, Fed officials should be encouraged by a further slowing in inflation, with core CPI rising 0.26% MoM in May data released the morning of the June FOMC decision.

While rounding to 0.3%MoM, there is greater risk of a print that rounds to a softer 0.2%, and we currently pencil in a 0.20% increase in May core PCE inflation.

But a strong 272k jobs added in May means the labor market backdrop is strong enough that unexpectedly stronger inflation data (0.31% or higher) could still further reduce the chance of Fed rate cuts this year.

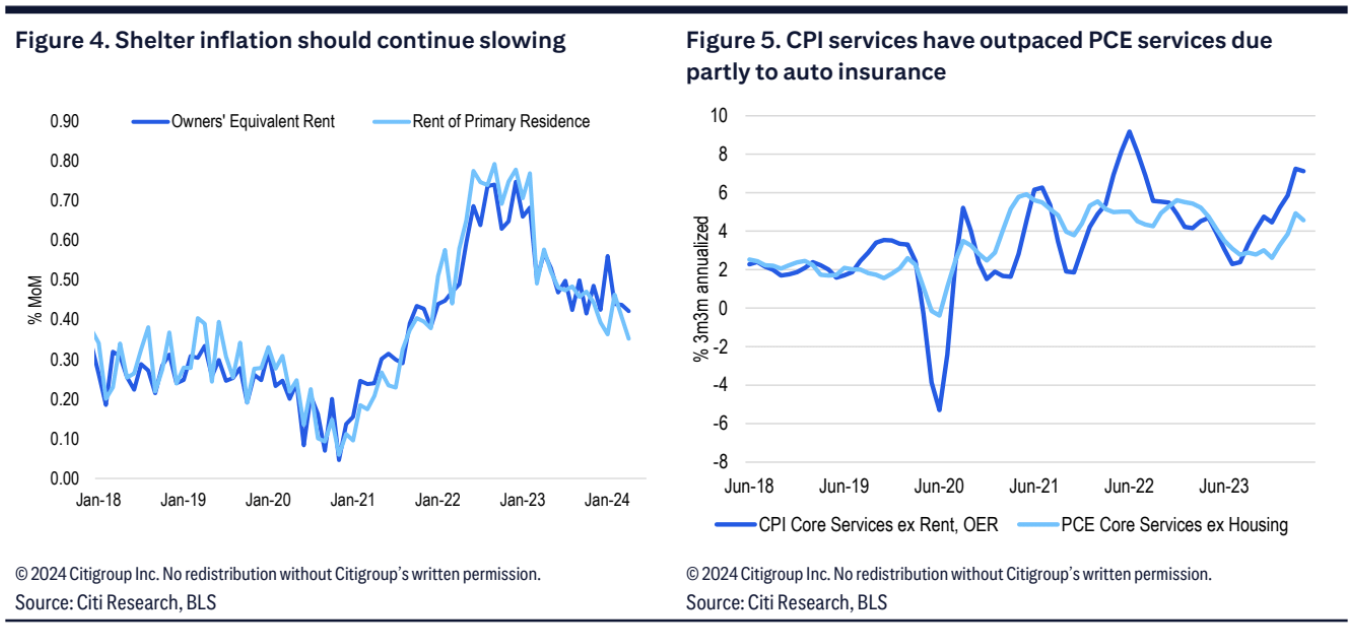

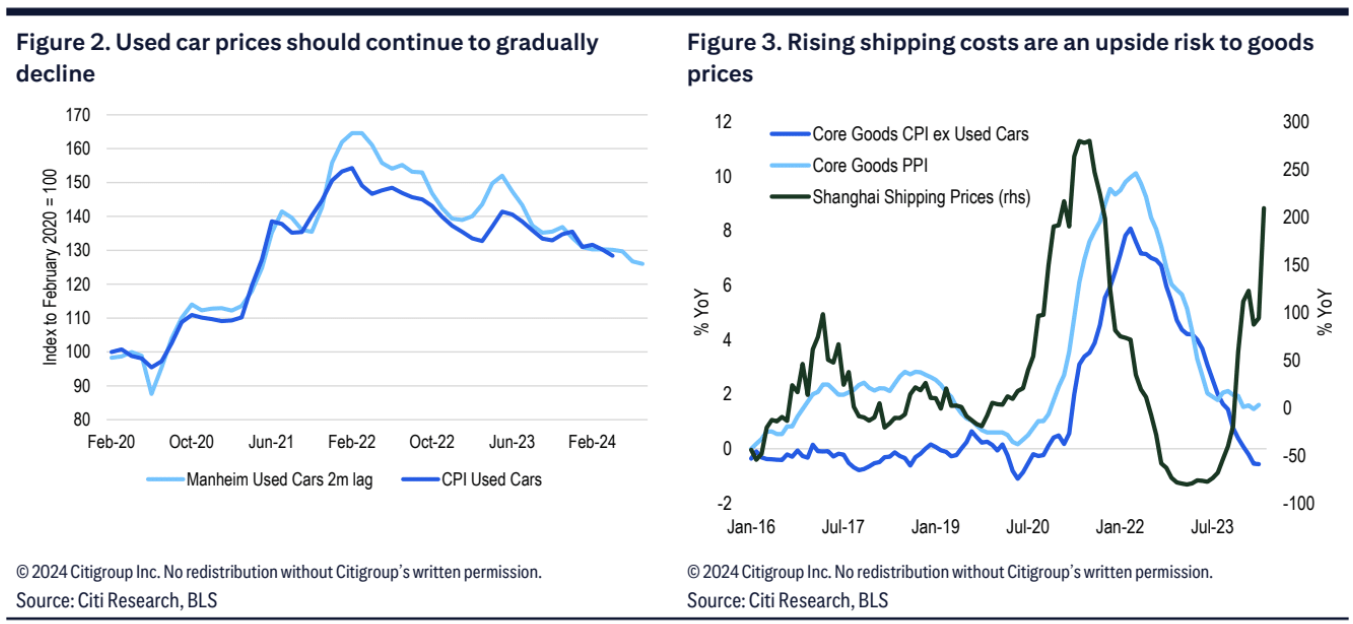

The two charts that matter most are used cars and rents, both of which should fall:

Check out the shipping shock. That’s a pre-election tariff inventory build.

This sets up a US and China economic crunch post-election.

AUD might get pushed around depending on how the data shakes out tonight, but the election remains the key price driver for H2 as DXY remains strong and AUD is under pressure.