DXY was stable last night:

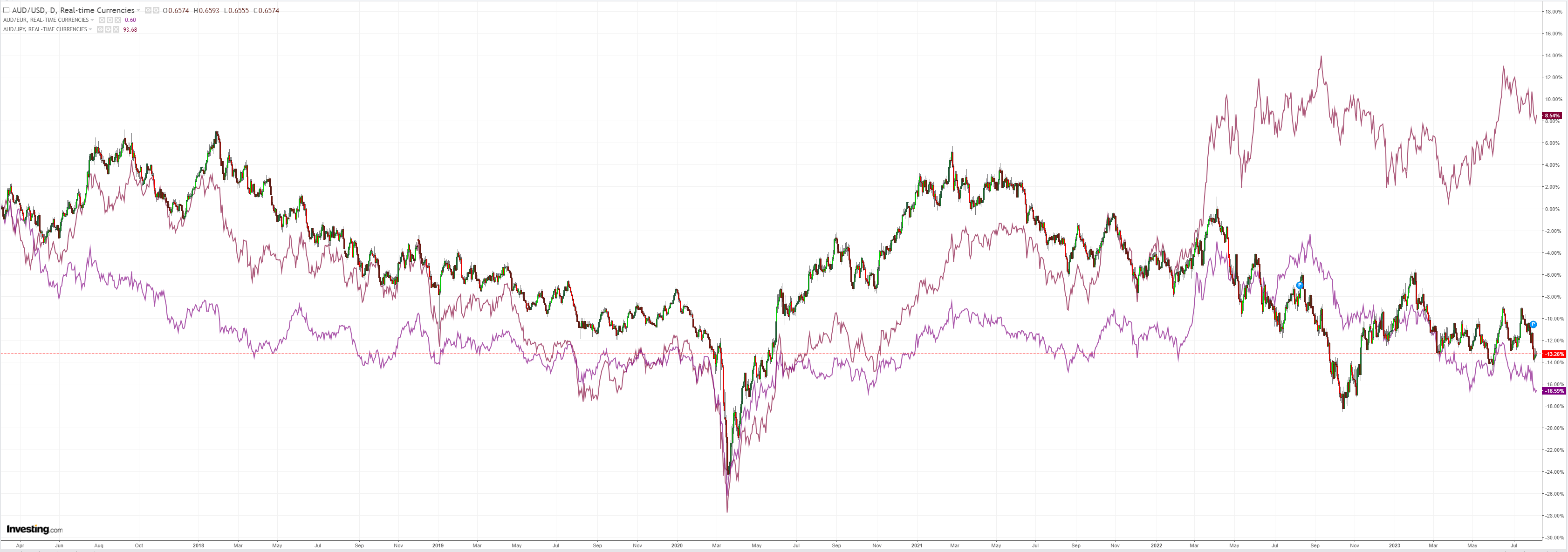

AUD dead cat bounced:

Dirt too:

Miners (NYSE:RIO) look to be resting at the foot of the gallows:

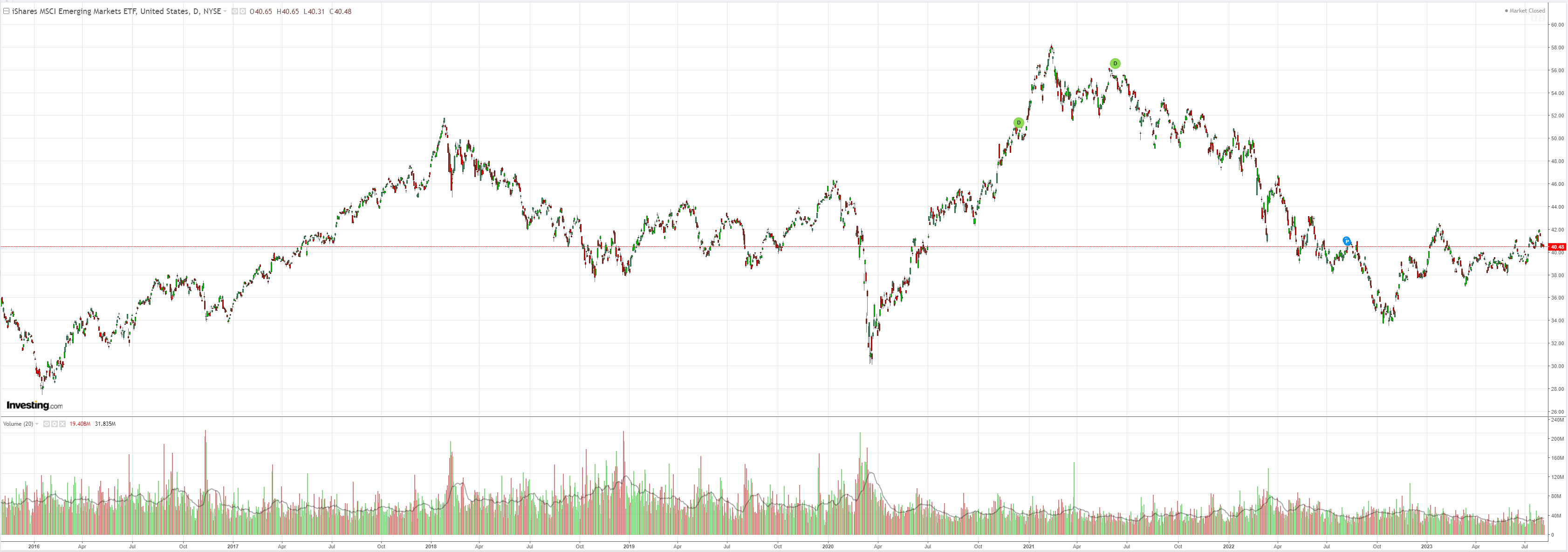

EM stocks (NYSE:EEM) are finished:

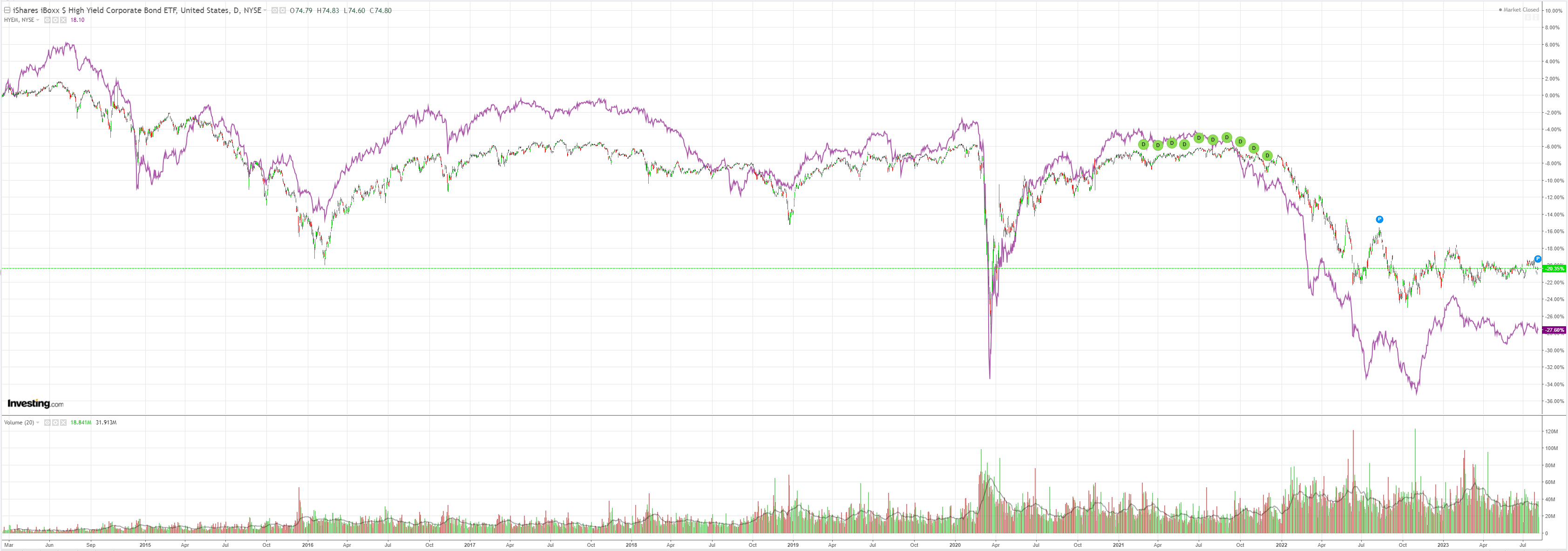

Junk (NYSE:HYG) won’t play:

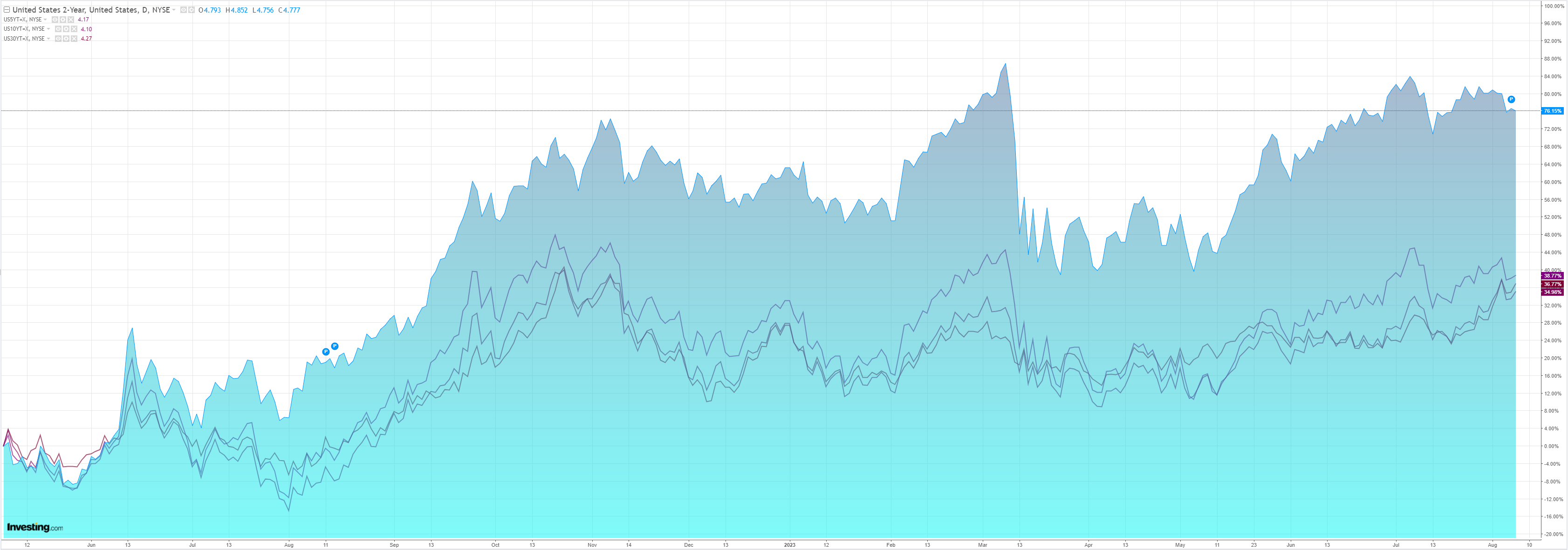

The bear steepening resumed:

Stocks firmed:

The big release this week is US CPI. I agree with Goldman that it will be weak:

We expect a 0.15% increase in July core CPI (vs. 0.2% consensus), corresponding to a year-over-year rate of 4.66% (vs. 4.8% consensus). We expect a 0.16% increase in July headline CPI (vs. 0.2% consensus), which corresponds to a year-over-year rate of 3.17% (vs. 3.3% consensus).

We highlight three key component-level trends we expect to see in this month’s report. First, we expect a 3.0% decline in used car prices and a 0.3% decline in new car prices in July, reflecting lower used-car auction prices and continued increases in auto dealer promotional incentives. Second, we expect residual seasonality to weigh on apparel and lodging prices this month, as the CPI seasonal factors are likely overfitting to the rebound in prices in the aftermath of the pandemic lockdowns. Third, we expect shelter inflation to remain roughly at its current pace (we forecast rent to increase by 0.44% and OER to increase by 0.47%), as the gap between rents for new and continuing leases continues to close.

Going forward, we expect monthly core CPI inflation to remain in the 0.2-0.3% range in the next few months, reflecting continued moderation in shelter inflation, lower used car prices, and slower nonhousing services inflation as labor demand continues to moderate. We forecast year-over-year core CPI inflation of 3.8% in December 2023 and 3.0% in December 2024.

If so, we can expect the AUD dead cat to bounce higher for a while.

But not far. “Risk on” markets have now reached the dangerous position of driving the bear steepening in bonds which is also its natural endpoint.