DXY was down bigly:

The Aussie dollar dead cat bounced:

Oil came off. Gold is moribund:

Base metals were mixed:

But miners (LON:GLEN) were hammered:

Despite the EM stock (NYSE:EEM) bounce:

And junk (NYSE:HYG):

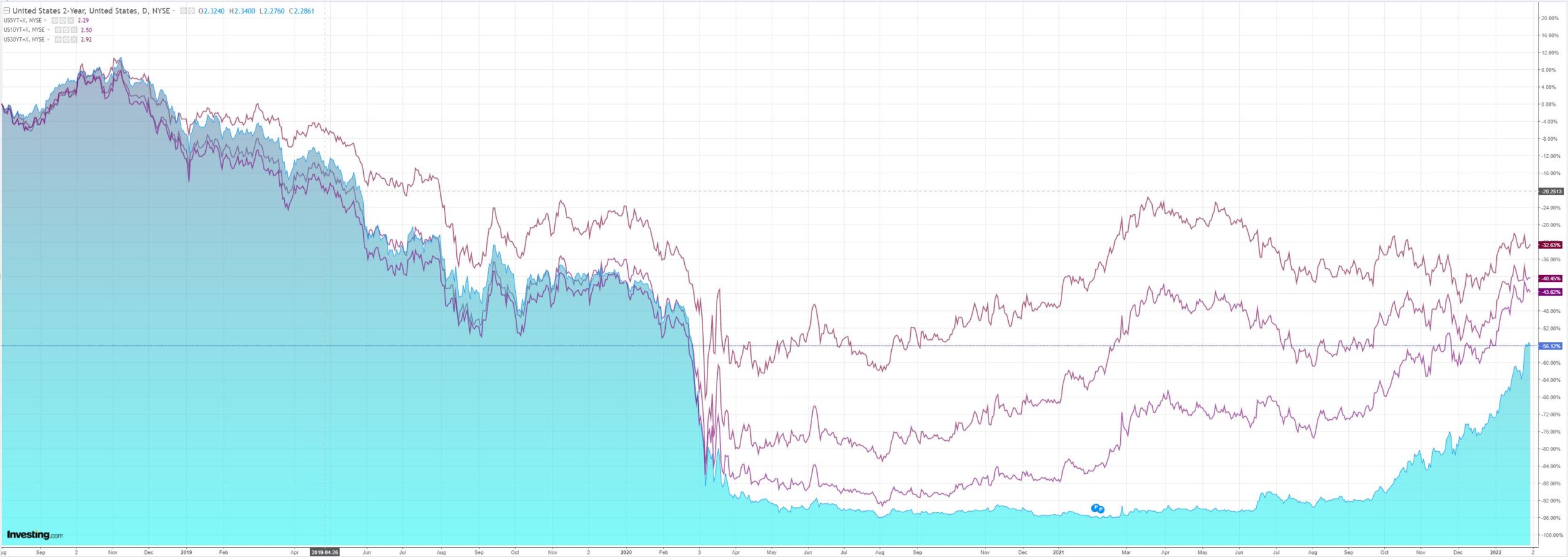

The Treasury curve was all over the place:

And stocks took off:

Westpac has the wrap:

Event Wrap

US MNI Chicago PMI survey beat estimates at 65.2 (est. 61.8, prior 64.3) but the report citied declines in production, new orders and employment. However, the business barometer rose. The Dallas Fed manufacturing survey fell more than expected at 2.0 (estimate 8.5, prior 7.8). The six-month outlook was encouraging though, rising to 16.5 from 14.6.

FOMC member Daly said it could raise interest rates as early as March to fight high inflation, but cautioned against overreacting and tightening policy too fast: “We are not behind the curve…When you’re trying to get an economy from extraordinary support to one that’s going to just gradually put it on to a self-sustaining path, you have to be data-dependent — as we say — but you also have to be gradual and not disruptive.”

FOMC member George said the central bank could take less aggressive actions in raising interest rates by shrinking the balance sheet more forcefully, which she said could help to avoid dangerous financial imbalances: “More aggressive action on the balance sheet could allow for a shallower path for the policy rate…Alternatively, combining a relatively steep path of rate increases with relatively modest reductions in the balance sheet could flatten the yield curve and distort incentives for private sector intermediation, especially for community banks, or risk greater economic and financial fragility by prompting reach-for-yield behavior from long-duration investors.”

Eurozone Q4 GDP was solid at +0.3%q/q (est. +0.4%q/q), from a revised Q3 of +2.3%q/q (prev. 2.2%q/q), to be in line with estimates at +4.6%y/y.

Germany’s CPI in January beat expectations. Headline inflation remained high at 4.9%y/y (est. 4.4%y/y, prior 5.3%y/y), core inflation also higher than expected at 5.1%y/y (est. 4.3%y/y, prior 5.7%y/y). The energy components remained high.

Event Outlook

Aust: At their February meeting, the RBA will announce the conclusion of the QE bond buying program; there will be a key focus on any shift in rhetoric concerning the timing of the tightening cycle, which Westpac expects to begin in August 2022. Daily measures point towards a lift in CoreLogic’s home value index for January, although gains are moderating and varying more by city (Westpac f/c: 0.9%). Total housing approvals are expected to post a strong gain in December (Westpac f/c: 8.0%) as HomeBuilder-related drags conclude; investor loans are anticipated to slightly outstrip owner-occupier loans (Westpac f/c: 8.5% and 7.5% respectively). December’s retail sales are expected to pull-back from the reopening surge in Oct-Nov (Westpac f/c: -2.0%).

NZ: Westpac expects the bi-monthly GDT dairy auction tonight to result in whole milk powder prices rising 5%.

Japan: The final estimate of January’s Nikkei manufacturing PMI is due.

Eur/UK: The final estimate of January’s Markit manufacturing PMI for the Euro Area and UK are also due. The Euro Area unemployment rate is expected to remain steady in December as activity cooled towards year-end (market f/c: 7.1%). Meanwhile, softer mortgage lending in December should indicate cooling housing demand in the UK (market f/c: £3.5bn).

US: The January ISM manufacturing PMI should reflect the strength of the sector despite omicron disruptions (market f/c: 57.5). Construction spending is anticipated to lift in December given the strength in housing (market f/c: 0.6%). The emergence of omicron should weigh on JOLTS job openings in December.

Nothing new for me. Classic bear market action. I’ll be selling the rip!