Street Calls of the Week

DXY dumped:

AUD popped:

CNY nothing burger:

Oil crash:

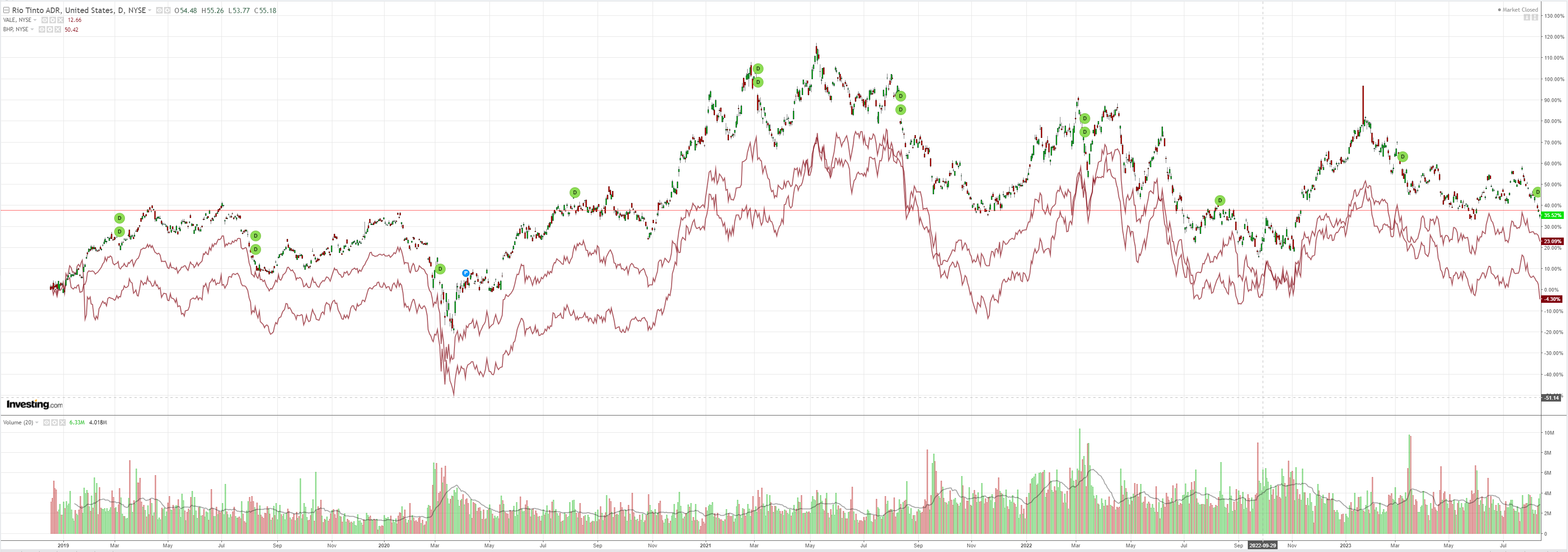

Dirt fade:

Miner’s firmed:

EM stocks at the precipice:

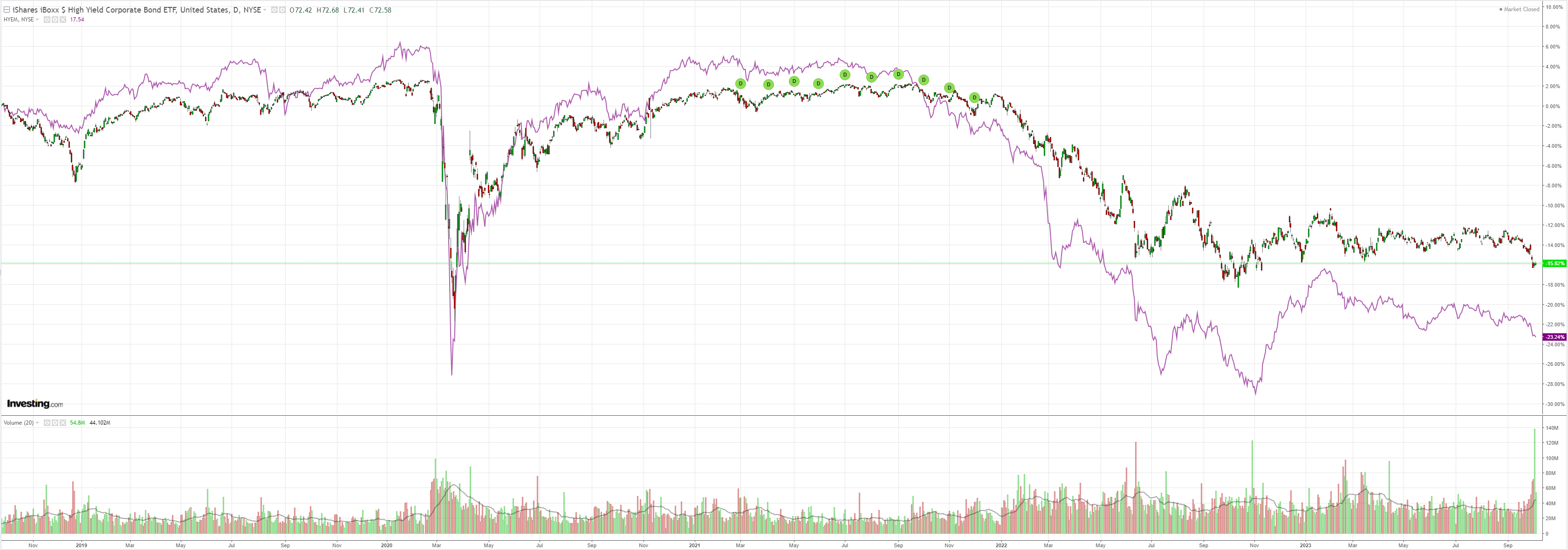

Junk over it:

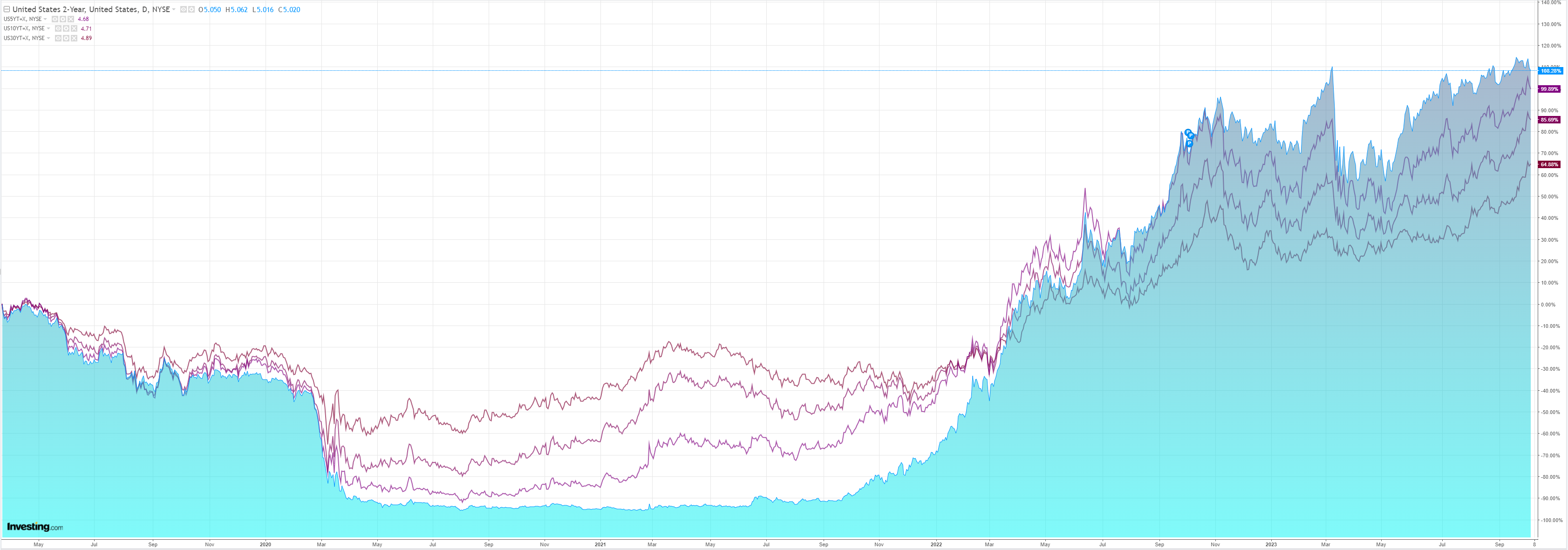

Yields bear steepened:

Stocks eased:

As we await NFP tomorrow, DXY is well overdue for a consolidation. Societe Gerneral:

I’m no technical analyst, but I do like RSIs–relative strength indicators–which (roughly speaking) measure the speed of market moves.

The 14-day RSI for 10-year Treasury yields broke above the 70 level that is the default measure of ‘overbought’, in mid-September 2022, rising above 80 before the end of the month.

It fell back briefly in early October before rising back over 70, coinciding with the highest-level yields would reach before this summer. We got above 70 for the RSI again in mid-September this year, and after a brief month-end pause, saw another spike, almost (but not quite) reaching 80 on Tuesday, when yields reached 4.8%.

Once again, that degree of stress was unsustainable, and yields are back down.

The Dollar Index has tracked the moves in yields and saw its RSI break 80 at the end of September 2022, though in the currency’s case, that coincided with the dollar’s peak.

This year, we saw a spike to 80 in the last week of September followed by a brief respite and a second spike to 75 this week that has (so far) coincided with the DXY peak.

Maybe these patterns only reflect the fact that September is often a bad month for risk sentiment (October sees a bounce more often than not, despite 1987).

But two years in a row, the pace of the sell-off in Treasuries, and the rally in the dollar, was too fast and caused an overshoot followed by a correction and period of position adjustment, before a return to fundamental drivers.

Will the spike in yields have a lasting impact on some market participants (as it did with Silicon Valley Bank)? Will the speed of the dollar’s rally trigger a reaction (was a break of USD/JPY150 enough to ensure that the BOJ changes policy in December?).

This may be just a brief pause while we wait for tomorrow’s labour market data and next week’s USTreasury supply and CPI data.

If the labour market data are strong, pressure will return sooner than it did last year.

I still think the Treasury market will take yields higher until something breaks in the system, just as the Gilt market took yields high enough and the FX market took the pound low enough a year ago, to force change in the UK Government.

That is a reasonable summary. I am not confident yet that NFP will be weak enough yet to knock yields back down. Thought the yield spike is going to tighten US bank lending meaningfully in due course.

Sell the AUD rallies.