DXY is fast approaching another breakout:

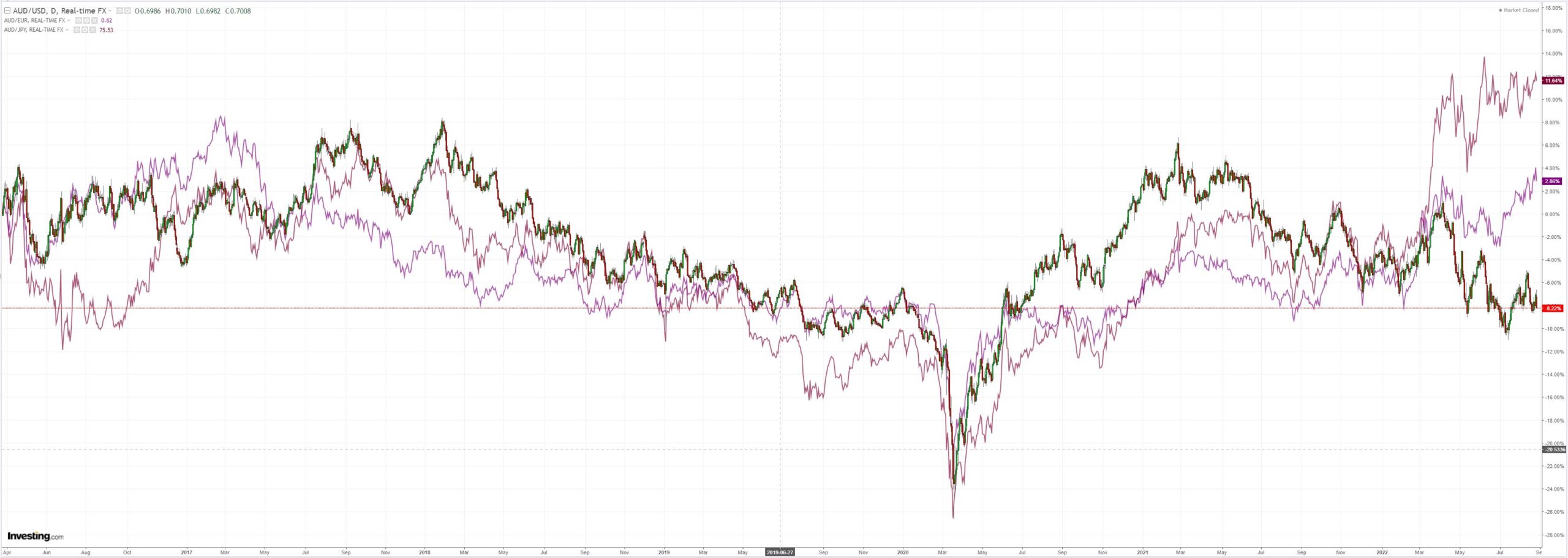

AUD was slammed across DMs Friday night:

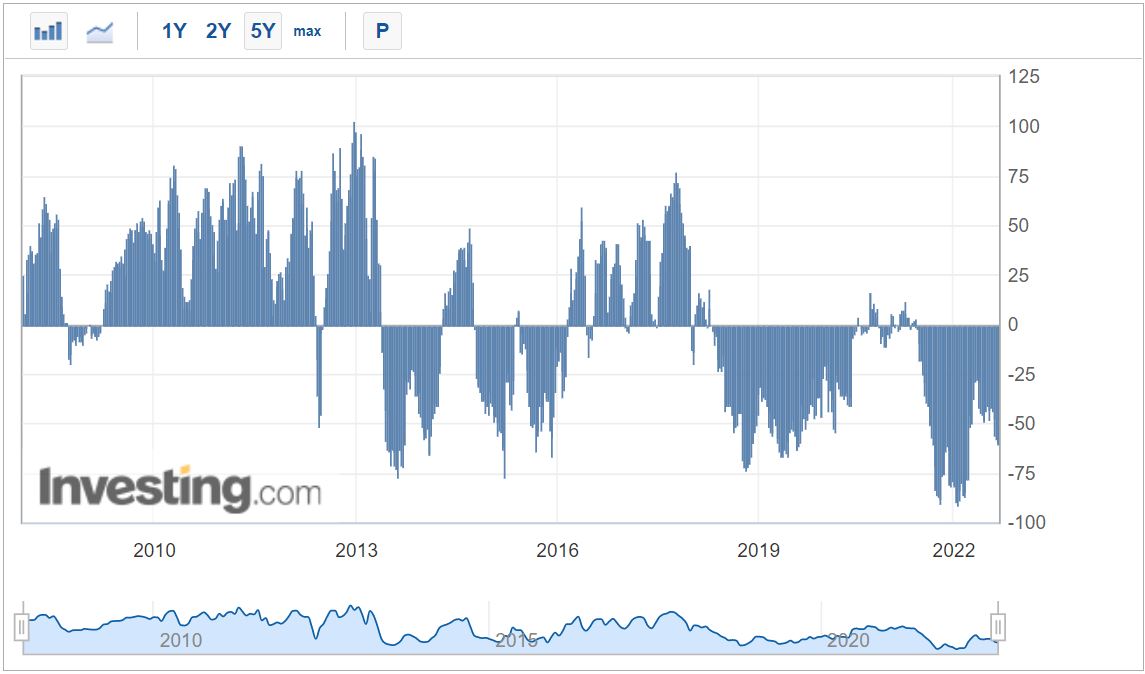

Markets are grinding shorter on CFTC:

Critically, CNY is shitting the bed:

Oil is refusing to fall in sympathy with gas:

Metals likewise:

Miners (LON:GLEN) were hit anyway:

EM stocks (NYSE:EEM) folded:

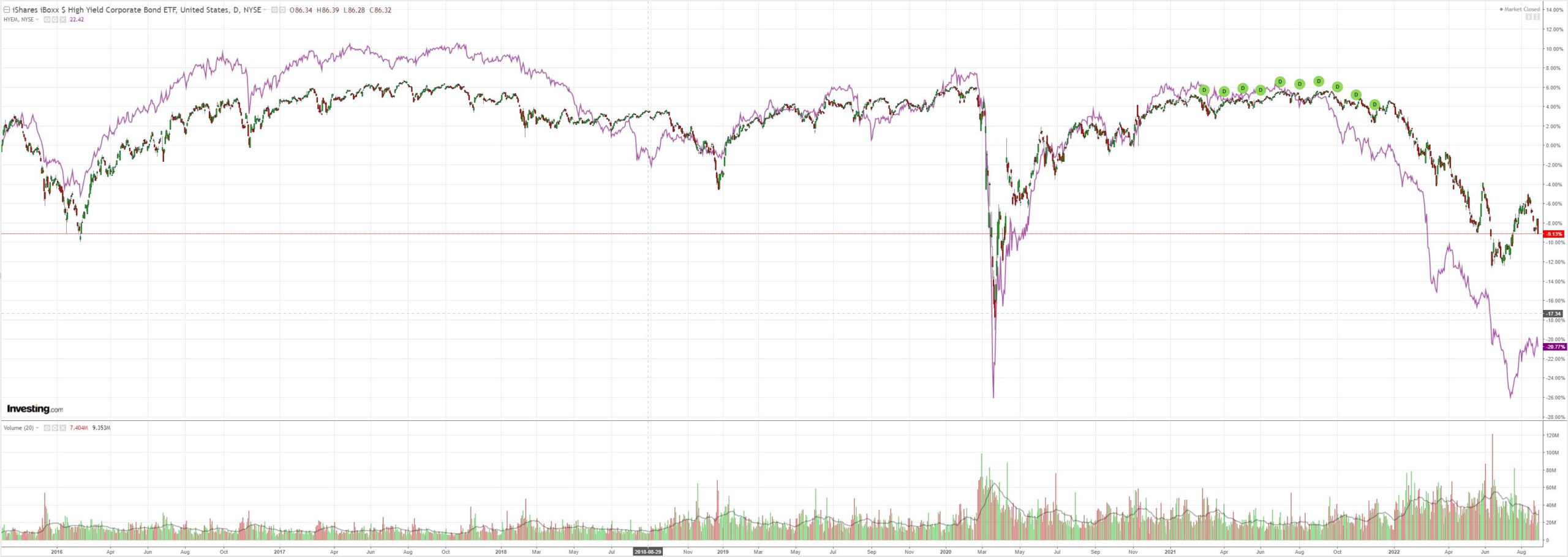

Junk (NYSE:HYG) reversed sharply:

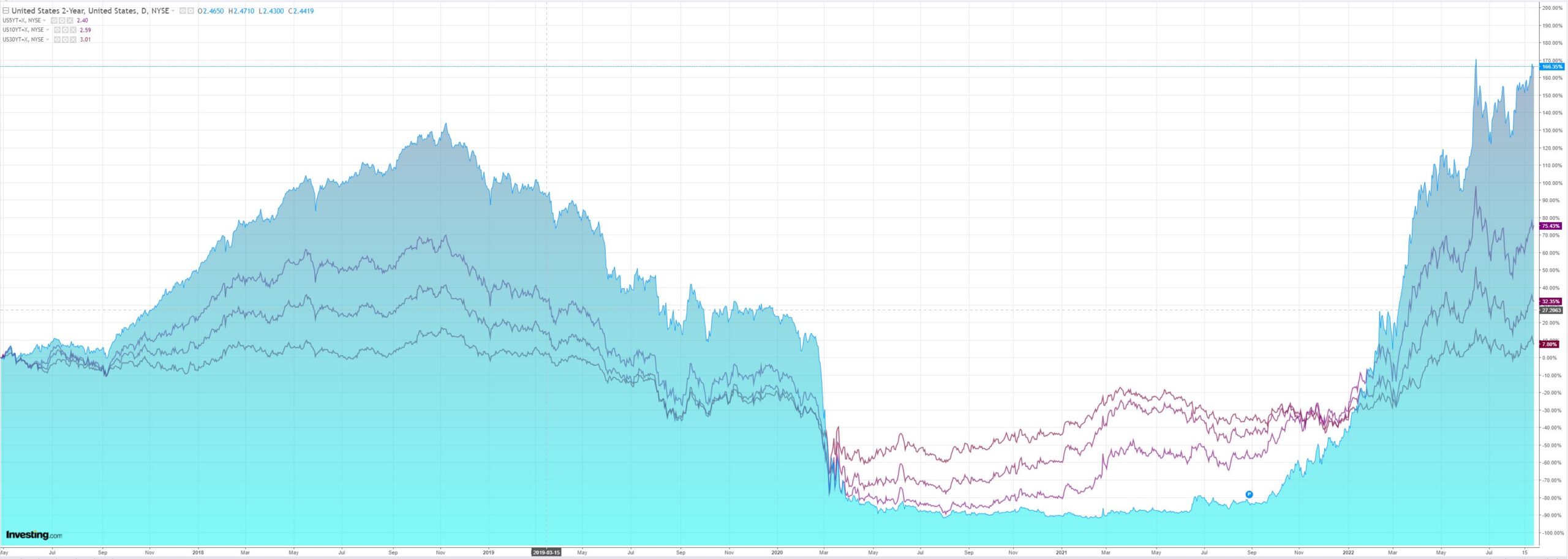

As the Treasury curve inversion deepened:

And stocks were slain:

Goldman has the wrap on Jackson Hole:

Chair Powell’s speech at the Fed’s Jackson Hole symposium reiterated that it will become appropriate to slow the pace of tightening “at some point,” as he laid out in his July press conference. However, Powell balanced that message by stressing that the FOMC remains committed to bringing inflation down, that the FOMC will likely need to maintain “a restrictive policy stance for some time,” and that progress on inflation “falls far short of what the Committee will needto see before we are confident that inflation is moving down.” We continue to expect the FOMC to slow the pace from here, delivering a 50bp hike in September and25bp hikes in November and December, for a terminal rate of 3.25-3.5%. Additional CPI and employment reports will be available by the September meeting, however, and Powell said that another 75bp hike “could be appropriate.” We see the risks to both the near-term pace and our terminal rate forecast as tilted to the upside.

And so we come to it. The great battle of our time. The Fed is going to squash inflation. It will likely need a goodly recession to achieve it. Not least owing to the global gas and electricity price blowoff emanating from Europe.

DXY is unstoppable in this environment and its strength is compounded by Chinese and European weakness which is sinking both CNY and EUR.

It remains my view that the Fed will have to keep tightening enough to stall US consumption. That will intensify a US inventory destocking that has barely started. The direct spillover is a worsening trade shock in China and Europe. I’m sure you see the toxic feedback loop here for forex.

AUD can only keep falling until one of two things happen. Either China throws the kitchen sink at stimulus which it is steadfastly refusing to do and, arguably, can’t even manage now that property is past the tipping point. Or, the Fed relents, but it won’t until it can confidently see inflation subsiding to 2% which is still many months away.

The recent risk rally was based on hope.

It is lost.