DXY returned with a bang last night:

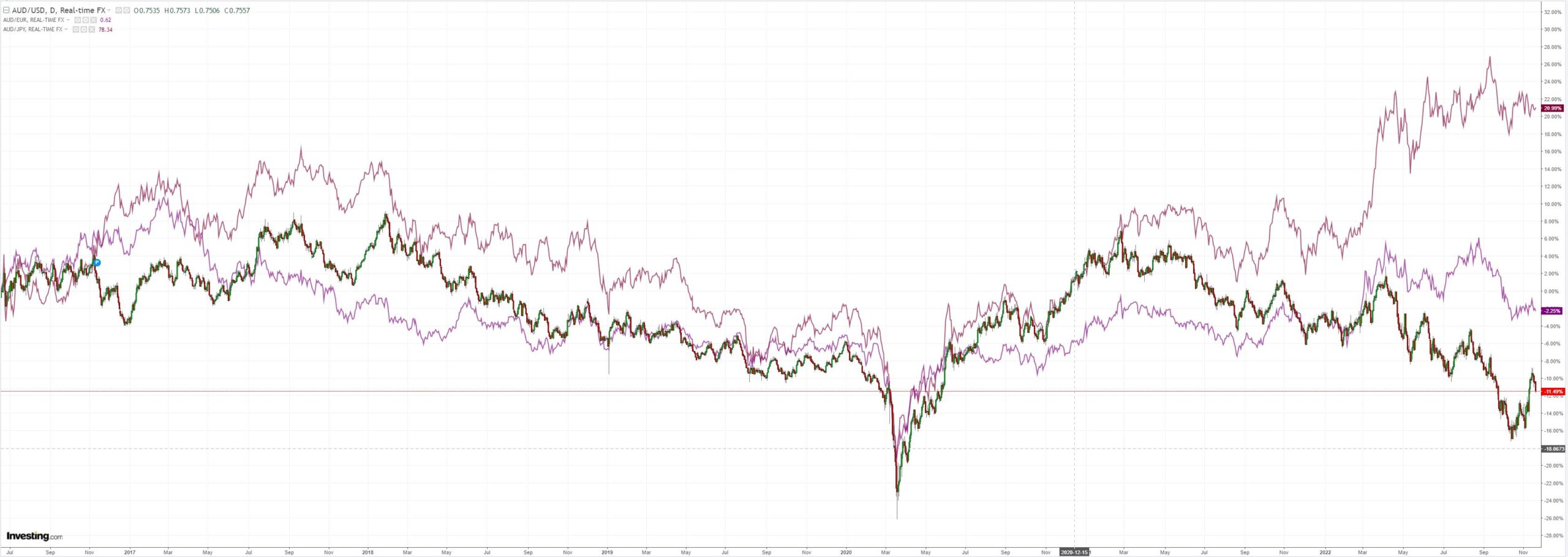

AUD was crushed by the returning king:

Oil is a rumourtage nightmare:

Base metals have declared the China reopening off:

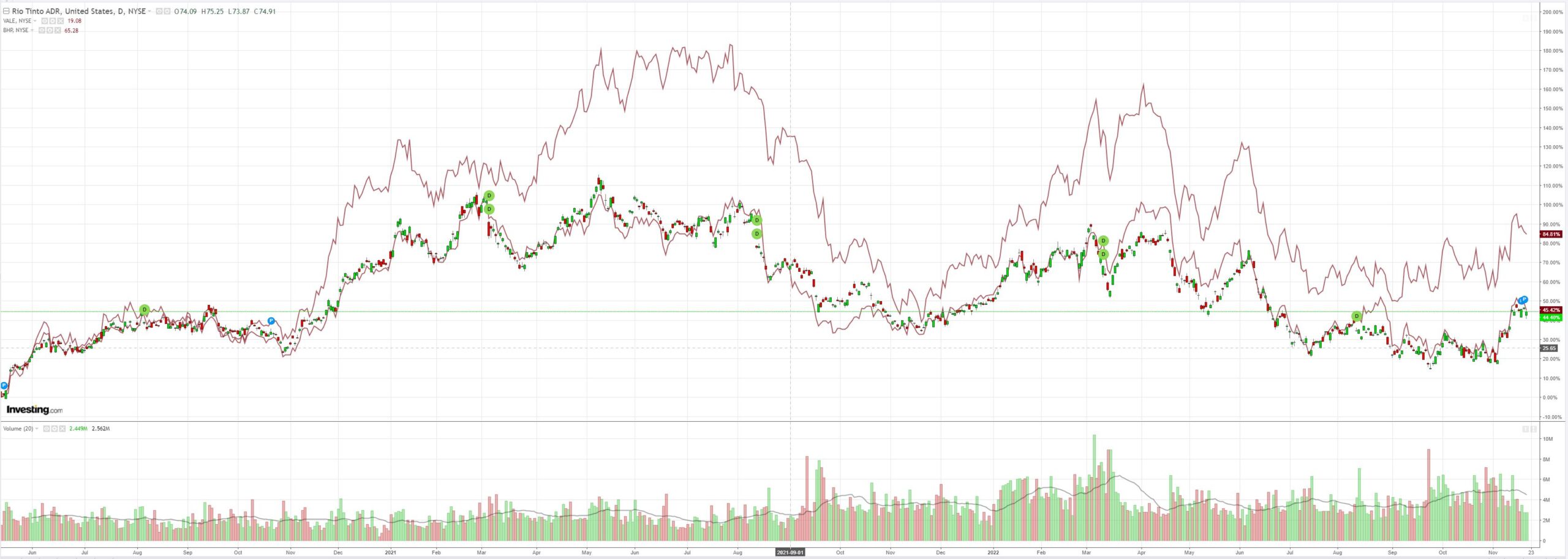

Big miners (ASX:RIO) are clinging to iron ore:

EM stocks (NYSE:EEM) rolled:

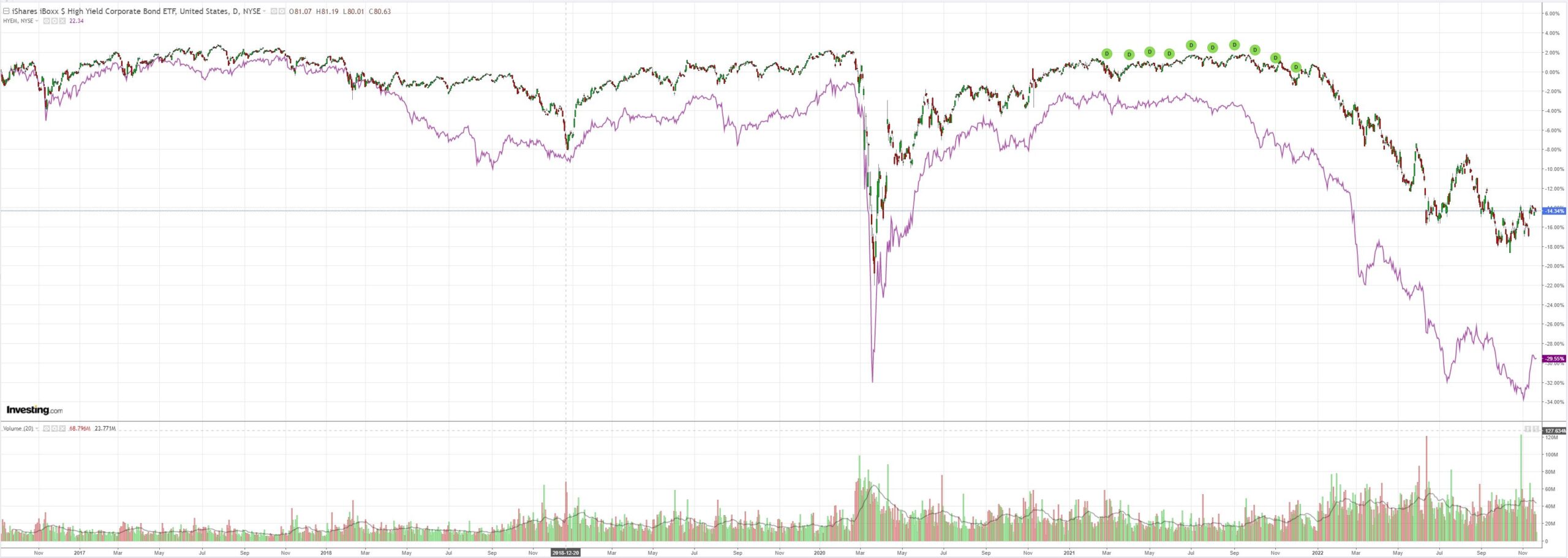

But junk (NYSE:HYG) was better:

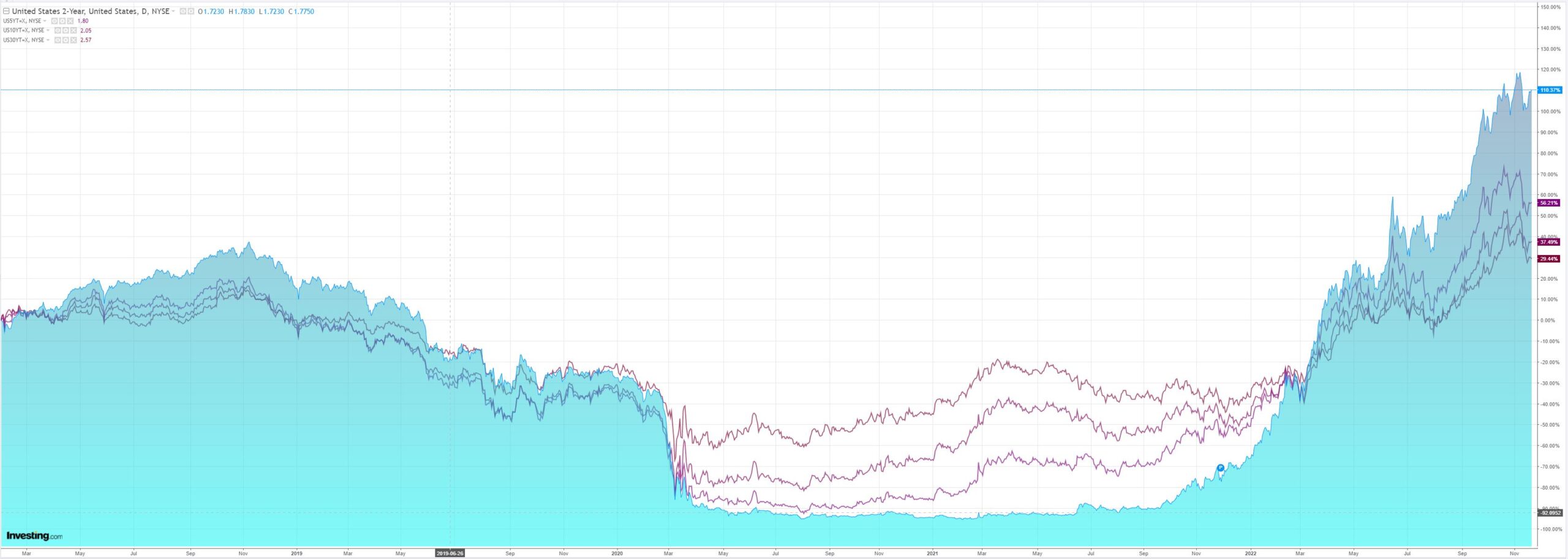

The Treasury curve keeps inverting ever morer:

And stocks gave up the ghost:

Charlie McElligott at Nomura sums it all up:

Risk is drifting on a mini “triple-whammy” causing a USD reversal stronger: 1) China’s again-devolving COVID outbreak (Beijing reported 3 COVID-related deaths, Guangzhou imposed a 5-day lockdown, Hong Kong’s CEO tested positive for COVID, and Shijiazhuang–the 11m population city profiled by the FT last week as a potential “test case” for re-opening–instituted lockdowns and mass PCR testing—h/t AK),2) the ultimate arrival of cold European weather finally seeing first draw-downs of Gas reserves and 3) a raft of better US economic data late last week(Bloomberg US Eco Surprise Index at best levels since May) is flowing-through financial markets via suddenly-squeezing US Dollar(Bloomberg Dollar Index has now bounced more than 2% off the three month low made last week),which sits at the root of the overnight risk-asset pullback to start the holiday-shortened US trading week.

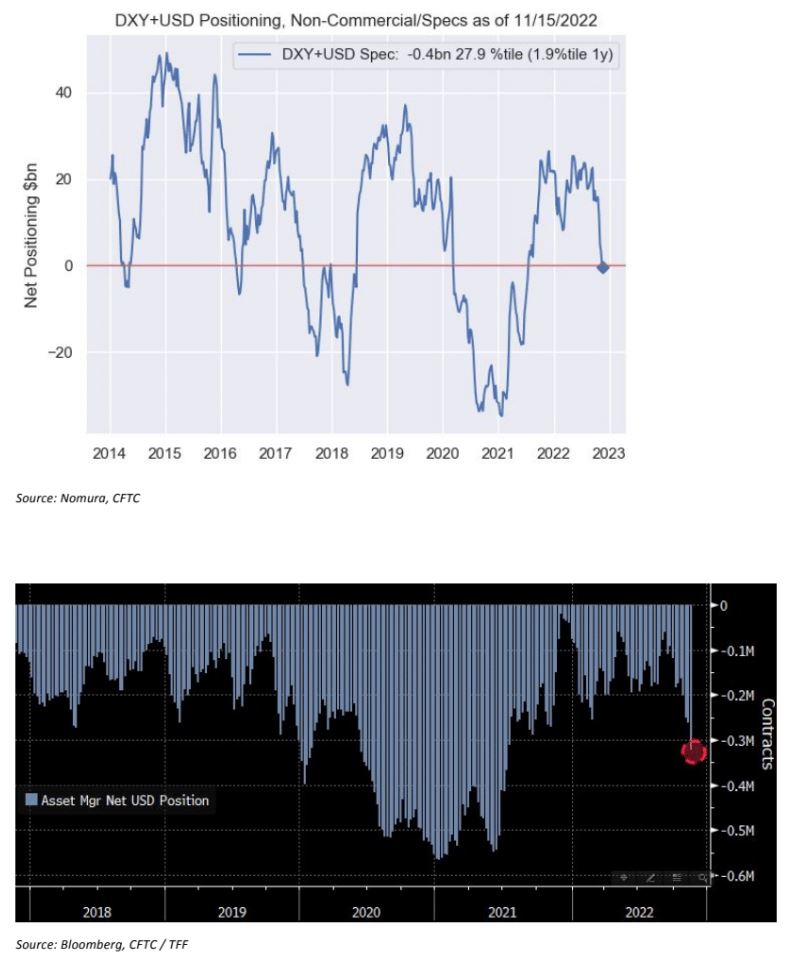

And naturally, this is occurring just as the latest CFTC / TFF data shows both1) Specs / Non Comms finally “net short” US Dollars for the first time since mid ’21and2) Asset Managers at their most “net short” US Dollars since July ’21—resulting in what is now the largest three session cumulative “positive” move in DXY in over three weeks, and overnight, with all G10 and Bloomberg EMFX weaker vs USD.

Remember and as noted in the days which followed the lite CPI print which set off such a prolific VaR shock unwind in legacy “FCI tightening” trade expressions most clearly represented by “Long USD,” that up until then had worked all year(and, accordingly, were VERY crowded)—the Dollar’s recent blast weaker (largest 6d draw-down since 2008) was not simply about crowded “Long USD” expressions being taken-down / stopped-out…but the fundamental catalysts also shifting.

Of course too, the fundamental macro drivers behind “Long USD” trades over the course of 2022 were also inflecting simultaneously in recent weeks:1)suddenly soft US CPI saw market implied pricing lunge towards perception of a lower Fed terminal rate on “Past Peak Tightening”;2) full gas storage and warm European start to winter helped to ease the EZ “recession / energy crisis / terms-of-trade” worst-case scenario shock; and3) indications of Chinese COVID policy adjustments which could finally allow for a long-awaited resumption of Yuan strength via the Chinese economy seeing re-acceleration—all saw “Long USD” positions being bailed out-of in violent stop-out fashion.

So now to get even the smallest incremental change to those three catalysts for the recent USD move—but against cleaner positioning and even greater year-end illiquidity—it isgoing to have an impact…especially as following the US data reacceleration last week showing “Good (data) is Bad (for market)” and a week of “hawkish” Fed talk, we now see “Terminal” rate projections (5.06% this morning)back to where they were pre the CPI “miss.

I have no idea if the lows of the cycle for AUD are in but I remain of the view that we’re going to retest them.