DXY is on the march again:

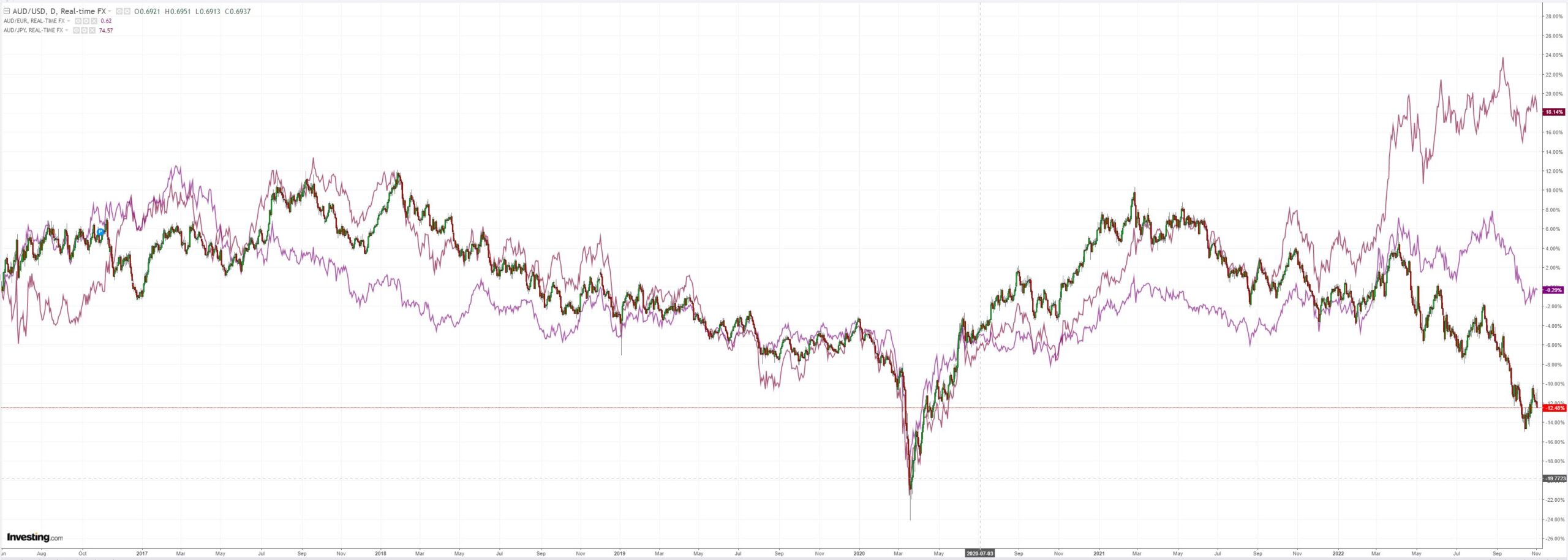

AUD was thumped:

Oil is very sticky:

Commods hung on but miners sank (no chart):

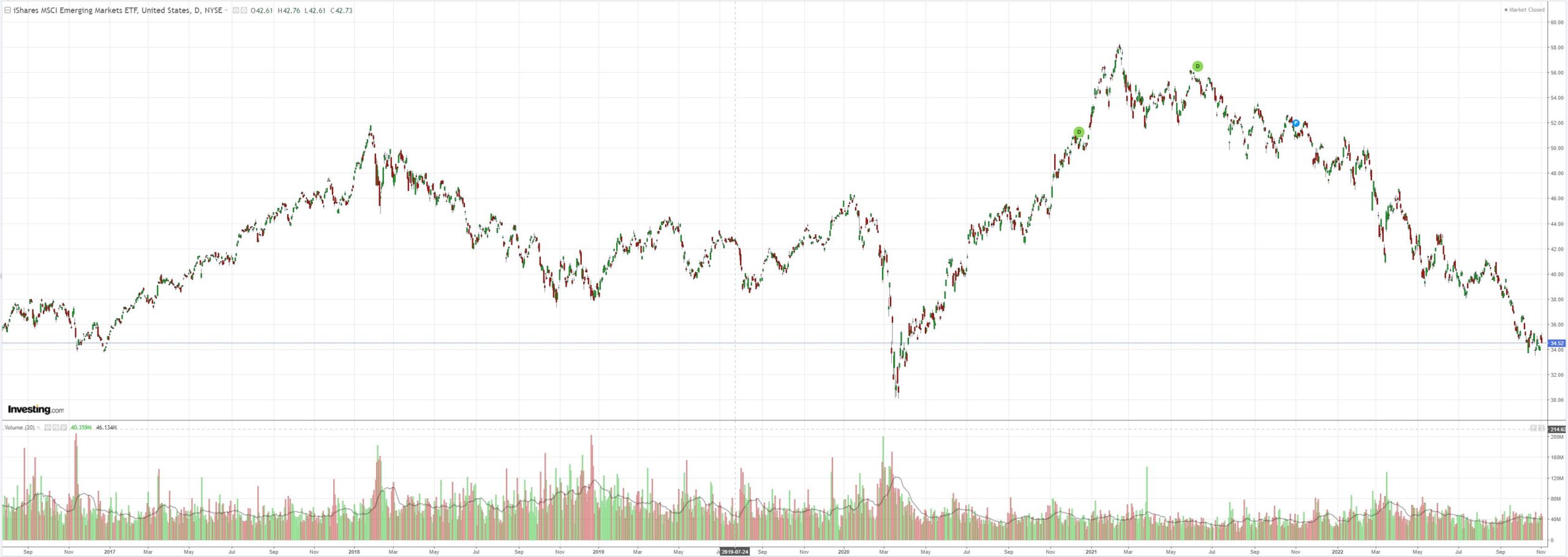

EM stocks (NYSE:EEM) are a mess:

EM junk iShares iBoxx $ High Yield Corporate Bond ETF (NYSE:HYG) is spooked:

As the Treasury curve inverted MOAR:

And stocks sank:

First up, ADP was strong:

ADP (NASDAQ:ADP) National Employment Report: Private Sector Employment Increased by 239,000 Jobs in October; Annual Pay was Up 7.7%.

Nothing dovish about that and nothing dovish is what the Fed delivered.

It did downshift the expected pace of tightening but, with that, lifted terminal rate expectations:

The Committee anticipates that ongoing increases in the target range will be appropriate in order to attain a stance of monetary policy that is sufficiently restrictive to return inflation to 2 percent over time. In determining the pace of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments. In addition, the Committee will continue reducing its holdings of Treasury securities and agency debt and agency mortgage-backed securities.

But Powell was all Volcker and no Burns. Nikileaks was strident:

The asymmetric risk framing is the key. That’s ‘hike until something breaks’.

Don’t fight the Fed.