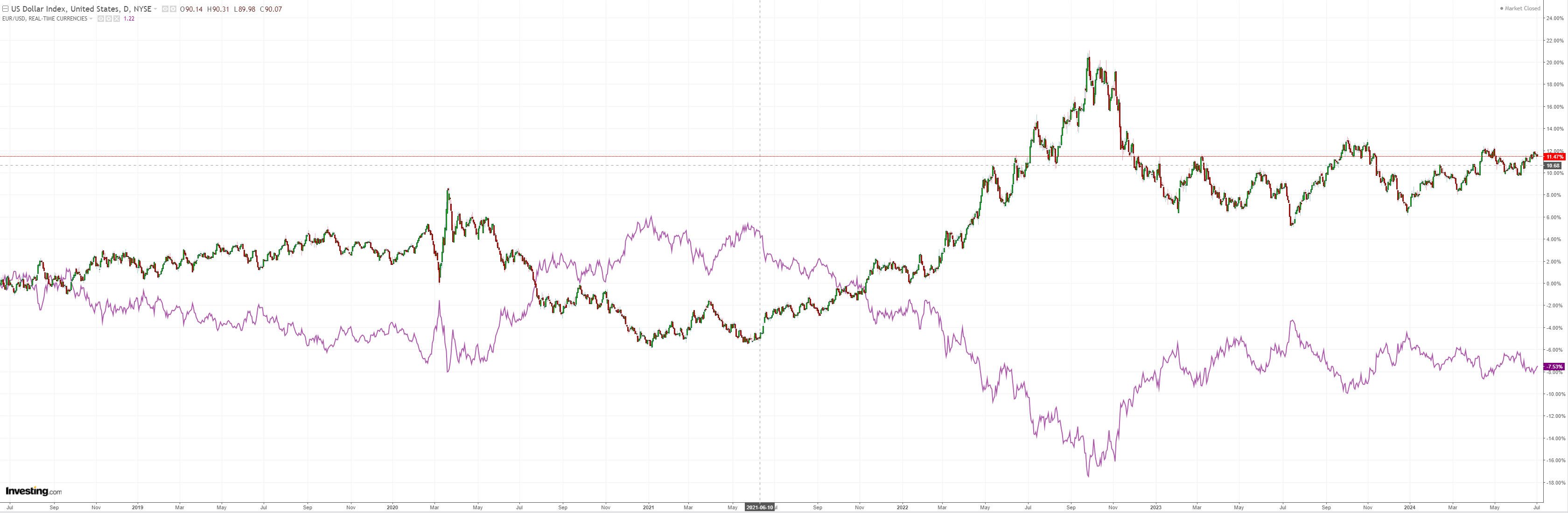

DXY eased overnight:

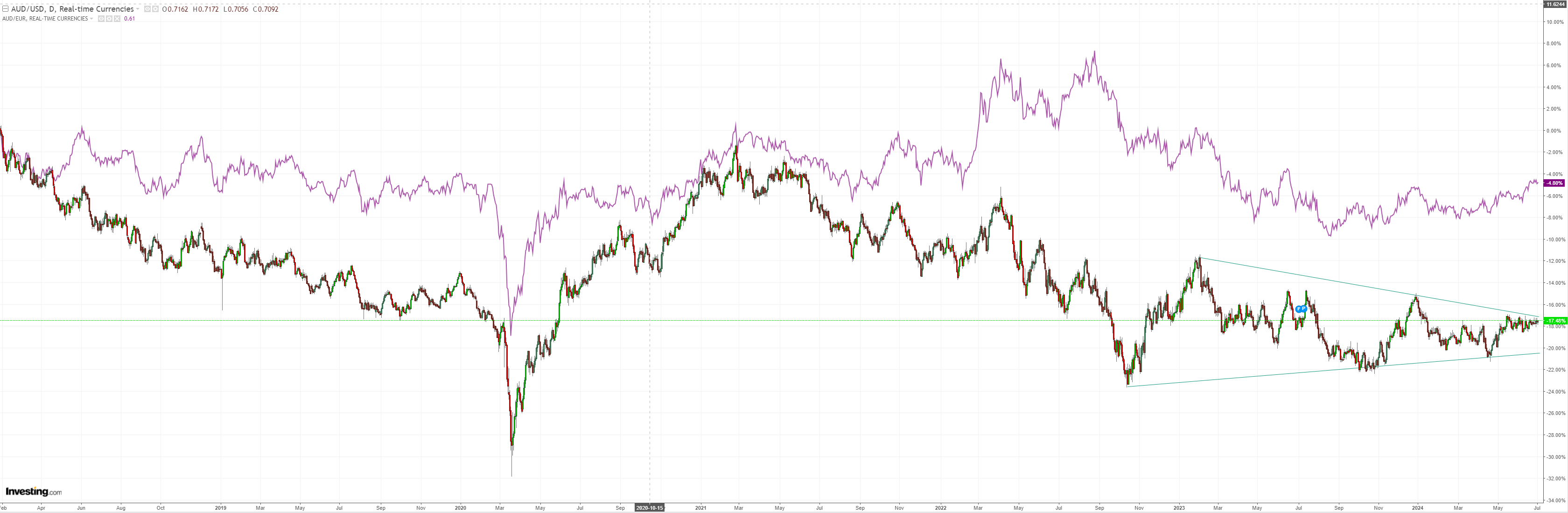

AUD is at the upper end of its wedge. Surely it can’t break higher given the superpower pressures!

North Asia being one of them:

Oil and gold have stalled:

Copper is trying again:

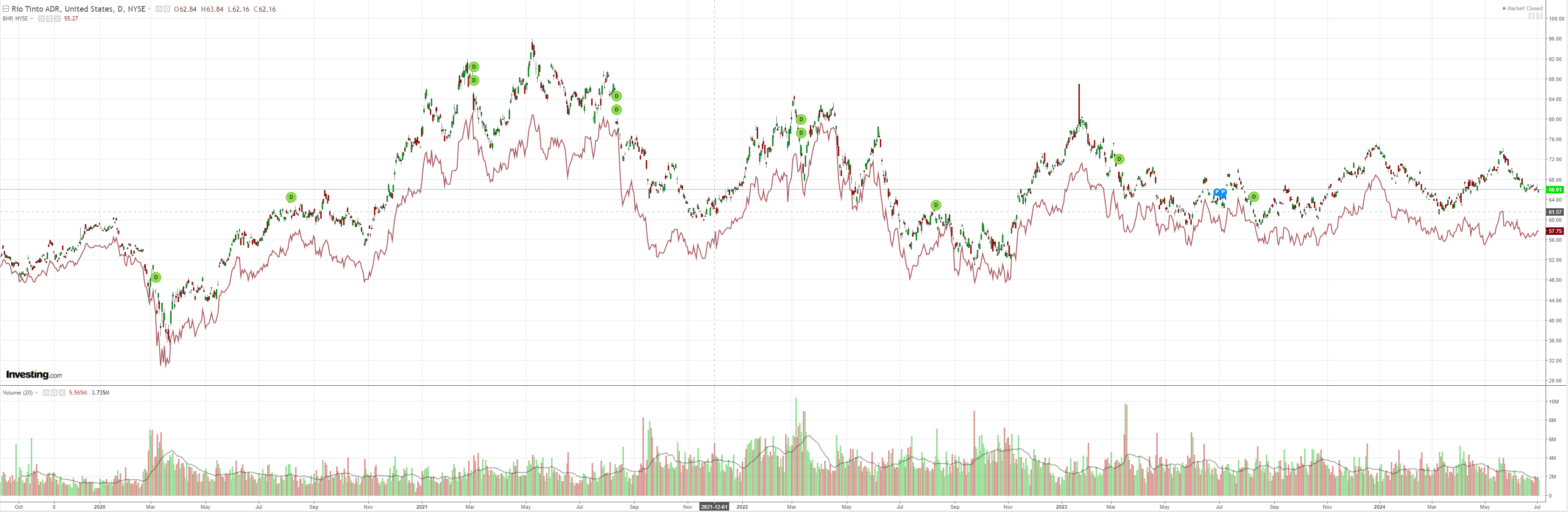

Big miners are clearly struggling:

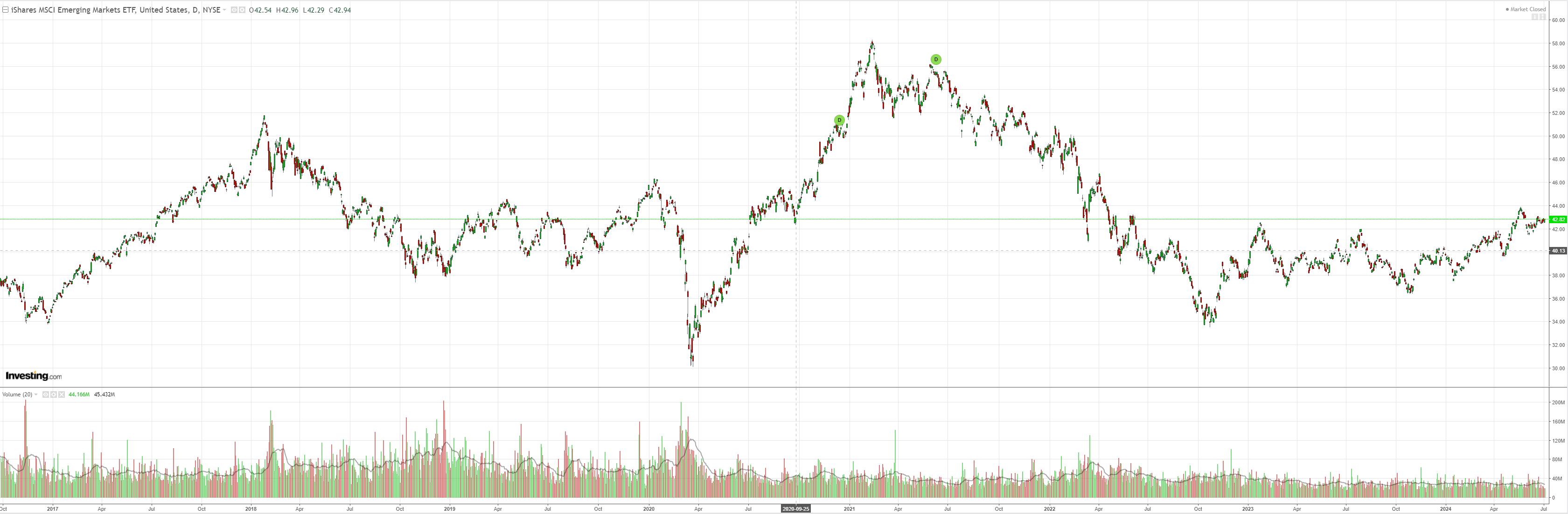

EM is holding support:

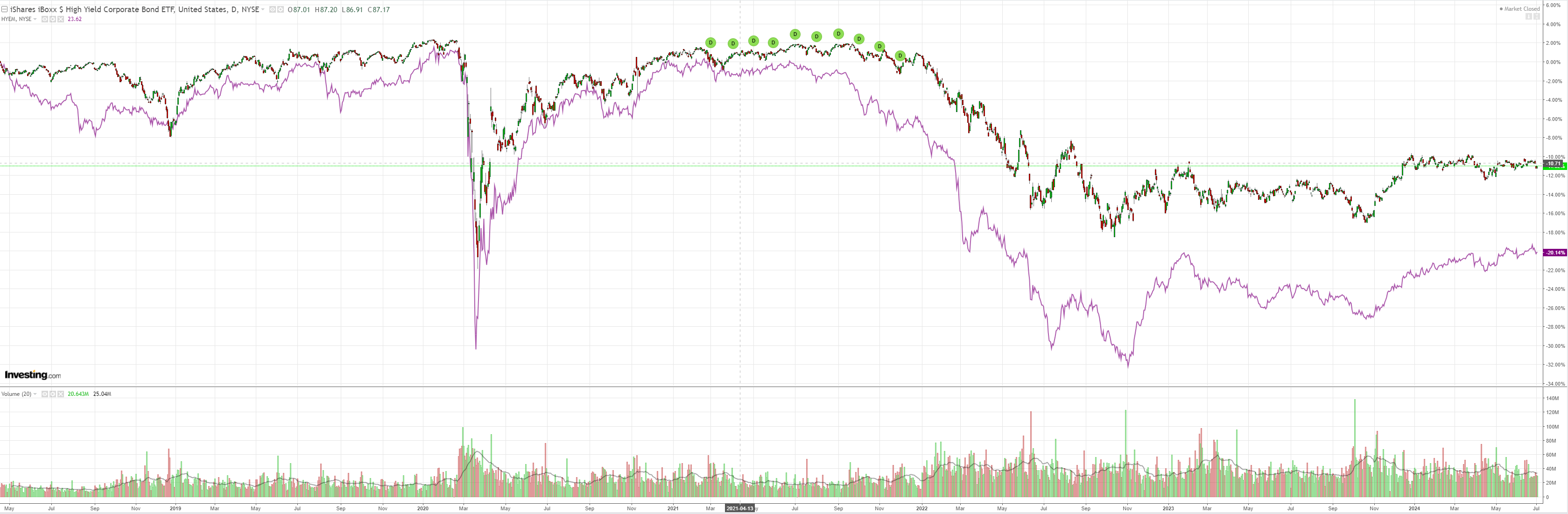

Junk is stalled:

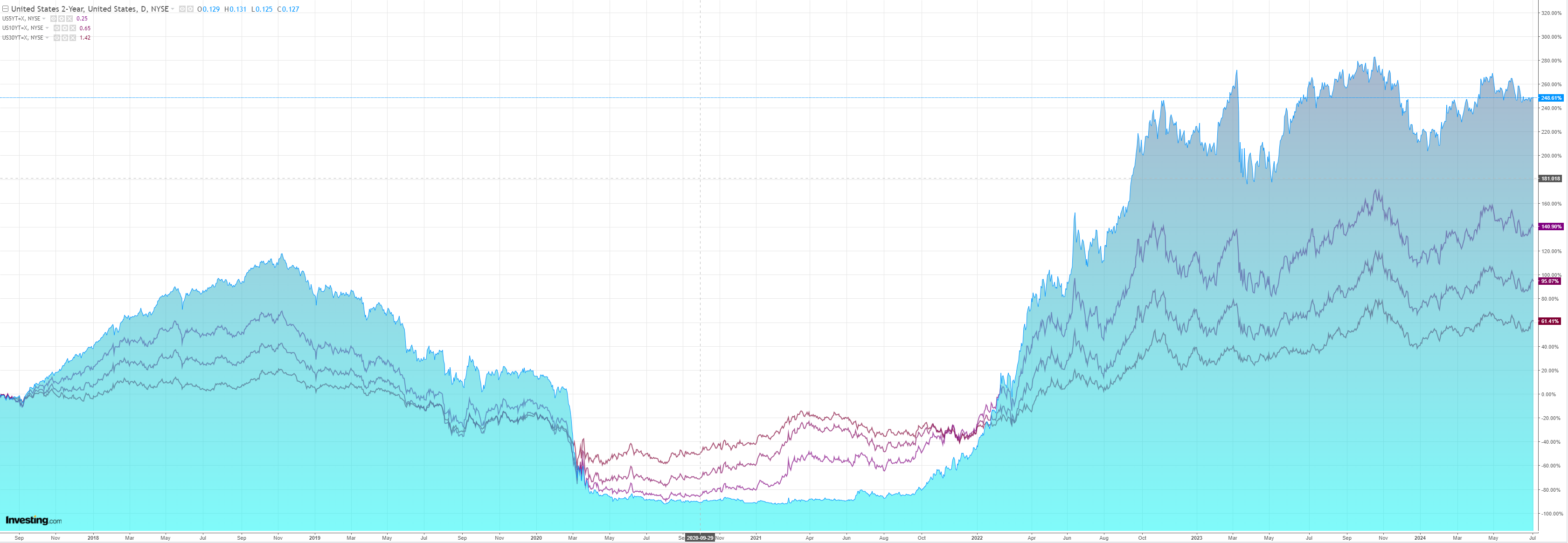

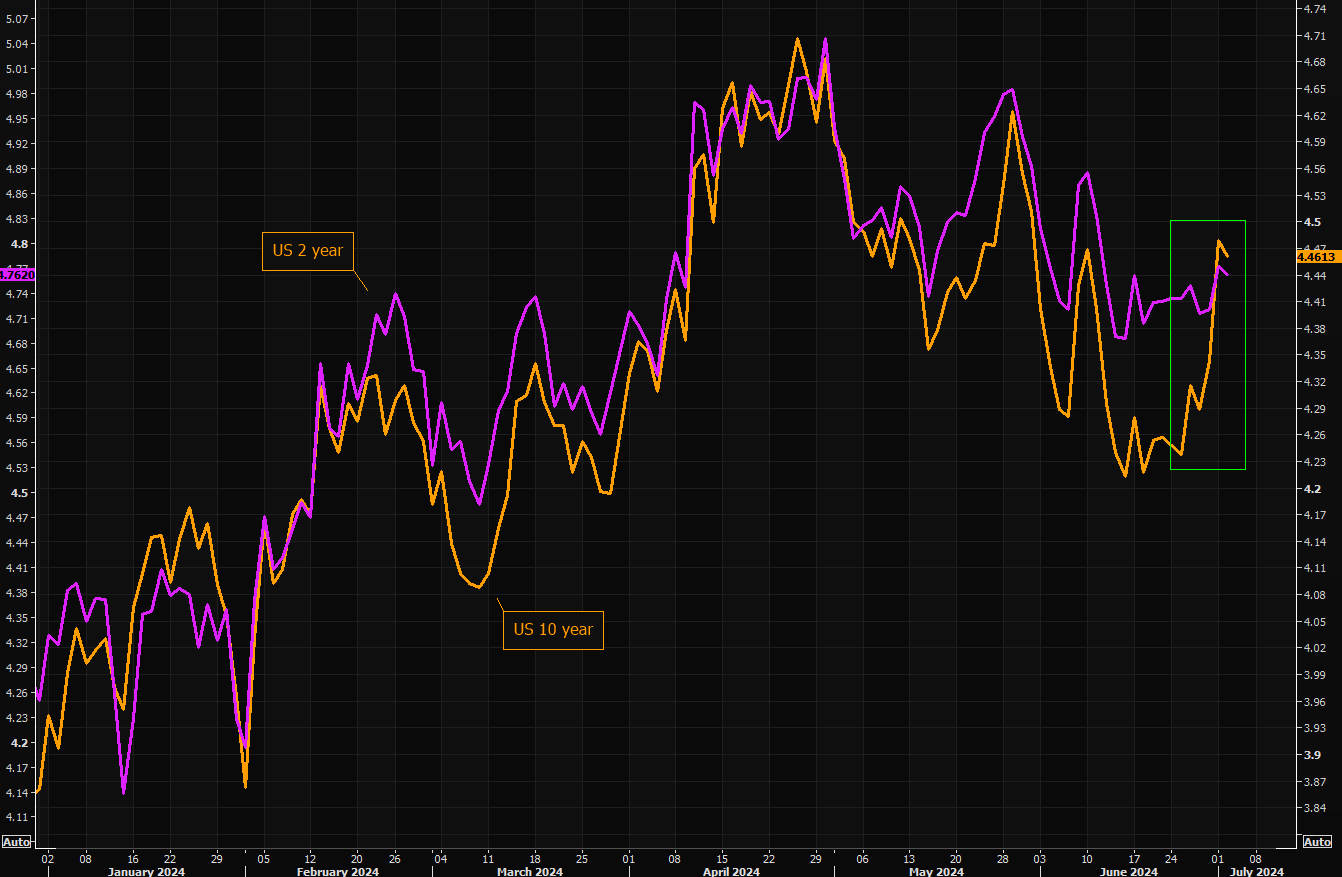

Yields eased with oil:

Stocks are unstoppable:

China is stuffed. Europe is firming slowly. The US is weakening, and markets are trading an inflationary Trump as the yield curve steepens on tax cuts, reduced immigration, and China tariffs:

This looks like panic.

I agree with Michael Hartnett at BofA that a Trump victory will be deflationary as massive tariffs land on China and it responds with a material devaluation of CNY. This is the stuff of a global growth scare amid intensifying deglobalisation.

Unless or until China also responds with domestic stimulus. Yet even that runs hard up against China’s still falling housing market.

I can’t see how this plays out bullishly for AUD.