At least for one night, markets have declared deflation the winner. DXY shot up as EUR sank on a dovish ECB:

AUD dislocated from all risk:

As commodities sank:

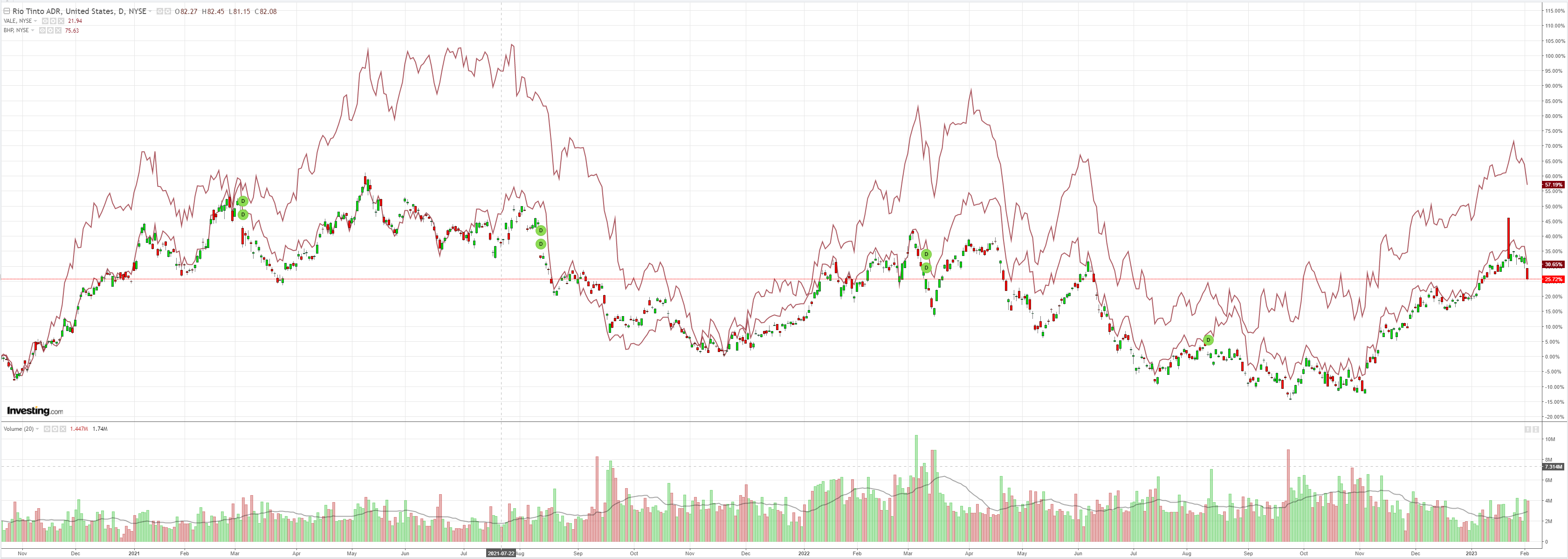

Miners (NYSE:RIO) were slaughtered:

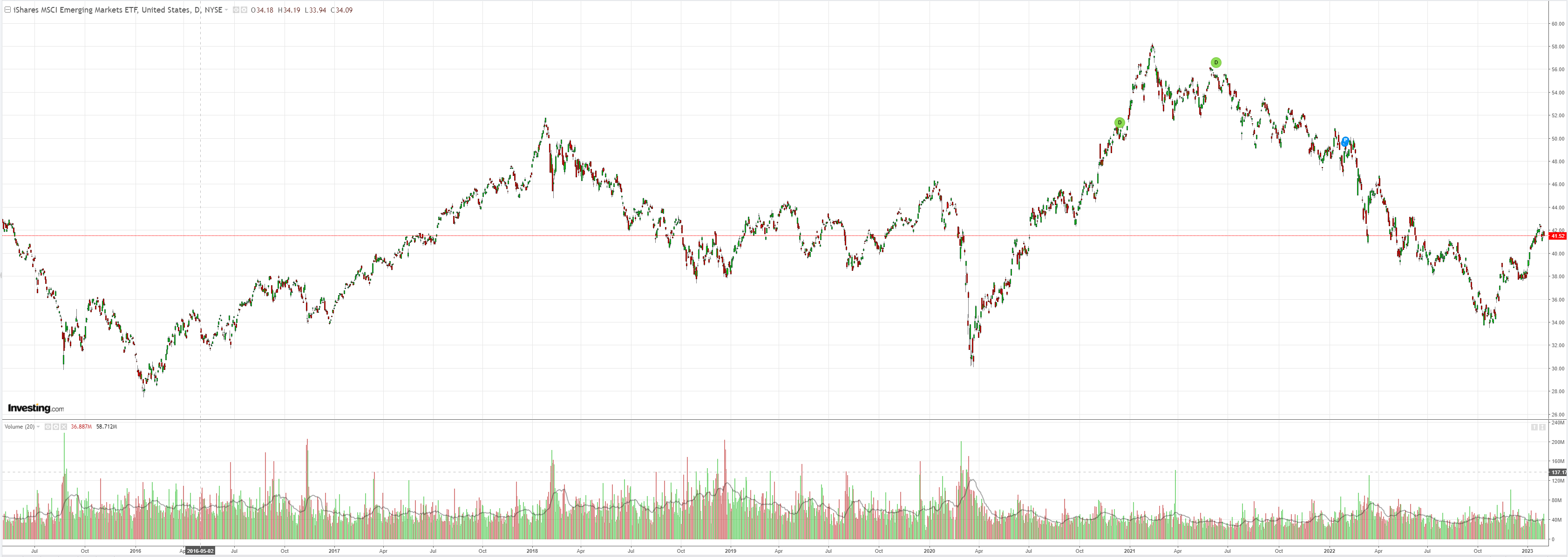

EMs (NYSE:EEM) faded:

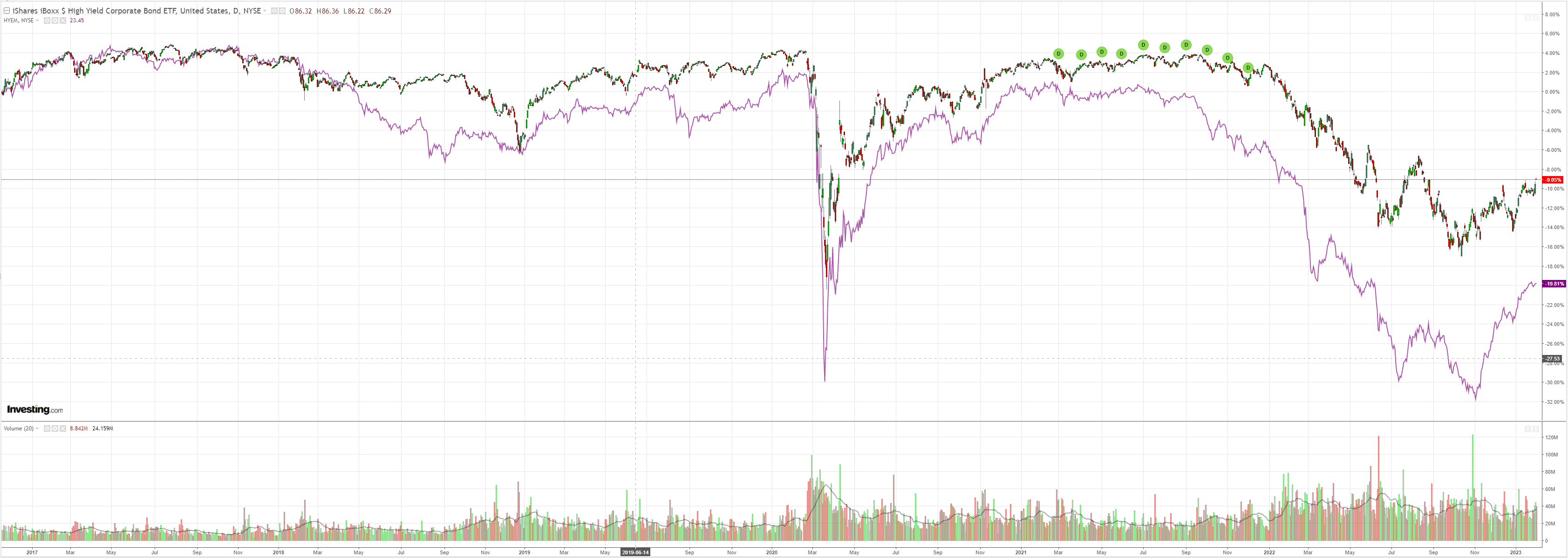

Junk (NYSE:HYG) was firm:

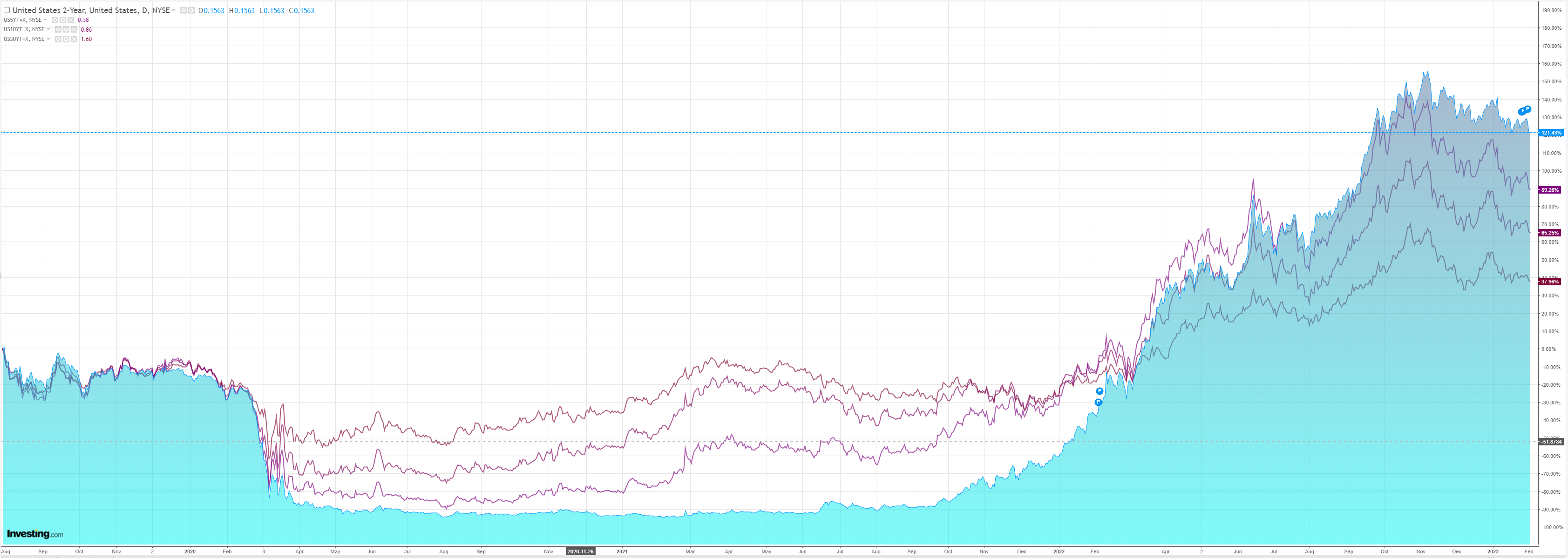

As yields fell:

All of which, along with Meta (BMV:META) earnings, gave us an extraordinary FAANG surge:

In short, markets screamed that deflation is the winner. Aided womanfully by a folding ECB hawk. Goldman:

1. At today’s meeting, the ECB Governing Council hiked key policy rates by 50bp, as widely expected. The monetary policy decision also stated that the Governing intended to raise interest rates by another 50bp in March. The Governing Council indicated that the policy path after March will be data-dependent, and President Lagarde noted during the press conference that there would likely be “more ground to cover” after March.

2. On the economy, the Governing Council observed that the economy had been more resilient than expected, and that risks around the growth outlook had become more balanced. During the press conference, President Lagarde noted that the tightening in financing conditions and the contraction in bank lending was a sign of“good transmission,” but not yet “full transmission” of monetary policy.

3. On inflation, the Governing Council agreed that risks to the inflation outlook had become “more balanced,” but remained skewed to the upside. While President Lagarde stressed that underlying inflationary pressures remained firm, she noted that the Governing Council would be attentive to the pass-through of lower energy prices to core inflation components. The Governing Council also noted that wages were growing faster but that recent wage dynamics had been in line with the December projections.

4. Finally, the Governing Council communicated details regarding its planned balance sheet unwind, which were close to expectations. The Governing Council did not comment on the remuneration of government deposits.

The ECB just pivoted and that stabilised DXY. This achieves two outcomes:

- commodities will struggle to rally from here unless or until real demand appears and China’s consumer-led reopening is not it;

- global inflation has more time to fall.

Ahead is still the great margin crush, as well as probable mild DM recessions. But with inflation falling, FAANG cheap, and the ECB no longer hanging over that economy like a dark cloud, duration and tech had their day.

Ironically, a stable or rising DXY will challenge any earnings lift for FAANGs but multiple expansions and a tumbling equity risk premium had that covered for today.

It was pure Goldilocks. And AUD was stone cold.