DXY is blasting to the heavens as EUR sink to hell. When will it end? Ask Vladimir Putin:

AUD is being crucified:

Oil won’t break and until it does everything else will instead:

Base metals have gotten the memo:

Big miners (LON:GLEN) also:

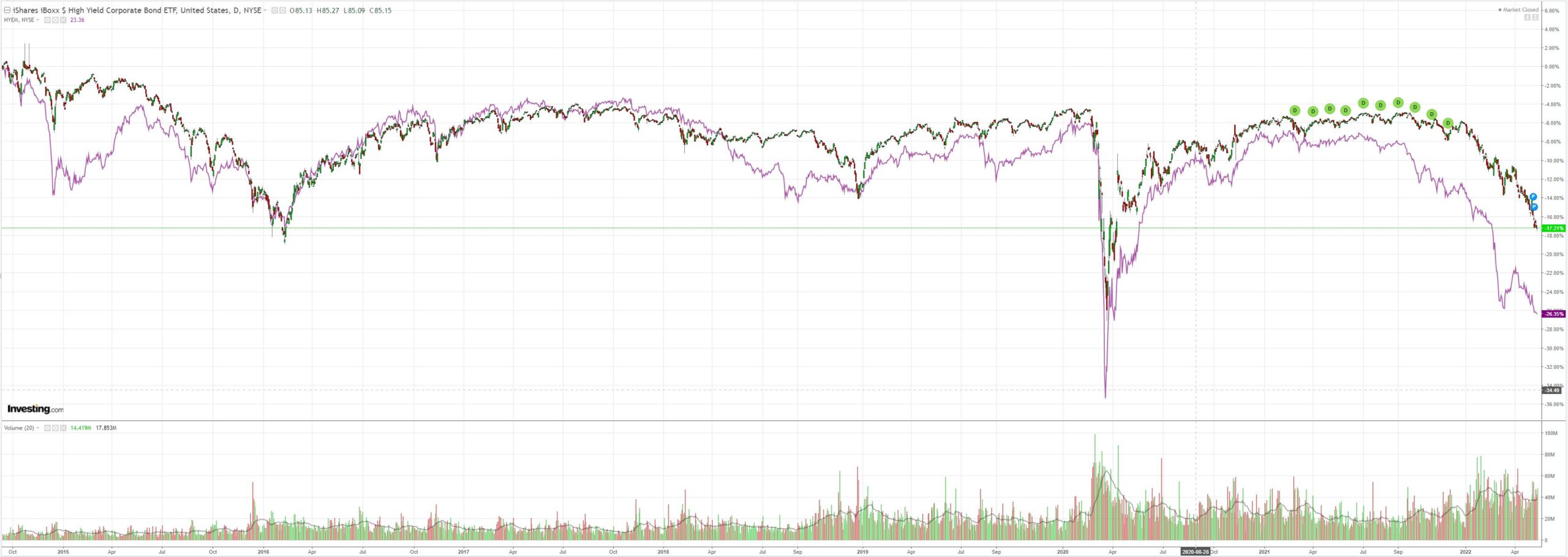

EM stocks (NYSE:EEM) and junk (NYSE:HYG) are leading the way:

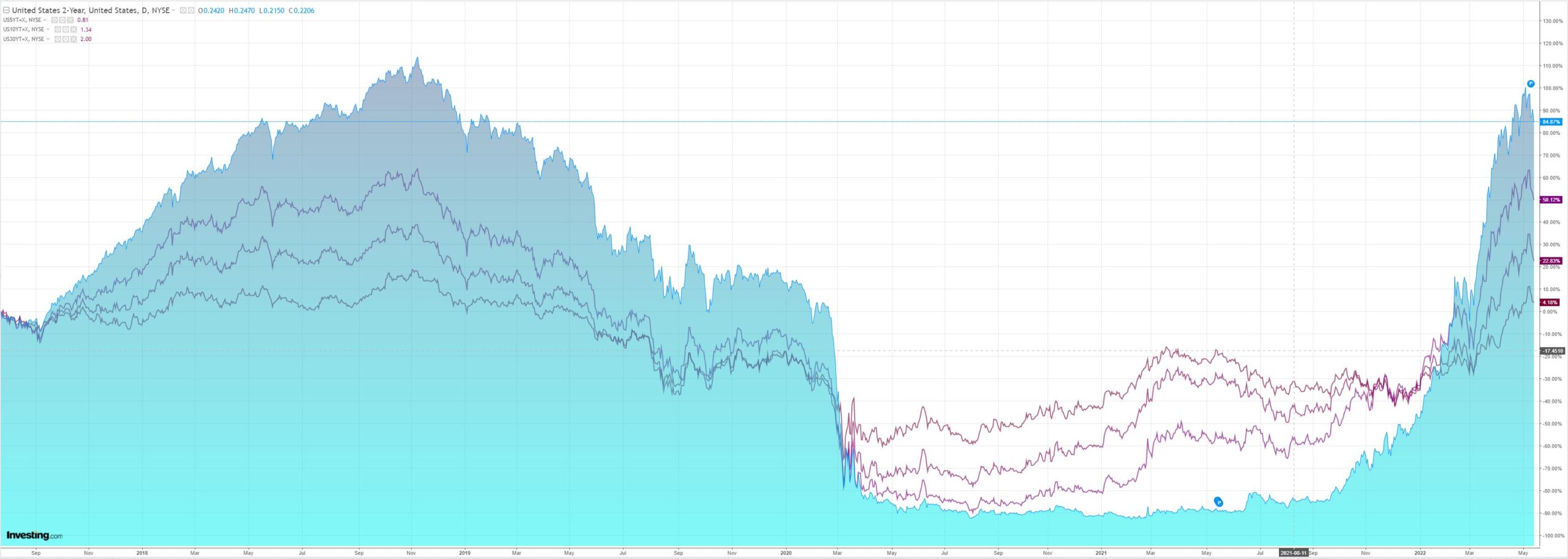

And it appears to be finally blowing back from periphery to center as Treasuries rally:

But stocks are struggling to follow as recession risk rockets:

Westpac has the wrap:

Event Wrap

US PPI in April was slightly firmer than expected, the headline measure up 0.5%m/m (est. 0.5% m/m) and 11.0%y/y (est. 10.7%y/y, prior revised to +11.5%y/y from 11.2%y/y). The core measure rose +0.6%m/m and 6.9%y/y (est. +0.6%m/m and 6.5%y/y, prior 7.1%y/y).

The results support the likelihood that peak inflation occurred in March. Weekly initial jobless claims of 203k were above the 193k estimate, but continuing claims were slightly lower at 1.343m (est. 1.68m).UK production data was soft, with Q1 GDP of +0.8%q/q (est. 1.0%q/q). In March, industrial production fell 0.2%m/m (est. flat), services fell 0.2%m/m (est. +0.1%m/m), and the trade deficit widened to -GBP23.9bn (est. -GB18.45bn).

Tensions increased in Europe, as gas pipelines through Ukraine remained disrupted. Sweden will submit an application on Monday to join NATO, with Finland’s formal decision to do so expected on Sunday.

Event Outlook

Aust: RBA Deputy Governor Bullock will participate in a panel at the Regulators (2022) in Sydney.

NZ: The manufacturing PMI has remained on a solid footing but businesses still remain cautious.

Eur: Supply pressures will continue to be a headwind to industrial production in March (market f/c: -2.0%)

US: Import prices are expected to hold at an elevated level in March (market f/c: 0.6%). Inflation and rate concerns will likely remain at the fore in the May University of Michigan’s consumer sentiment survey (market f/c: 64.0). The FOMC’s Kashkari and Mester are due to speak at different events.

There are lots of reasons for why the AUD is falling so fast:

- rising global recession risk;

- risk off;

- DXY to the moon;

- commodities crunched;

- an uncertain election.

But, I put it to you, there is one factor that is head and shoulders above all of these and it is this, a collapsing CNY:

Markets hate a falling CNY. The AUD in particular hates it:

- Chinese competitiveness rises against all EMs just as the Fed sucks liquidity away from the same.

- Chinese domestic commodity competitiveness rises.

- Chinese rebalancing goes into reverse.

- China sells Treasuries and imposes capital controls to contain CNY falls, draining more liquidity from DMs and EMs.

- US/China Cold War 2.0 tensions rise.

This time around, Chinese domestic demand is so weak owing to OMICRON and the property crash that we have the added specter of an external crisis in that country that overshoots CNY as an export shock arrives.

Ironically, only the Fed can turn this around but it can’t pivot until inflation is licked and that means breaking oil.

In a sense, having driven the AUD up with his war and commodity prices, our Vlad is now destroying it.