Street Calls of the Week

DXY is up and away. EUR unwinding:

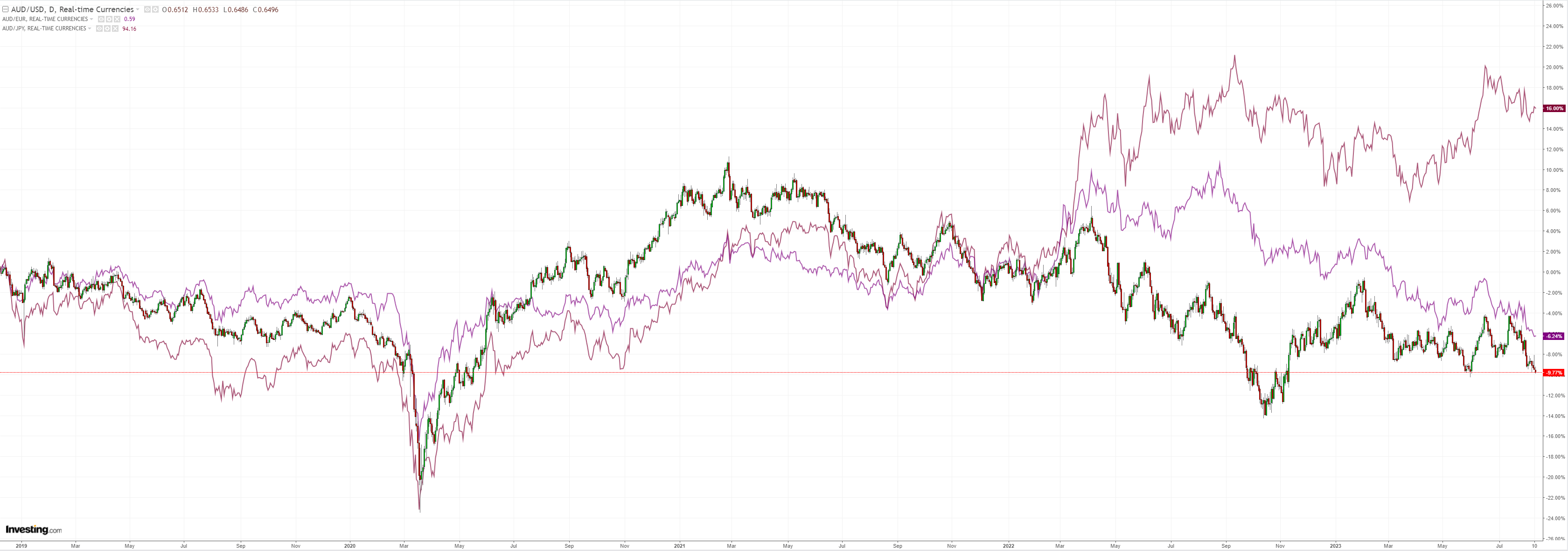

AUD had its lowset closing low of 2023, rupturing support by only just:

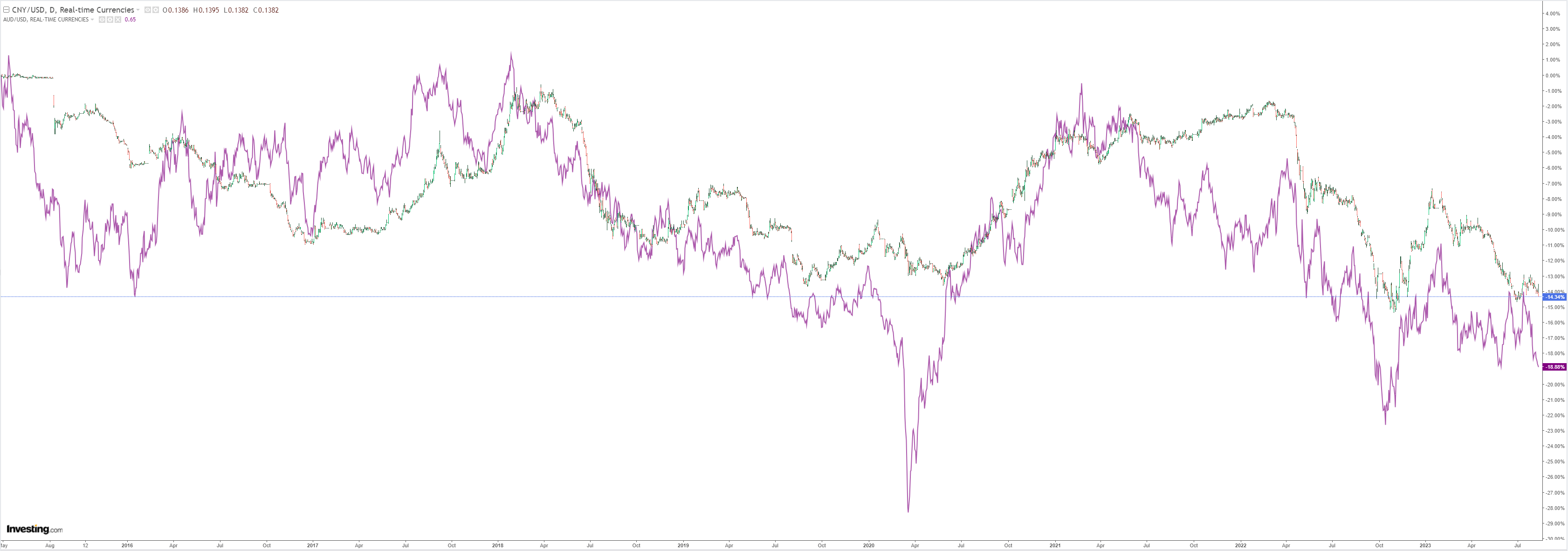

CNY is going to fall a lot further and AUD with it:

Oil’s rally is artificial. Much further and it will wipe out hope for a soft landing:

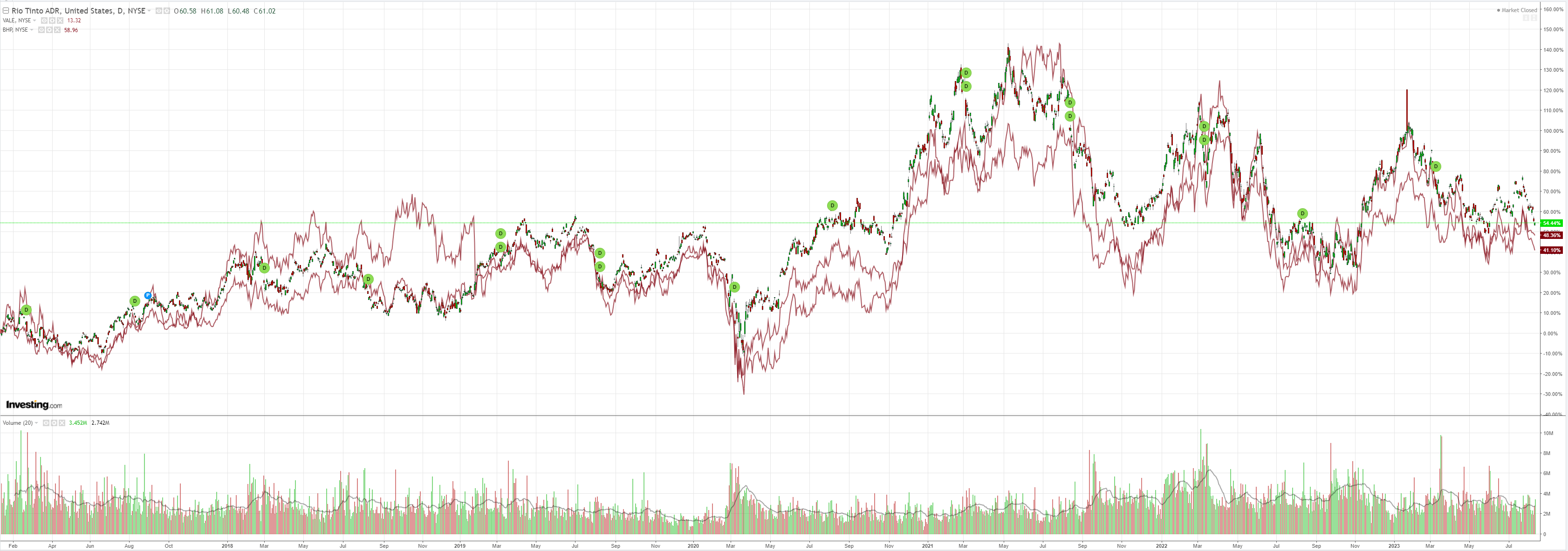

Dirt is telling the real truth. Global growth is in trouble:

So are big miners (NYSE:RIO):

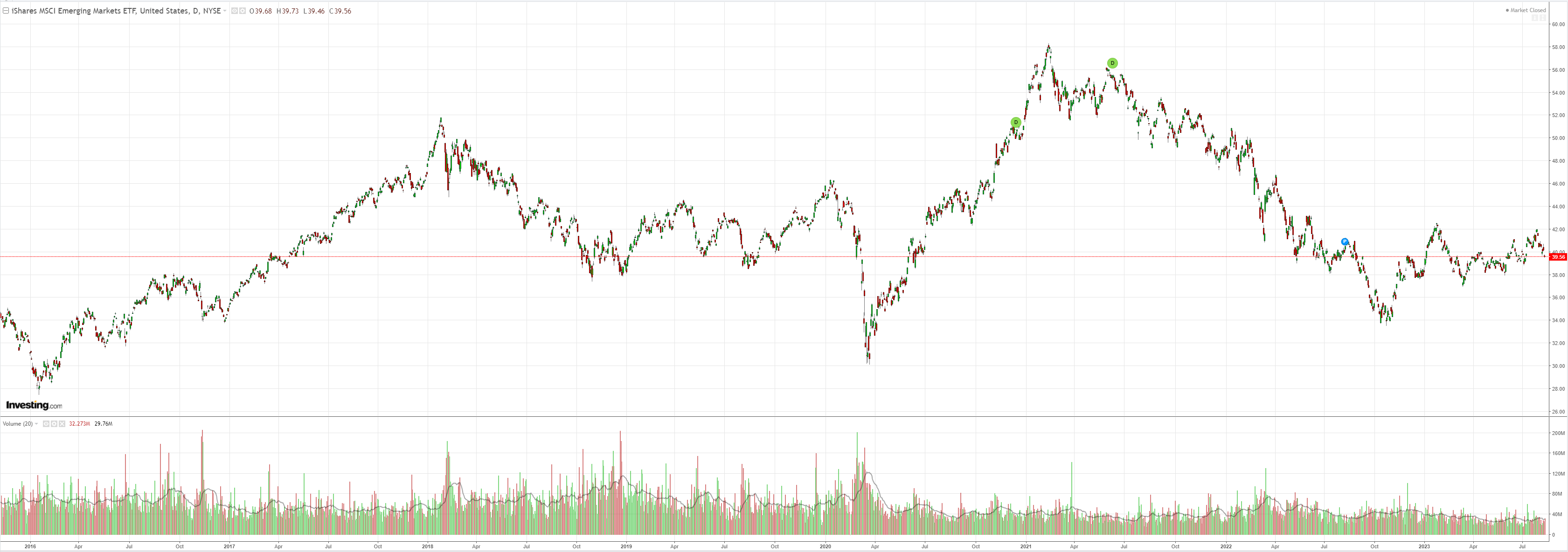

EM (NYSE:EEM) has come full circle back to the Third World:

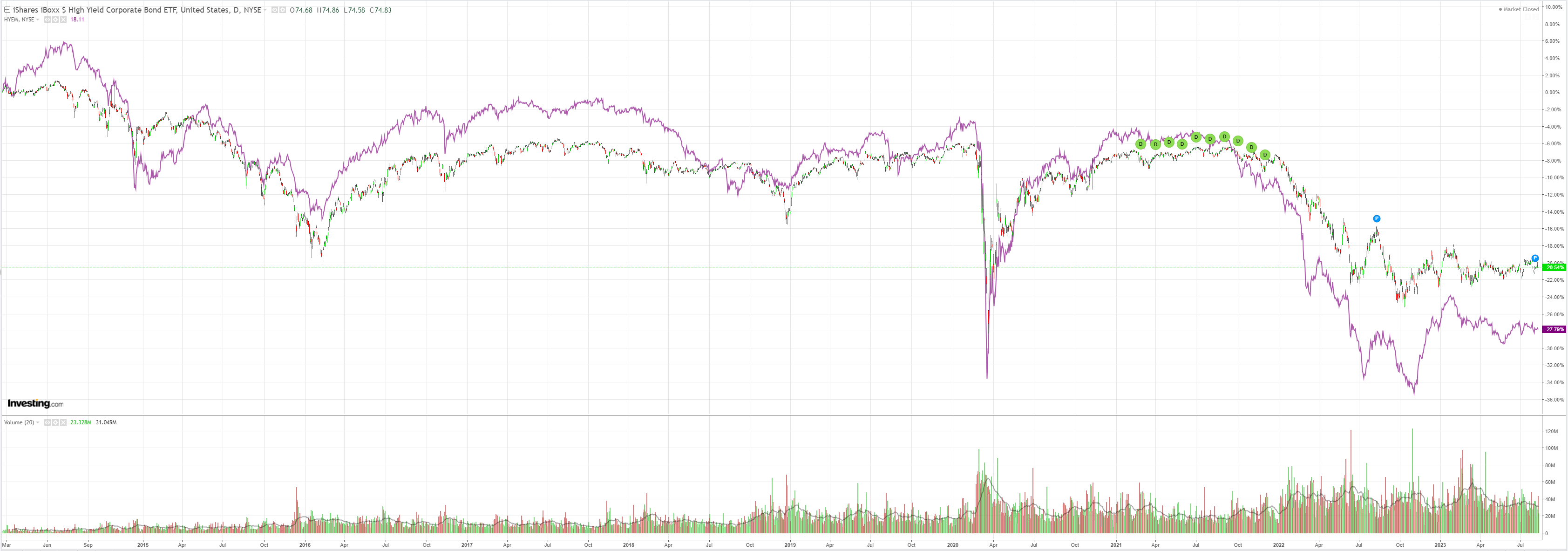

Junk (NYSE:HYG) is dead:

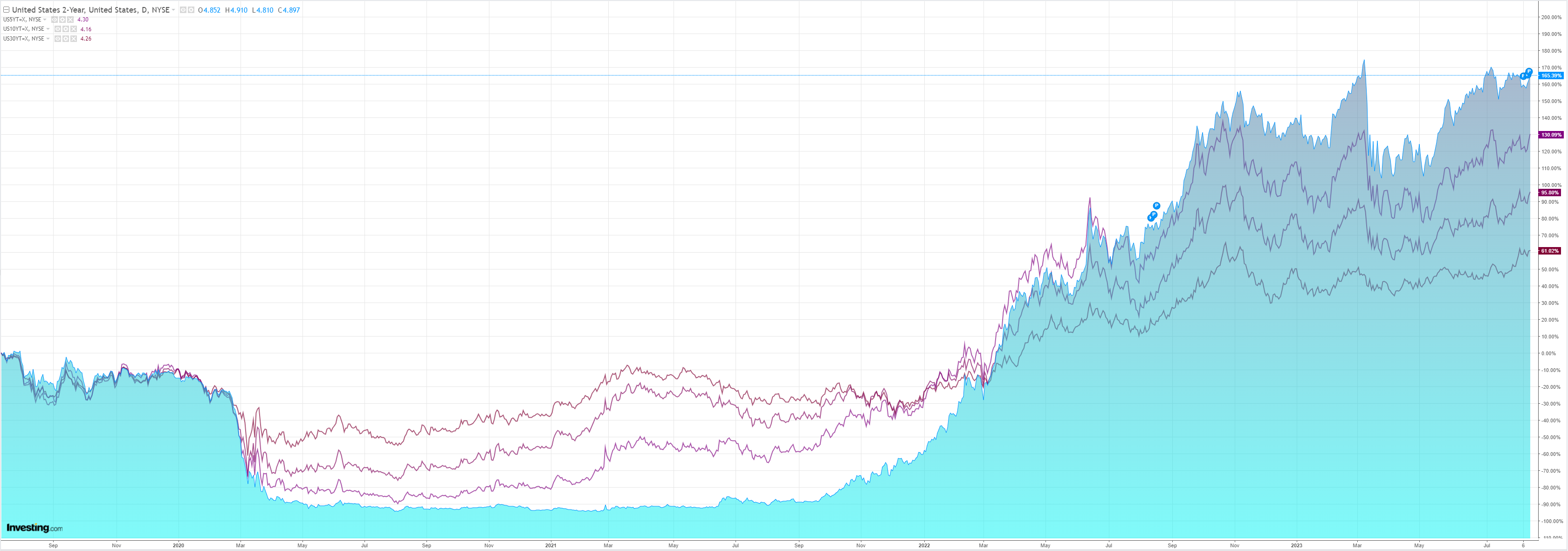

The oil bear steepener is strangling stocks:

Jefferies explains the obvious in oil:

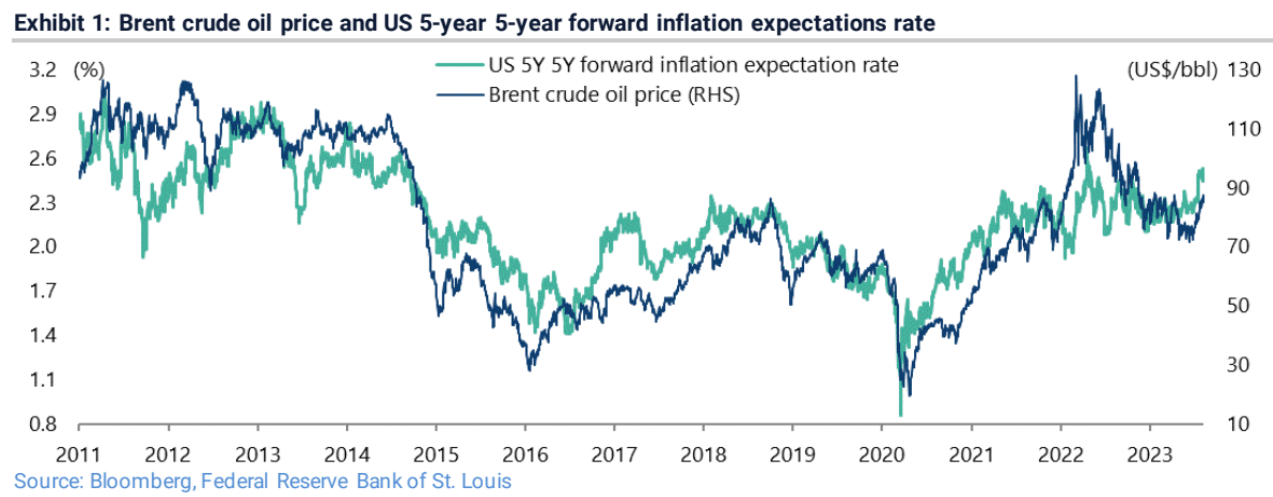

GREED & fear has been reminded of late about a previously identified correlation. That is that the renewed strength of the oil price has coincided with a renewed pickup in inflation expectations. The Brent crude oil price has risen by 22% from a recent low reached in late June, while the US five-year five-year forward inflation expectations rate is up from 2.23% in late June to 2.53% on Monday, the highest level since April 2022, though it has since declined to 2.45% (see Exhibit 1). The correlation between the Brent crude oil price and the five-year five-year forward inflation expectation rate has been 0.88 since 2011.

This is potentially an awkward development in the context of the prevailing narrative that both the Federal Reserve and the ECB are all but done in this tightening cycle even if the official mantra in both cases remains “data dependent”.

OPEC is driving the outcome with its production cuts. Bully for it. It will kill the “soft landing” narrative in due course via the bear steepening and a rising DXY which loves rising oil these days.

Just as China, Europe and the US all tip towards recession.

AUD has further to fall.