DXY is the King:

AUD the court jester:

Oil may be beginning to sniff out the start of global recession:

Metals not so much:

EM stocks (NYSE:EEM) fell further:

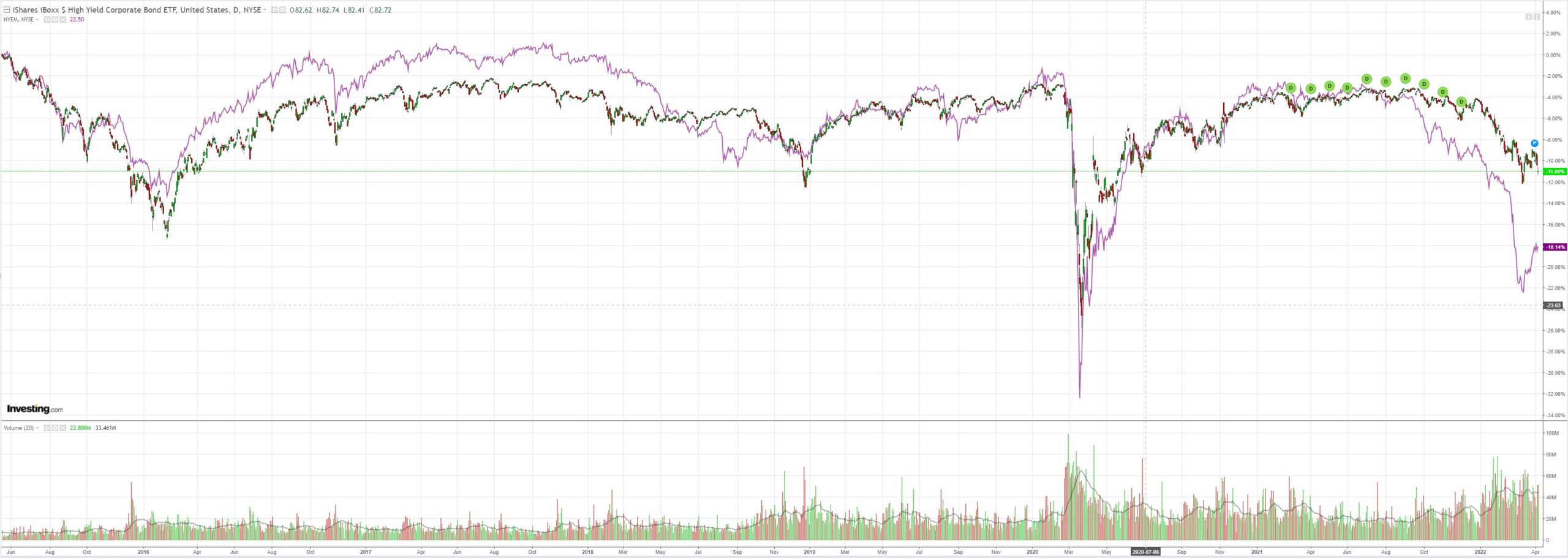

US junk (NYSE:HYG) was smoked as EM held on:

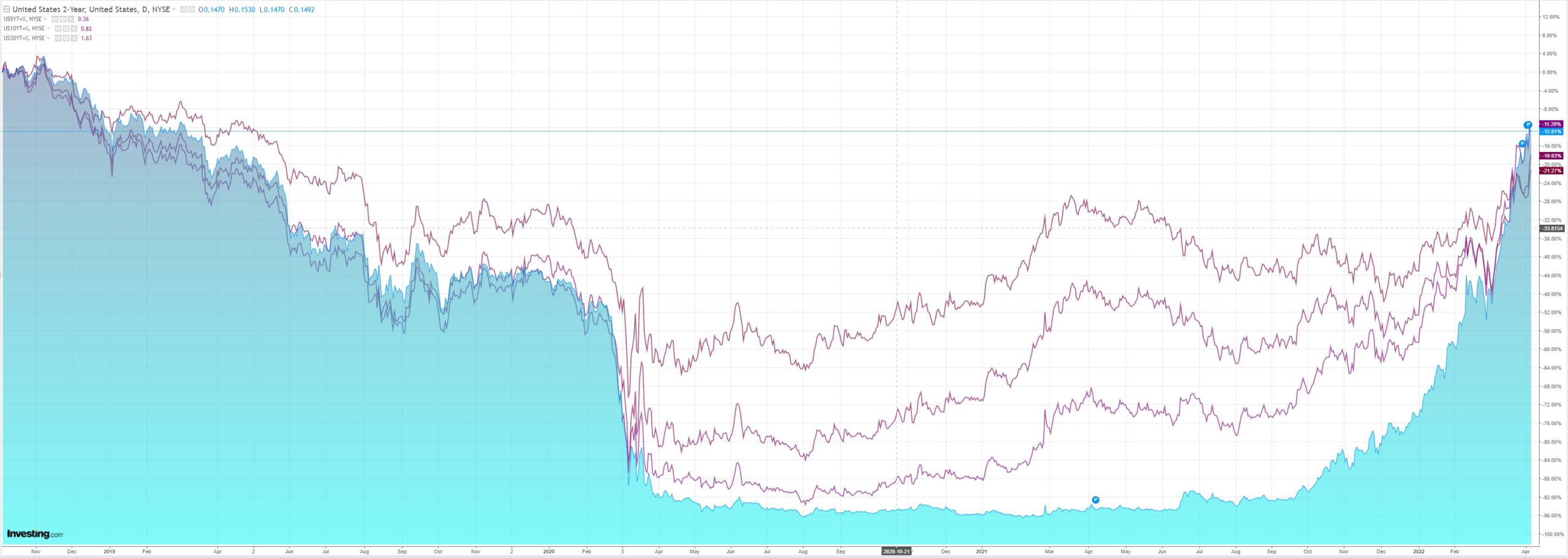

The curve actually steepened for once:

But stocks were hit again:

Westpac with the wrap:

Event Wrap

The FOMC minutes from the March meeting provided details on the proposed unwinding of the QE program. Bonds would be sold at a pace of up to $95bn per month, comprising up to $60bn treasuries and $35bn mortgage-backed bonds. This pace is about twice as fast as the previous unwinding of QE in 2017-2019. Regarding rate hikes, “many” officials had favoured a 50bp hike in March but were dissuaded by the uncertainties over the Russian invasion of Ukraine. Overall, the minutes were no more hawkish than had already been priced in by the markets.

Eurozone PPI in Feb. rose 1.0%m/m and 31.4%y/y (est. +1.2%m/m and 31.6%y/y).

UK announced further sanctions on Russia, freezing assets of Sberbank, Credit Bank of Moscow, and another 8 oligarchs, as well as seeking to end all imports of Russian coal and oil by end 2022.

Event Outlook

Aust: A widening of the trade surplus is anticipated for February as strong exports earnings continue to outstrip gains in imports (Westpac f/c: $13.2bn).

China: Authorities seem comfortable with the renminbi’s value, with foreign reserves expected to remain stable in March (market f/c: $3199bn).

Eur: Recent inflationary pressures are set to dampen the short-term outlook for retail sales (market f/c: 0.5%). The ECB minutes from the March meeting will be released.

US: Initial jobless claims are set to remain at a very low level (market f/c: 200k). Demand for consumer credit should meanwhile remain robust in February as pandemic savings continue to be worked down (market f/c: $18.1bn). The FOMC’s Bullard will discuss the economy and monetary policy; Bostic and Evans will then speak at a different event.

Credit Agricole (PA:CAGR):

King USD has received a boost of late especially vs the beleaguered EUR, CHF and JPY, which are still haunted by the stagflationary effects of the war in Ukraine. That said, the USD continues to lag the high-yielding currencies of global energy exporters like the AUD, CAD and NOK. We have argued that there are at least two reasons for the bifurcated USD performance. The first is the fact that, despite the latest market wobbles, global risk sentiment remains resilient and this continues to fuel demand for high-yielding USD proxies. In addition, the aggressive flattening (and, until recently, the inversion) of the UST yield curve (using UST 2-10Y) seems to further reduce the investment appeal of the USD at a time when US real rates and yields remain deeply negative. In addition, an increasing number of clients have been discussing the prospects of reduced appetite for the USD from central banks from here, especially if the global economy splinters into political and trade blocs that use liquid USD-proxies to settle transactions. Moreover, some clients are arguing that countries that are unhappy about the role of ‘Global Sherriff’ played by the US could seek to reduce their USD exposure as a way to safeguard the independence of their own foreign policy. On the day, focus will be on the minutes from the March FOMC meeting as well as a speech by the Fed’s Patrick Harker. Many positives seem to be in the price of the overvalued and overbought USD, and we think that the USD can only broaden its gains if the combination of geopolitical, stagflation and monetary tightening risks deals a lasting blow to risk sentiment in the near term.

Perhaps. My view remains that a DXY blowoff that crushes everything in its path is dead ahead as a global recession panic takes hold.