DXY was solid Friday night:

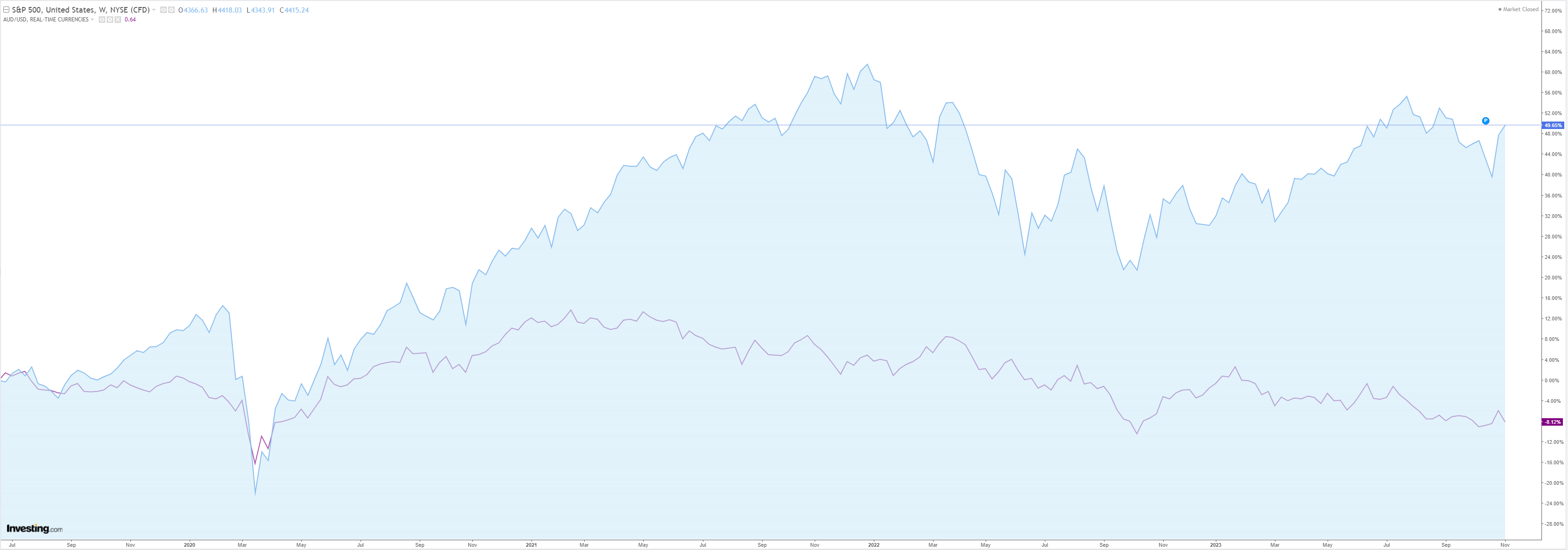

AUD was weak again:

CNY is unmoved:

Gold was hit, oil rose:

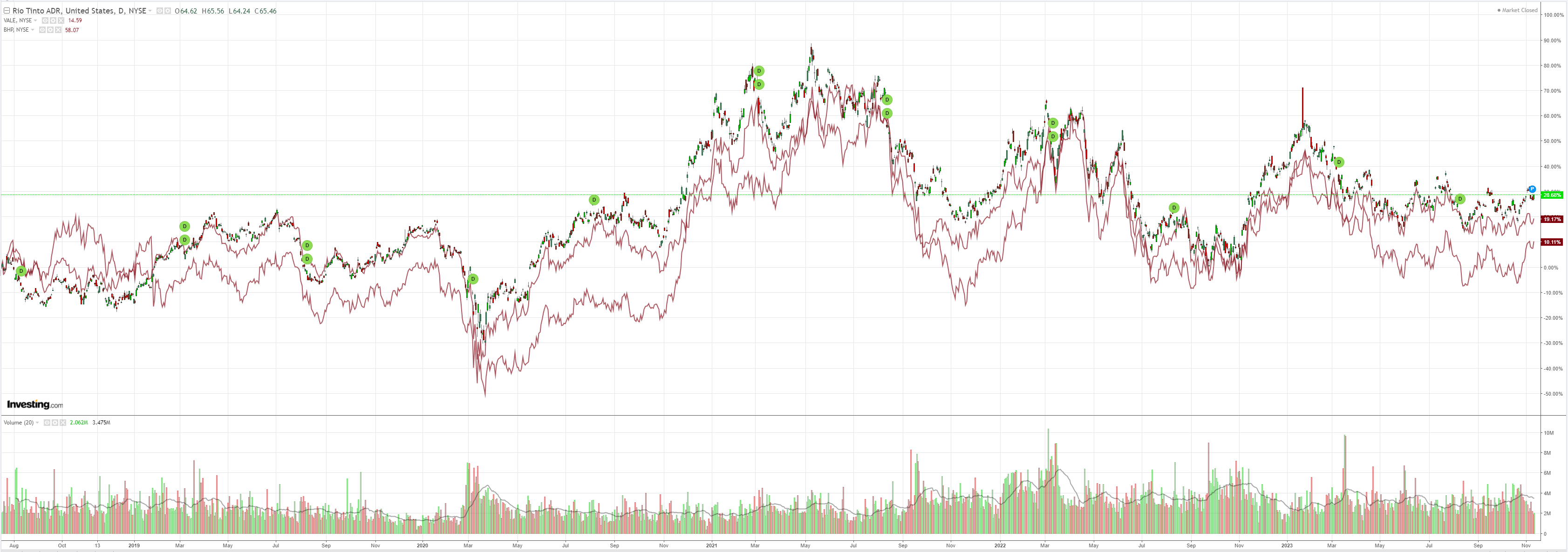

Miners are still rangebound:

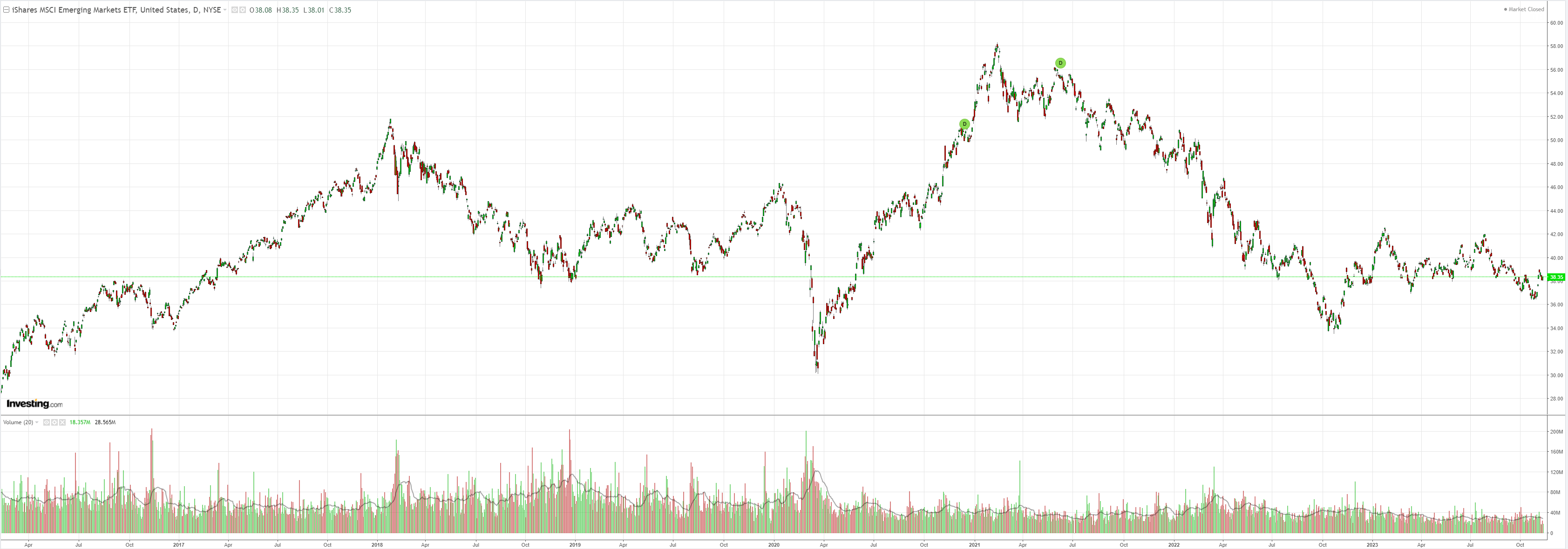

EM too:

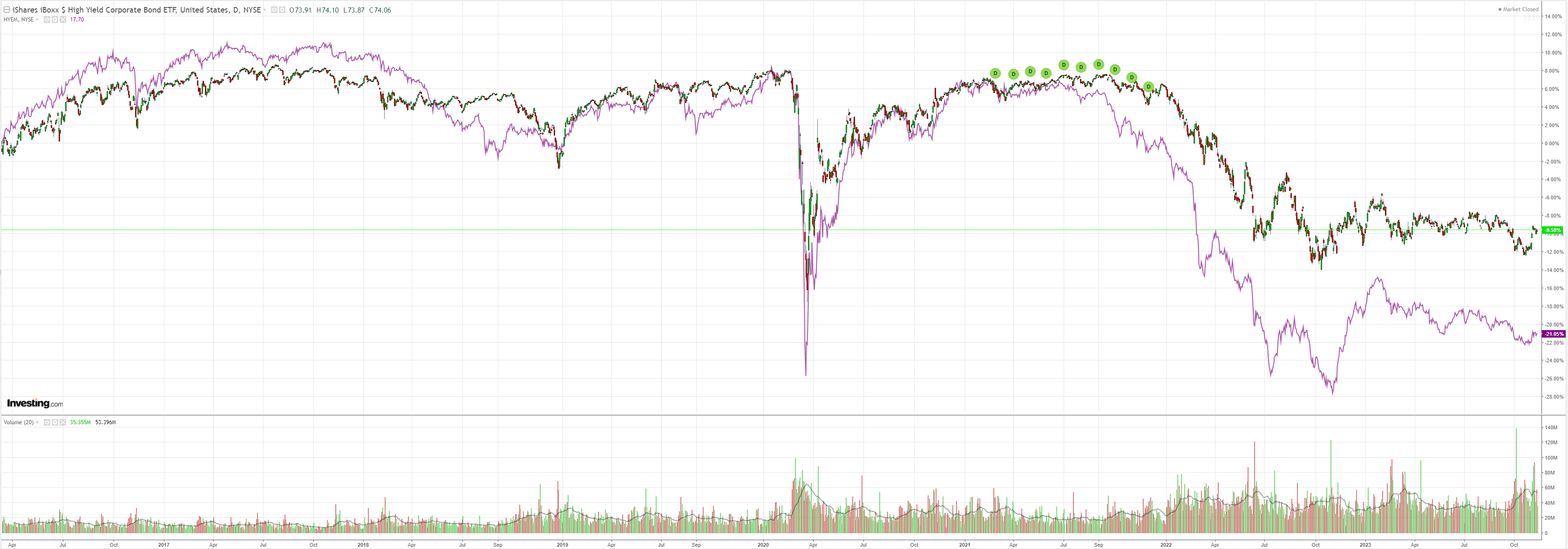

Junk is weaker:

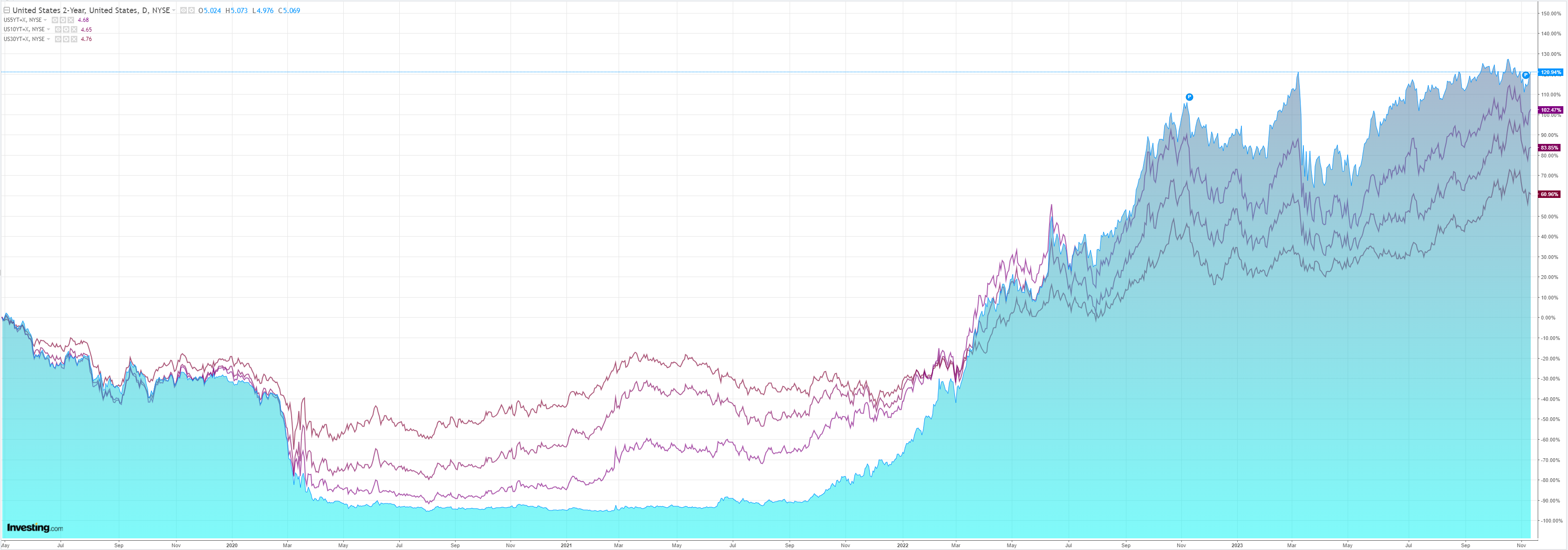

Yields edged up:

Stocks went berserk:

It may be risk on for stocks but AUD doesn’t want any part of it. It has dislocated from risk ever since China’s introduction of the “three red lines” for property developers:

Credit Agricole (EPA:CAGR) has a nice wrap:

The easing of global financial conditions for most of this past week seems driven by the weakness of global oil prices despite persistent tensions in the Middle East as well as the pricing in of a dovish central banks’ pivot by global fixed income markets,despite policymakers’ ‘higher for longer’ stance.

The two developments are interconnected with the recent drop in global energy prices reinforcing the gradual softening of some market inflation expectation gauges.

Our central case remains that the combination of a weaker inflation and growth outlook could force the Fed and other G10 central banks to start easing in the next six to nine months and expect the USD to lose ground on the back of that.

A continuation of the latest trends in global fixed income markets risks a ‘premature easing’ of financial conditions in the near term, however, especially if they are coupled with stock market resilience.

Given that the Fed still thinks that ‘persistent tightening’ of financial conditions is needed to achieve its inflation goal, the FOMC could start pushing more aggressively against further easing of financial conditions, including a weaker USD.

Next week’s US CPI data and Fed speakers could thus put the easing of global financial conditions to the test.

In particular, we think that markets would be very attentive to any evidence that inflation remained too sticky for comfort and thus force the Fed to ‘engineer’ a renewed tightening of US financial conditions, in a boost to the USD.

“Premature easing” is what this stock market does best.

CPI will need to be strong to stop it.

AUD meh.