The DXY rally paused:

The AUD comet kept falling:

Chasing bottomless Chinese assets:

Oil fell, gold firmed:

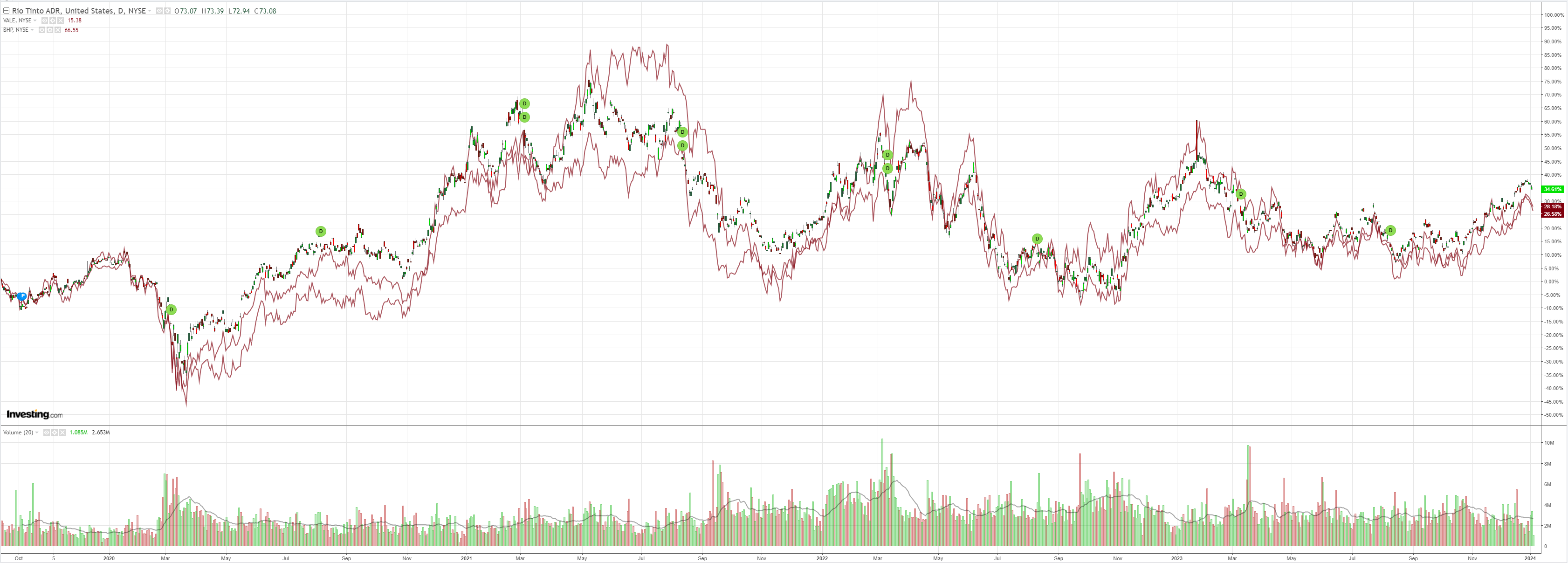

Dirt puked:

Miners too:

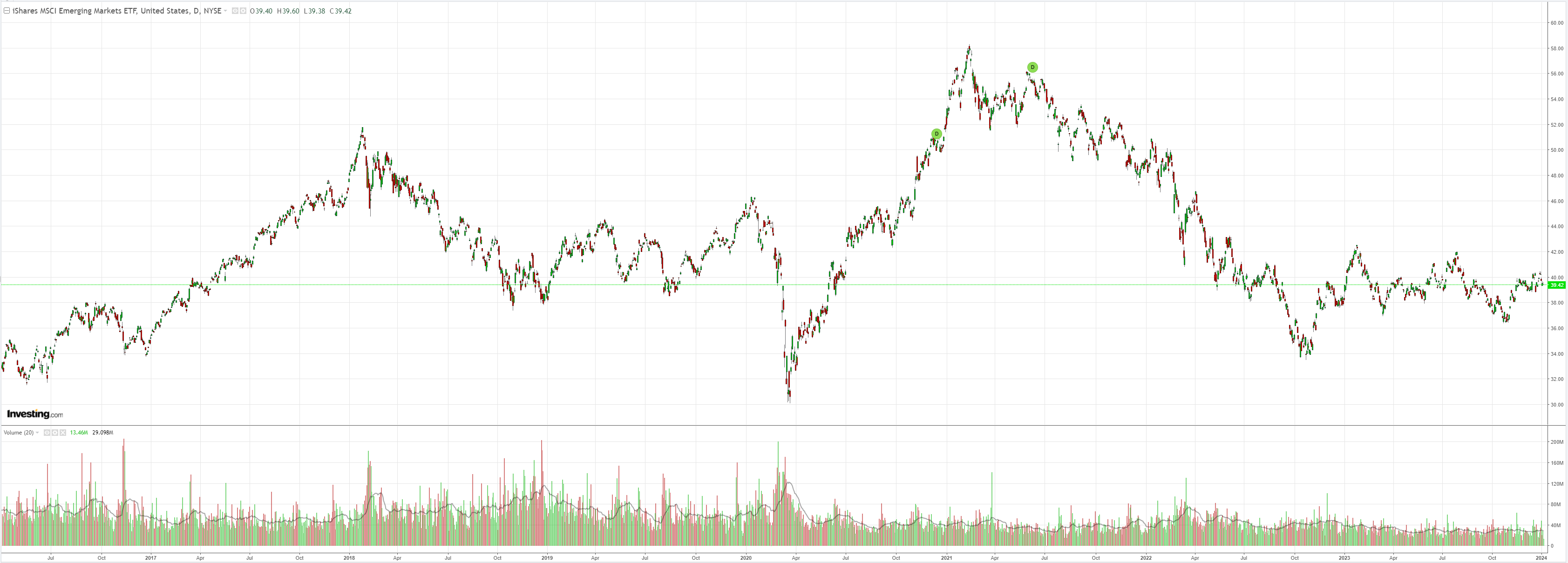

EM yuk:

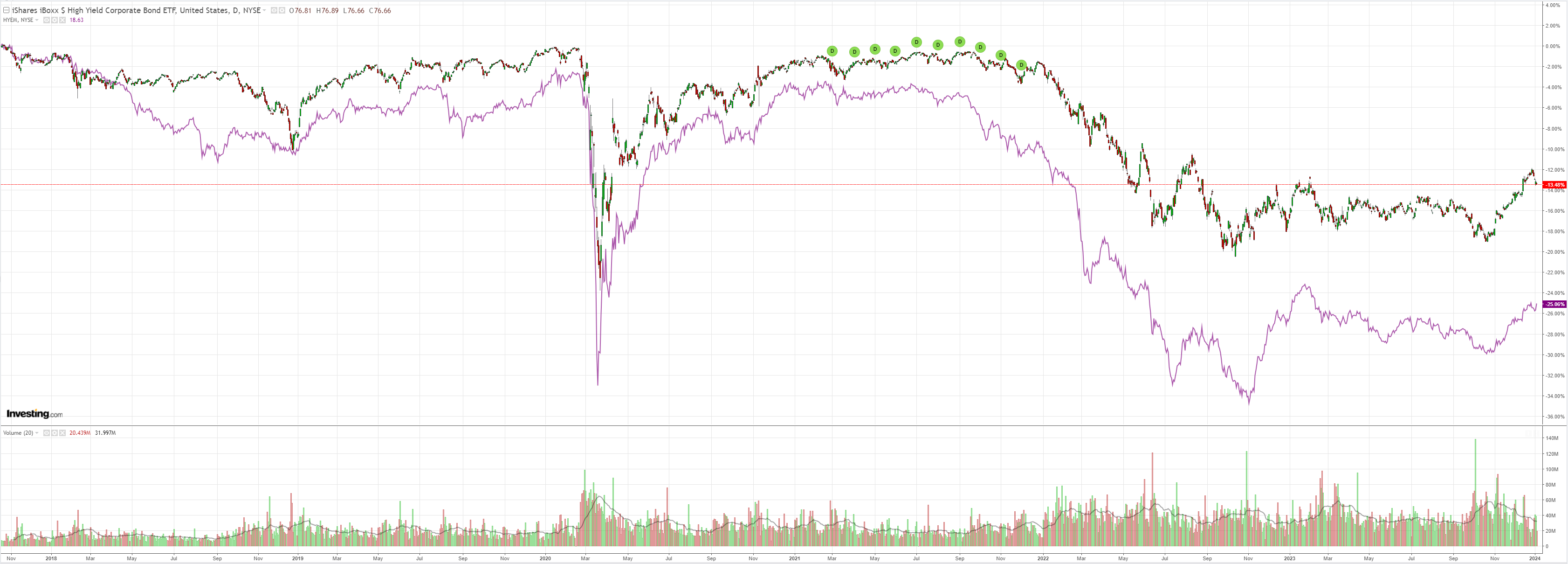

But junk revived:

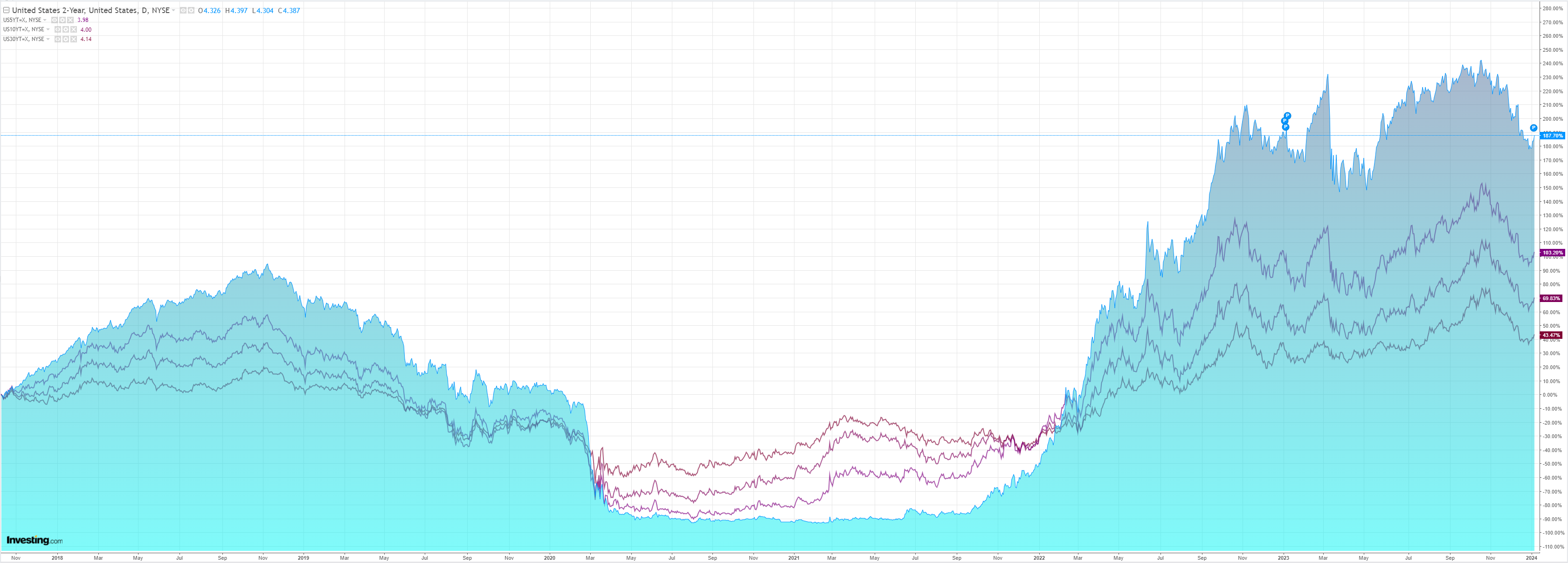

Despite climbing yields:

And falling stocks:

The story remains dominated by energy. Oil is pivotal for yields, stocks, and any mooted soft landing.

I am relatively confident oil will remain weak. Goldman:

We revisit our Oil Comment on Red Sea disruptions. We estimated a potential $3-4/bblboost to crude prices from a hypothetical prolonged and full redirection of all oil flows through the Bab-El-Mandeb strait at the southern end of the Red Sea because ac.100mb increase in oil on water would reduce global available commercial inventories.

Our 1st chart of the week (Exhibit 1) shows that oil flows through the Bab-El-Mandebstrait have fallen by 53% (on a 14DMA basis) since December 18th, with Southbound flows of Russian barrels to Asia driving most of the drop.

The news-based geopolitical risk index (GPR) and Brent call options implied volatility edged higher over this period.

We, however, believe that the geopolitical risk premium currently priced into Brent oil prices remains modest based on the relatively low implied volatility of out-of-the-money call options.

We agree that elevated spare capacity, flexible OPEC+ supply, low recession risk, and opportunistic SPR purchases by China and the US should keep Brent in a 70-90 range in 2024 in most scenarios.

That said, we remain focused on geopolitical risk scenarios (e.g.the unlikely closureof the strait of Hormuz) where OPEC doesn’t deploy its spare capacity as the key upside risk to our range-bound forecast for oil prices.

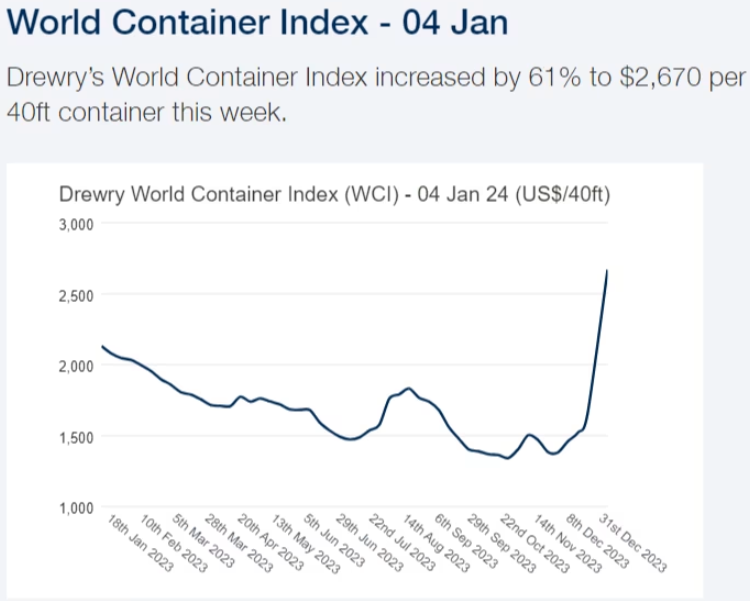

Looking across shipping markets, freight rates have risen sharply for container vessels transporting manufactured goods, especially on Asia-Europe routes.

In contrast, freight rates have not risen significantly for oil (2nd chart of the week, Exhibit 2) and LNG tankers.

I can’t see Iran escalating to the point of closing the Straits. That would be extreme provocation of the entire (Arab) world. But the disruption may be enough to prevent further price falls, which will present a problem for the rally and AUD. Especially this, via BofA:

The Panama Canal and Suez Canal, key chokepoints for global trade, are causing delays, diversions, and higher freight rates. Drought has cut Panama Canal transits, while rocket attacks recently drove Maersk and others to pause Red Sea transits. Our Shipping Equity Research team pointed out that these bottlenecks will impact container trade most, with 8.1% of global container volume traversing the Panama Canal and 28% flowing through the Suez. A closure of these key thoroughfares would boost container demand by 1.5% and 7% respectively. For tankers and bulkers, the closure of the Suez Canal would add roughly 30% to transit distances and boost fleet demand between 1-2%, according to their estimates. Longer supply lines tie up more vessels, boost freight rates, widen origin-destination spreads, and lift bunker demand. Furthermore, a worsening supply chain may be bullish goods demand as companies over-order to ensure adequate inventories.

It is probably still more hiccup than it is disaster but while it lasts such disruption threatens an overheated risk rally based on the assumption of deep monetary easing.

AUD will follow the outcome.