DXY eased overnight:

AUD has a very bearish chart sitting right on key support:

Oil cracked:

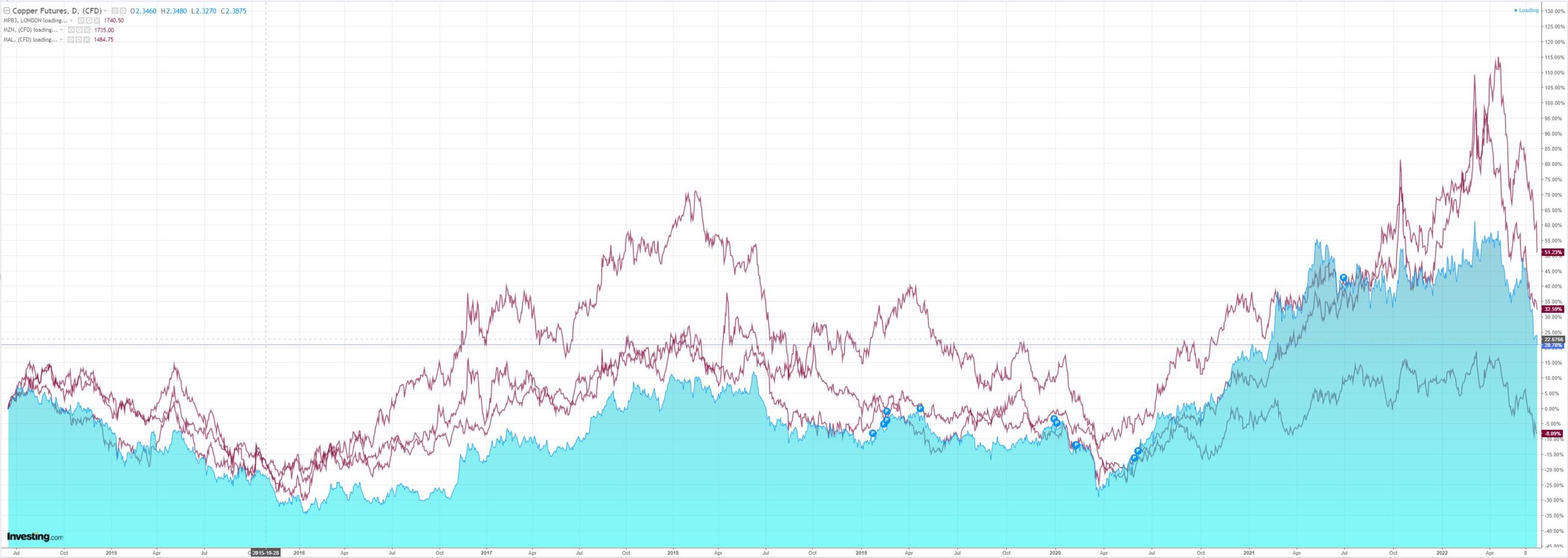

Metals are flaming, free-falling recession comets:

Miners (LON:GLEN) too:

EM stocks (NYSE:EEM) are clinging to the Chinese rally:

Junk (NYSE:HYG) is screaming doom:

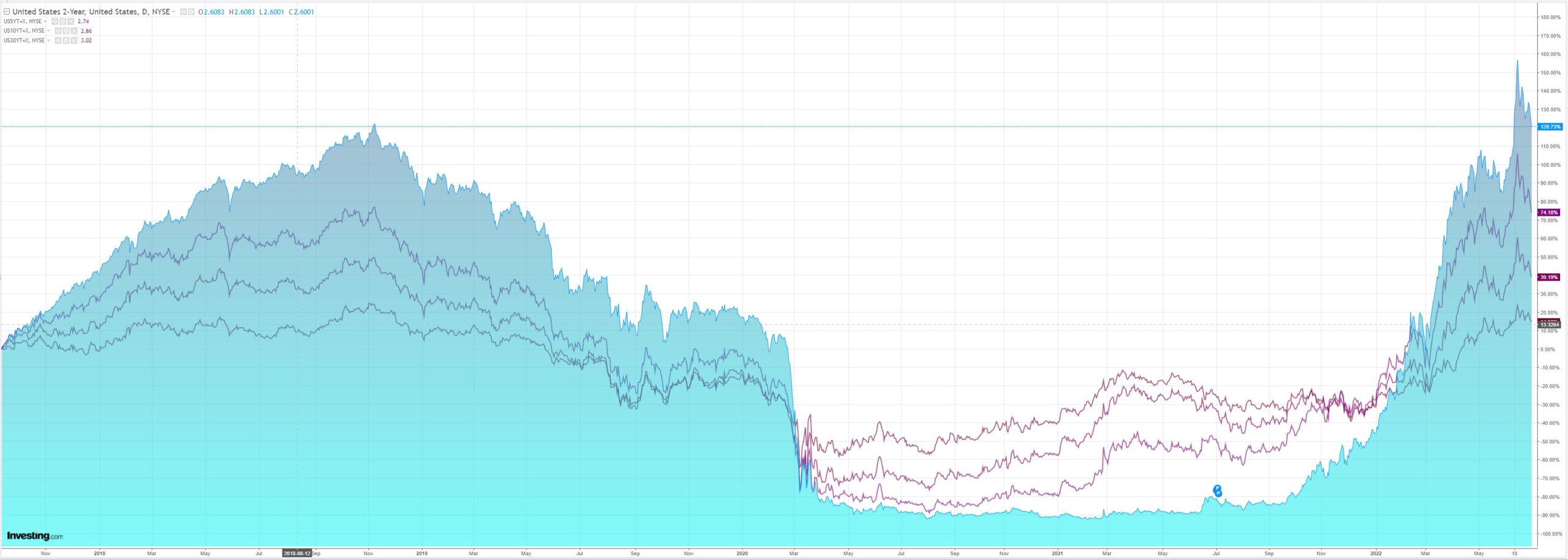

The bond bear market is over:

Ominously, stocks are now falling anyway:

Westpac has the wrap:

Event Wrap

US personal income in May rose 0.5%, as expected, but personal spending disappointed at +0.2%m/m (est. +0.4%, prior revised to +0.6%m/m from +0.9%m/m). The PCE deflator remained elevated at 6.3%y/y (est.6.4%, prior 6.3%), but the core measure slipped further to 4.7% (est. 4.7%, prior 4.9%, peak in March 5.3%). The Chicago PMI disappointed at 56.0 (est. 58.0, prior 60.3). Although employment was firm at 50.7 and prices paid eased to 79.6 from 88.6, the surprise in the survey was that new orders plunged 9.8 points to 49.9 – the lowest in two years, and a quarter of firms saw fewer new orders received in June. Production fell 5.7 to 55.2.

German retail sales in May rose 0.6%m/m (est. +0.5%m/m). Unemployment rose sharply, +133k (est. -5k) to a 5.3% rate (est. unch. at 5.0%). Much of the rise was due to Ukrainian refugees being included in the data. Germany’s labour agency claimed that the underlying labour market was stable. Eurozone unemployment surprised lower, slipping to 6.6% from a downwardly revised April level of 6.7%.

French CPI in June was slightly higher at 5.8%y/y (est. 5.7%y/y), harmonised 6.5%y/y (est. 6.5%y/y), with the mixed outcomes among national CPIs likely to add interest to tomorrow’s Eurozone result (est. 8.5%y/y).

UK final Q1 GDP was little changed from the initial releases (+0.6%q/q, +8.7%y/y). Nationwide’s June house price survey rose 0.3%m/m to 10.7%y/y (est. +0.5%m/m and 10.8%y/y).

Sweden’s Riksbank raised its benchmark rate 50bp to 0.75%, as was widely expected, and it retained a hawkish outlook, affirming that rates should rise to 2.0% into 2023 with a faster than previously shrinking of its balance sheet as it counters higher inflation (expected to be above 7% through this year and in 2023).

Event Outlook

Aust: CoreLogic’s home value index will post a stronger decline in June as the RBA’s front-loaded rate hike cycle impacts housing activity, especially in Sydney and Melbourne (Westpac f/c: -0.7%).

NZ: Cost of living pressures will continue to weigh on ANZ consumer confidence in June. Meanwhile, building consents should remain firm in May although headwinds around supply issues and sentiment will limit the upside over time (market f/c: 0.0%).

Japan: The Q2 Tankan large manufacturers index is expected to show mixed results as the rebound in manufacturing activity works against a flurry of supply issues (market f/c: 13). The final estimate to June’s Nikkei manufacturing PMI is also due.

Eur/UK: The Eurozone CPI is expected to lift further in June as price pressures continue to broaden and intensify (market f/c: 0.7%mth; 8.5%yr). Meanwhile, rising interest rates and a slowing economy should gradually weigh on net mortgage lending in the UK (market f/c: £4.3bn). The final estimate to June’s S&P Global (NYSE:SPGI) manufacturing PMI is also due for both Europe and the UK (market f/c: 52.0 and 53.4 respectively).

US: June’s ISM and S&P Global manufacturing PMIs should continue to reflect robust momentum in the sector (market f/c: 54.5 and 52.4 respectively). Construction spending should be supported by home building strength over the medium term (market f/c: 0.4%).

We’re grinding our way towards global recession even before we get any kind of credit event or critical market dislocation. Whether that can continue is in the lap of the gods.

If we can, then it will be a garden variety recession and stocks may only fall another 10%. If we do get the Minsky moment then it’ll be more like 25% and a stonking recession with a huge deflationary shock.

In forex, the equivalent prices for AUD are probably 65 cents versus 60 cents.

Place your bets!