Street Calls of the Week

DXY has confirmed a false breakdown and EUR a false breakout:

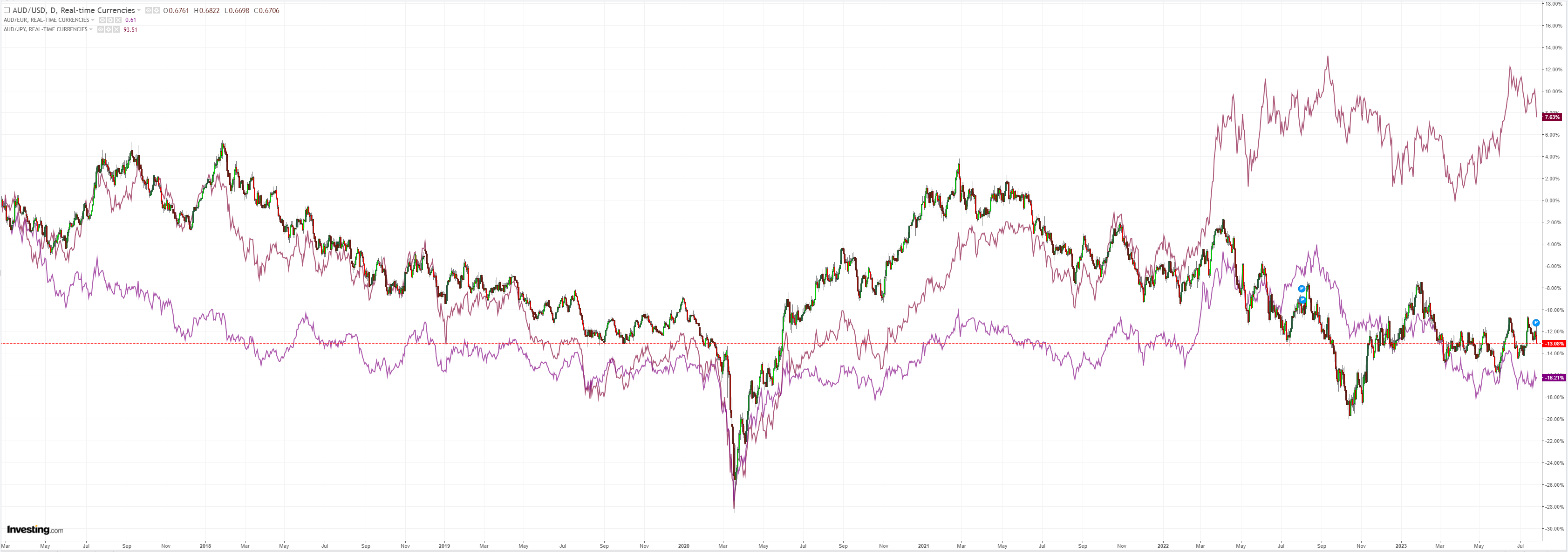

AUD follows the latter:

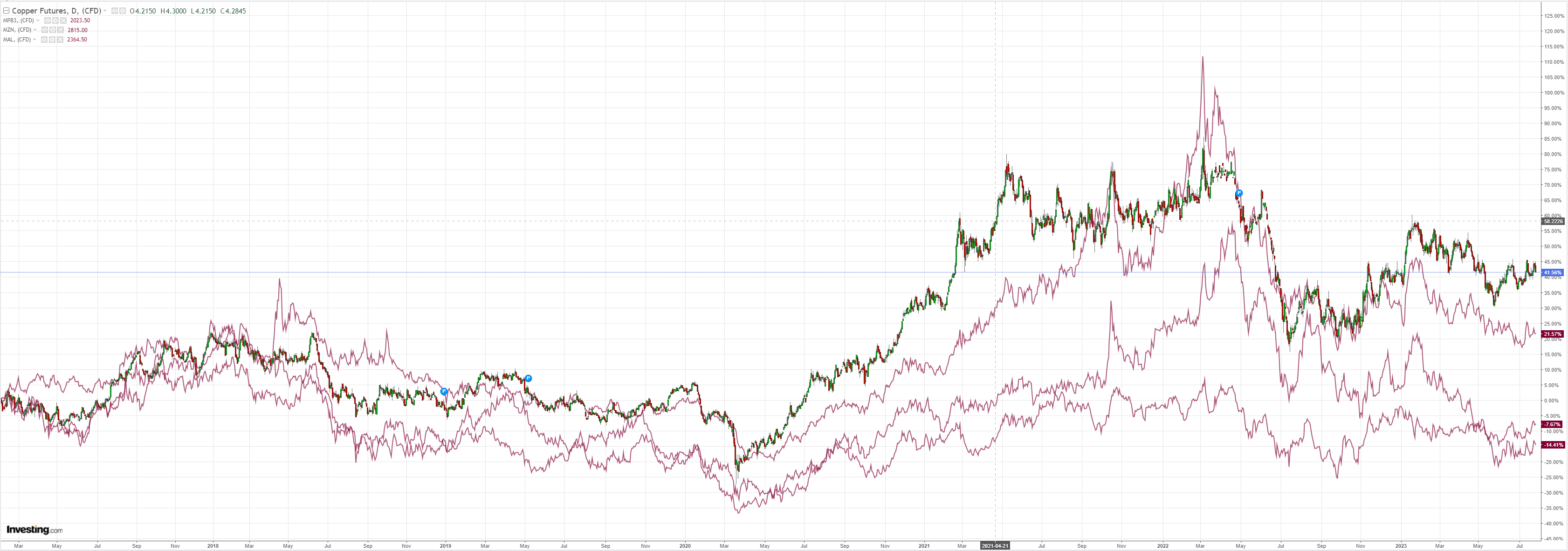

Commodities were all hosed:

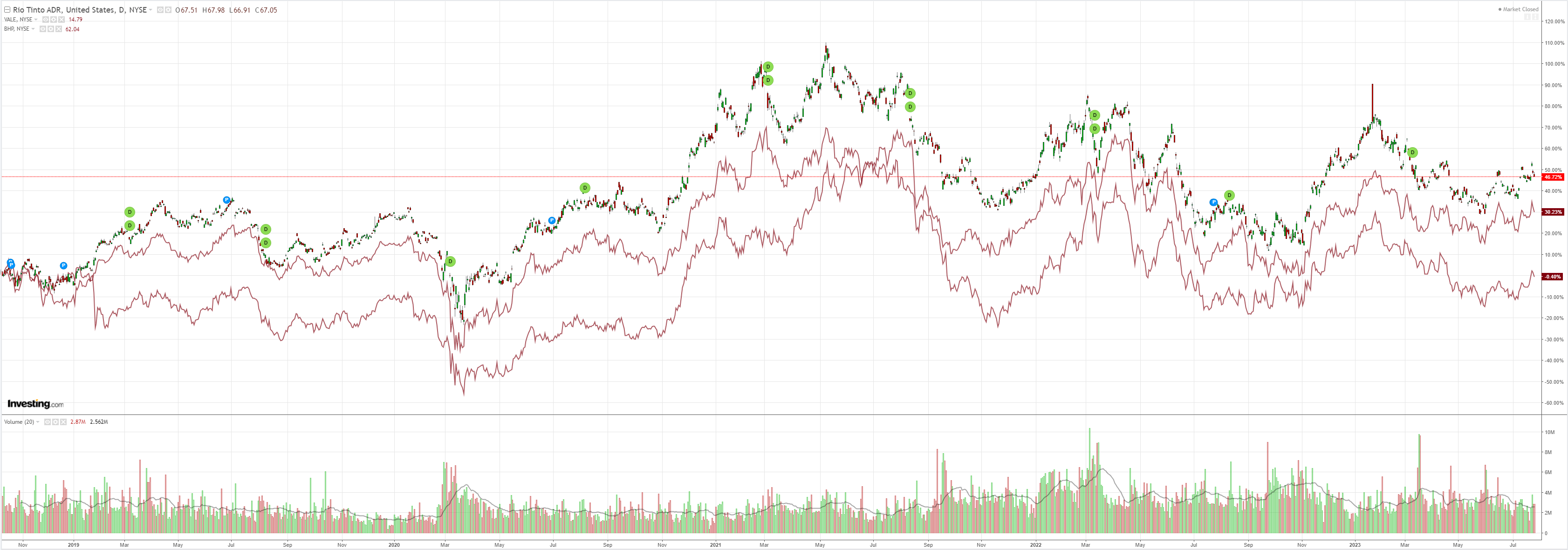

Big miners (NYSE:RIO) too:

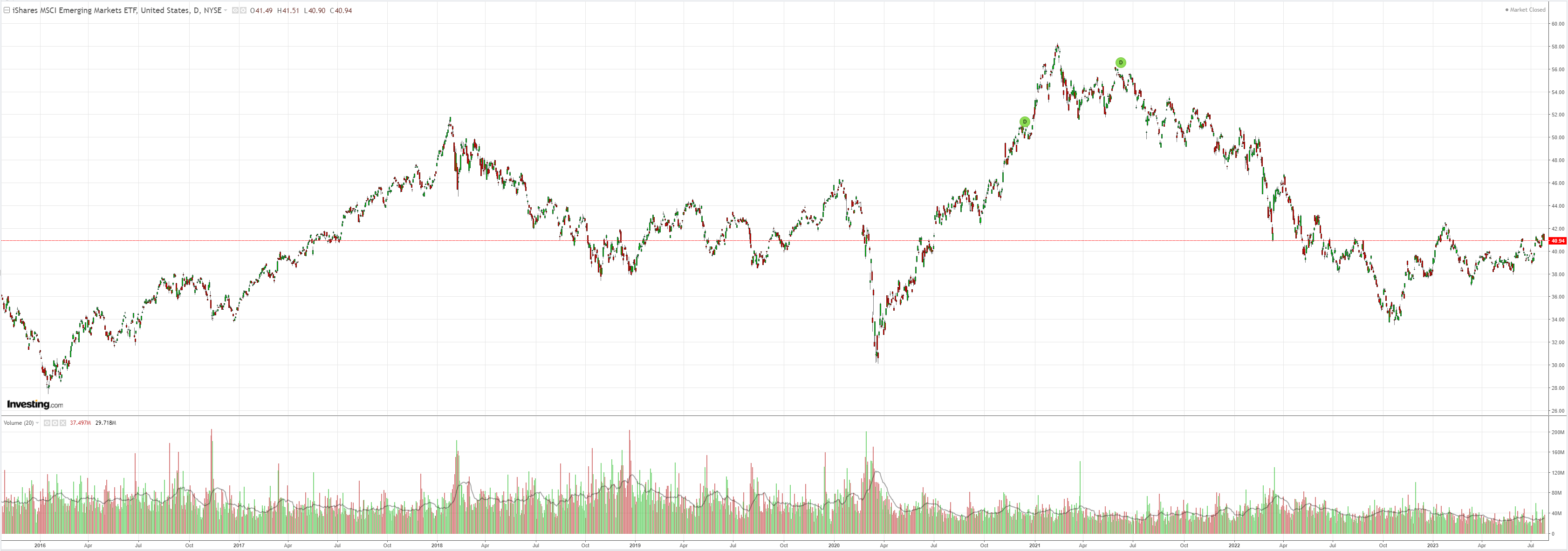

EM (NYSE:EEM) trying, failing:

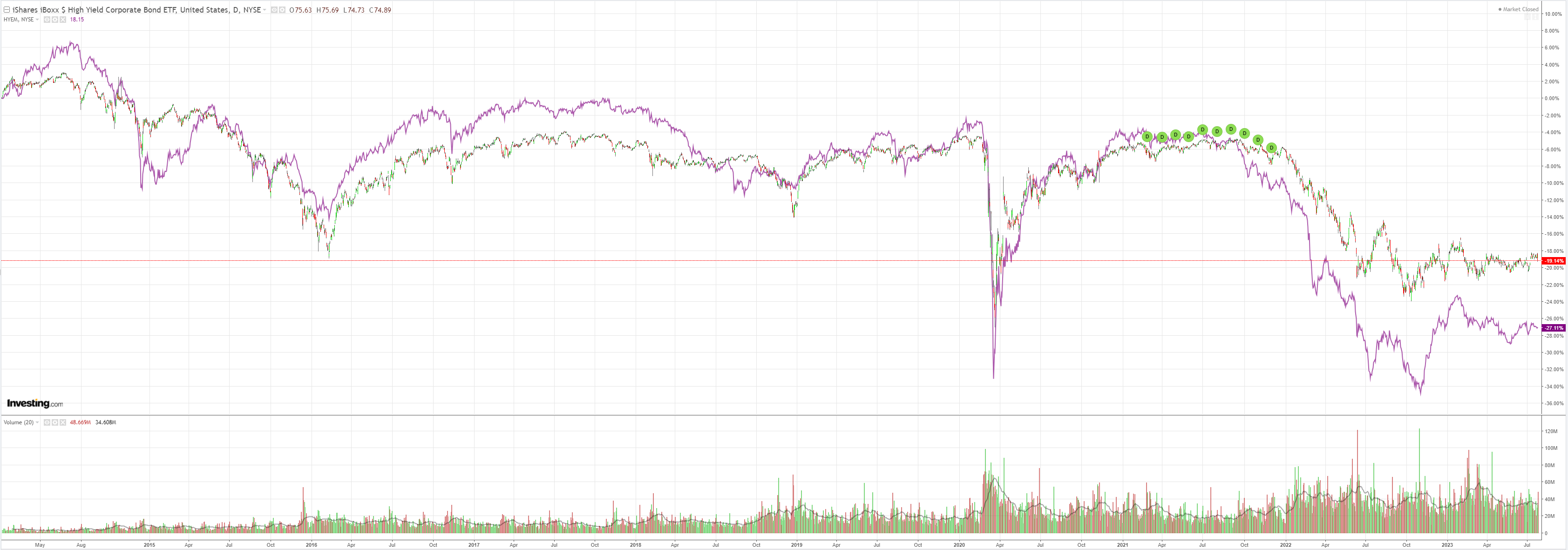

Junk (NYSE:HYG) has completely blanked the stock bubble:

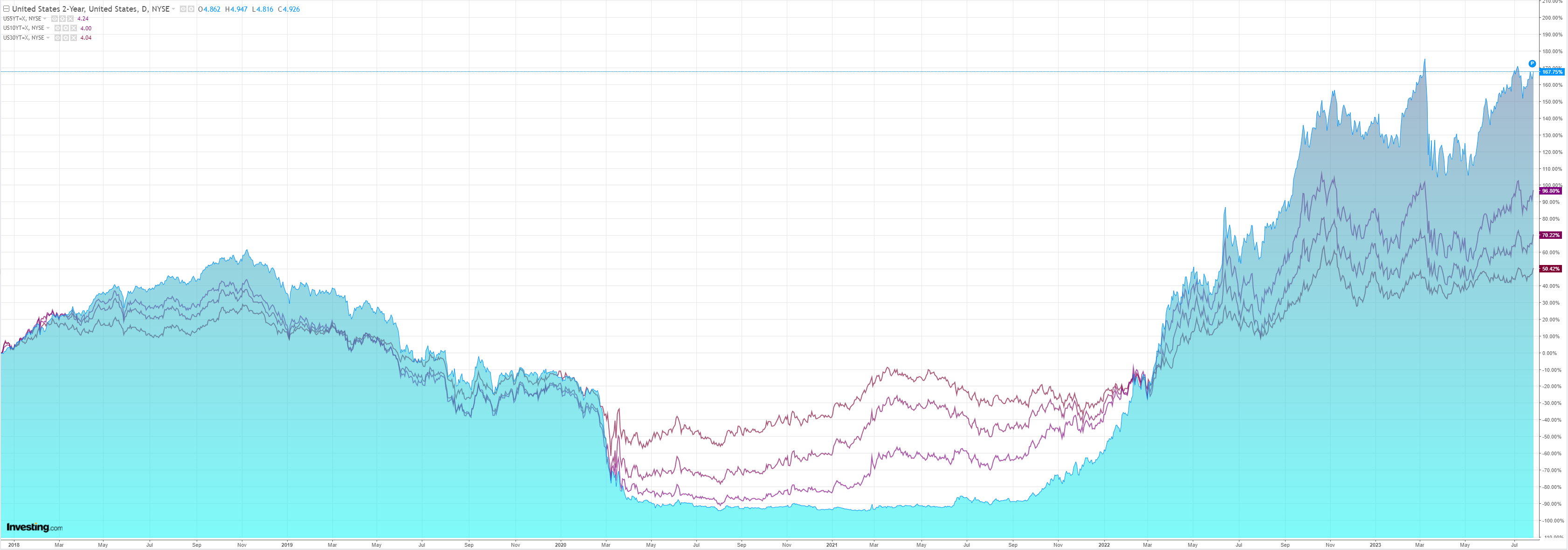

Long bonds jack-knifed:

Stocks fell except for very weird action in Europe on an ECB slip of the tongue:

US GDP thumped along in Q2 at 2.4%. Jobless claims were bullish. Pending home sales too. The secret sauce is this from JPM:

- The FY23 deficit is tracking about US$1.5 trillion, but only thanks to the odd accounting of student debt forgiveness

- Excluding student debt, the deficit would be closer to $1.8tn, and almost $1tn larger than in FY22

- This widening should partly reverse as we move into FY24, when we project a deficit around $1.6tn

$tr in secret stimulus is like 4% of GDP!

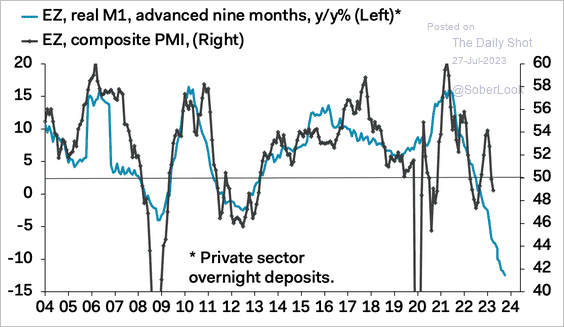

The ECB hiked 25bps, and the Continent is headed into recession with a bullet:

Hints that ECB might pause spiked stocks, but what about the crash in growth and earnings?

The BOJ added to the turmoil by hinting that it might tweak yield curve control which spiked yields and JPY at the worst possible time.

Add what we already know, that the China stimulus is a bust.

What it all boils down to for forex is the US economy is flying ahead of everybody else. That is not an environment in which DXY falls. Even if the Fed pauses, everybody else will be easing first.

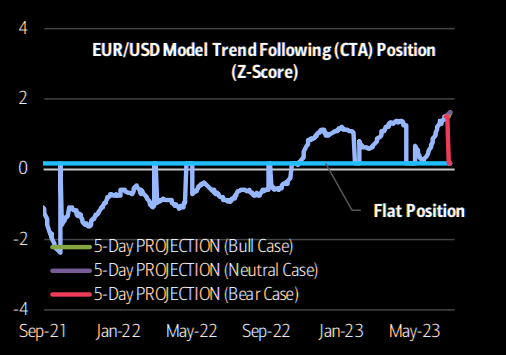

Add that the robots are very short DXY and very long EUR:

If DXY spikes that will not favour risk, liquidity, tech earnings, commodities or the AUD.