DXY was soft as EUR firmed:

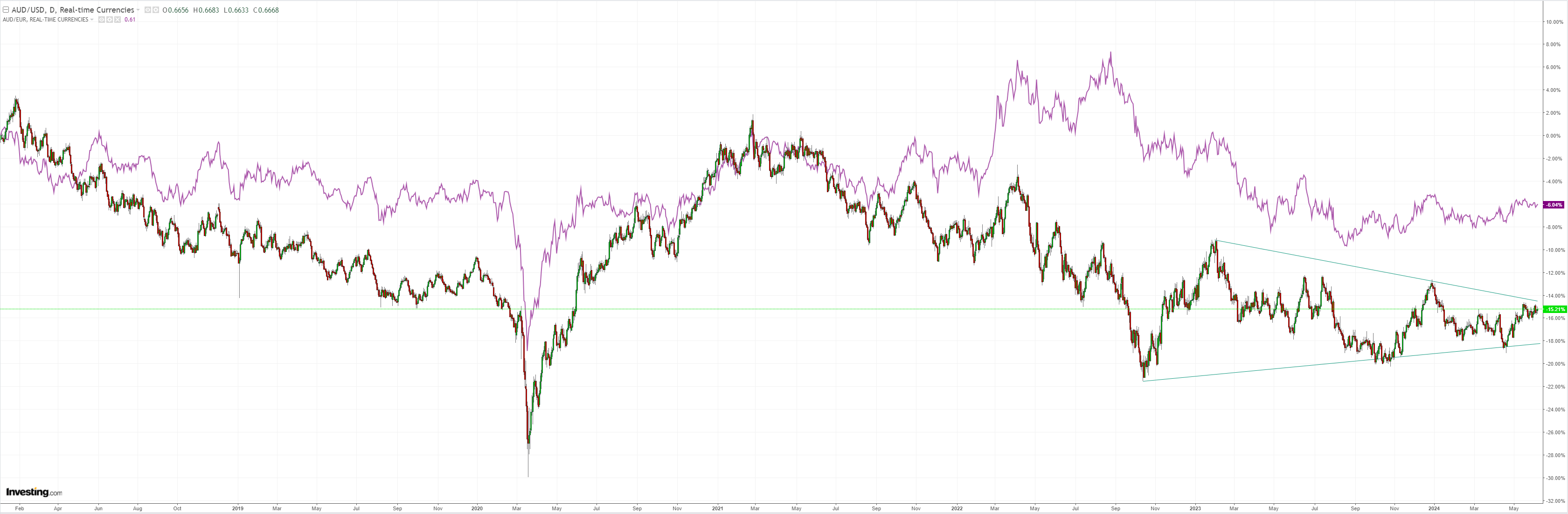

AUD is stuck in the mighty wedge:

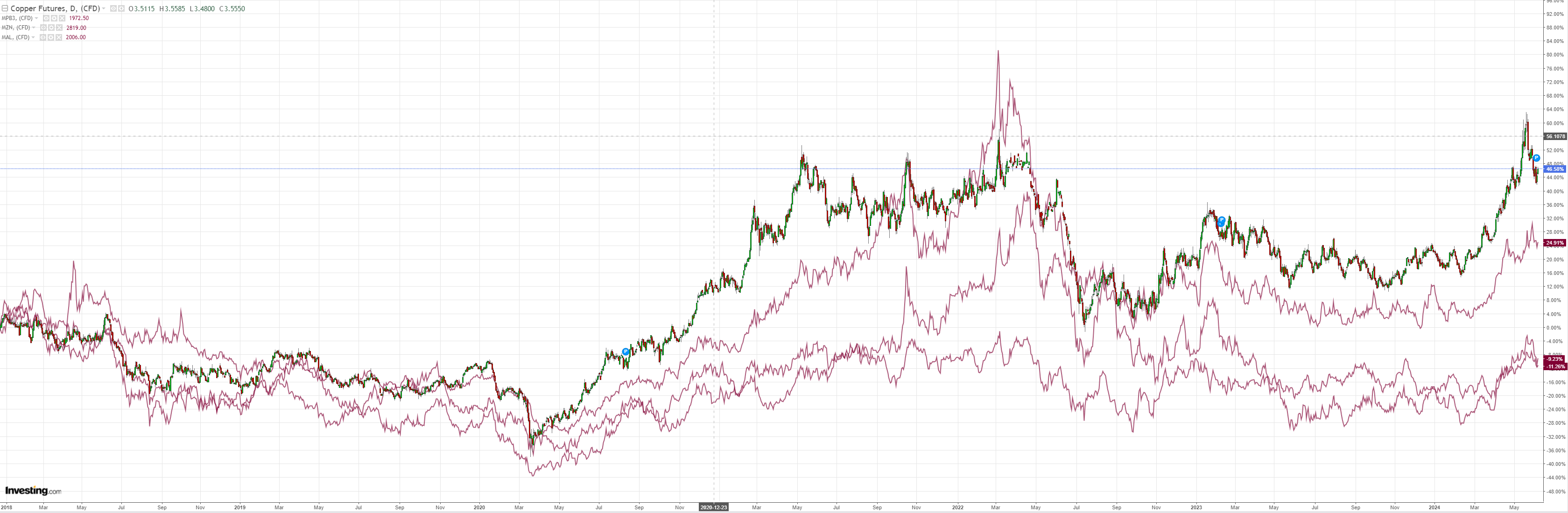

North Asia helped a little:

Oil is dead cat bouncing:

Ditto metals:

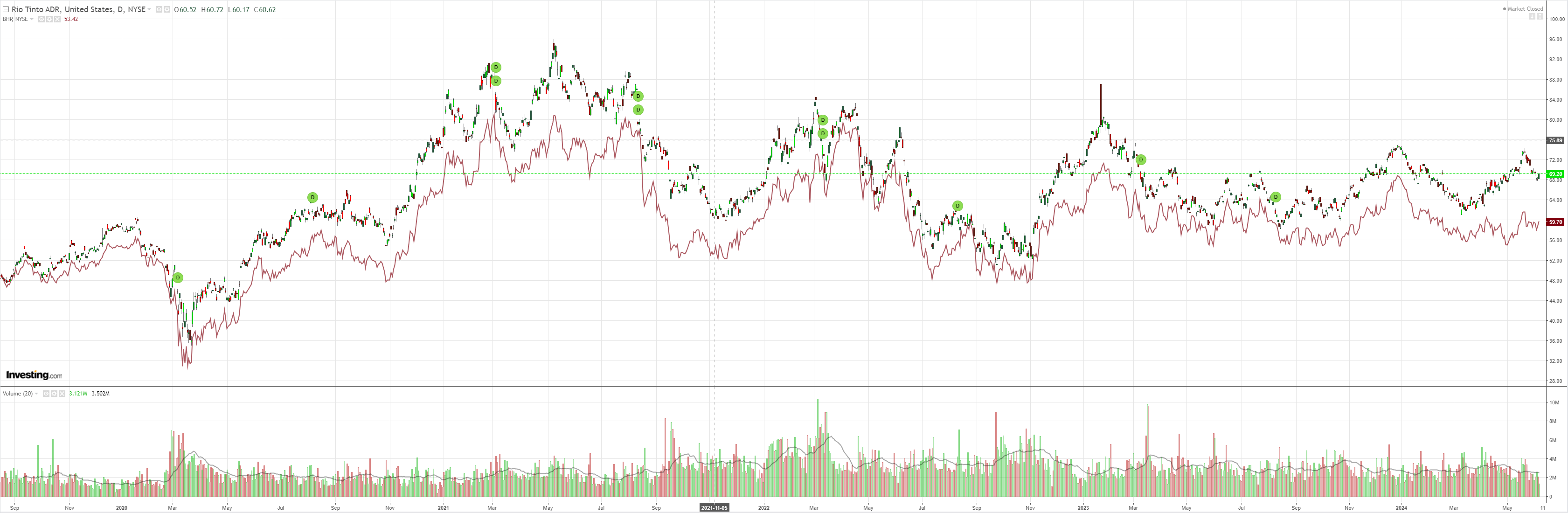

Miners:

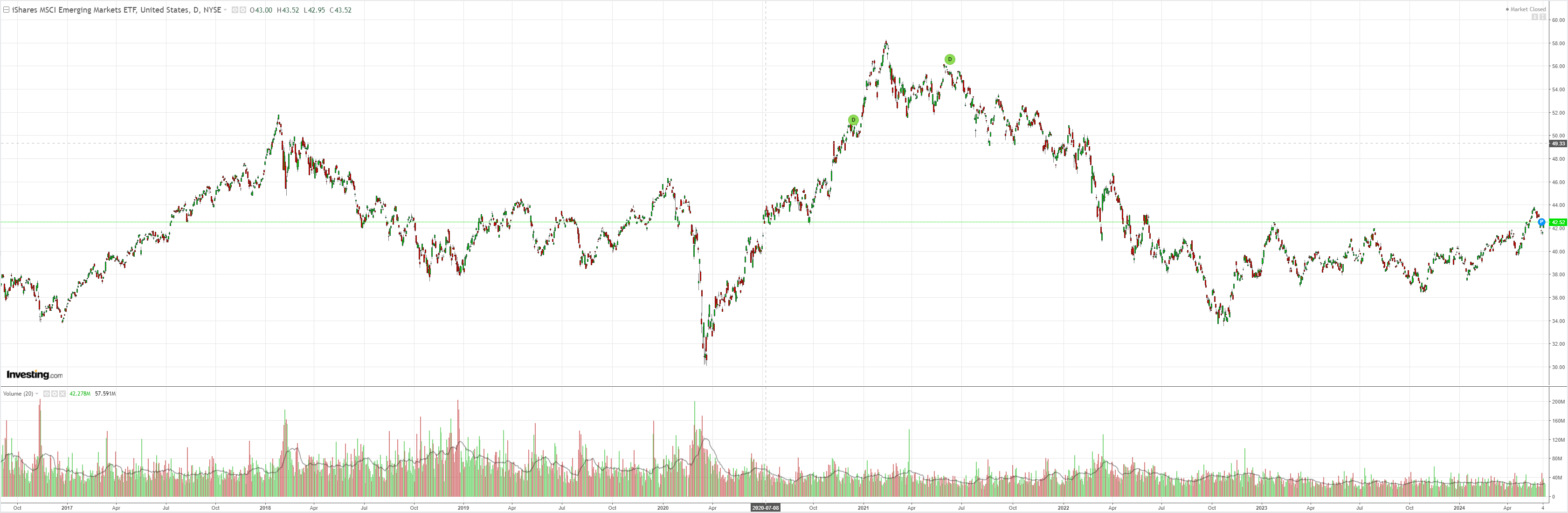

And EM:

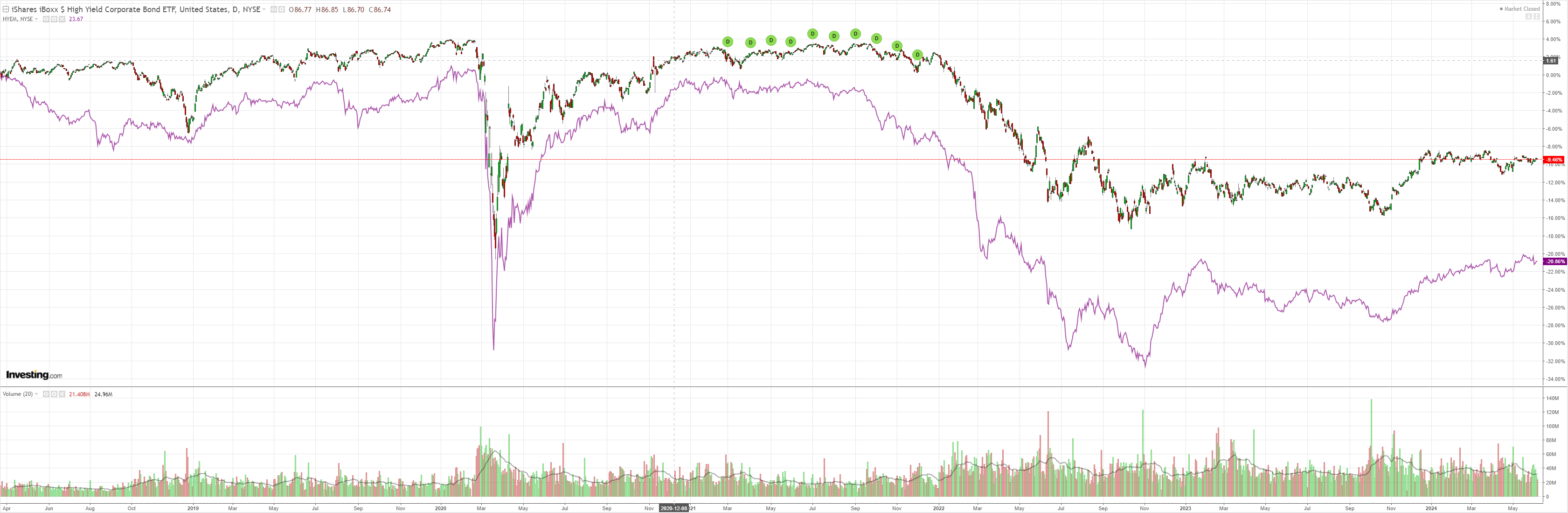

But junk is stalled:

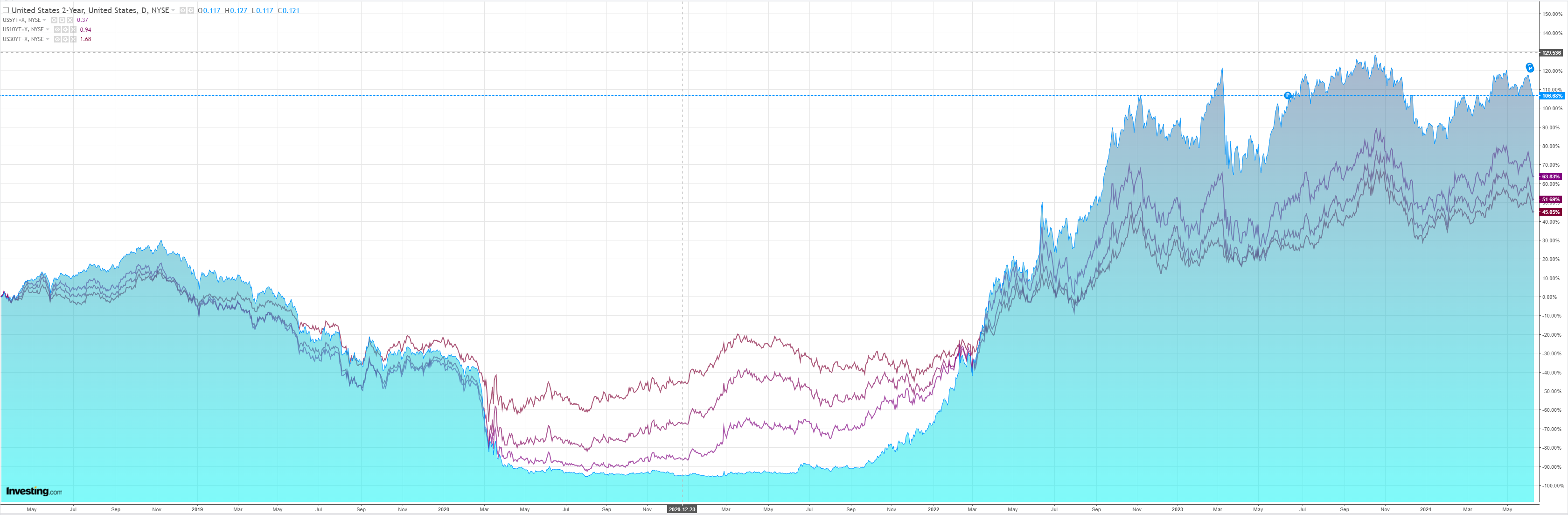

As yields rose a touch:

Stocks stopped:

The ECB joined the rate cut club as its chief economist characterised the cut as a reversal of the last “insurance hike”.

The bank may not want to rush in but there is every likelihood that this is the beginning of an easing cycle:

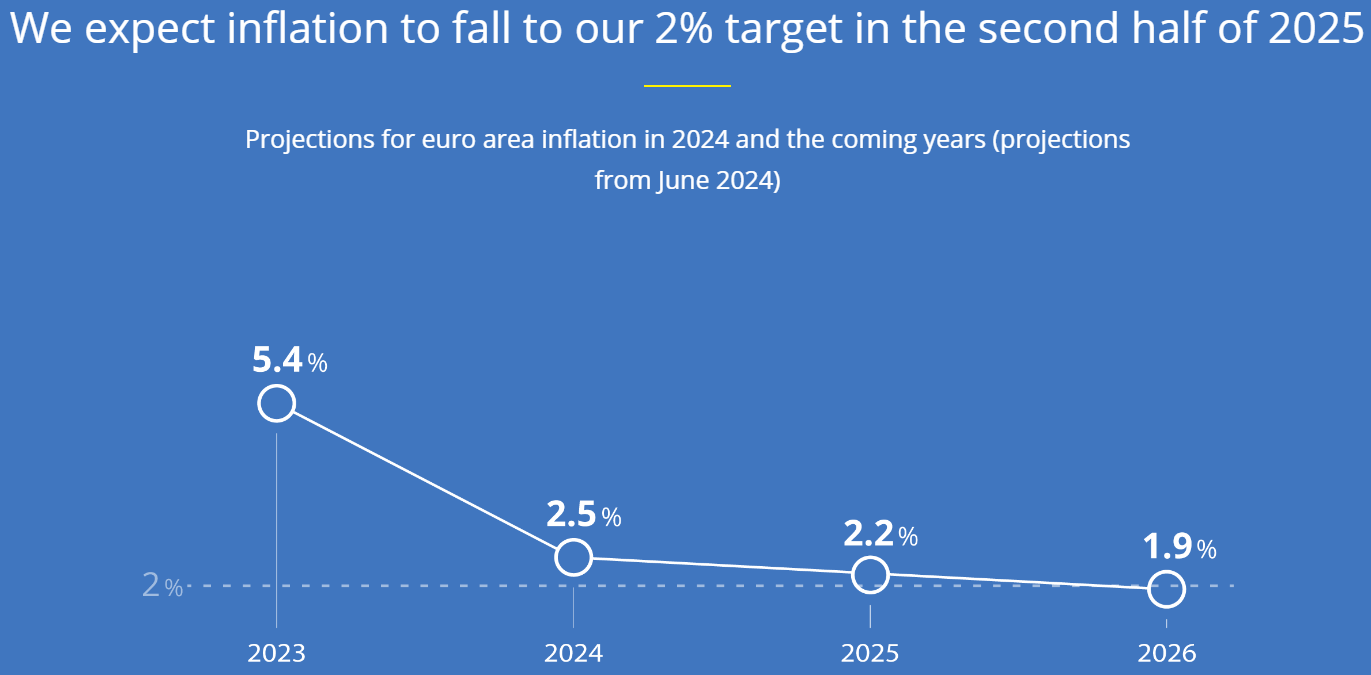

At the same time, despite the progress over recent quarters, domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year.

The latest Eurosystem staff projections for both headline and core inflation have been revised up for 2024 and 2025 compared with the March projections.

Staff now see headline inflation averaging 2.5 per cent in 2024, 2.2 per cent in 2025 and 1.9 per cent in 2026.

For inflation excluding energy and food, staff project an average of 2.8 per cent in 2024, 2.2 per cent in 2025 and 2.0 per cent in 2026.

Economic growth is expected to pick up to 0.9 per cent in 2024, 1.4 per cent in 2025 and 1.6 per cent in 2026.

For forex, the ECB leading the rate cut cycle could go either way.

If US growth is strong, EUR will likely fall.

If US growth fades, then EUR may rise on a tilting US versus global growth outlook.

Even so, the US election probably keeps the playing field in favour of DXY in H2.

AUD will follow EUR, as usual.