DXY was hammered last night:

So AUD roared back. 1% daily moves now indicate growing chaos:

CNY likewise:

Oil is trending up which will upset everybody in short order:

Dirt calmed down:

Big miners Rio Tinto (NYSE:RIO) too:

EM stocks (NYSE:EEM) are finally enjoying a minute in the sun:

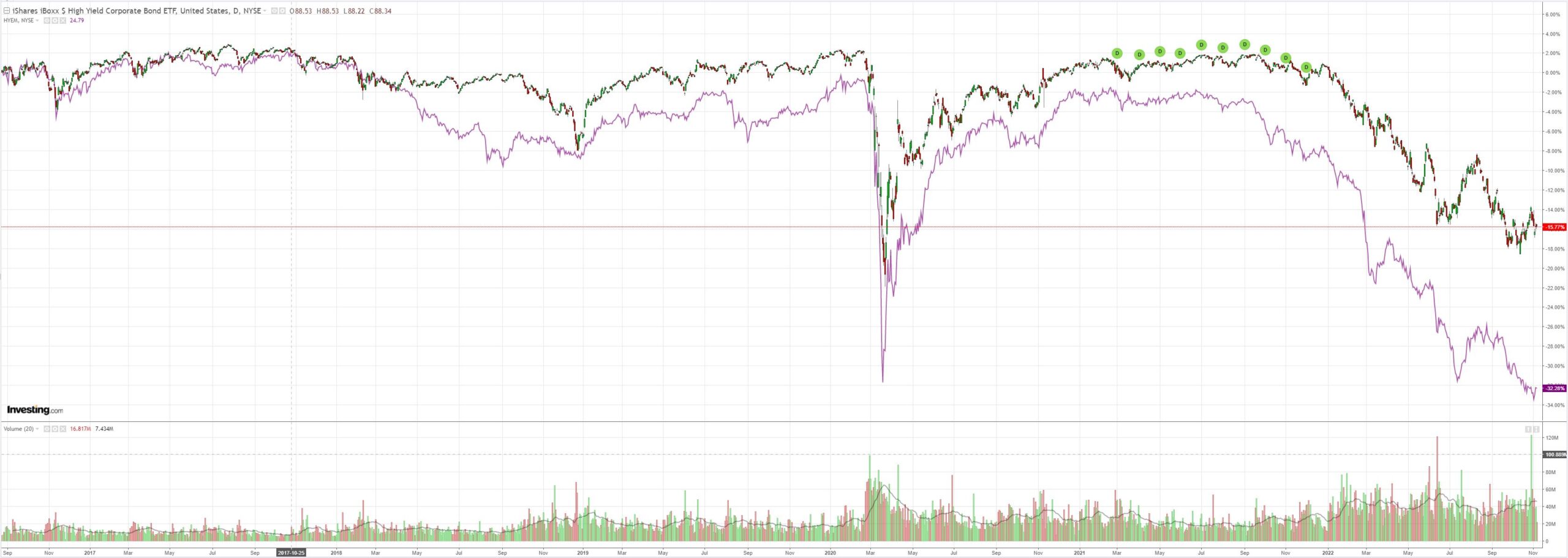

But junk (NYSE:HYG) is very unimpressive:

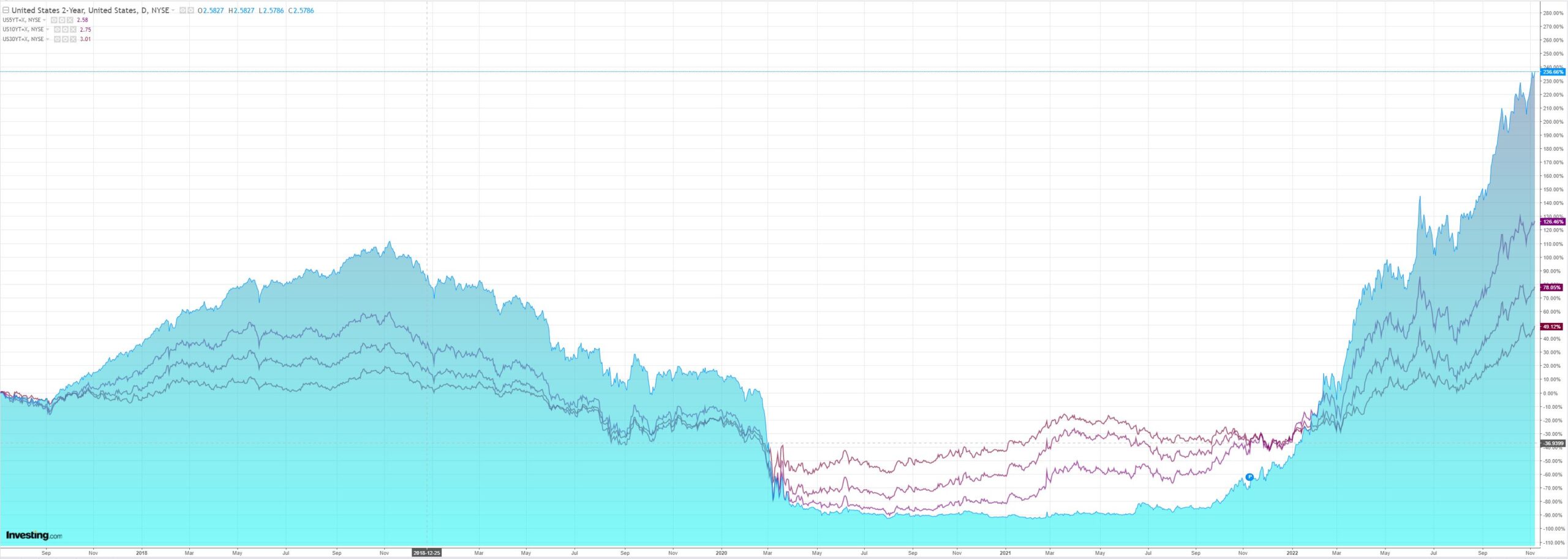

US yields broke out as the Chine reopening that isn’t pushes inflation:

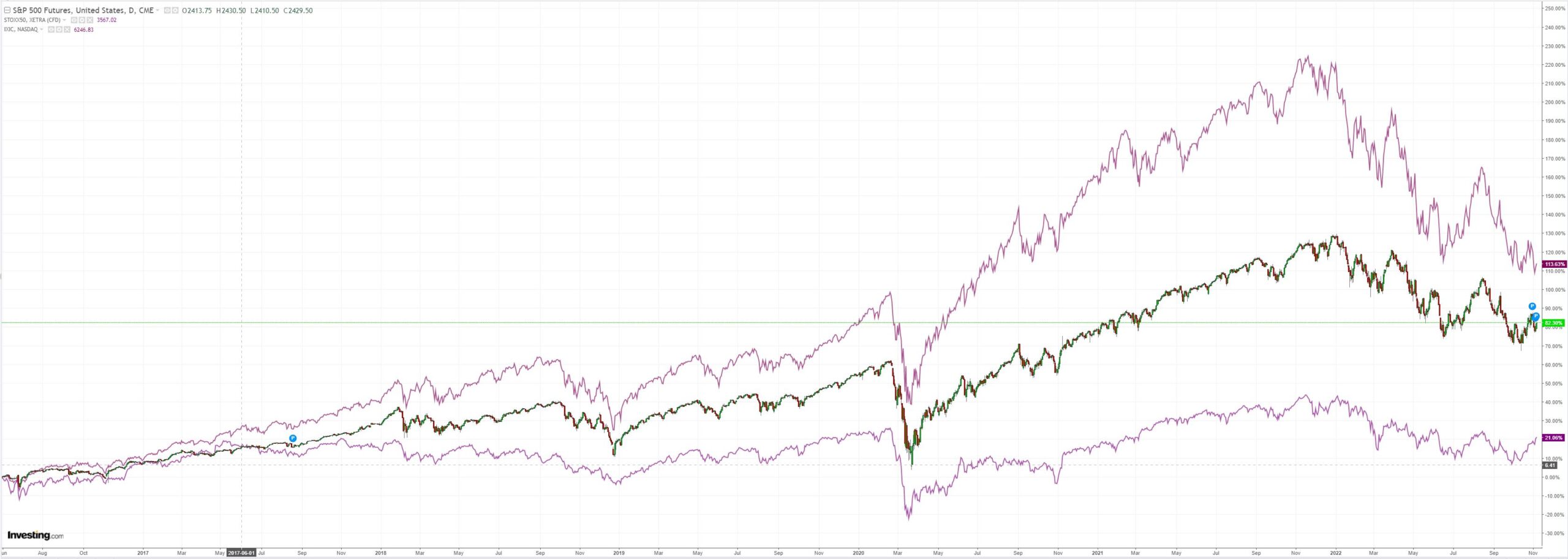

Stocks rose just because:

This bear market is tortuous because all bear markets are. It takes a lot of time and cost to wring out the psychological excesses of the boom.

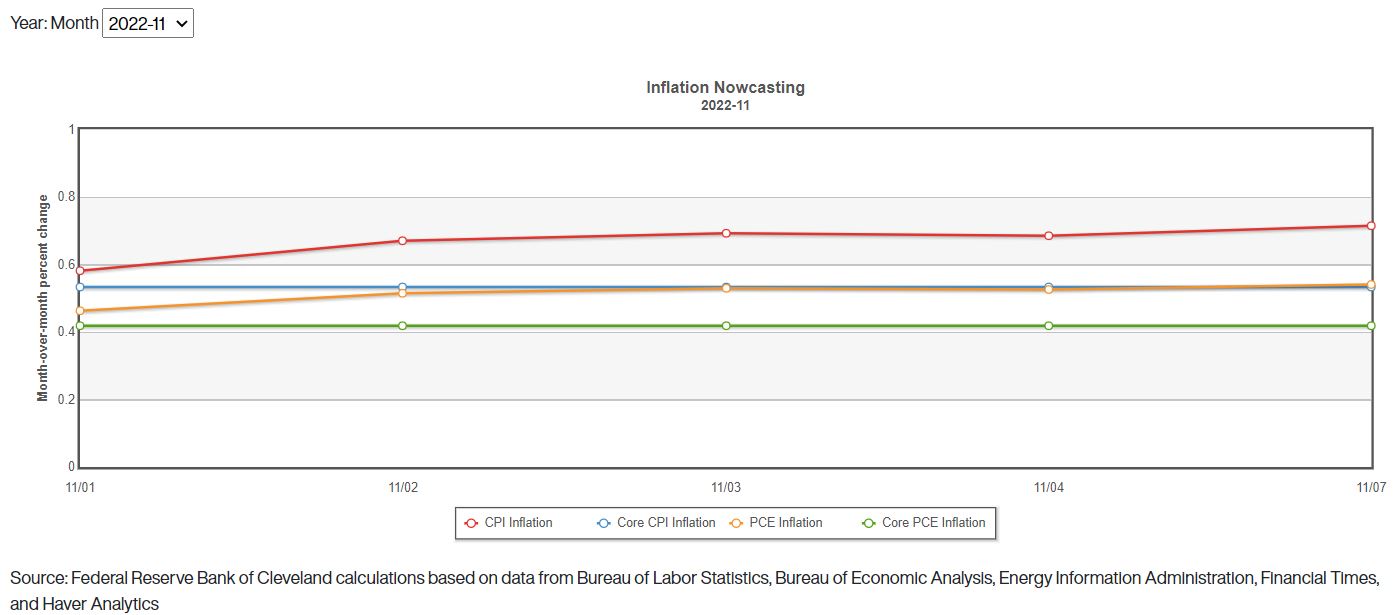

Any China reopening will be a disaster for stocks as it pushes an entirely new round of commodity inflation before the Fed has dealt with the last round. US inflation is still stuck fast in the Fed’s Nowcast model and the jobs report suggested another 75bps hike in December:

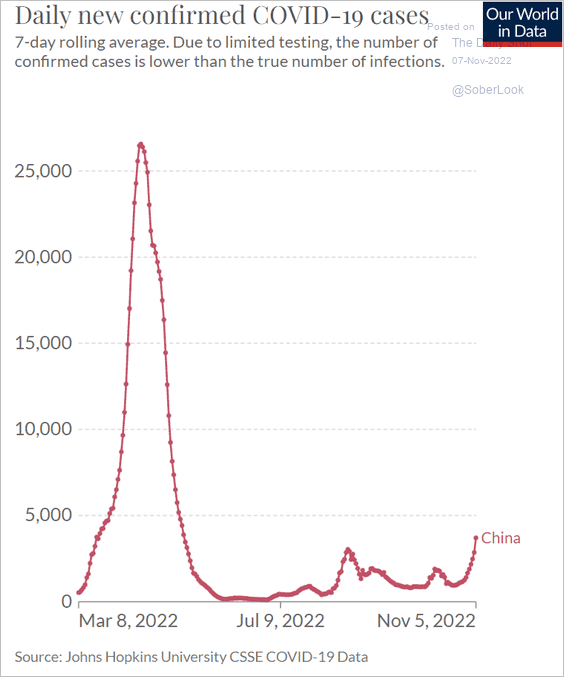

As well, any Chinese reopening will be slow. Not to mention that its economy is about to be locked down not open up in the short term:

As well as being hammered by a trade shock even as its property crash rolls on.

But these reflexive markets can crash down and up on a butterfly’s wing.

AUD included.