DXY firmed last night:

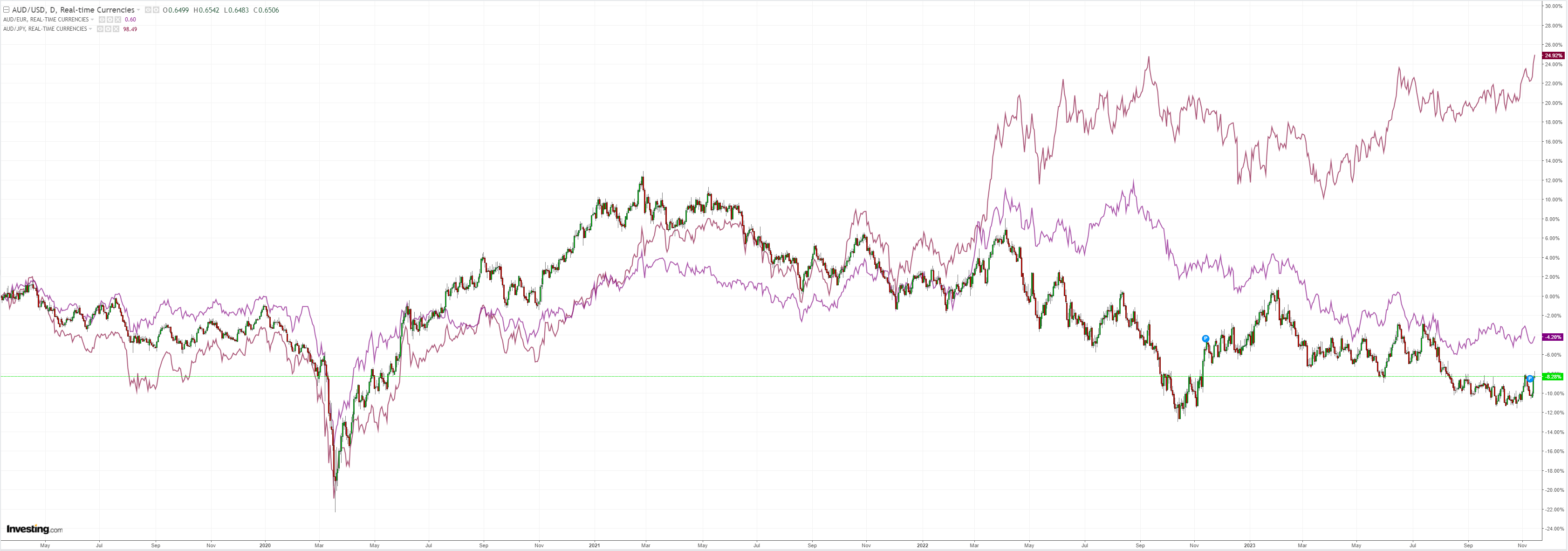

But AUD did too:

Even the peg is firming:

But not oil or gold:

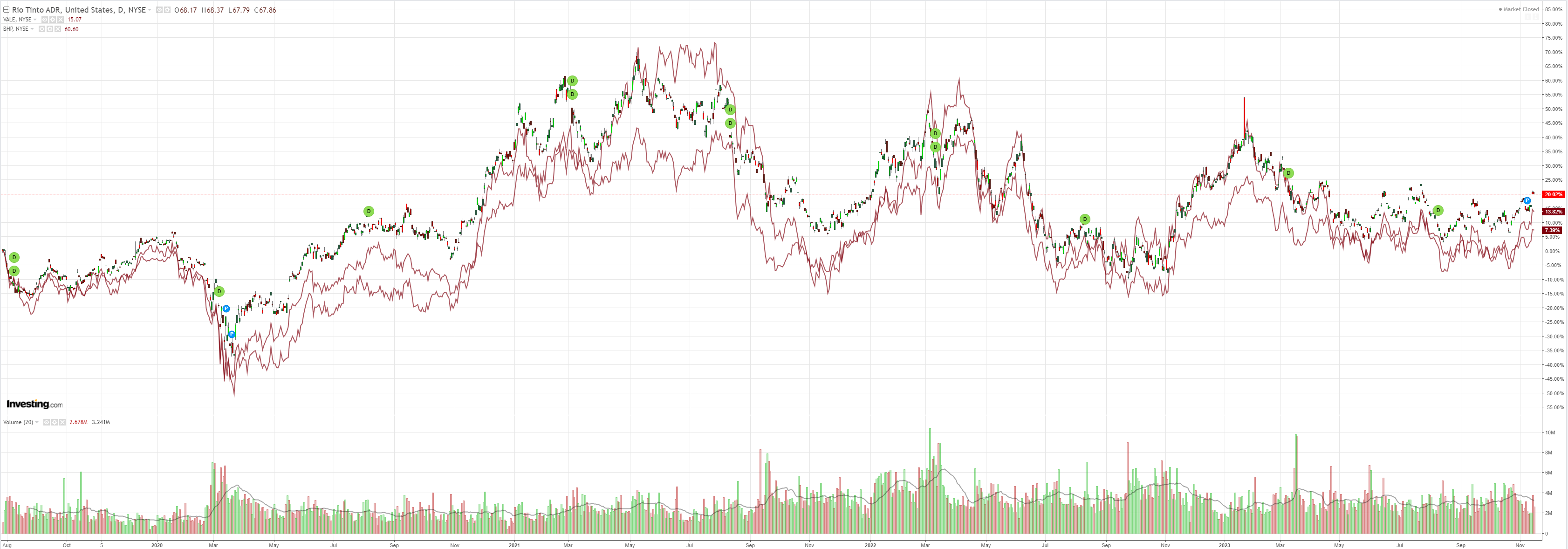

Dirt wants in:

Miners meh:

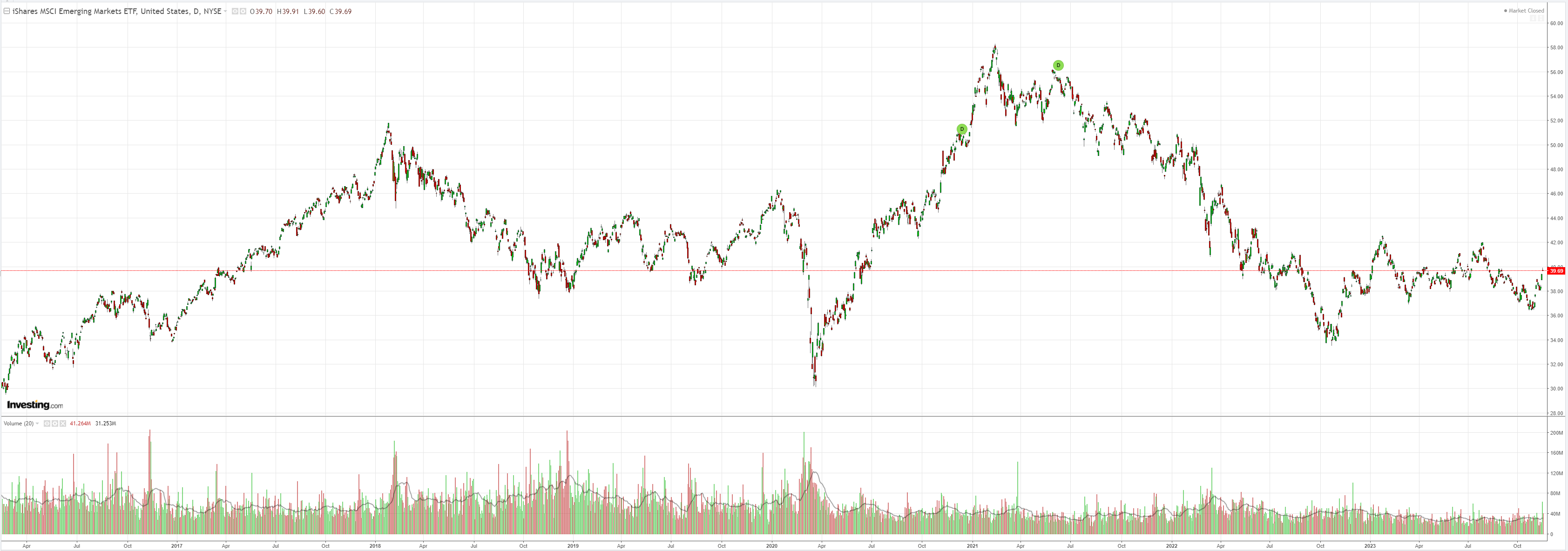

EM yawn:

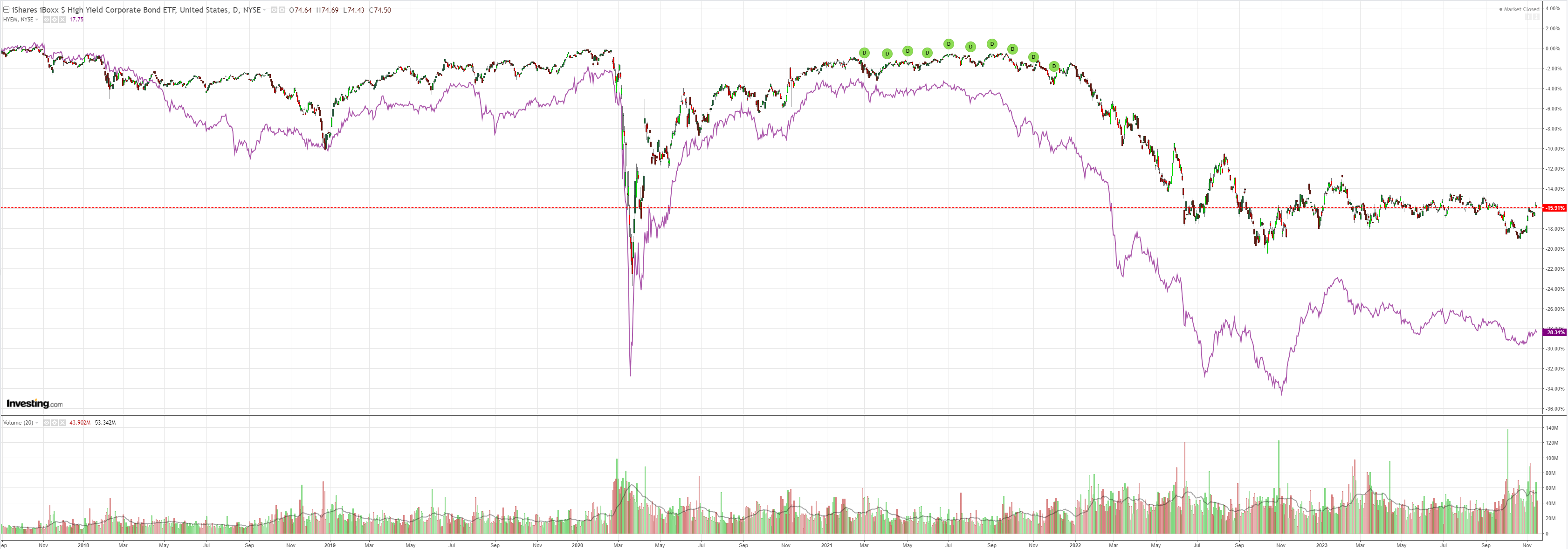

Junk is not corroborating risk:

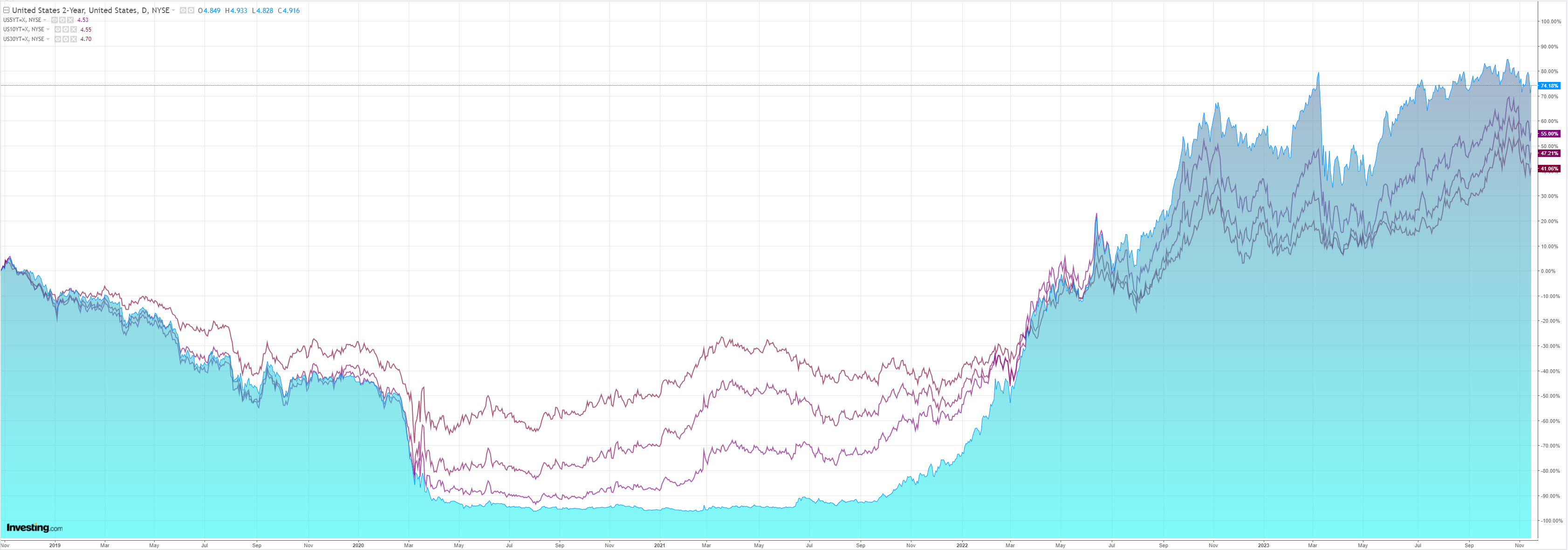

Yields rose:

Stocks stalled:

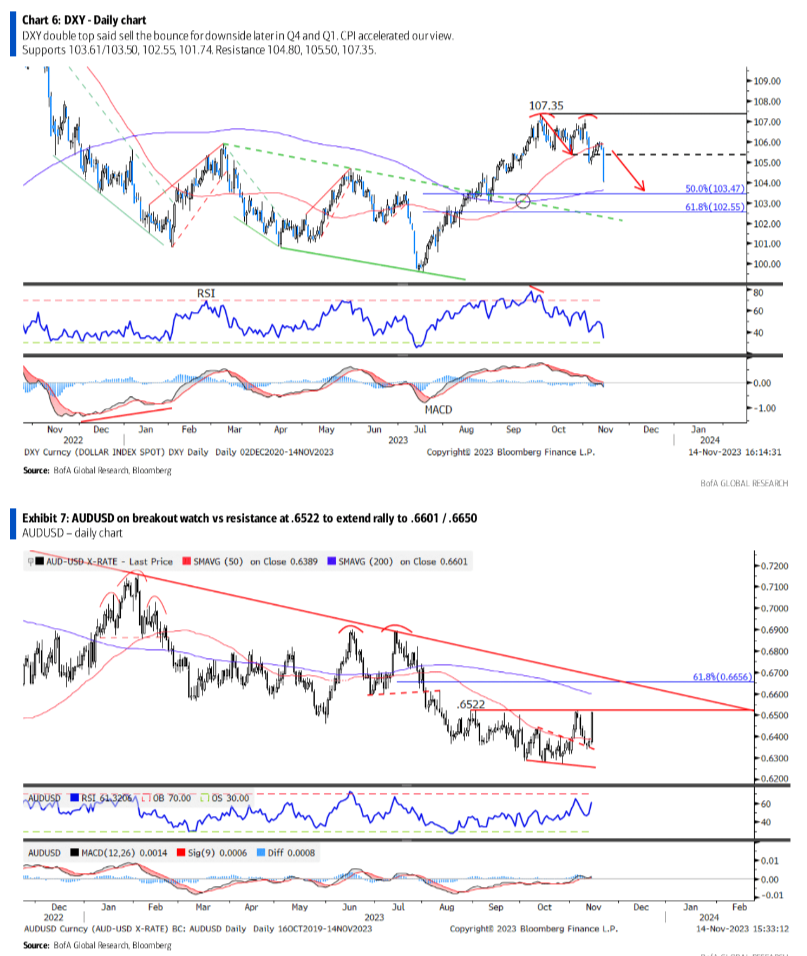

US data was soft with PPI -0.5 and retail sales down. BofA says buy AUD:

Goldilocks resumed post US CPI, crushing the USD

Today’s highly anticipated CPI print for October printed below expectations and showed further signs of disinflationary impulses amidst the trend of softening US economic data.

This prompted a notable cross-market response: higher equities lower US yields, area ssessment of Fed expectations, and the biggest sell-off of the DXY year-to-date.

This cross-market price action in 4Q23 has been repeating 4Q22 (goldilocks for risk assets).

This resulted in the DXY forming a double top with initial downside to 103.50.

Market reaction to weaker than expected US CPI accelerated the move with the majority of technical pattern downside already reached (103.50).

However, the DXY is not yet oversold and either a hawkish catalyst or macro risk-off scenario is needed to buy.

Short term: AUDUSD on bullish breakout watch vs .6522 to rally to .6601 / .6650.USDZAR testing “double support” lines at 18.16 which, if broken, may lead to 17.60.