DXY popped:

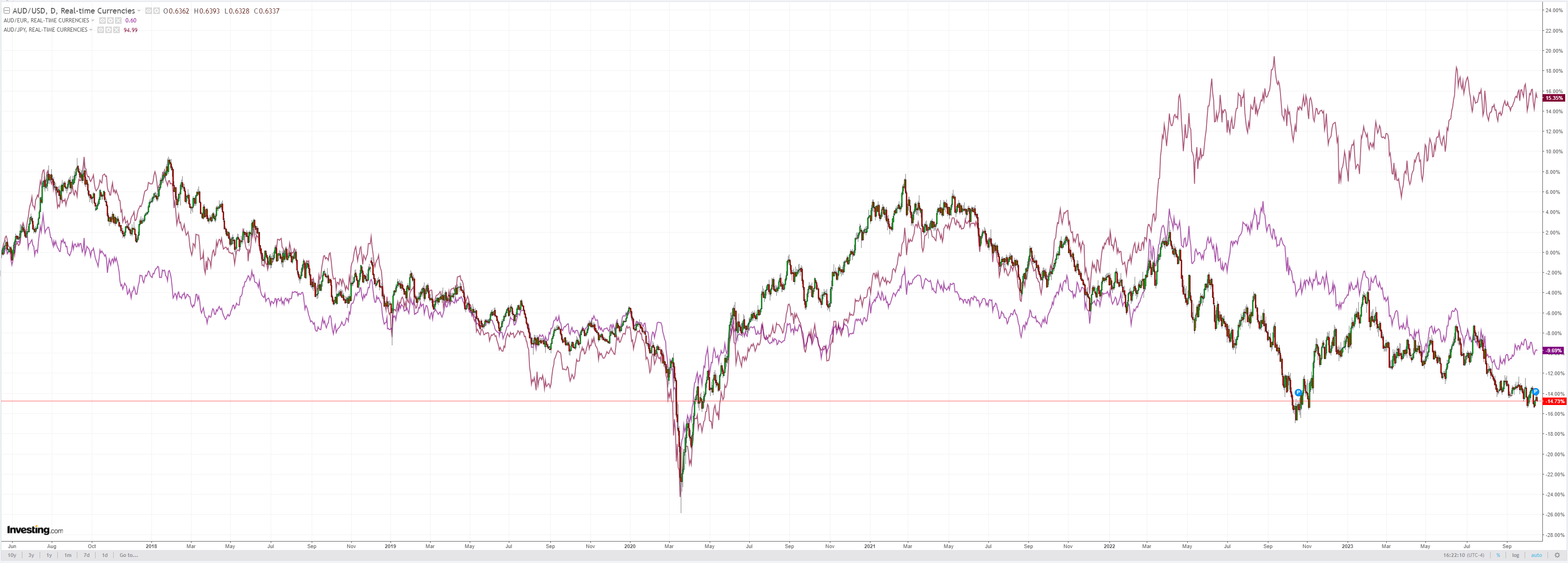

AUD dropped:

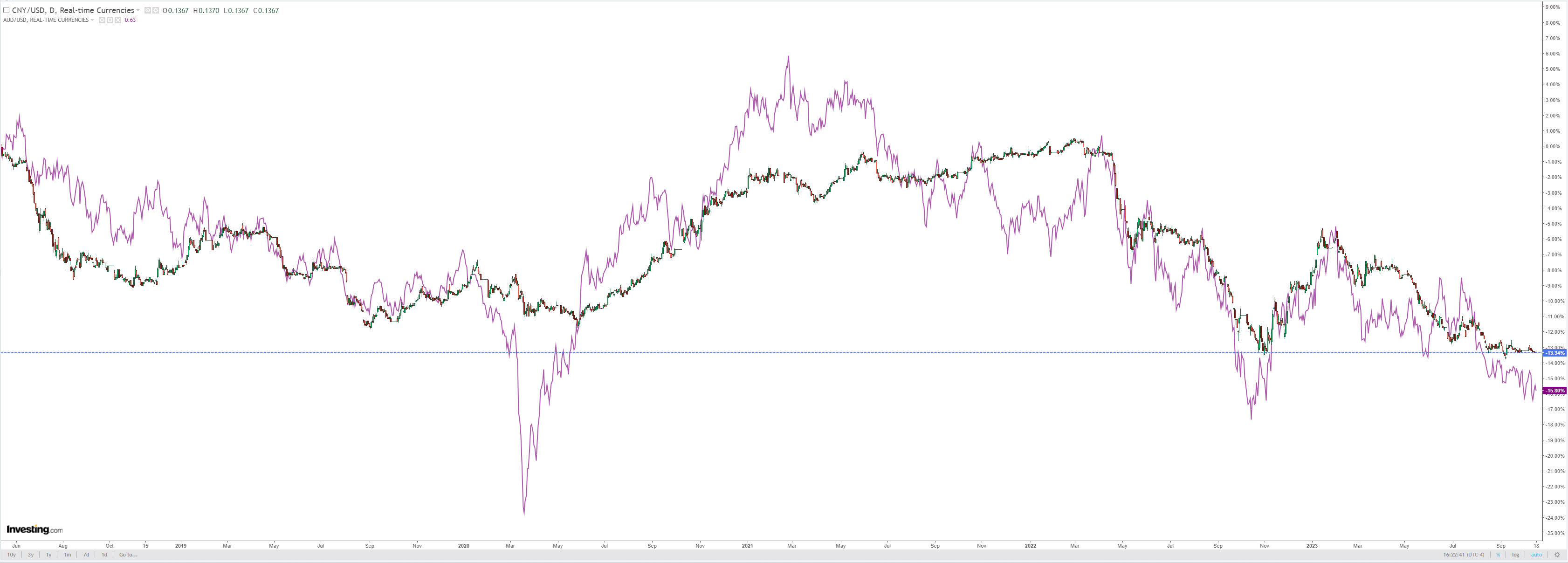

CNY is over:

The oil and gold show continues:

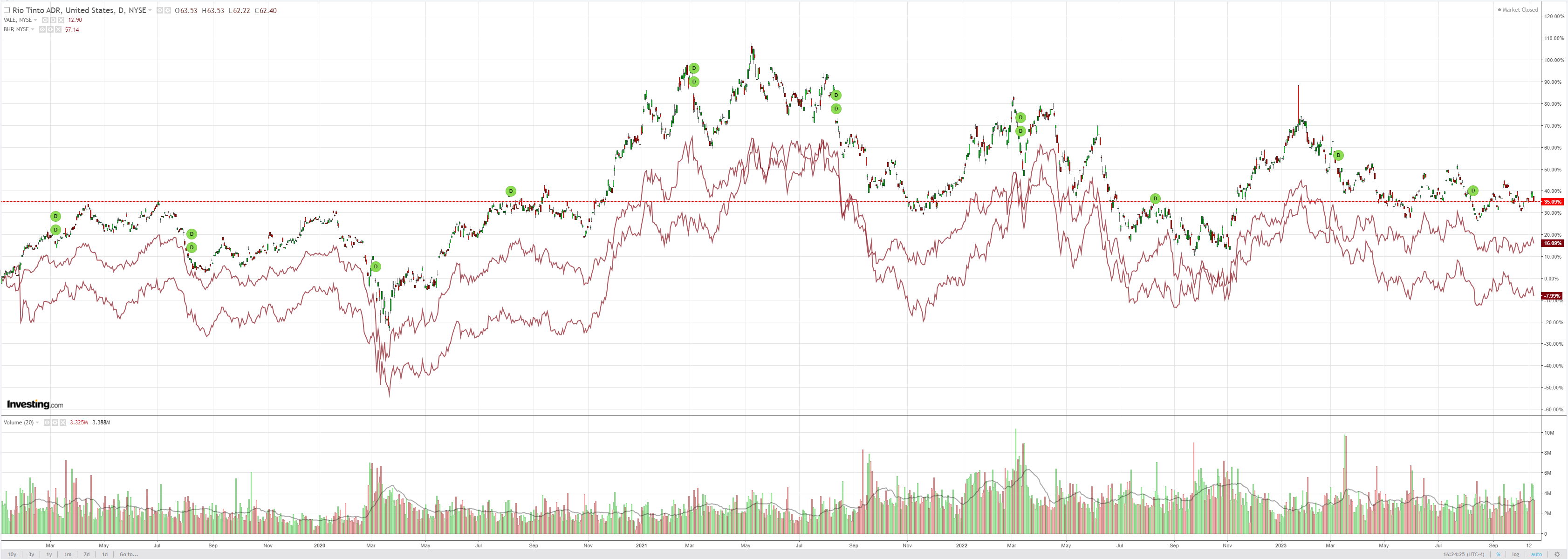

Base metals are waiting to die:

Big miners sank:

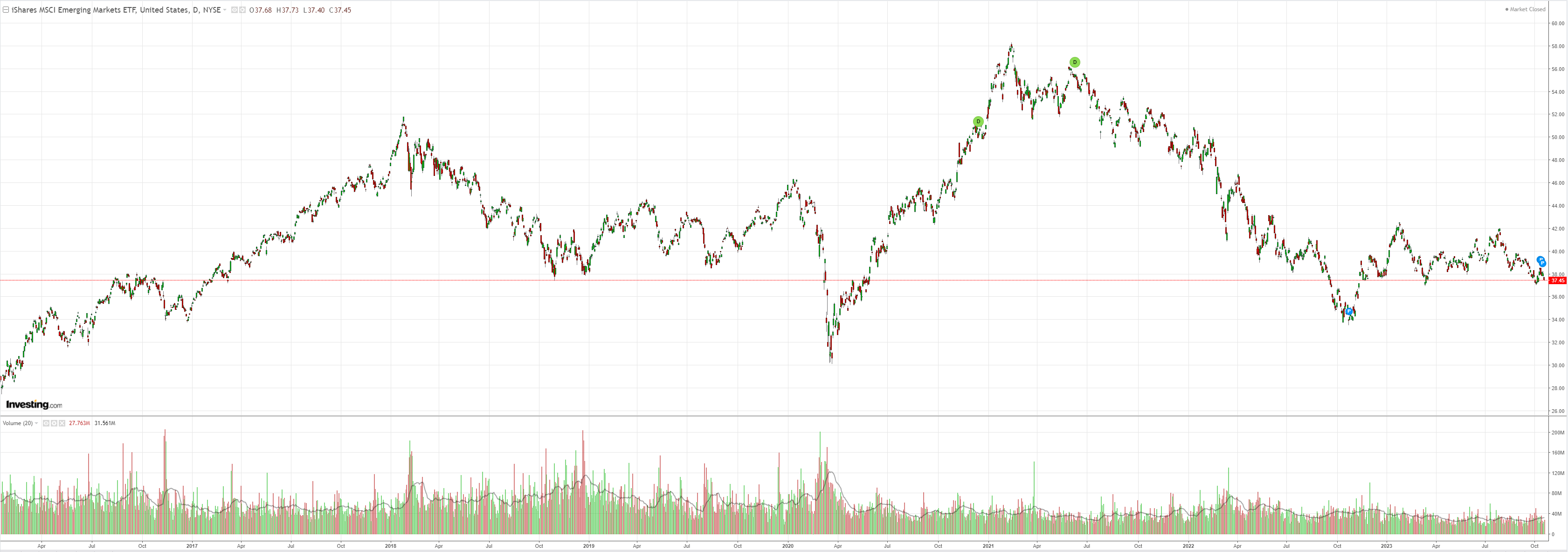

EM breakdown imminent:

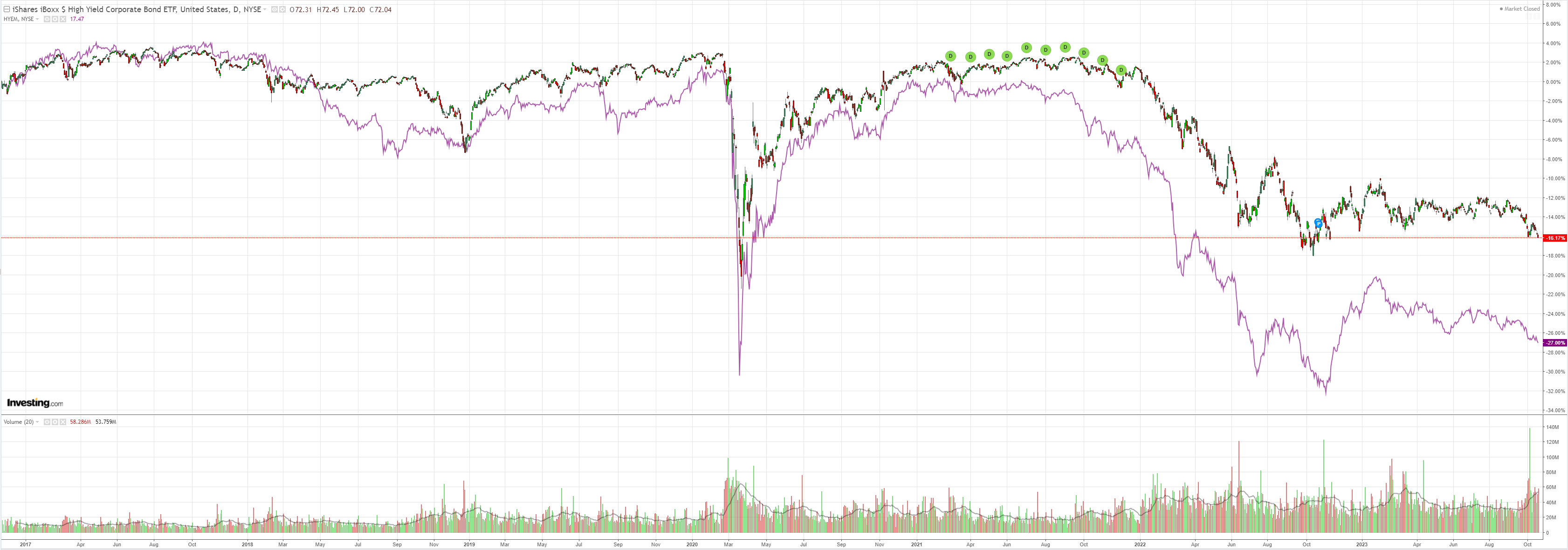

Junk is leading the way:

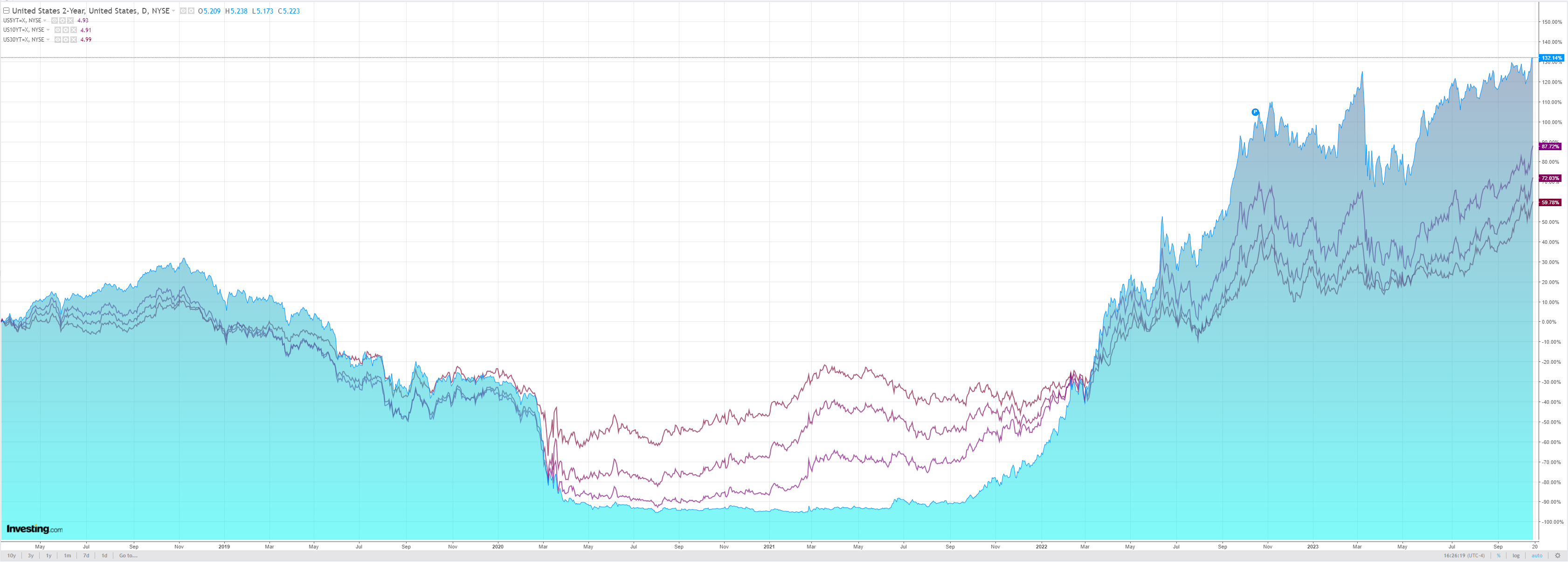

As yields seek the breaking point:

Which passed for stocks:

Markets are now discounting minimal disruption from the Israeli war via unwinding safe haven bets on bonds, but it is left with a still rising oil price. That will be DXY bullish in due course. Credit Agricole (EPA:CAGR):

The US rates and yields rallied in the wake of the better-than-expected US retail sales and industrial production releases yesterday. In that, US 2Y rates hit their highest levels since 2006 while the UST 10Y yields moved very close to their highest level since 2007 that they reached earlier in October. There also appears to be an interesting disconnect between the rally in US rates and yields and the USD’s recent underperformance.

One potential explanation for that would be the fact that rates and yields outside of the US are on the rise as well (eg, in Australia) and this is keeping the USD relative rate appeal little changed especially in real terms. The USD is also the biggest FX market long according to our latest FX positioning data and the latest FX price action looks a lot like profit taking of extended longs. All that being said, the USD is starting to look undervalued vs the EUR, GBP, CAD and JPY according to our short-term fair value models that are based on relative rate differentials among other fundamental FX drivers. The longer the decoupling between FX and rates continues, the cheaper the USD will look.

I expect another leg up for DXY and another leg down for AUD as bond markets sniff out the cyclical breaking point.