DXY roared back last night:

AUD was burned alive:

CNY has ceased to float:

Oil and gold fell:

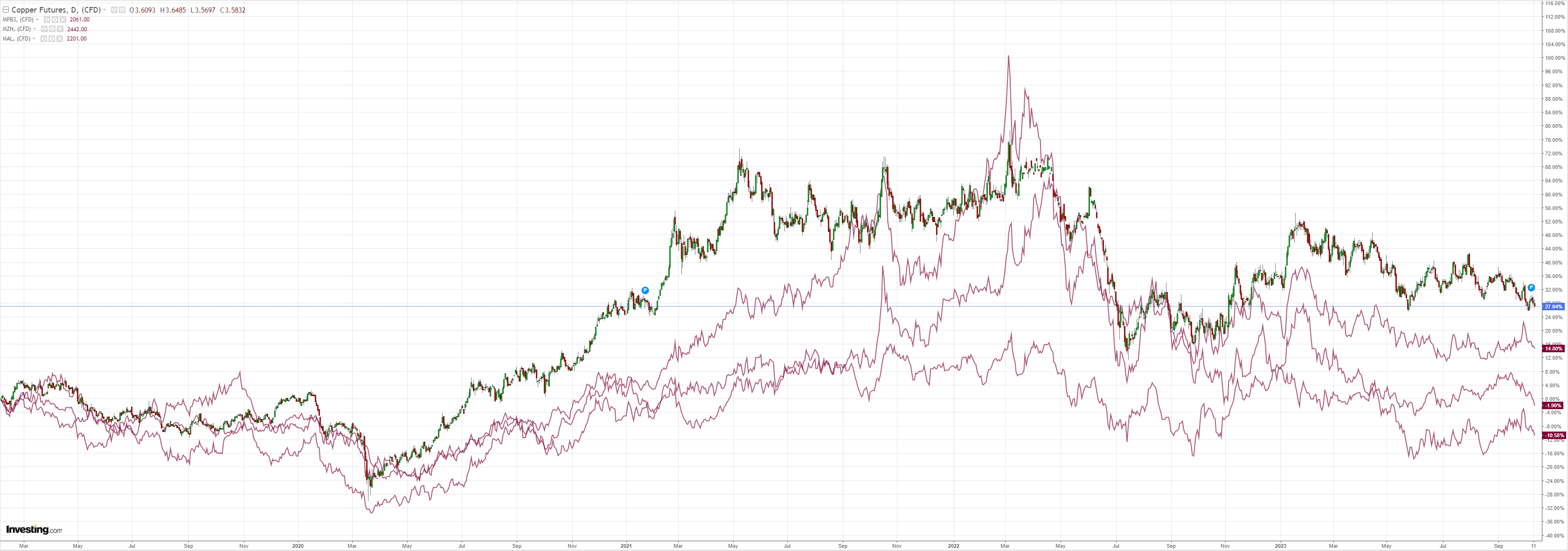

Dirt was hosed away:

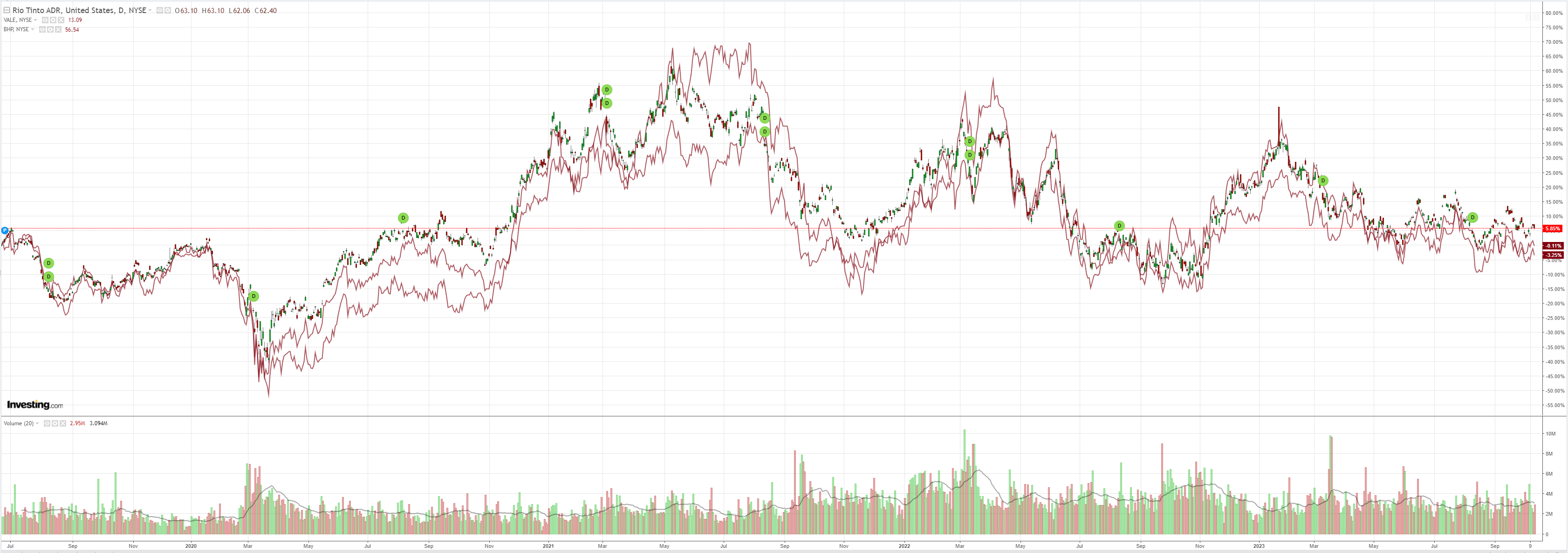

Miners too:

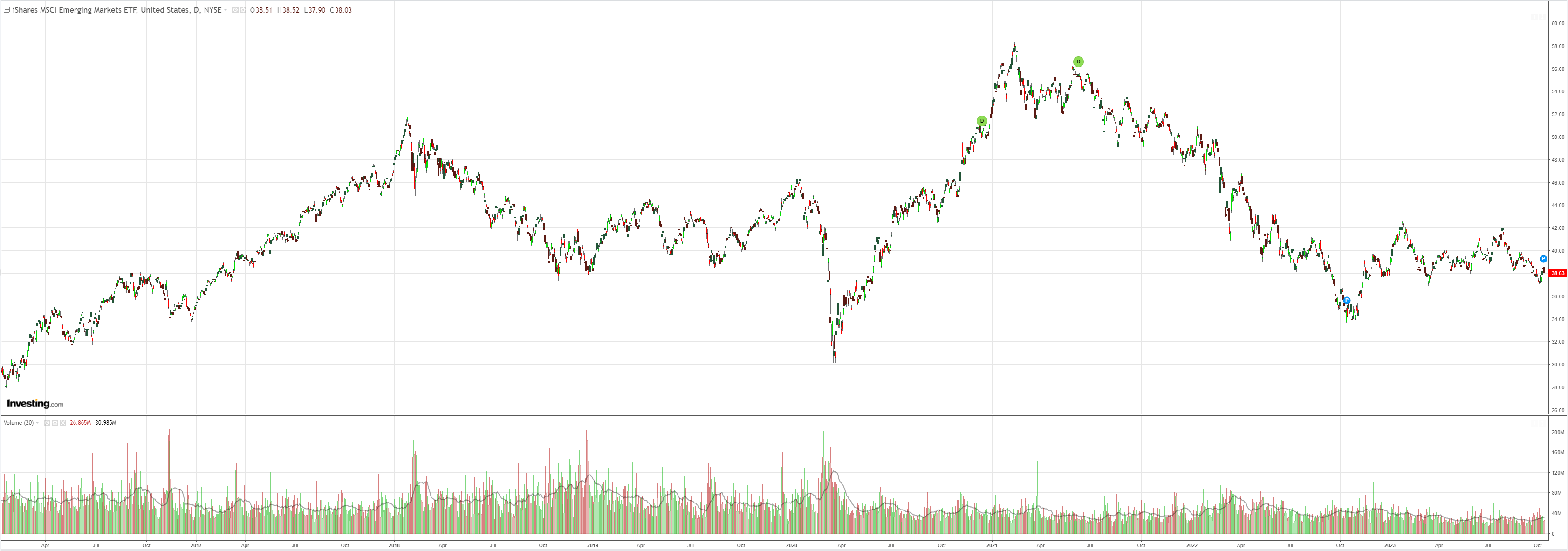

And EM:

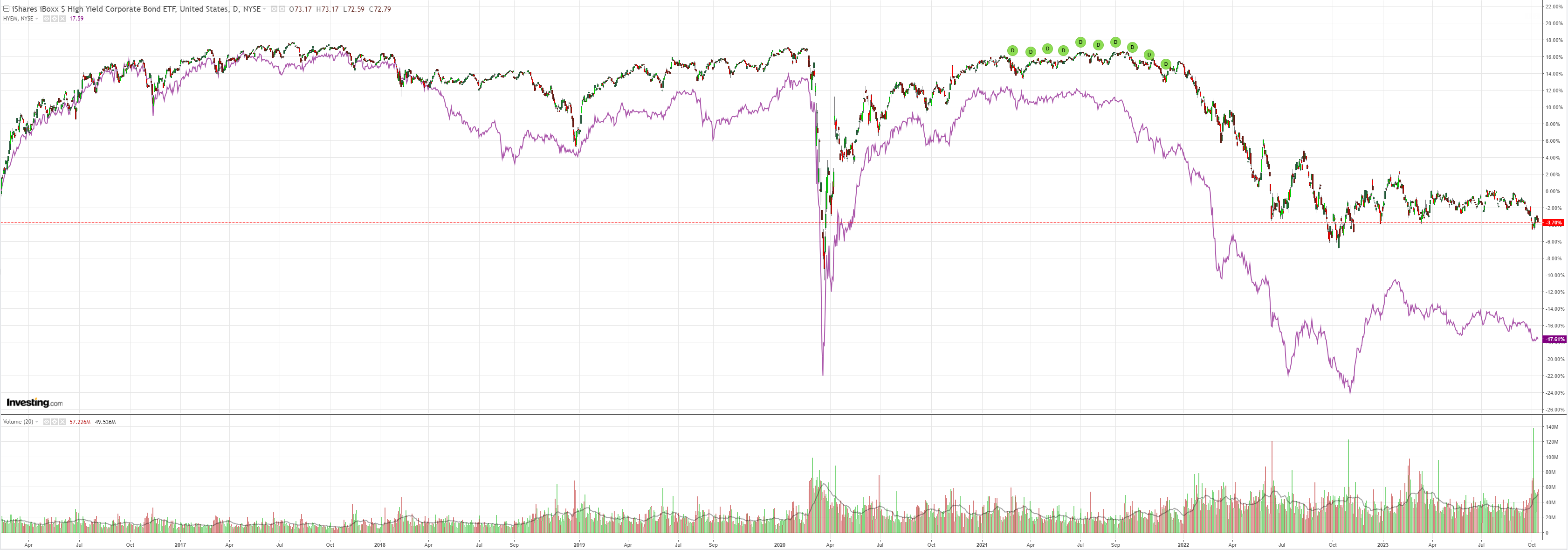

Junk declined:

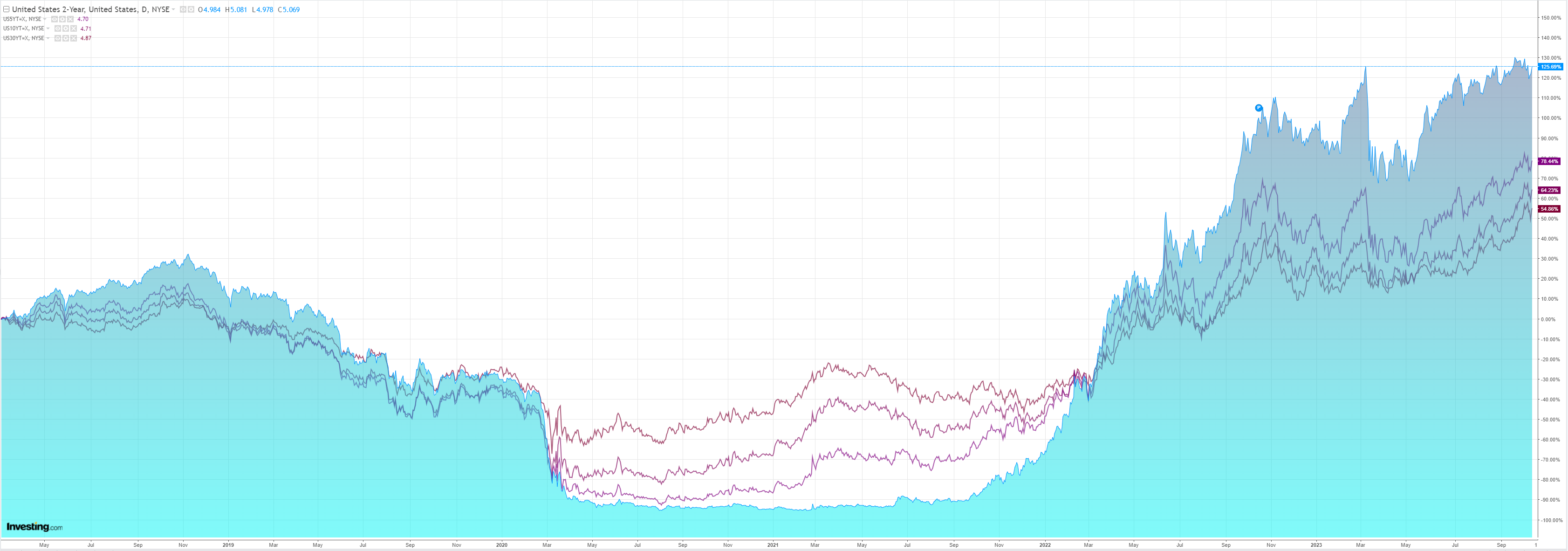

Yields spiked:

Stock sagged:

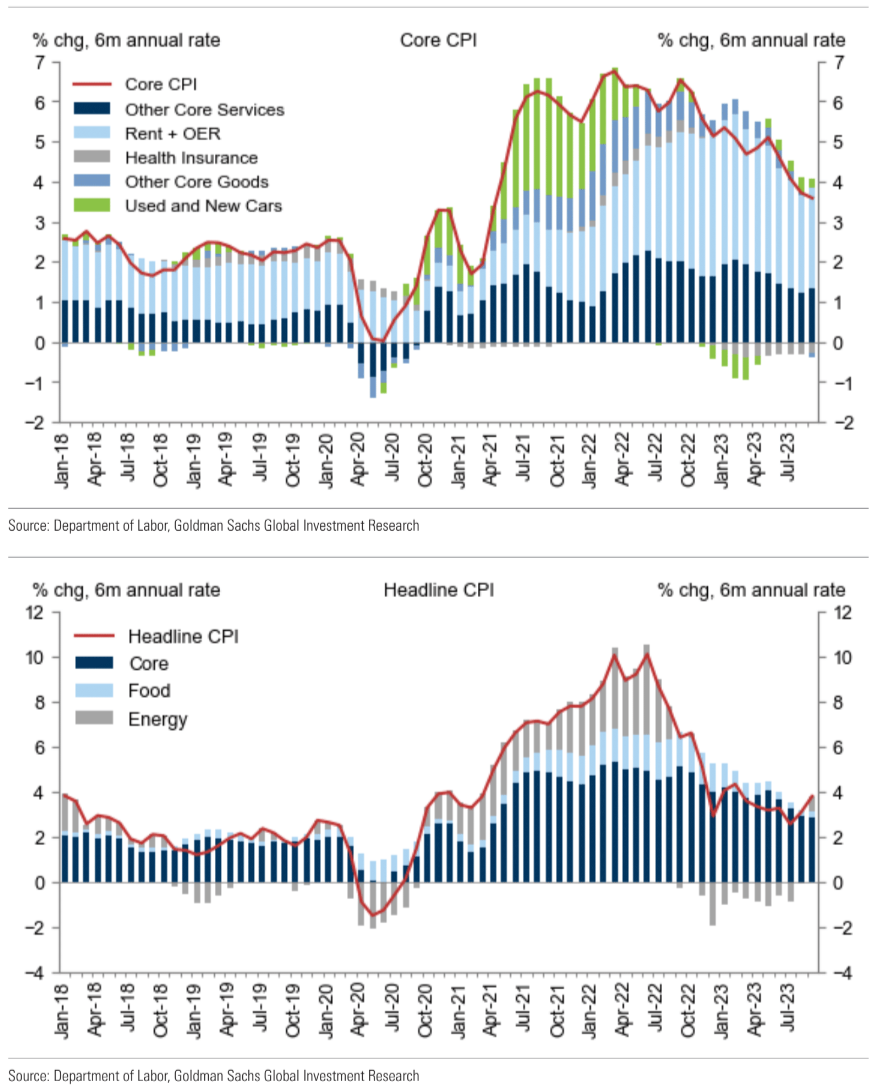

Goldman wraps the US CPI:

September core CPI rose 0.32% (mom sa), 2bp above consensus and 12bp above the prior three-month average of 0.20%. The year-on-year rate declined by two tenths to 4.1%. Used cars contributed -0.09pp to the core (mom sa), and we expect additional declines in used car prices in coming months, though the degree of uncertainty around these declines has risen, in part as a result of the ongoing auto strikes. More importantly, the sharp decline in owners’ equivalent rent inflation in August was reversed in September (+0.56% in September vs. +0.38% in August and +0.49% in July) and rent inflation edged slightly higher (+0.49% in September vs. +0.48% in August and +0.42% in July), though we suspect that part of the rebound in OER reflects a boost from the imputation of utility prices. Travel categories (lodging +3.7%, airfares+0.3%) and hospital services (+1.5%, largest monthly increase since 2016) were firmer than we expected and contributed to a sharp acceleration in core services prices excluding rent and OER (+0.61% vs. prior three-month average +0.18%). That being said, the sequential acceleration in core services prices likely overstates any pick up in price pressures for wage-sensitive categories, as seasonal adjustment issues likely depressed readings in prior months and the September reading was boosted by the noisy and often mean-reverting travel categories. Nonetheless, inflation breadth widened, with our estimate of the Cleveland Fed’s trimmed-mean CPI inflation at +0.39% in September compared to +0.29% in August and +0.21% in July. Also of note, car insurance inflation remained strong (+1.3%, mom sa) as carriers continue to pass through the lagged impact of higher repair and replacement costs. Headline CPI rose 0.40%, as food prices increased 0.2% but energy prices rose 1.5%.

It is not as bad as it looks because rents are falling in the real world and the lagging CPI will catch down soon.

However, it is bad enough. And the Fed should hike again in November. It should have learned that playing smart arse with inflation is a fool’s game for central banks. It must be crushed.

Has it learned this lesson? I don’t know. The speed with which various governors have pivoted dovish on the bond back-up suggests not.

So, I’m divided. The Fed should hike in November, but I do not know if it will and, if not, it will unleash another monster equity rally to kick the cycle along and give inflation another chance to rebound.

Until we know, AUD bounces along the bottom.