Street Calls of the Week

DXY faded:

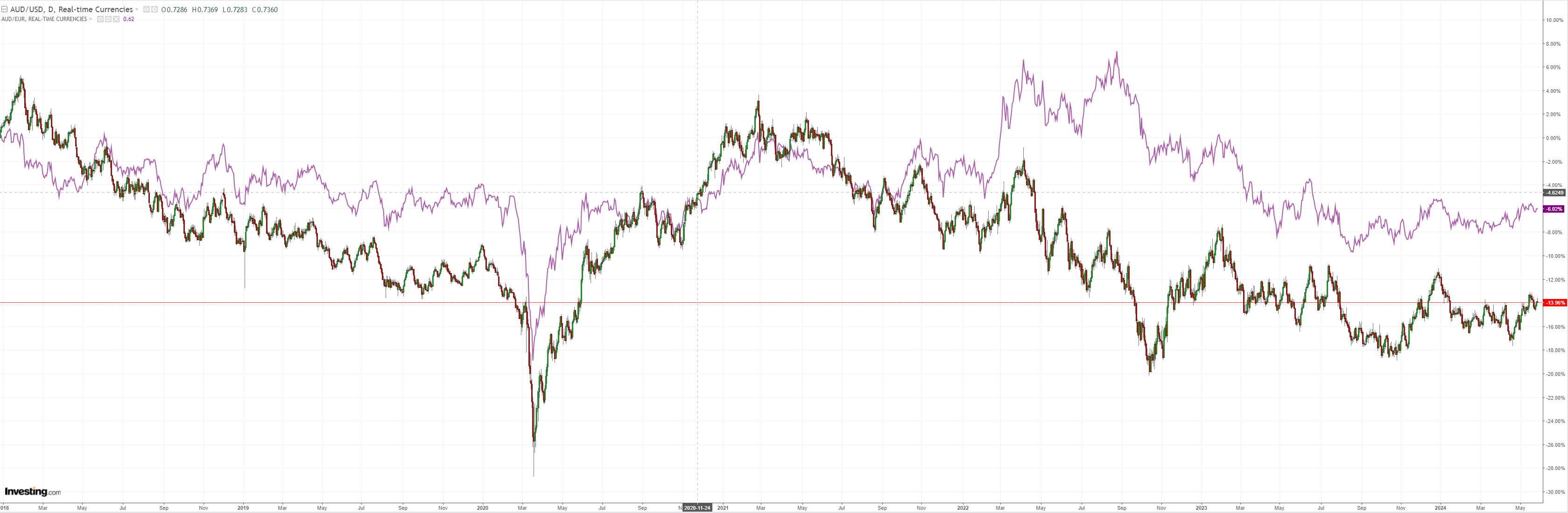

AUD is treading water:

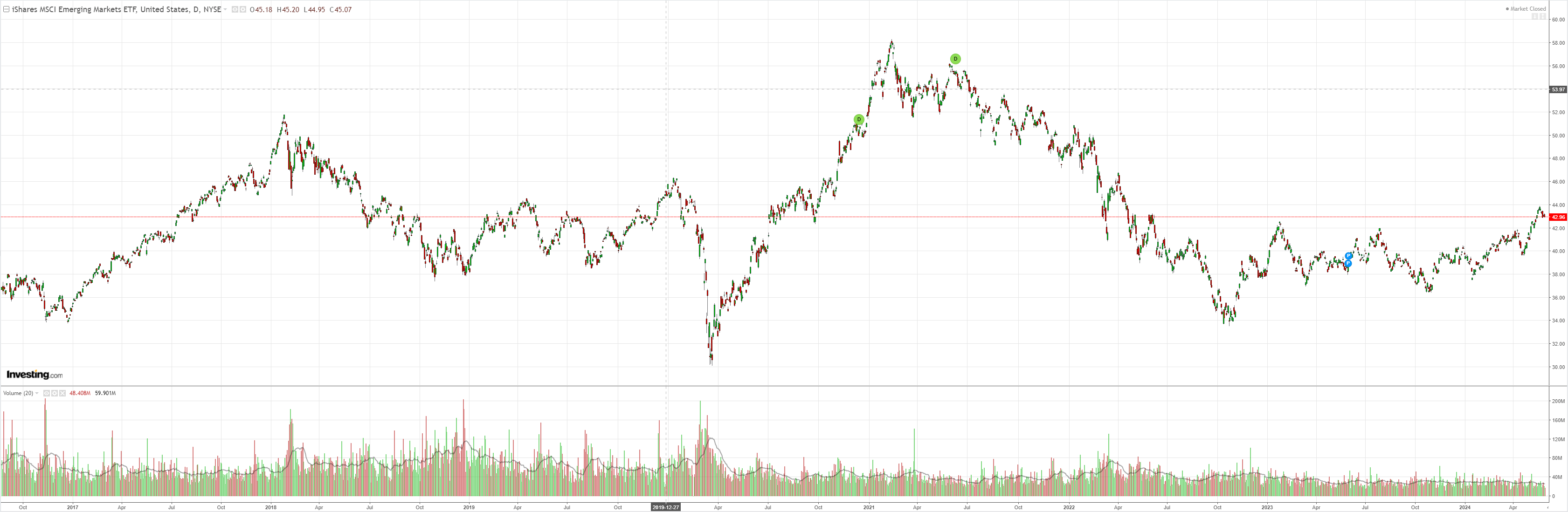

North Asia is weak:

Oil bounced:

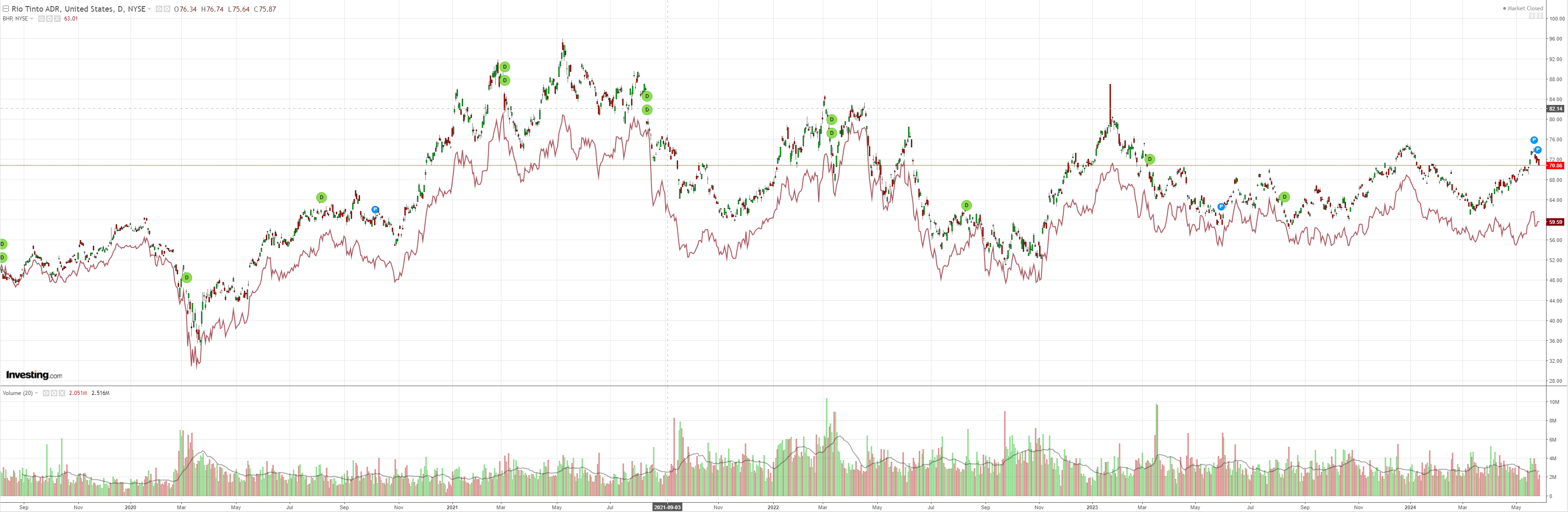

The dirt bubble resumed:

But not miners:

Nor EM:

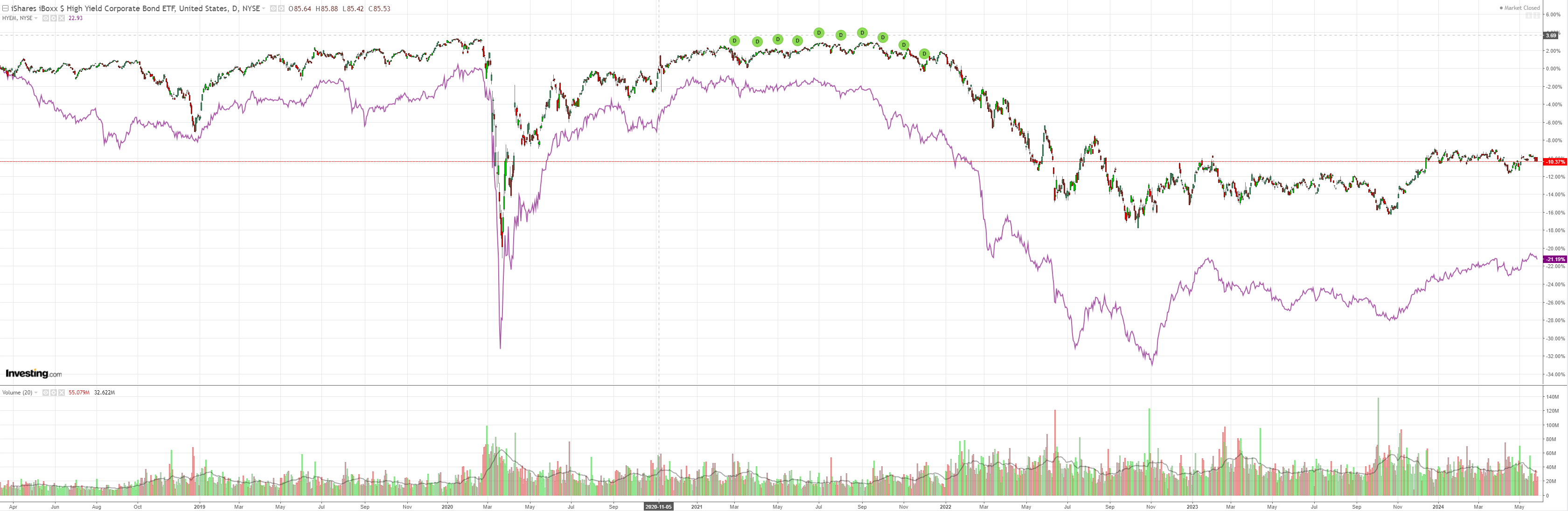

Junk warned:

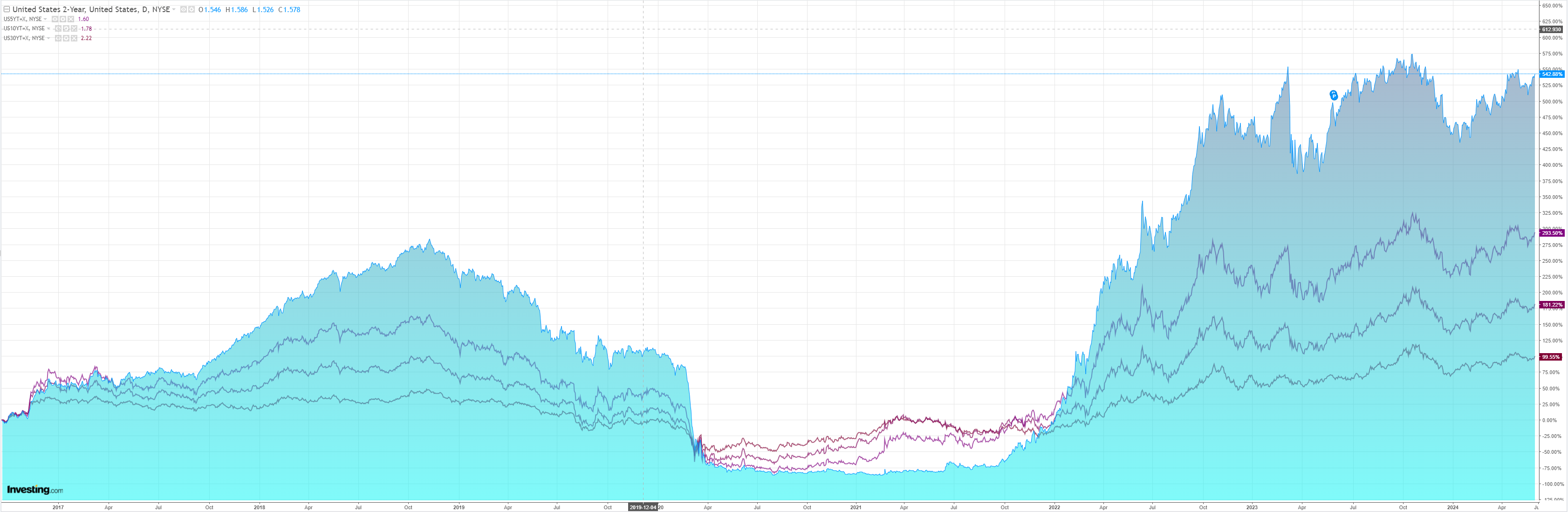

As the yield steepening returned:

Stocks were mixed:

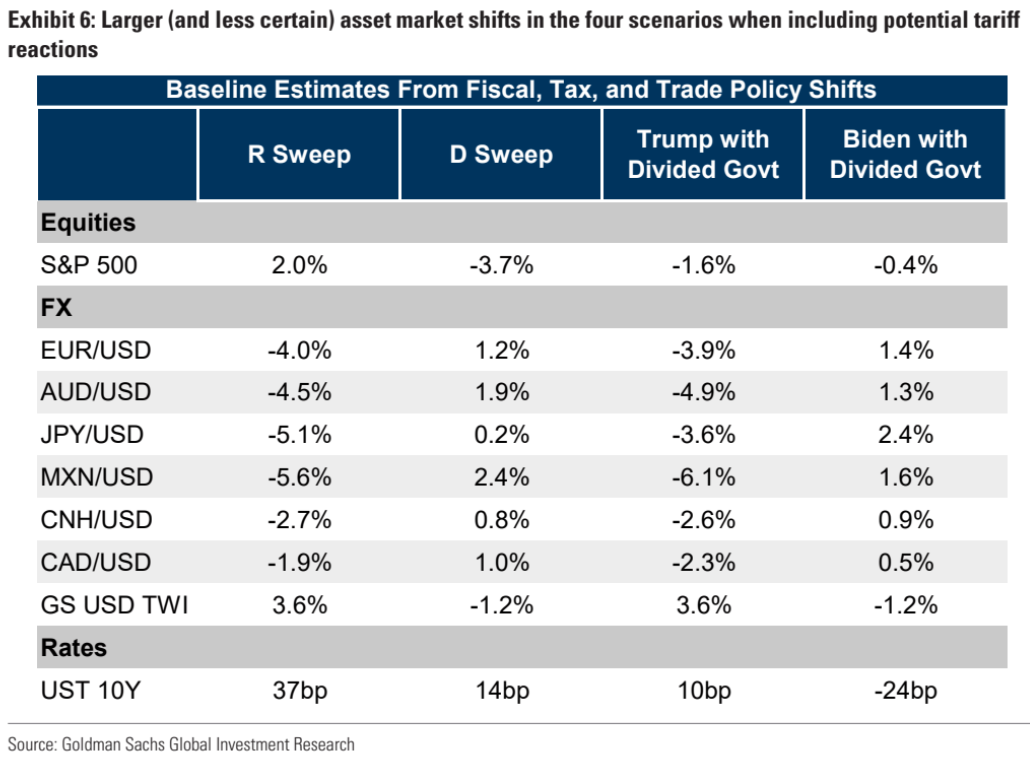

Goldman has a few ideas about how the US election will play out for forex. Its baseline scenario currently projects

- a moderate rally in equities, higher yields, and a strengthening of the US dollar in the event of a Republican sweep;

- a modest decline in equity, higher yields, and a strengthening of the US dollar in the event of a Democratic sweep;

- a modest decline in equity, slightly higher yields, and a strengthening of the US dollar in the event of a Trump with divided government;

- flat equities, lower yields, and USD weakness in a Biden with divided government outcome.

Other possible policy changes (such as Fed risks and geopolitical tail risks) could also expand the consequences for forex.

But Goldman argues that the asset footprint observed in 2016 might not consistently follow a Republican sweep, given the ambiguity surrounding policy.

Since a stronger USD is the most constant response to tariff threats, Goldman views it as the most dependable effect of a likely Republican triumph.

In either “sweep” scenario, higher yields are more likely than in divided government scenarios.

In short, the AUD will fall on a Trump win, a little less if it is a clean sweep.

I find it hard to believe that more Trump would be less AUD bearish.