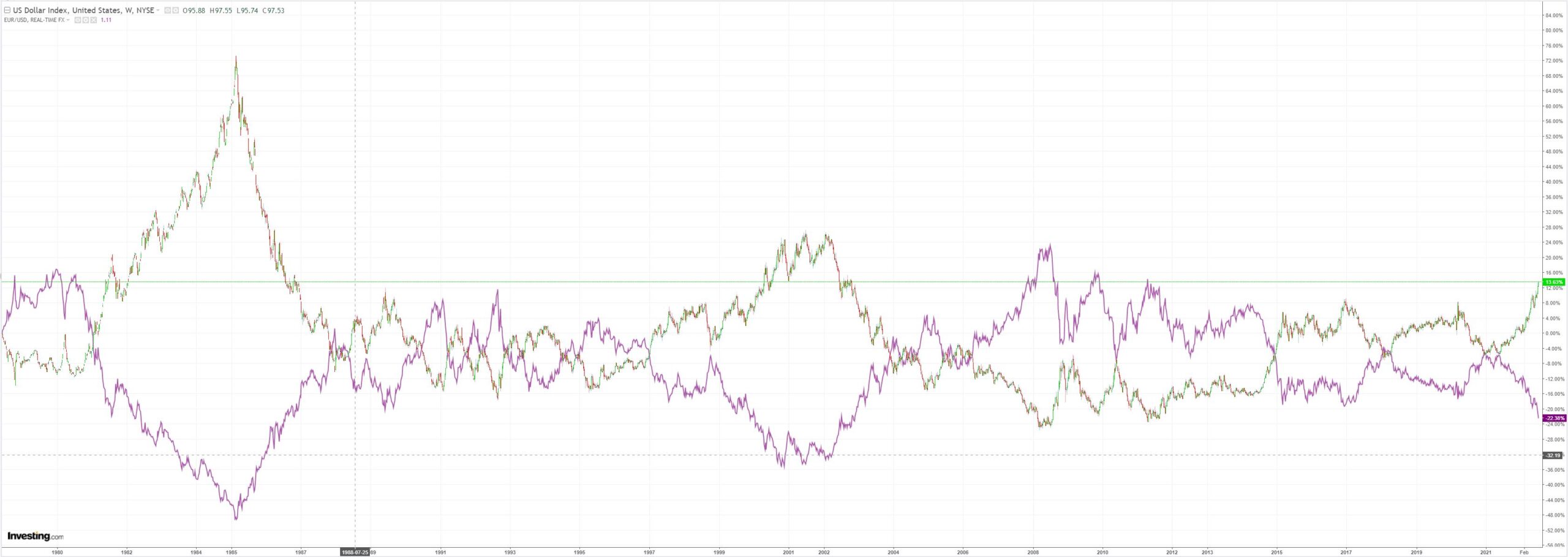

DXY is rampant as EUR heads for Hades:

AUD can’t take the heat:

Oil only eased:

As metals puked anew:

Big miners (LON:GLEN) too:

EM stocks (NYSE:EEM) are back at the brink:

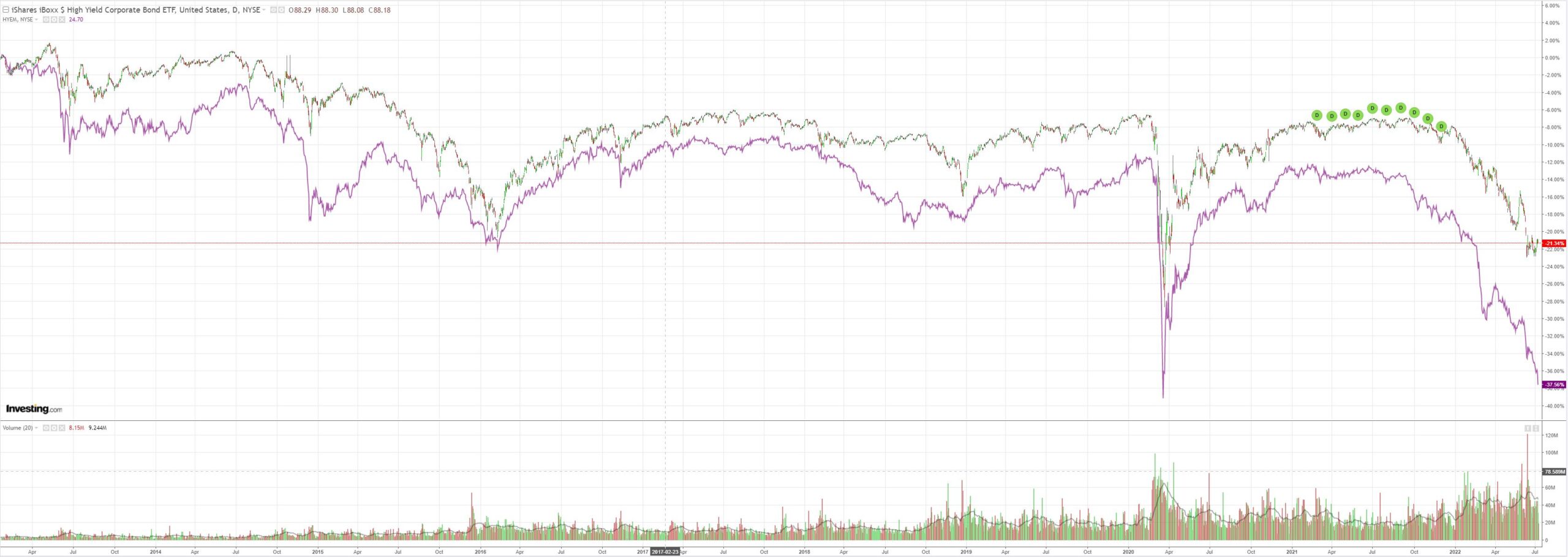

EM junk (NYSE:HYG) is a medieval comet of doom:

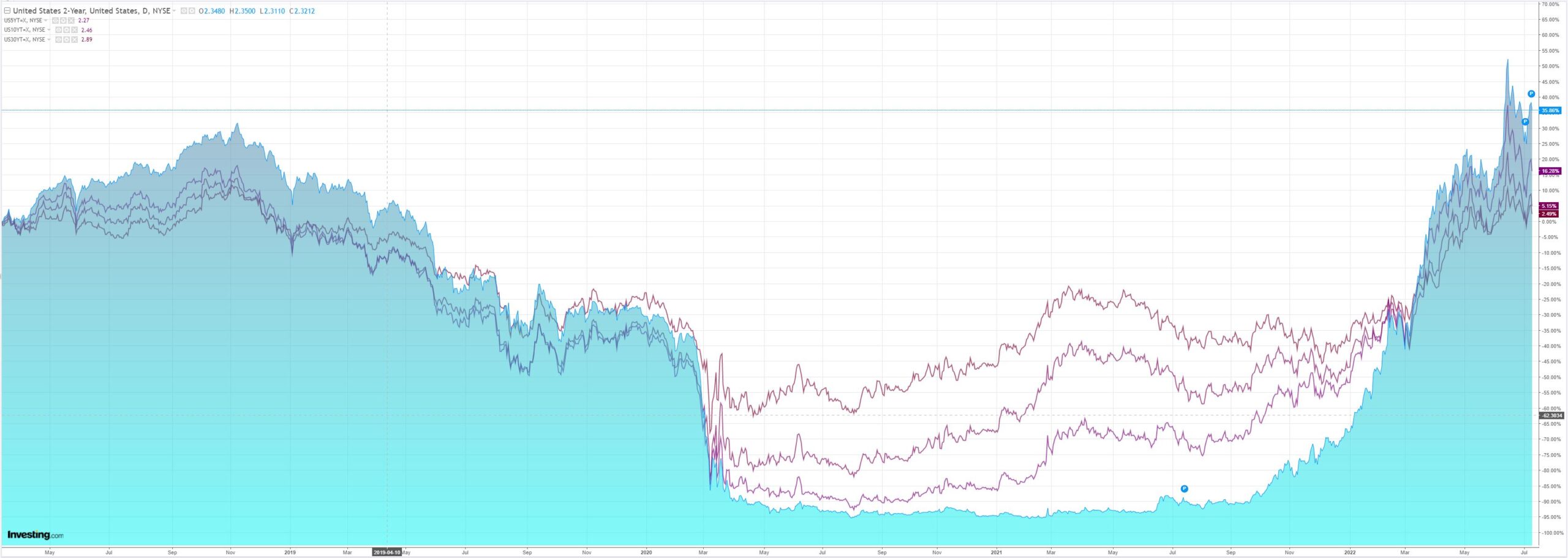

Treasury yields rolled and the curve was steamrolled:

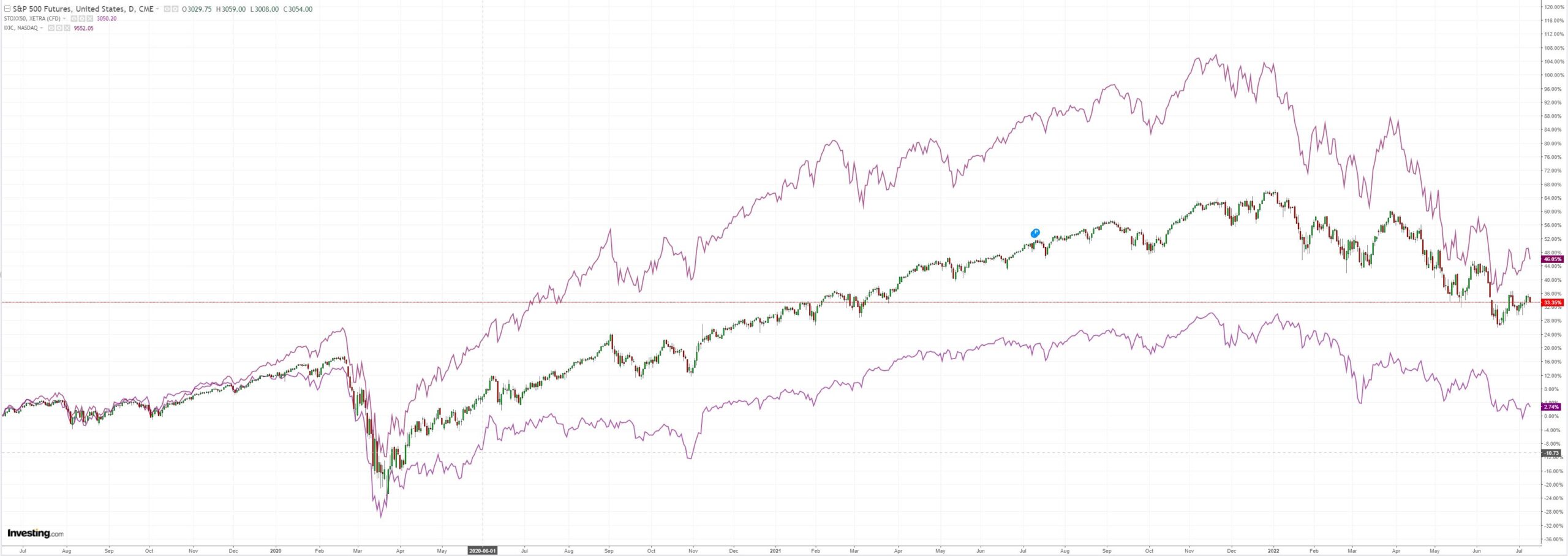

Stocks swooned anyway:

Westpac has the wrap:

Event Wrap

FOMC member George said she is worried about the potential negative consequences of “oversteering” policy. She said “communicating the path for interest rates is likely far more consequential than the speed with which we get there.” Further aggressive and “abrupt” action could do more harm than good, she believed. She found it “remarkable” that after just four months of rate hikes, there is already discussion of recession risk and rate cuts next year. Bullard expects the FOMC to achieve a soft landing, since the economy looks strong enough to withstand the rate hikes. He does not believe the Fed needs to drive the economy into recession or boost the unemployment rate as it works to lower inflation and achieve its 2% target.

Event Outlook

Aust: Westpac-MI Consumer Sentiment is set to see interest rate concerns dominate again with the RBA’s second consecutive 50bp rate hike in July. The June NAB business survey will provide further insight into how conditions are being perceived by businesses. Meanwhile, overseas arrivals and departures should continue to forge ahead in June.

NZ: Net migration will likely remain low in May as both arrivals and departures rise.

Eur: The ZEW survey of expectations should continue to reflect the weakness in European confidence in July.

US: Cost pressures and labour shortages are expected to continue weighing on small business optimism in June (market f/c: 92.5). The FOMC’s Barkin is also due to speak.

DXY is on a tear after another good US jobs report and as we move towards the next US CPI report later this week.

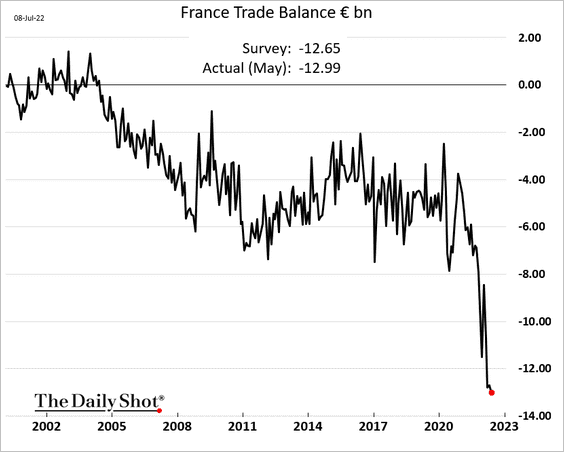

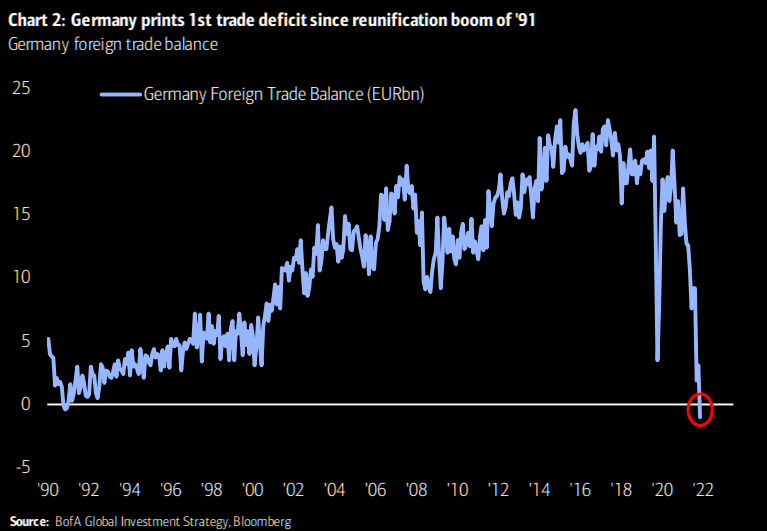

Moreover, EUR has turned reserve currency whipping boy as the Ukraine war turns the European economy inside out. Strong trade balances have been upended by energy imports:

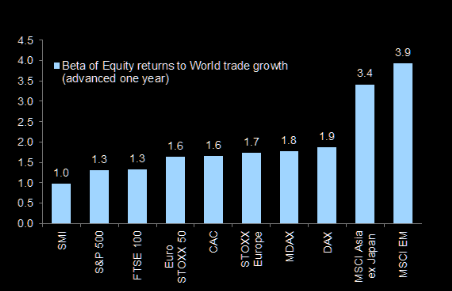

Deteriorating trade is making it worse:

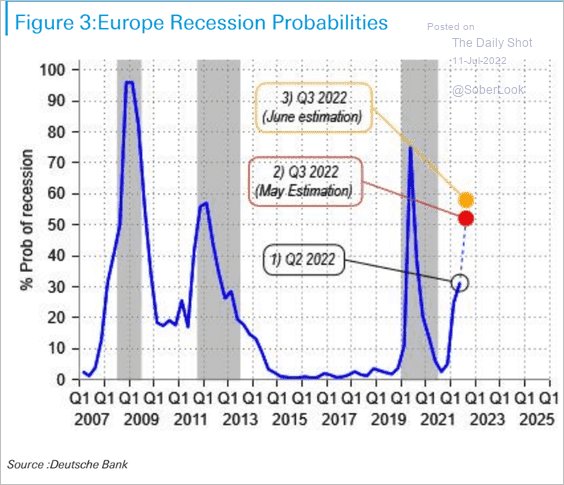

Recession risk is through the roof:

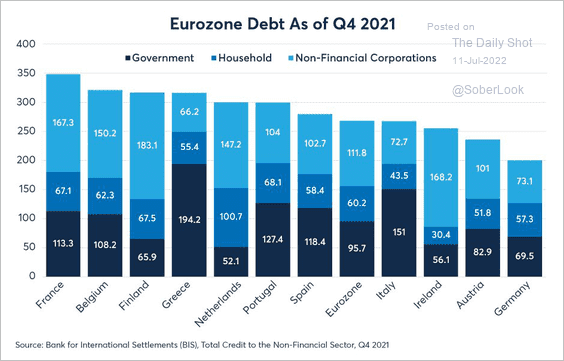

With break-up risk returning with a vengeance:

EUR has no chance of a rebound before the Fed turns. Frankly, unless something changes in energy, it doesn’t appear to have much basis for a rally after that, either.

Where EUR goes AUD follows!