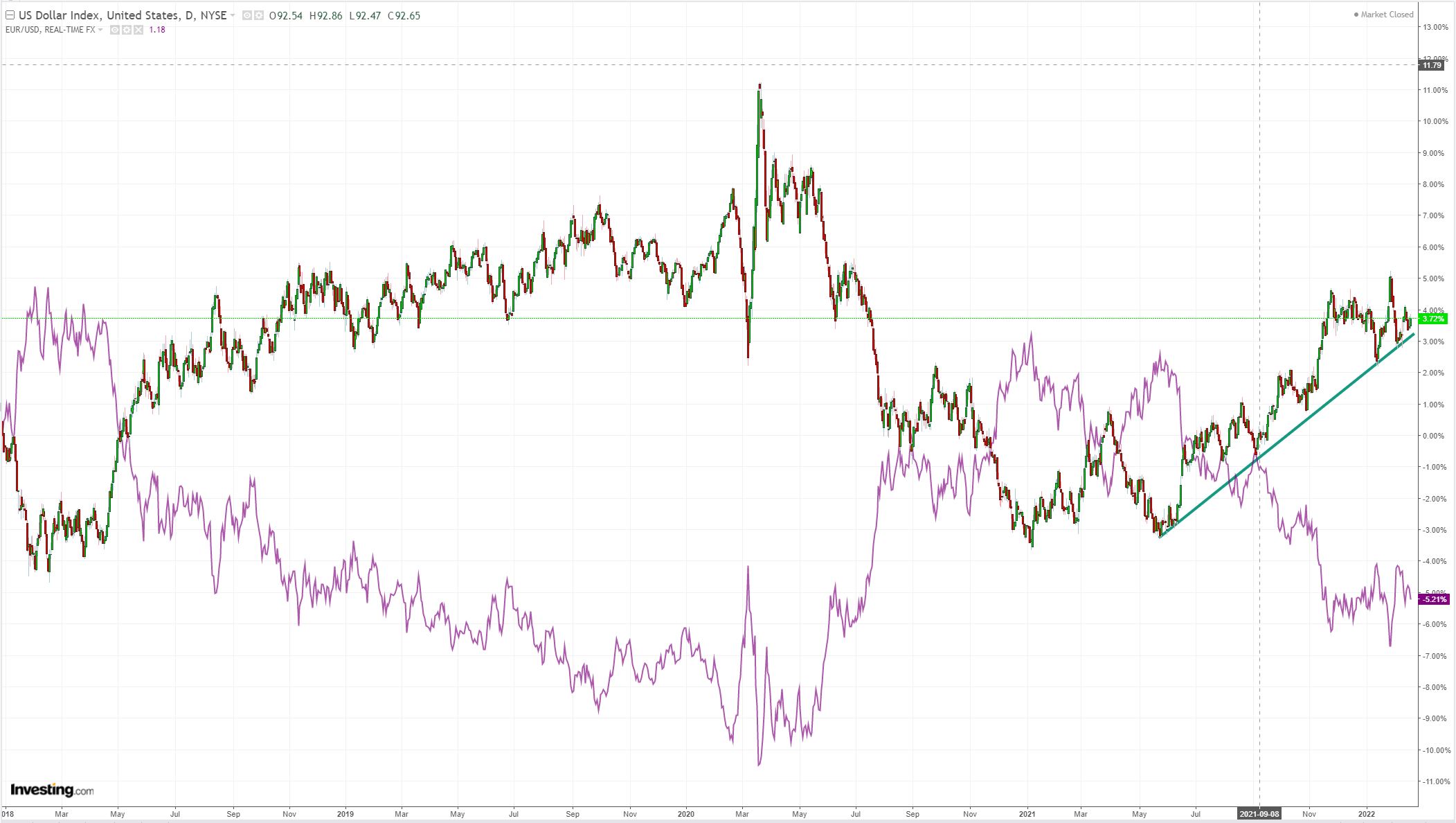

DXY was up Friday night and is forming a pretty decent uptrend:

AUD was mostly but so weak as EUR:

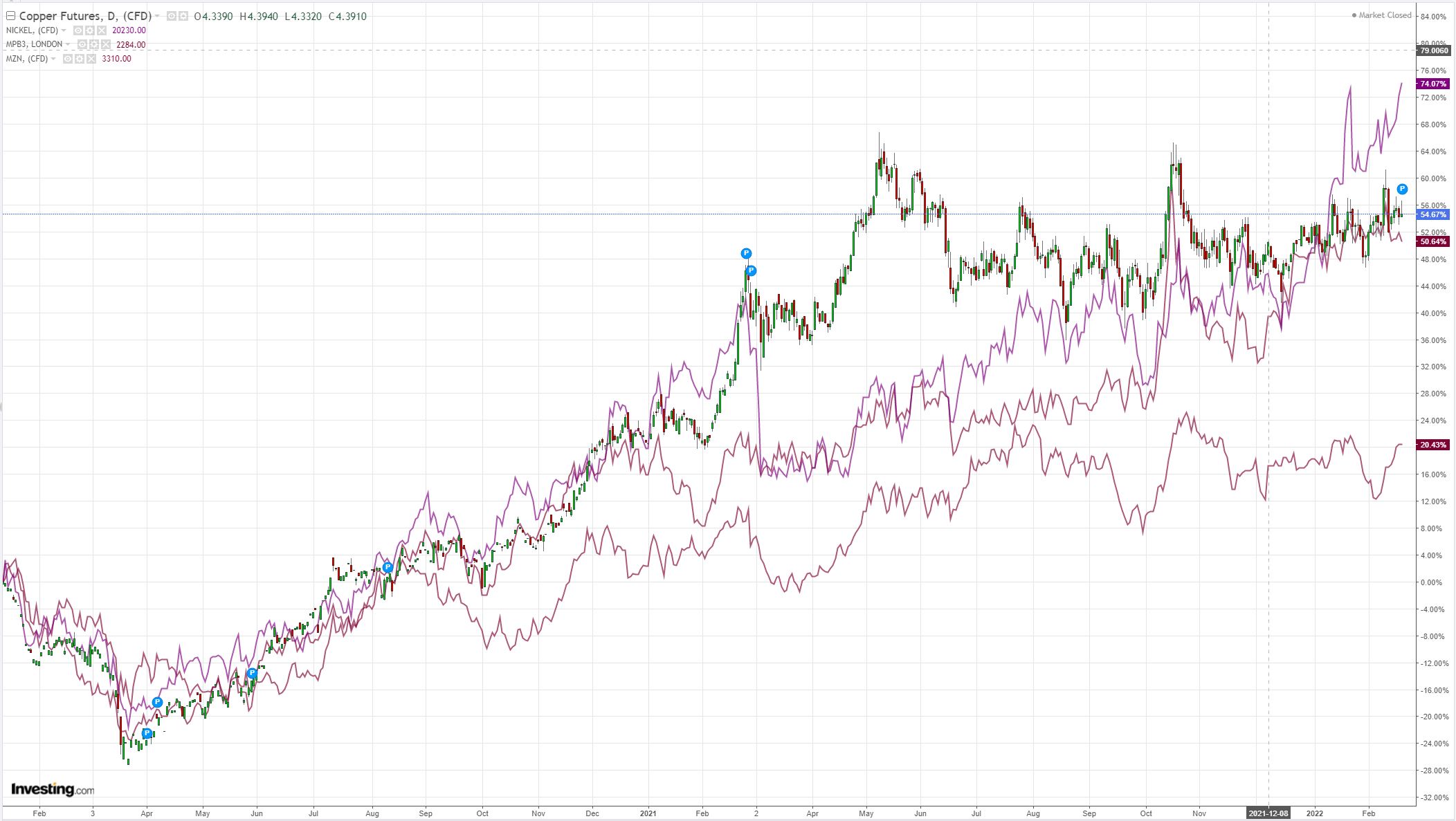

Base metals were mixed:

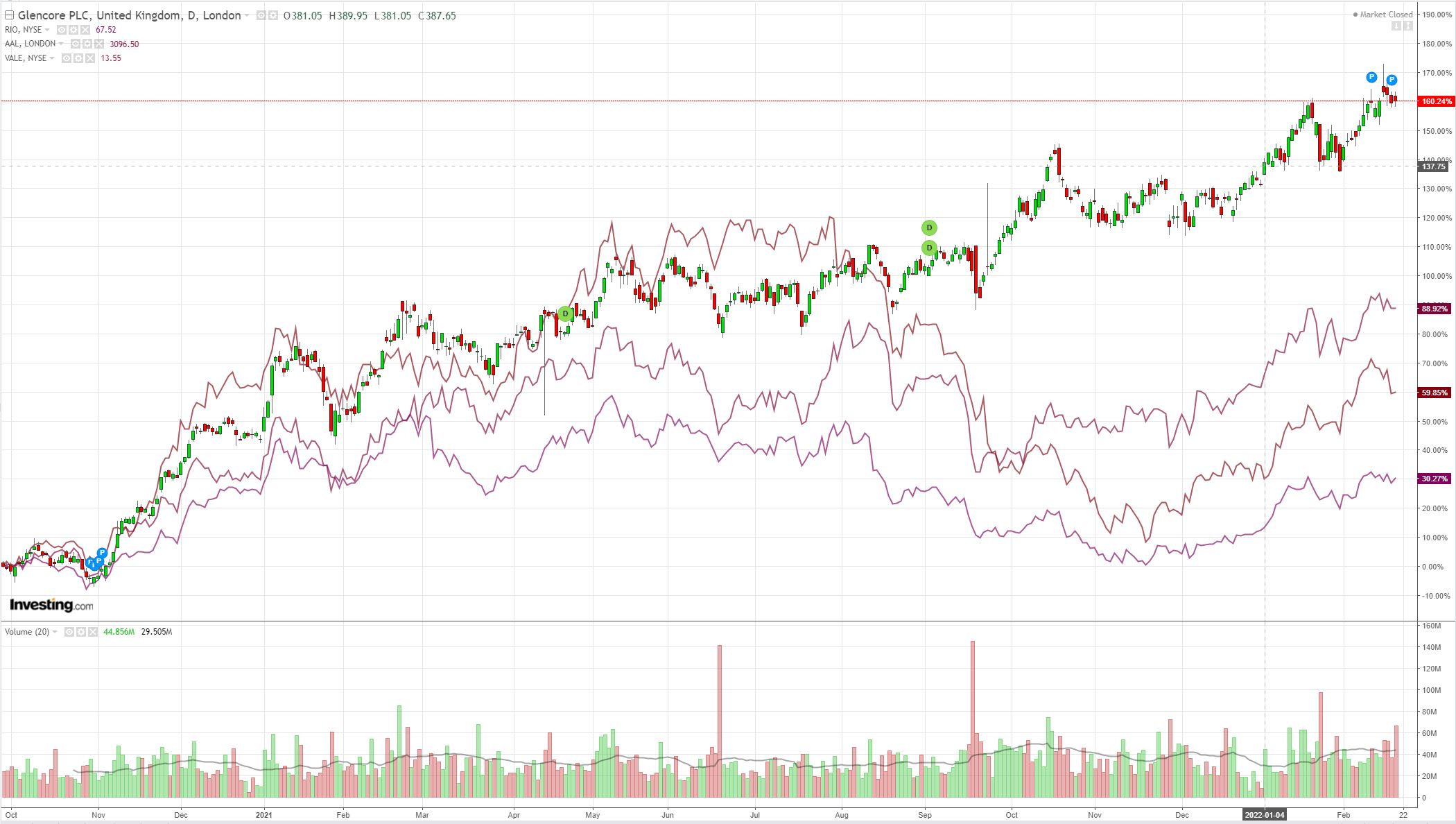

Big miners (LON:GLEN) struggled:

EM stocks (NYSE:EEM) are locked in a down trend:

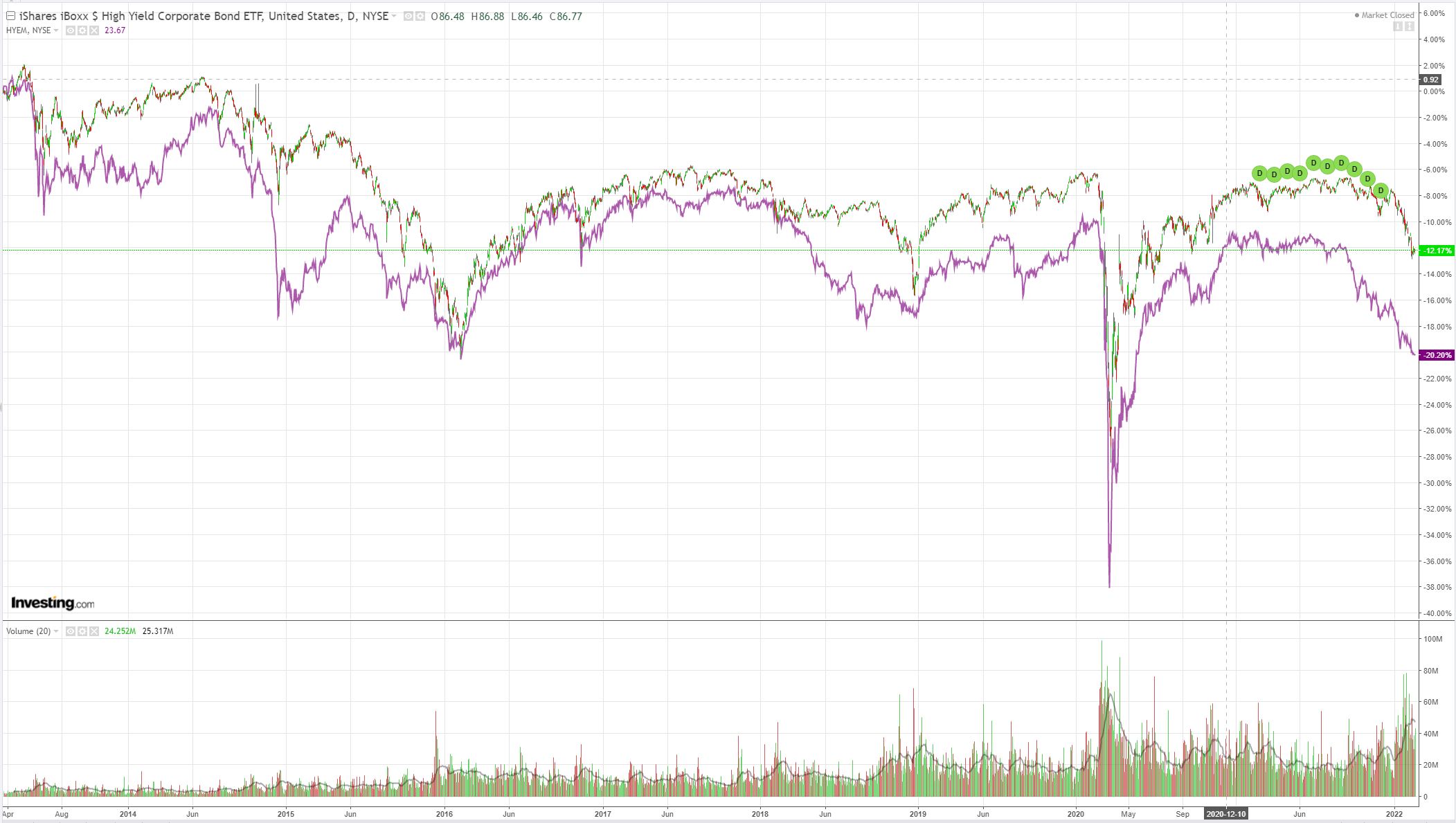

(NYSE:HYG) Chasing the screaming meteor of doom:

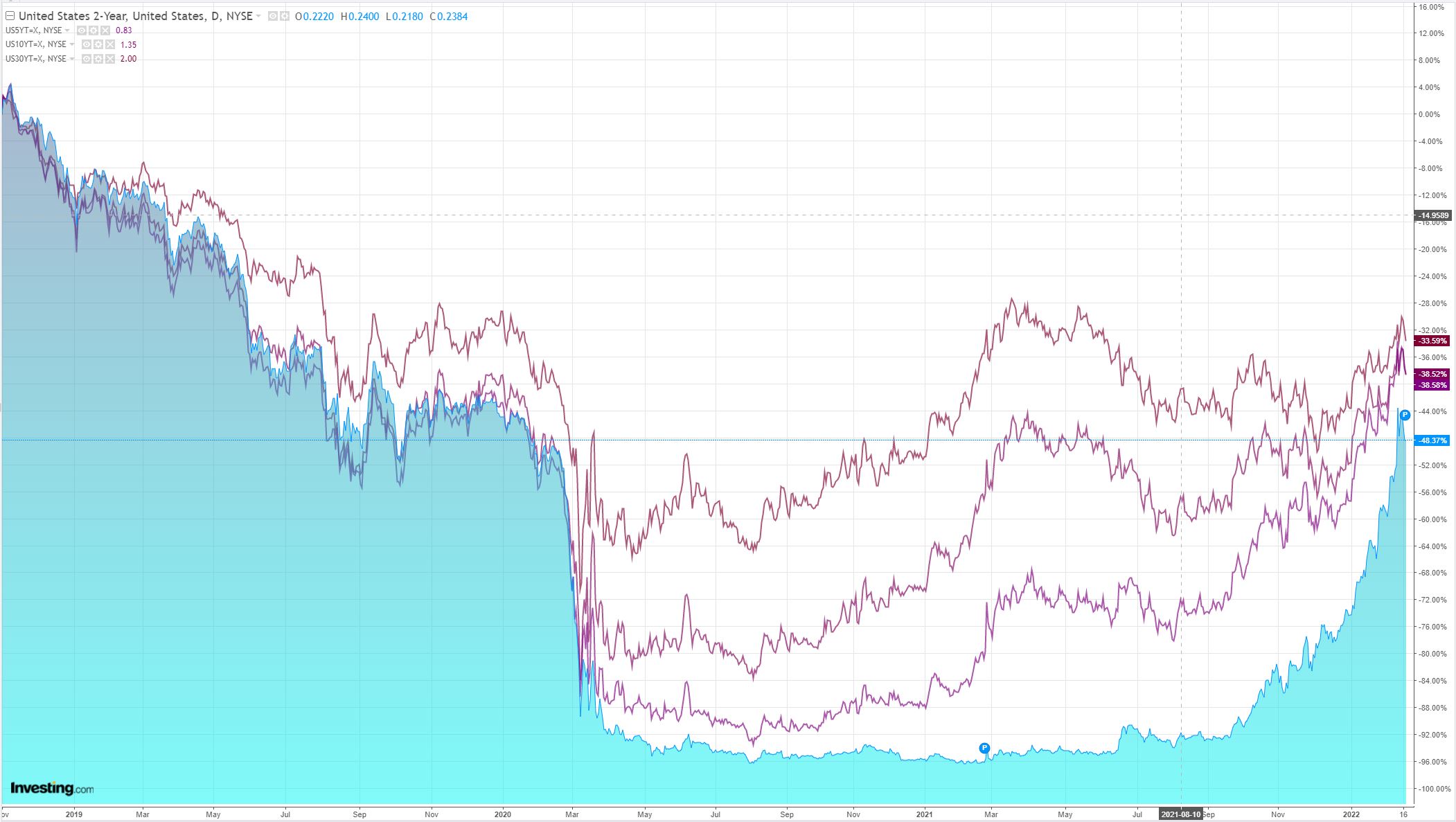

Treasuries were bid:

Stocks are headed south:

War is coming. The FT:

Western leaders said Russia was following a “playbook of deception” to justify an invasion of Ukraine, amid intensifying clashes in the east of the country between Ukrainian forces and pro-Russian separatists.

Speaking at the Munich Security Conference, US vice-president Kamala Harris said Moscow was creating false pretexts for an attack while amassing troops and firepower in plain sight.

“We are seeing Russia spreading disinformation, lies and propaganda,” Harris told the annual get-together of politicians, diplomats and military officials, calling it “the playbook of Russian aggression”.

There have been mysterious pipeline explosions, artillery shells, local mobilisations and all of the usual pretexts for war.

It appears likely any day. Credit Agricole (PA:CAGR) wraps it nicely:

One of the more interesting developments in recent months has been the fact that global risk appetite has been deteriorating despite the still rather favourable backdrop of fairly robust business sentiment indicators lik ethe G10 PMIs that remain close to historically elevated levels and signal a generally healthy expansion ahead. This discrepancy highlights that the main market worry at present is about the current valuations of risky assets in the face of the continuing withdrawal of central bank support for the global economyand the ongoing fight against soaring inflation.

The current developments further highlight that one of the main risks for FX markets in the near term could be a more pronounced slowdown in economic activity. In turn, this could be the result of three related tail risks: (1) A global stagflation shock on the back of soaring energy prices;(2) an aggressive further tightening of the global financial conditions as central banks fight the runaway cost-push inflation and (3) an escalation of the tensions with Russia, which can send energy prices soaring again.

On their own, each of these tail risks could be damaging for sentiment. Taken together, these ‘fat chances’ can fuel fears about an imminent economic downturn and trigger a severe market selloff, signifying the fact that, historically, the distribution of risk-correlated assets’ returns has fairly ‘fat tails’. We also recognise that the risks to the performance of our portfolio that remains overweight carry trades, have grown of late.

War, an energy shock, and a global economic slowdown (at least for goods) are no longer “fat tails”. They are base cases.

As Russia invades Ukraine I would expect another brief energy price spike as fears of oil and gas embargos erupt. But not for long. Sanctions regimes will likely dodge energy. European gas prices were still steadily falling last week as LNG imports boom and a mild winter works its magic on inventories.

The base case for Ukraine is relatively swift domination by Russia. The question is, will it bleed on endlessly as a guerrilla conflict? But neither of these is particularly worrying for markets.

Nor should anybody be especially worried about it more generally. NATO overreached in Ukraine. It’s a corrupt oligarchy that is every bit as bad as Russia itself. NATO will let it go and fortify everybody else behind a new iron curtain.

As for FX and AUD, I can’t see how this does anything but lift DXY and sink EUR plus the Pacific peso. It might be relatively brief as markets digest war quickly.

But then we’ll return to the main game of the hawkish Fed, which an oil spike won’t help, and the deeply risky game of kicking the hornet’s nest that is the giant and growing US inventory pile.