DXY is still easing back:

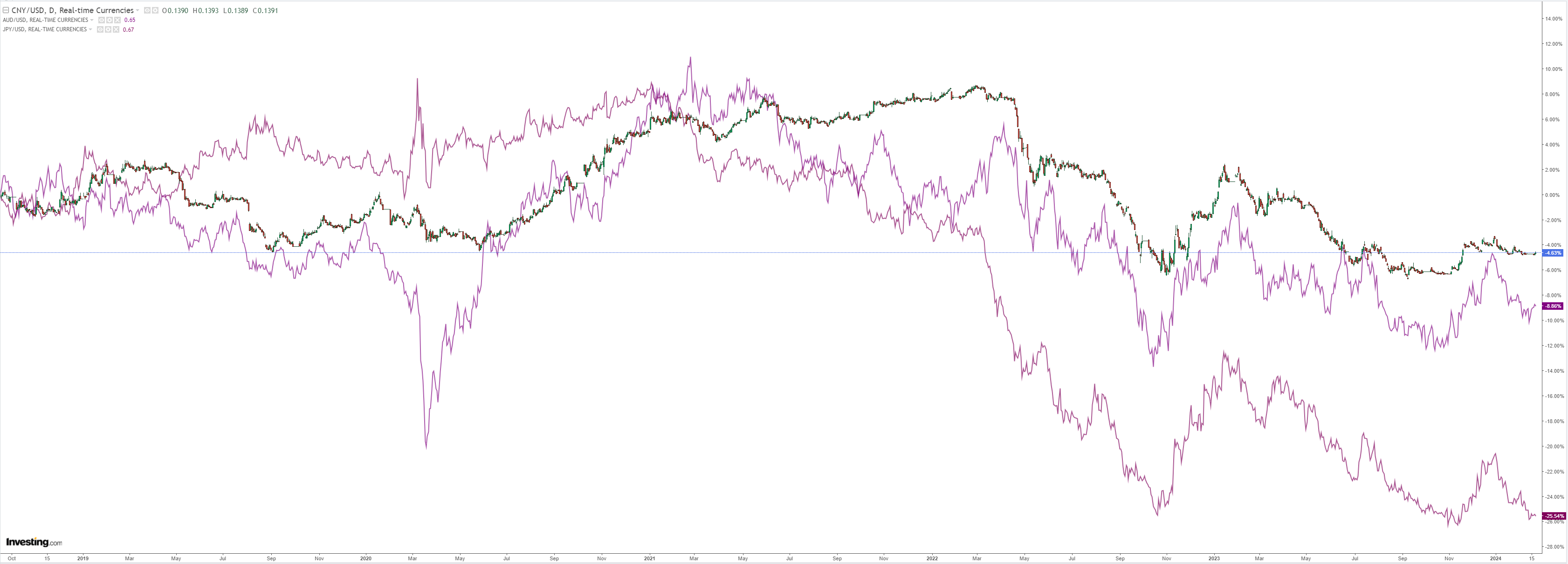

AUD is trading sideways:

North Asia is soft:

Oil and gold soft:

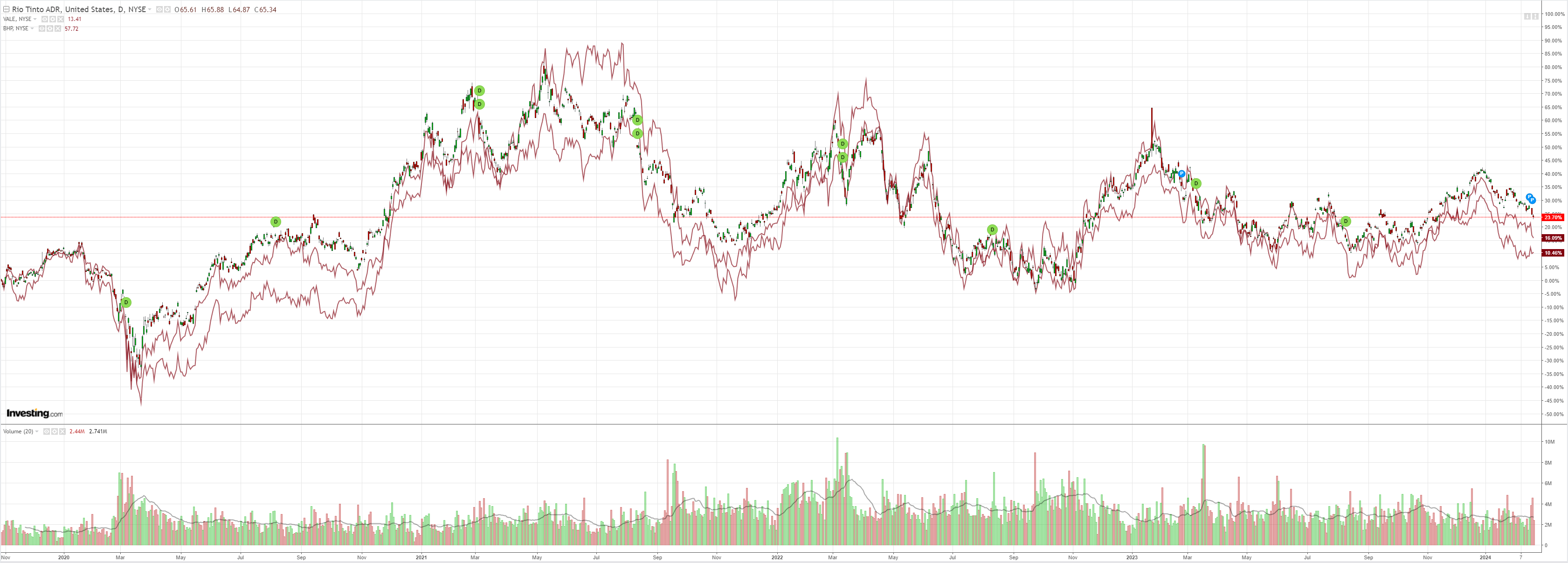

Dirt is up on the latest Chinese drivel:

Miners fell anyway:

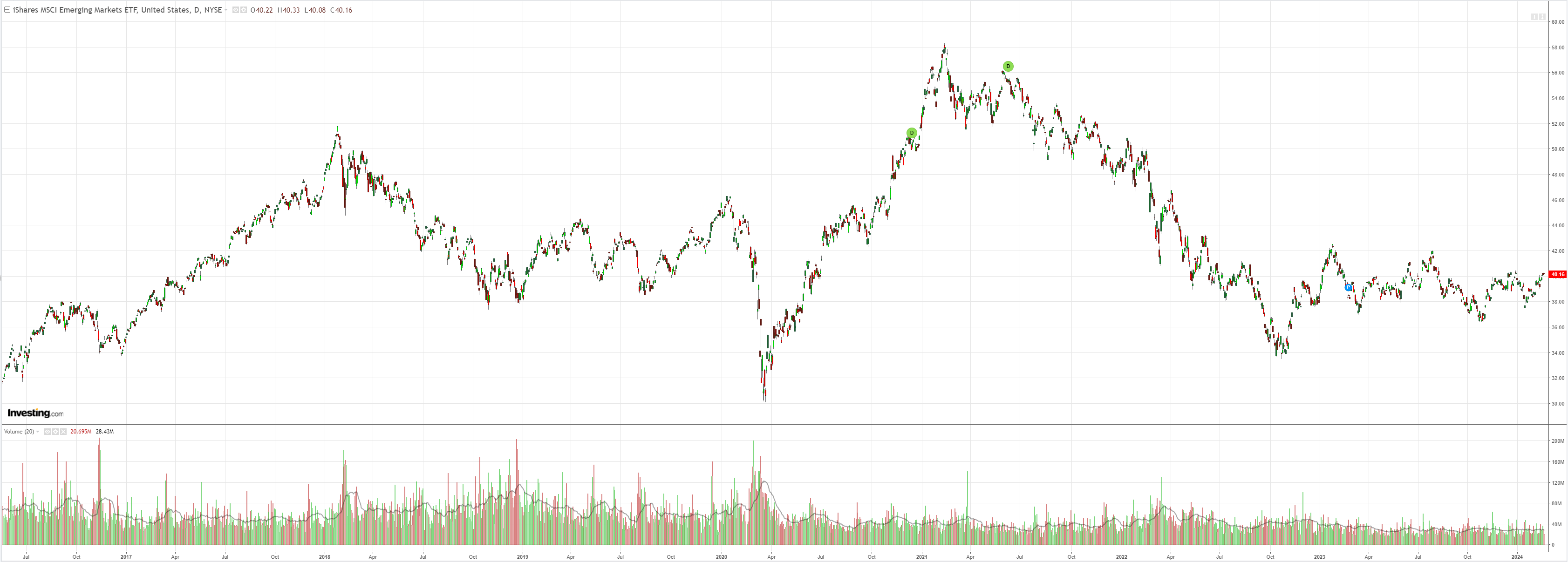

EM was stable:

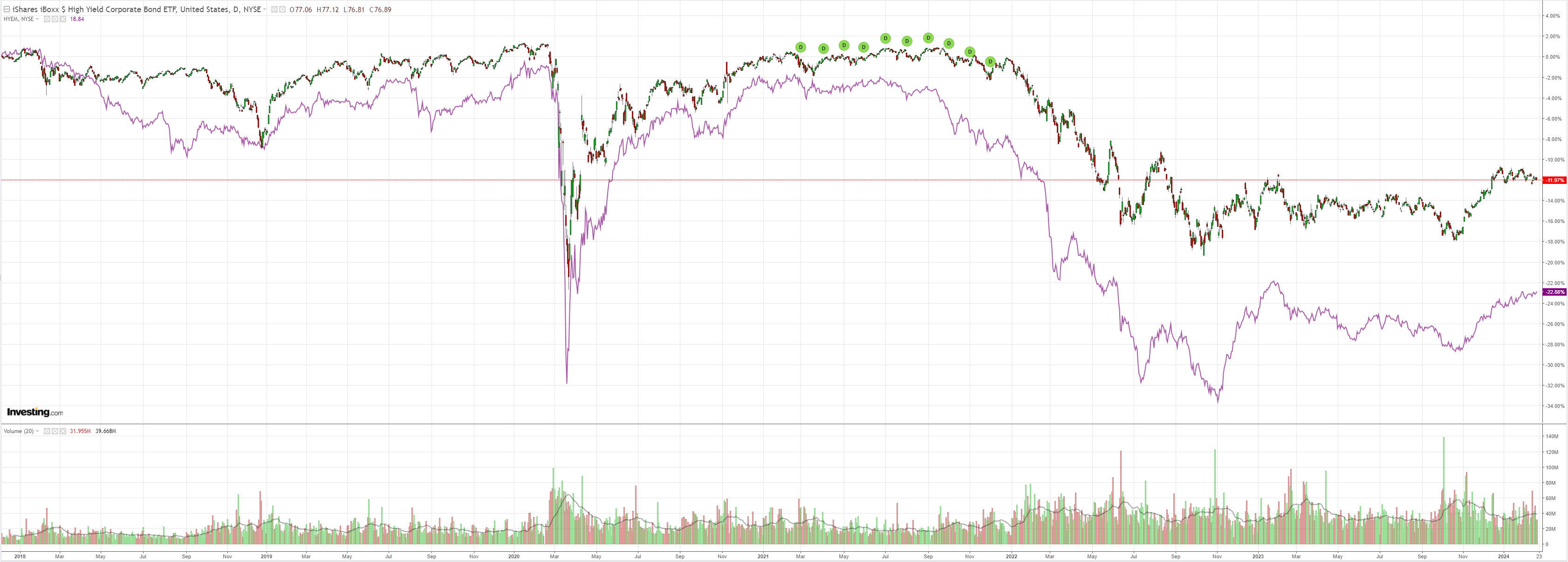

Junk jaws are slowly closing:

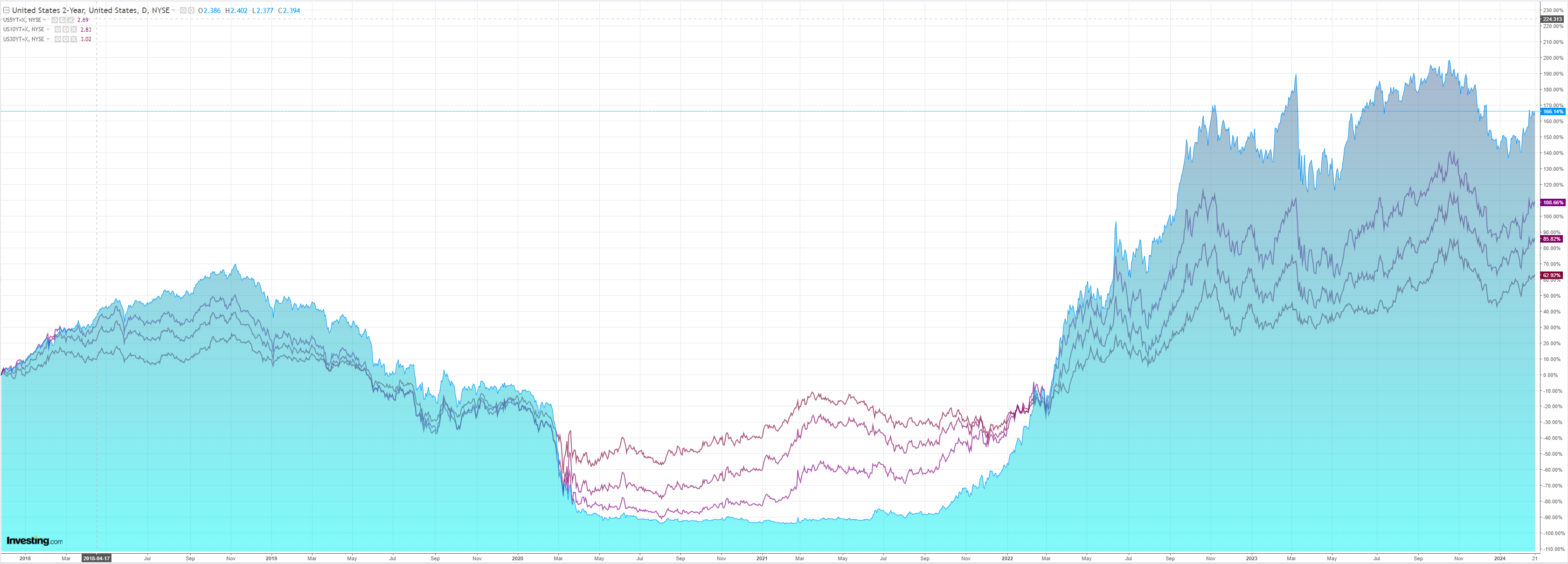

Yields were up again:

Stocks fell into NVDA:

The Fed minutes were sensible:

Participants noted improvements in both headline and core inflation and discussed the underlying components of these series. Although total PCE inflation in December remained above the Committee’s 2 percent objective on a 12-month basis, on a 6-month basis, total PCE inflation was near 2 percent at an annual rate, and core PCE inflation was just below 2 percent.

Participants judged that some of the recent improvement in inflation reflected idiosyncratic movements in a few series.

Nevertheless, they viewed that there had been significant progress recently on inflation returning to the Committee’s longer-run goal.

Many participants indicated that they expected core nonhousing services inflation to gradually decline further as the labor market continued to move into better balance and wage growth moderated further.

Various participants noted that housing services inflation was likely to fall further as the deceleration in rents on new leases continued to pass through to measures of such inflation.

But:

In discussing risk-management considerations that could bear on the policy outlook, participants remarked that while the risks to achieving the Committee’s employment and inflation goals were moving into better balance, they remained highly attentive to inflation risks.

In particular, they saw upside risks to inflation as having diminished but noted that inflation was still above the Committee’s longer-run goal.

Some participants noted the risk that progress toward price stability could stall, particularly if aggregate demand strengthened or supplyside healing slowed more than expected. Participants highlighted the uncertainty associated with how long a restrictive monetary policy stance would need to be maintained.

Most participants noted the risks of moving too quickly to ease the stance of policy and emphasized the importance of carefully assessing incoming data in judging whether inflation is moving down sustainably to 2 percent.

A couple of participants, however, pointed to downside risks to the economy associated with maintaining an overly restrictive stance for too long.

That is, cuts are coming, but only in due course.

Much of this is still DXY bullish but not actively so. Not least because there is no rush to cut elsewhere, even though conditions are much weaker, so stalemate seems to be the call for now.

Meanwhile, bearish positioning is protecting AUD.